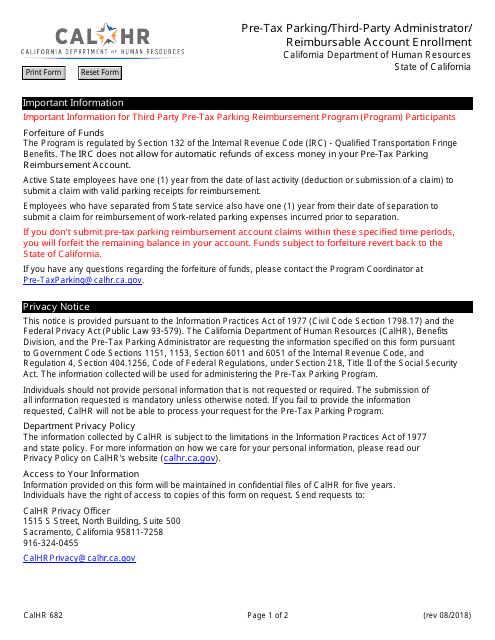

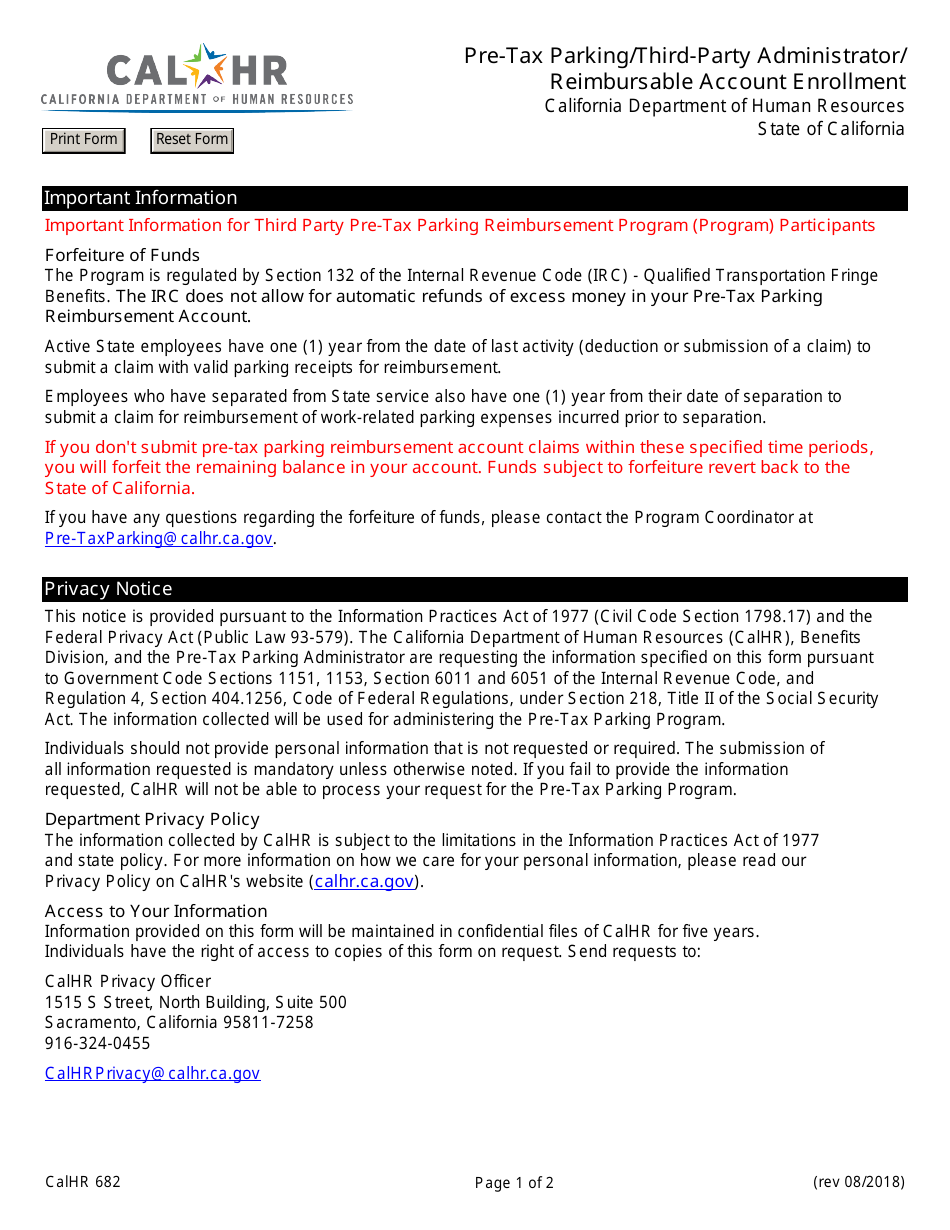

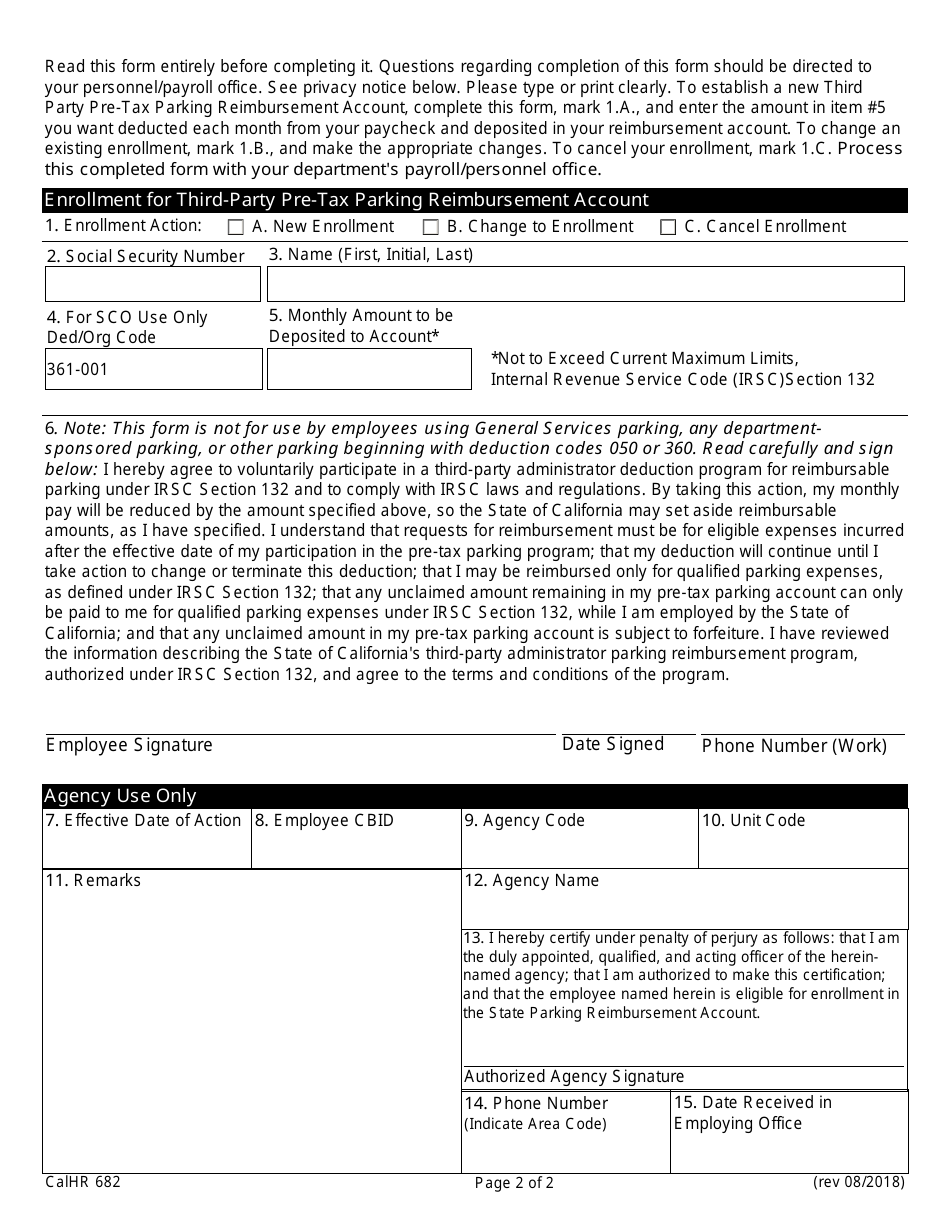

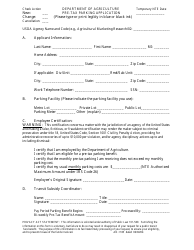

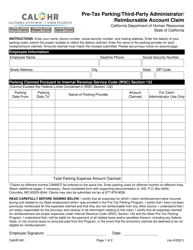

Form CALHR682 Pre-tax Parking / Third-Party Administrator / Reimbursable Account Enrollment - California

What Is Form CALHR682?

This is a legal form that was released by the California Department of Human Resources - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CALHR682?

A: CALHR682 is a form for enrolling in the pre-tax parking/third-party administrator/reimbursable account in California.

Q: What does the CALHR682 form cover?

A: The CALHR682 form covers enrollment for pre-tax parking, third-party administrator, and reimbursable account.

Q: Who can use the CALHR682 form?

A: The CALHR682 form can be used by employees in California who are eligible for pre-tax parking benefits.

Q: What are the benefits of enrolling in pre-tax parking?

A: Enrolling in pre-tax parking allows employees to save money by using pre-tax dollars to pay for parking expenses.

Q: What is a third-party administrator?

A: A third-party administrator is a company that handles certain employee benefits, such as pre-tax parking accounts.

Q: What is a reimbursable account?

A: A reimbursable account is an account where employees can be reimbursed for eligible expenses, such as parking fees.

Q: Is enrollment in pre-tax parking mandatory?

A: No, enrollment in pre-tax parking is optional.

Q: Can I make changes to my enrollment in the future?

A: Yes, you can make changes to your enrollment in pre-tax parking, third-party administrator, or reimbursable account in the future if needed.

Q: Are there any restrictions on what parking expenses can be reimbursed?

A: Yes, there may be restrictions on what parking expenses can be reimbursed. It is important to review the guidelines provided with the CALHR682 form.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the California Department of Human Resources;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CALHR682 by clicking the link below or browse more documents and templates provided by the California Department of Human Resources.