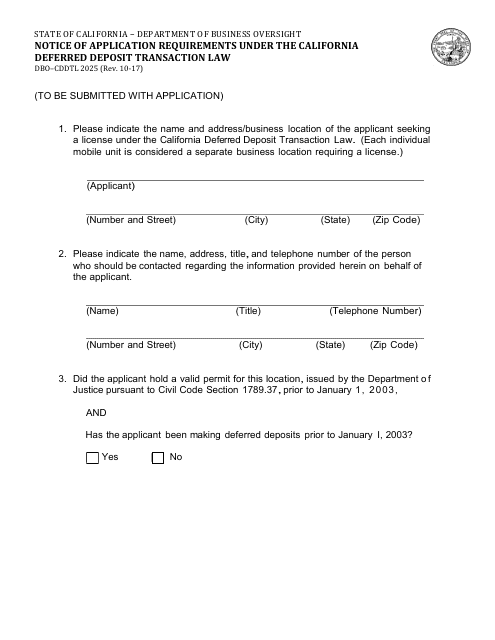

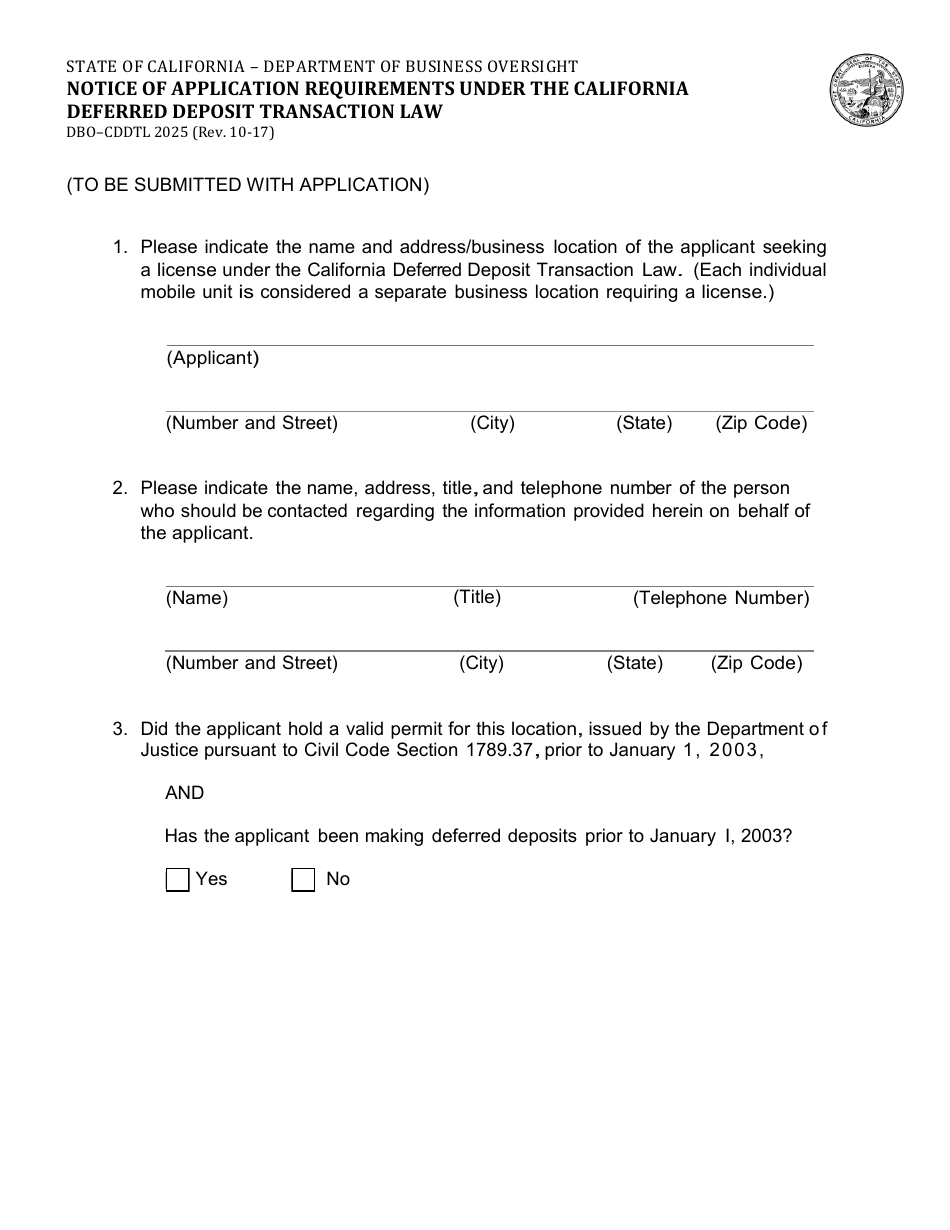

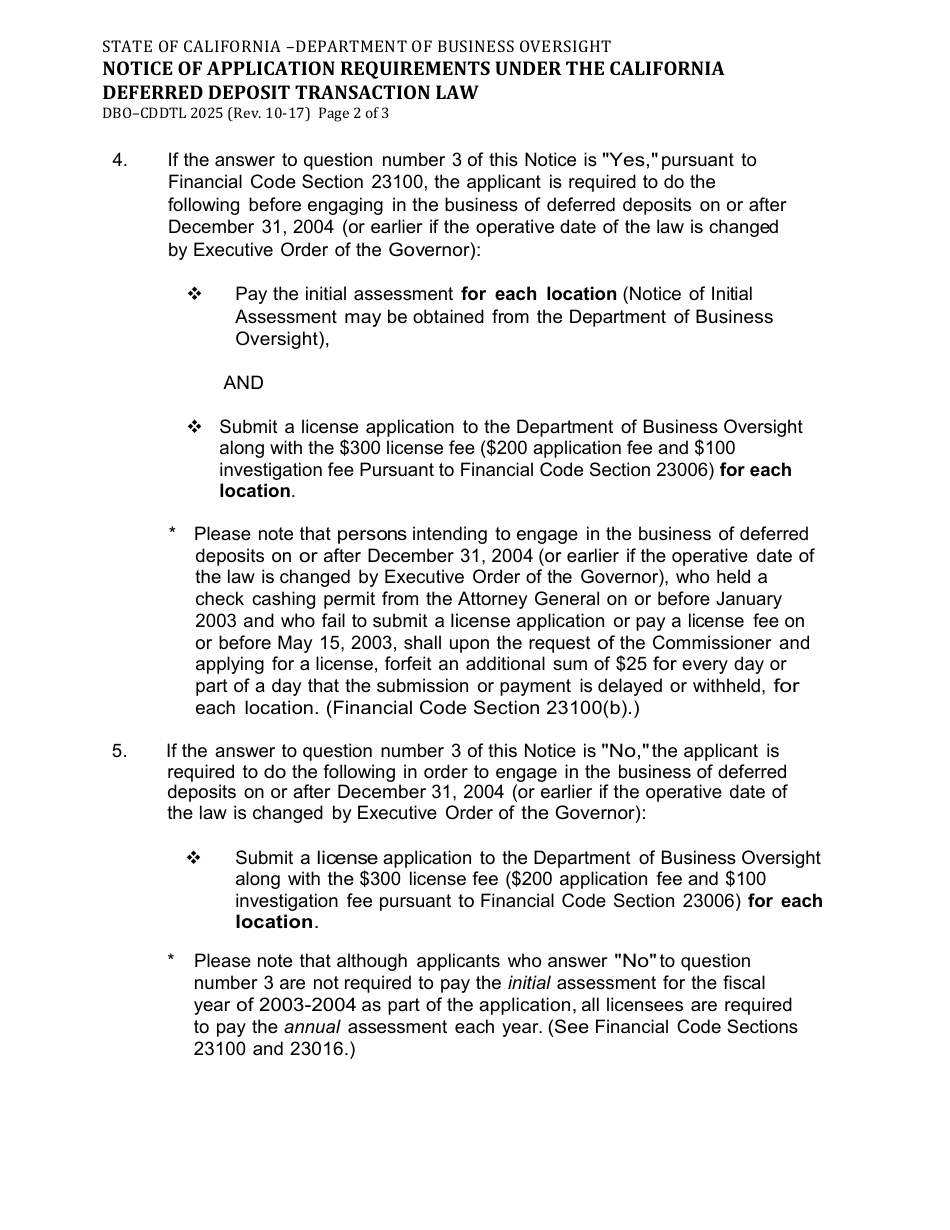

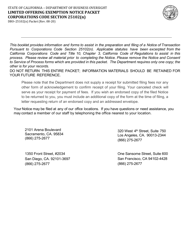

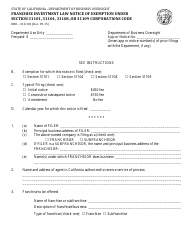

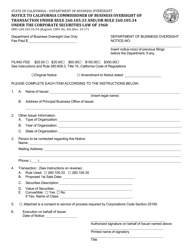

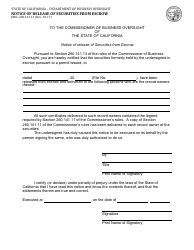

Form DBO-CDDTL2025 Notice of Application Requirements Under the California Deferred Deposit Transaction Law - California

What Is Form DBO-CDDTL2025?

This is a legal form that was released by the California Department of Financial Protection and Innovation - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DBO-CDDTL2025?

A: Form DBO-CDDTL2025 is a notice of application requirements under the California Deferred Deposit Transaction Law in California.

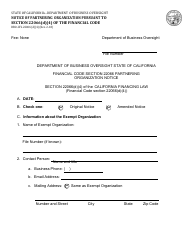

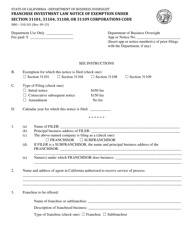

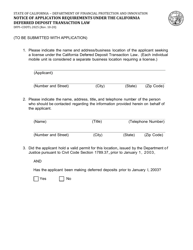

Q: What is the California Deferred Deposit Transaction Law?

A: The California Deferred Deposit Transaction Law is a law that regulates payday loans and other short-term consumer loans in California.

