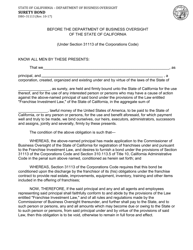

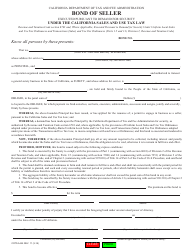

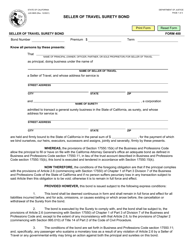

Form DBO-CSCL105 Bond of Check Seller - California

What Is Form DBO-CSCL105?

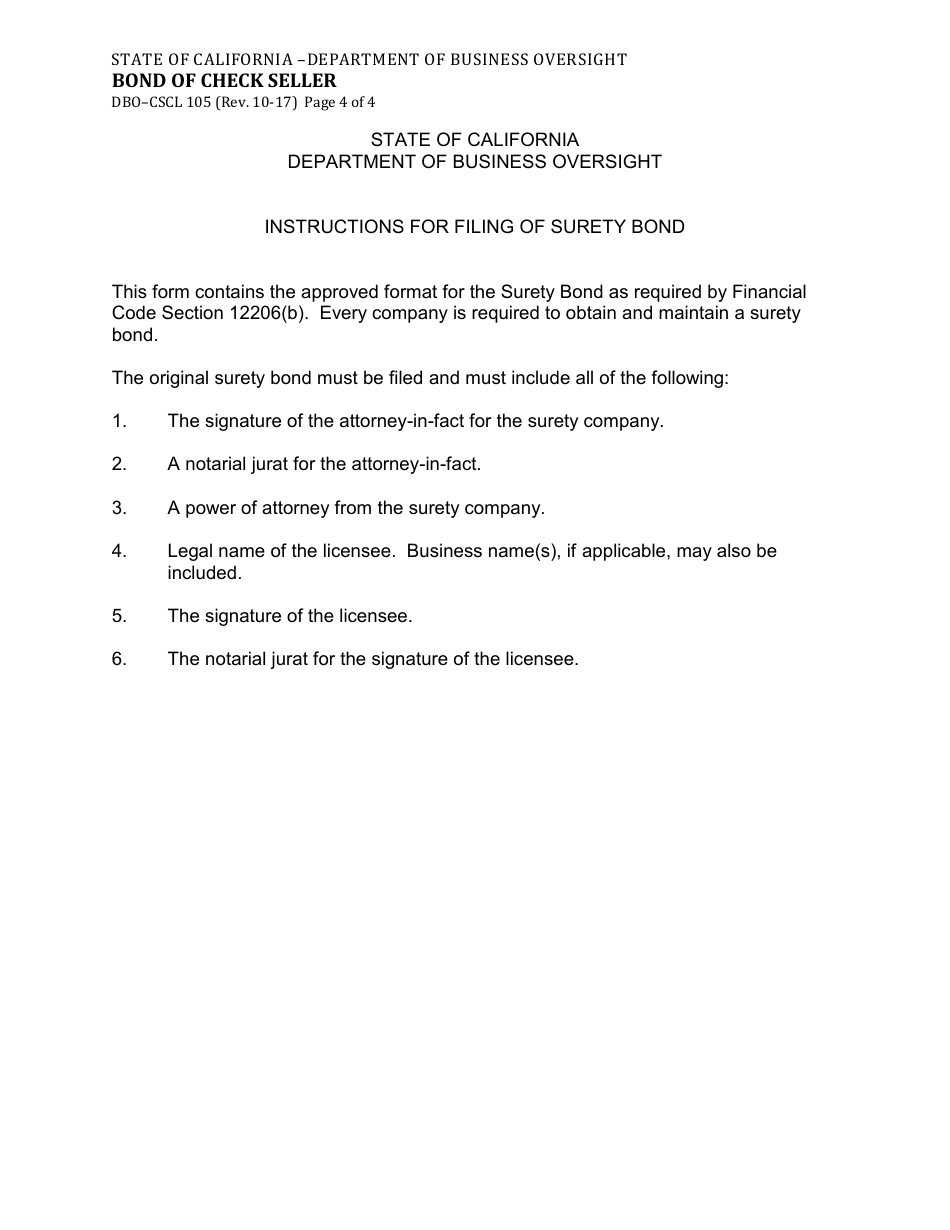

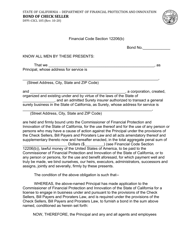

This is a legal form that was released by the California Department of Financial Protection and Innovation - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is DBO-CSCL105?

A: DBO-CSCL105 is the form name for Bond of Check Seller in California.

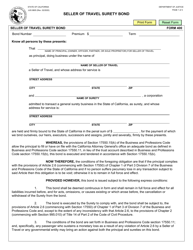

Q: What is a Bond of Check Seller?

A: A Bond of Check Seller is a type of surety bond required by the California Department of Business Oversight (DBO) for check sellers in California.

Q: Who needs to file DBO-CSCL105?

A: Check sellers in California need to file DBO-CSCL105.

Q: What is the purpose of DBO-CSCL105?

A: The purpose of DBO-CSCL105 is to provide financial protection to consumers in case the check seller engages in fraudulent or illegal activities.

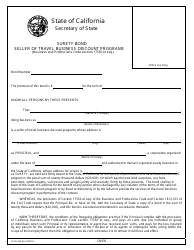

Q: Is DBO-CSCL105 a requirement in other states?

A: No, DBO-CSCL105 is specific to California and its requirements for check sellers.

Q: How much is the bond amount for DBO-CSCL105?

A: The bond amount for DBO-CSCL105 varies depending on the check seller's average daily transaction volume, with a minimum bond requirement of $100,000.

Q: Are there any exemptions to the DBO-CSCL105 requirement?

A: Yes, certain types of check sellers may be exempt from the DBO-CSCL105 requirement. It is best to consult with the California Department of Business Oversight (DBO) for specific exemption criteria.

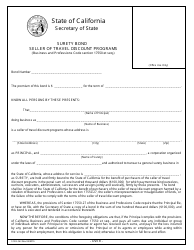

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the California Department of Financial Protection and Innovation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DBO-CSCL105 by clicking the link below or browse more documents and templates provided by the California Department of Financial Protection and Innovation.