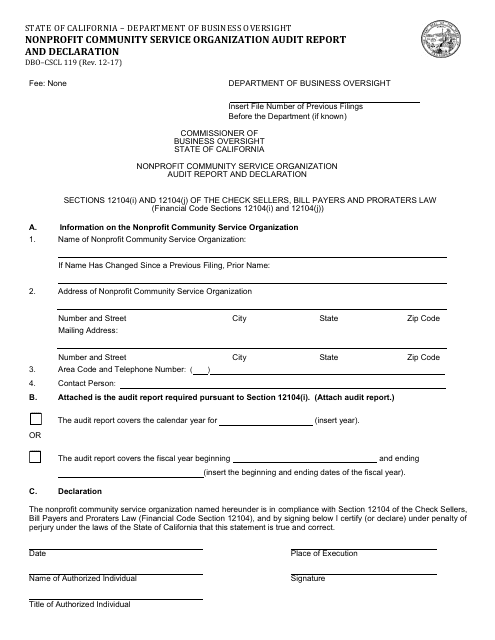

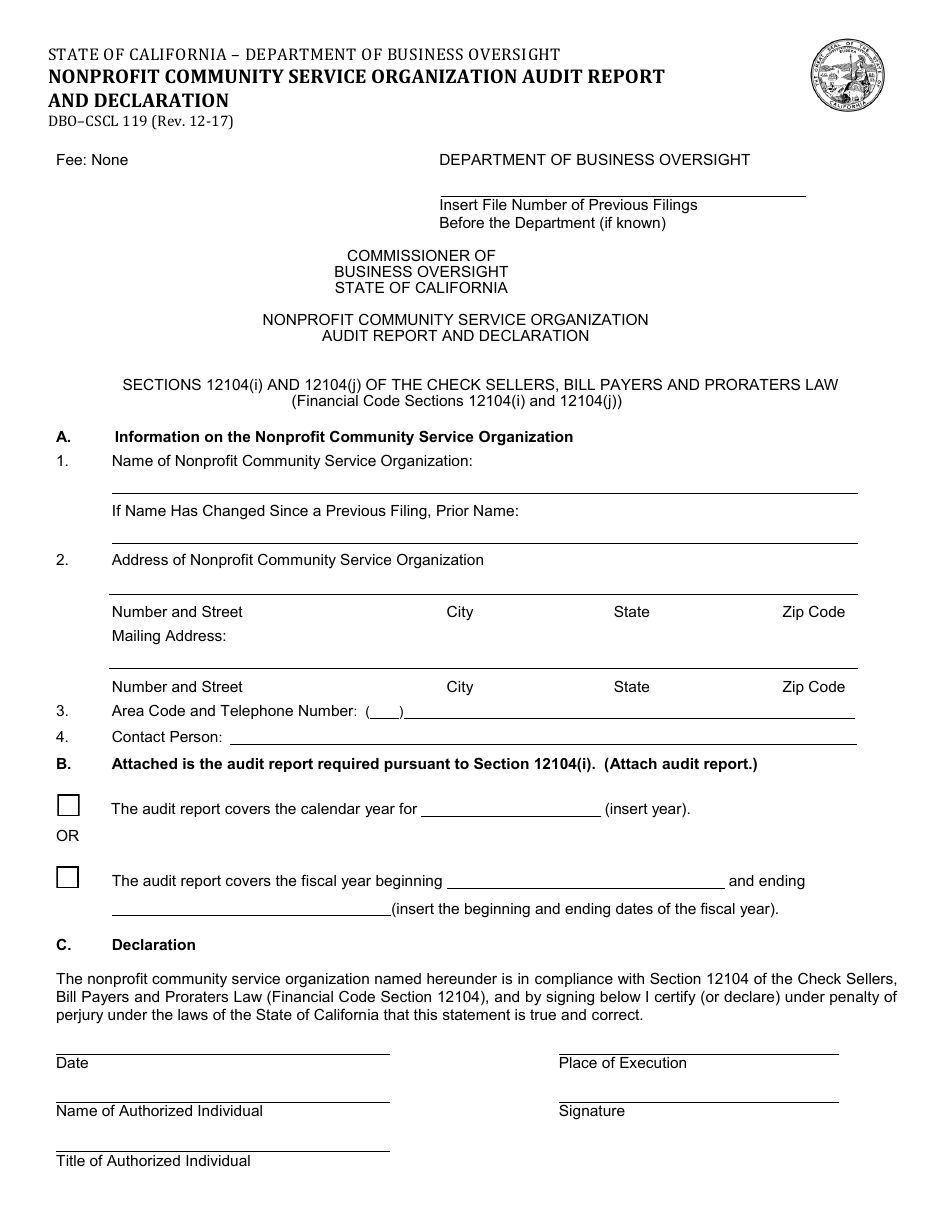

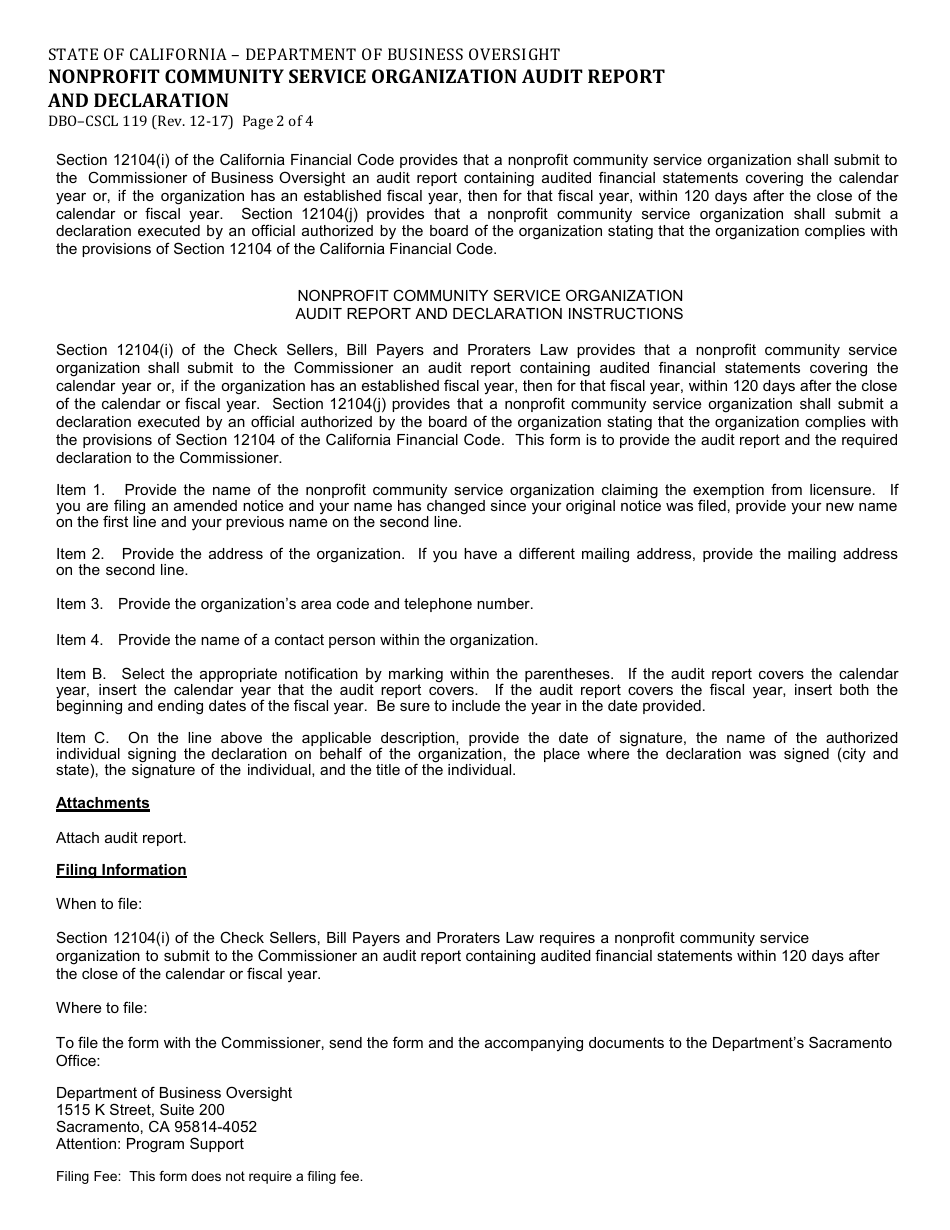

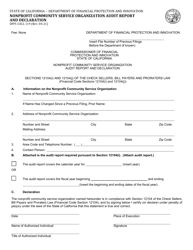

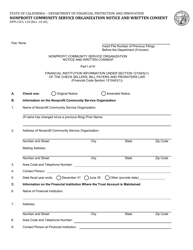

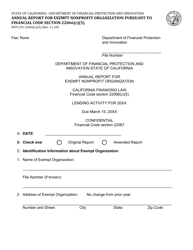

Form DBO-CSCL119 Nonprofit Community Service Organization Audit Report and Declaration - California

What Is Form DBO-CSCL119?

This is a legal form that was released by the California Department of Financial Protection and Innovation - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DBO-CSCL119?

A: Form DBO-CSCL119 is a Nonprofit Community Service Organization Audit Report and Declaration form in California.

Q: Who needs to file Form DBO-CSCL119?

A: Nonprofit Community Service Organizations in California need to file Form DBO-CSCL119.

Q: What is the purpose of Form DBO-CSCL119?

A: The purpose of Form DBO-CSCL119 is to report the financial activities and audit results of a Nonprofit Community Service Organization in California.

Q: When is Form DBO-CSCL119 due?

A: Form DBO-CSCL119 is due on the fifteenth day of the fifth month after the end of the organization's fiscal year.

Q: Are there any penalties for late or incorrect filing of Form DBO-CSCL119?

A: Yes, there may be penalties for late or incorrect filing of Form DBO-CSCL119. It is important to file the form accurately and on time to avoid any penalties.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the California Department of Financial Protection and Innovation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DBO-CSCL119 by clicking the link below or browse more documents and templates provided by the California Department of Financial Protection and Innovation.