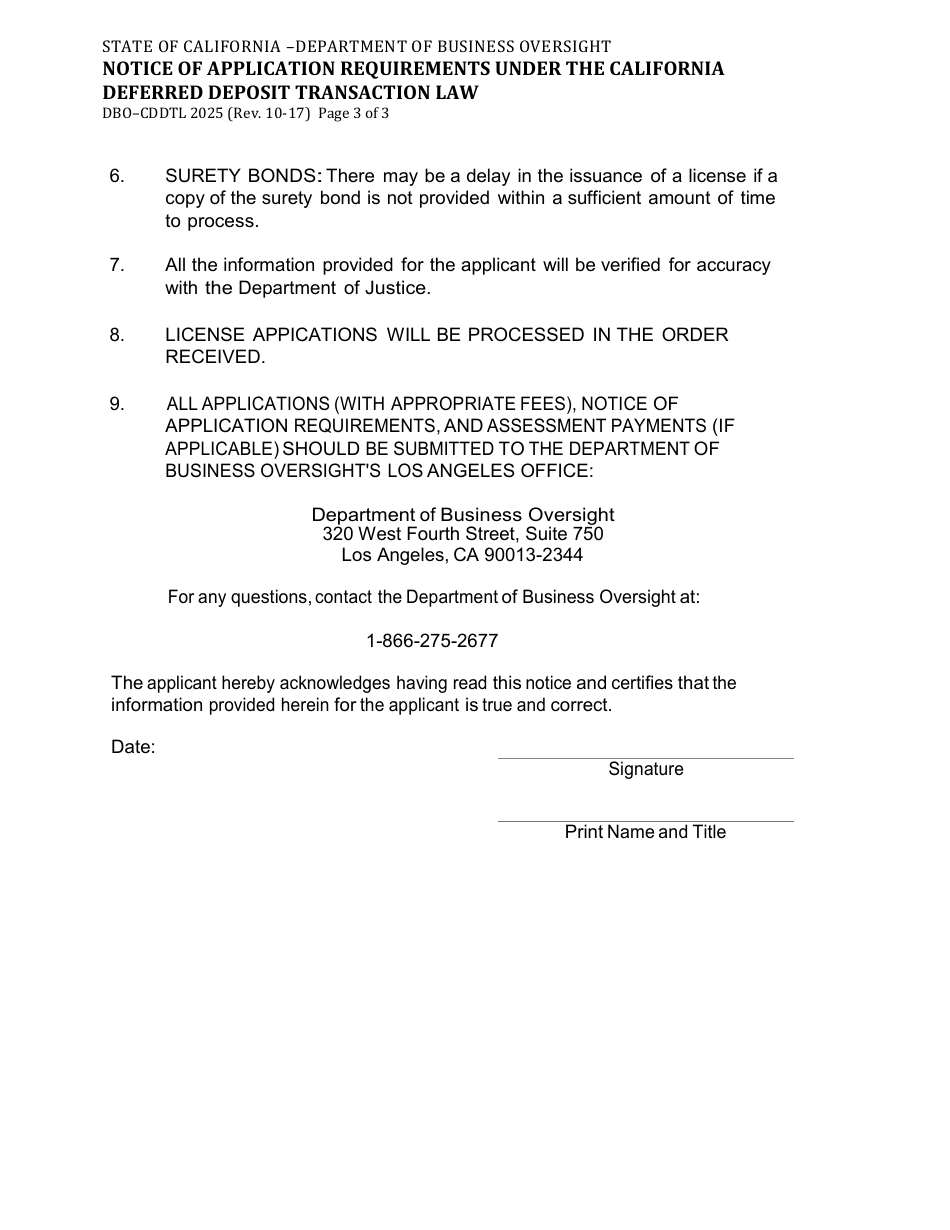

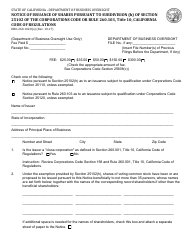

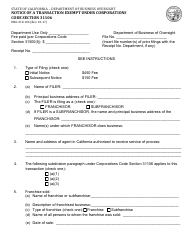

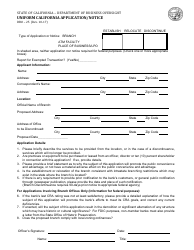

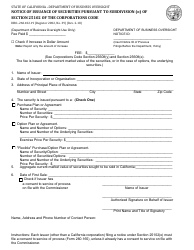

Q: What are the application requirements under the California Deferred Deposit Transaction Law?

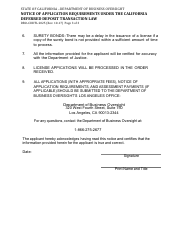

A: The application requirements under the California Deferred Deposit Transaction Law vary, but Form DBO-CDDTL2025 provides a list of the specific requirements for obtaining a license to engage in deferred deposit transactions in California.

Q: What should I do if I want to engage in deferred deposit transactions in California?

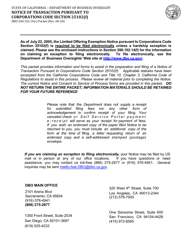

A: If you want to engage in deferred deposit transactions in California, you should review Form DBO-CDDTL2025 and ensure that you meet all the application requirements outlined in the form. You may also need to obtain a license from the California Department of Business Oversight.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the California Department of Financial Protection and Innovation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DBO-CDDTL2025 by clicking the link below or browse more documents and templates provided by the California Department of Financial Protection and Innovation.