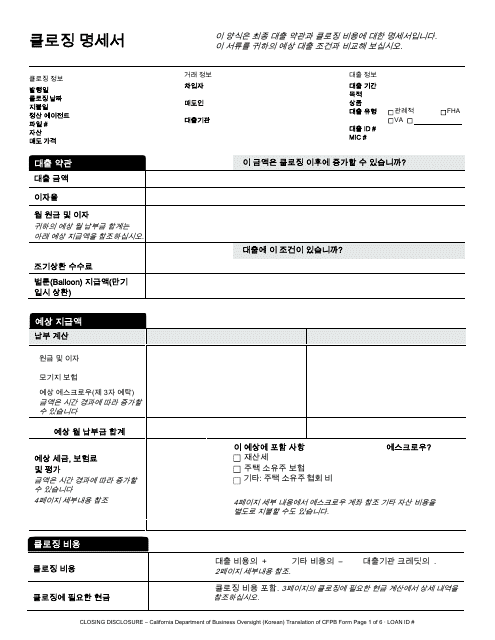

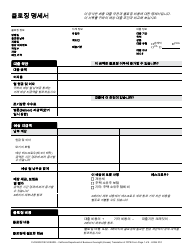

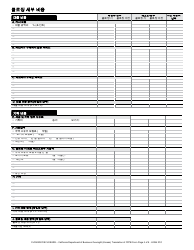

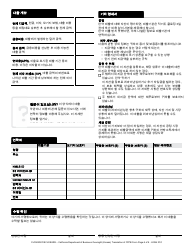

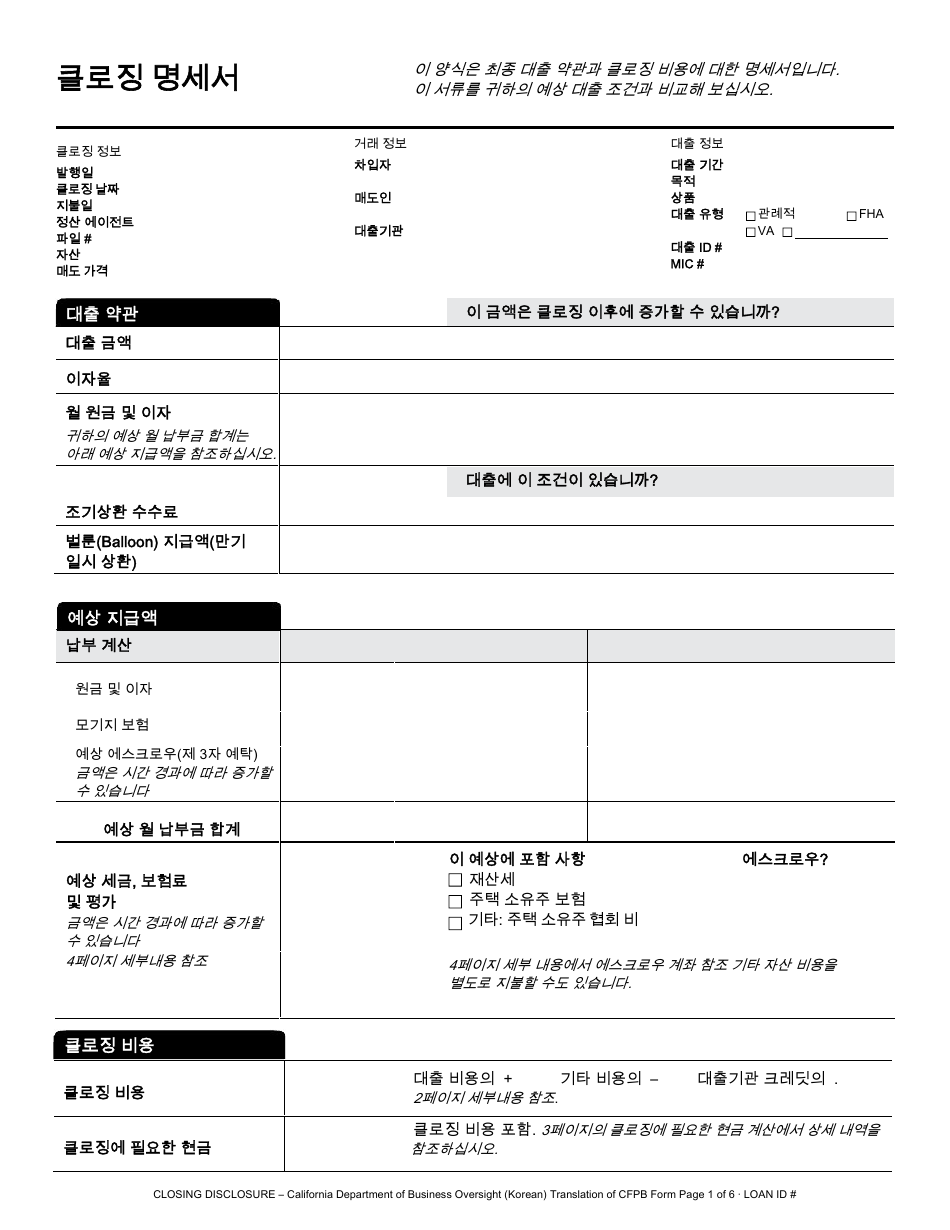

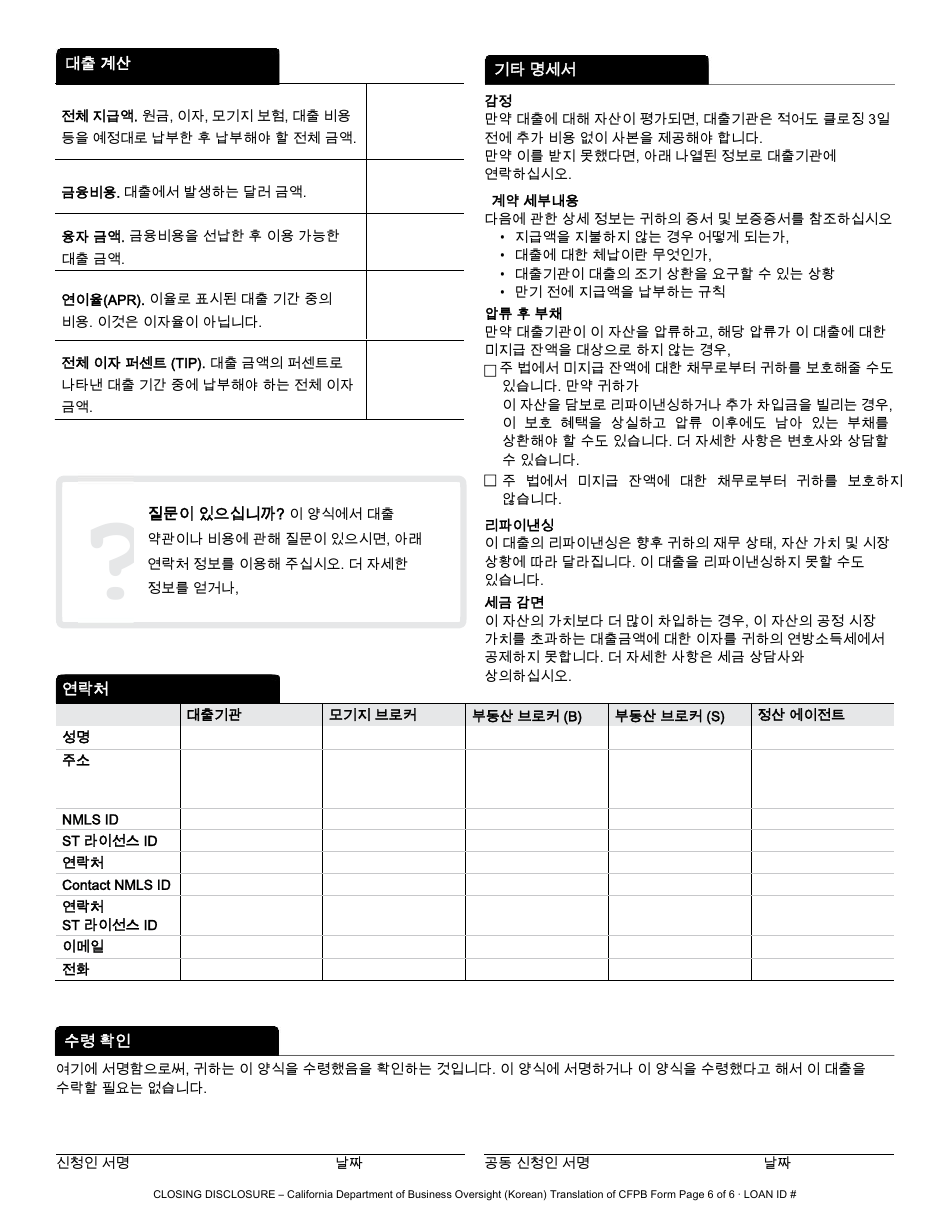

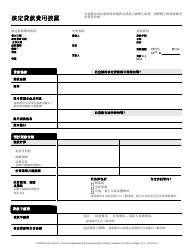

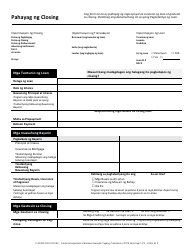

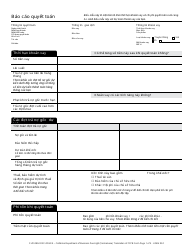

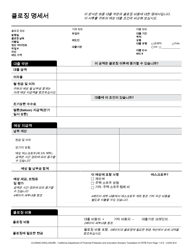

Closing Disclosure Form - California (Korean)

This is a legal document that was released by the California Department of Financial Protection and Innovation - a government authority operating within California.

The document is provided in Korean.

FAQ

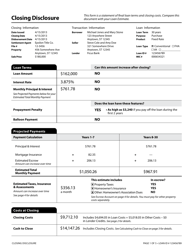

Q: What is a Closing Disclosure form?

A: A Closing Disclosure form is a document that provides details about the final terms of a mortgage loan, including the loan amount, interest rate, and closing costs.

Q: Why is the Closing Disclosure form important?

A: The Closing Disclosure form is important because it helps borrowers understand the costs and terms associated with their mortgage loan before they finalize the transaction.

Q: Who is responsible for providing the Closing Disclosure form?

A: The lender is responsible for providing the Closing Disclosure form to the borrower.

Q: When should the borrower receive the Closing Disclosure form?

A: The borrower should receive the Closing Disclosure form at least three business days before the loan closing.

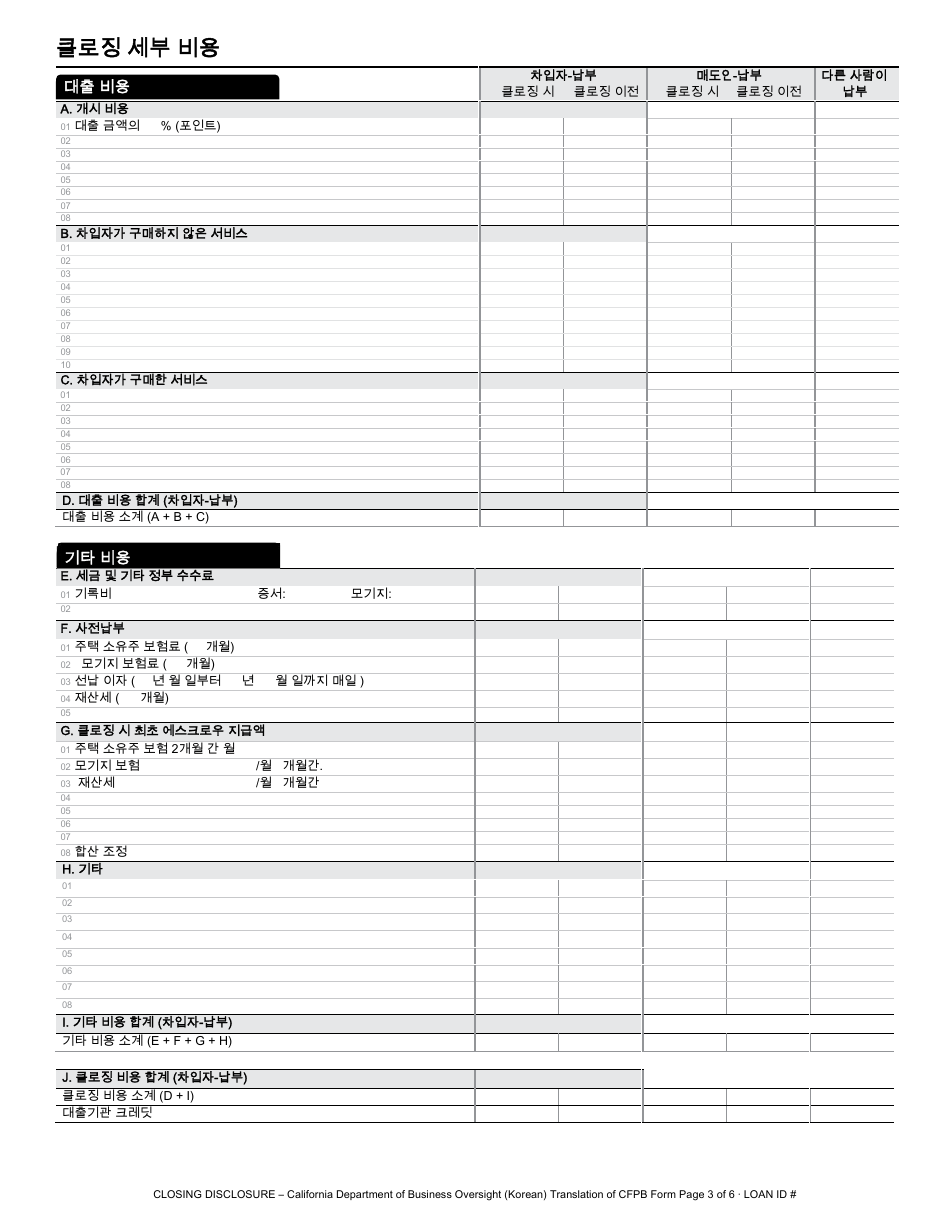

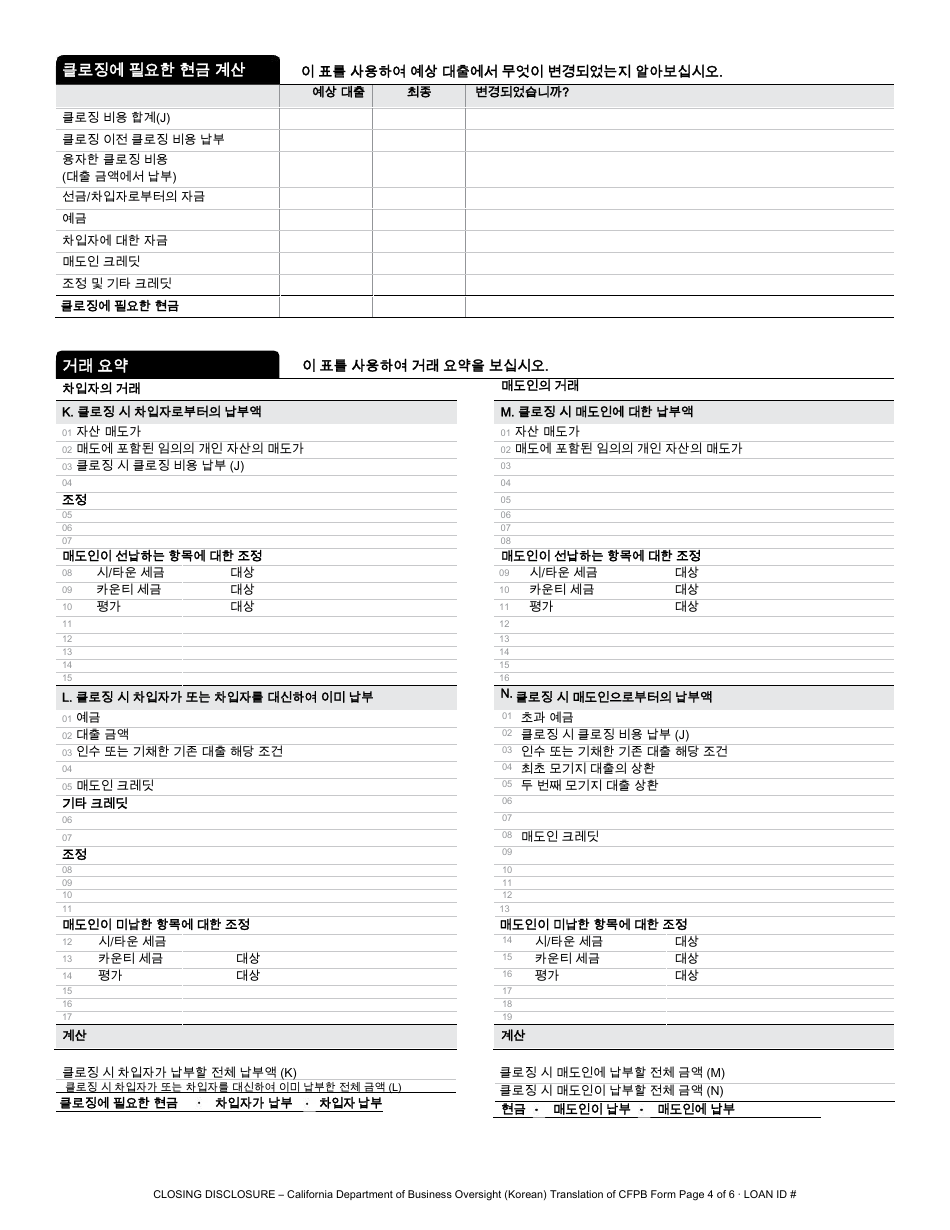

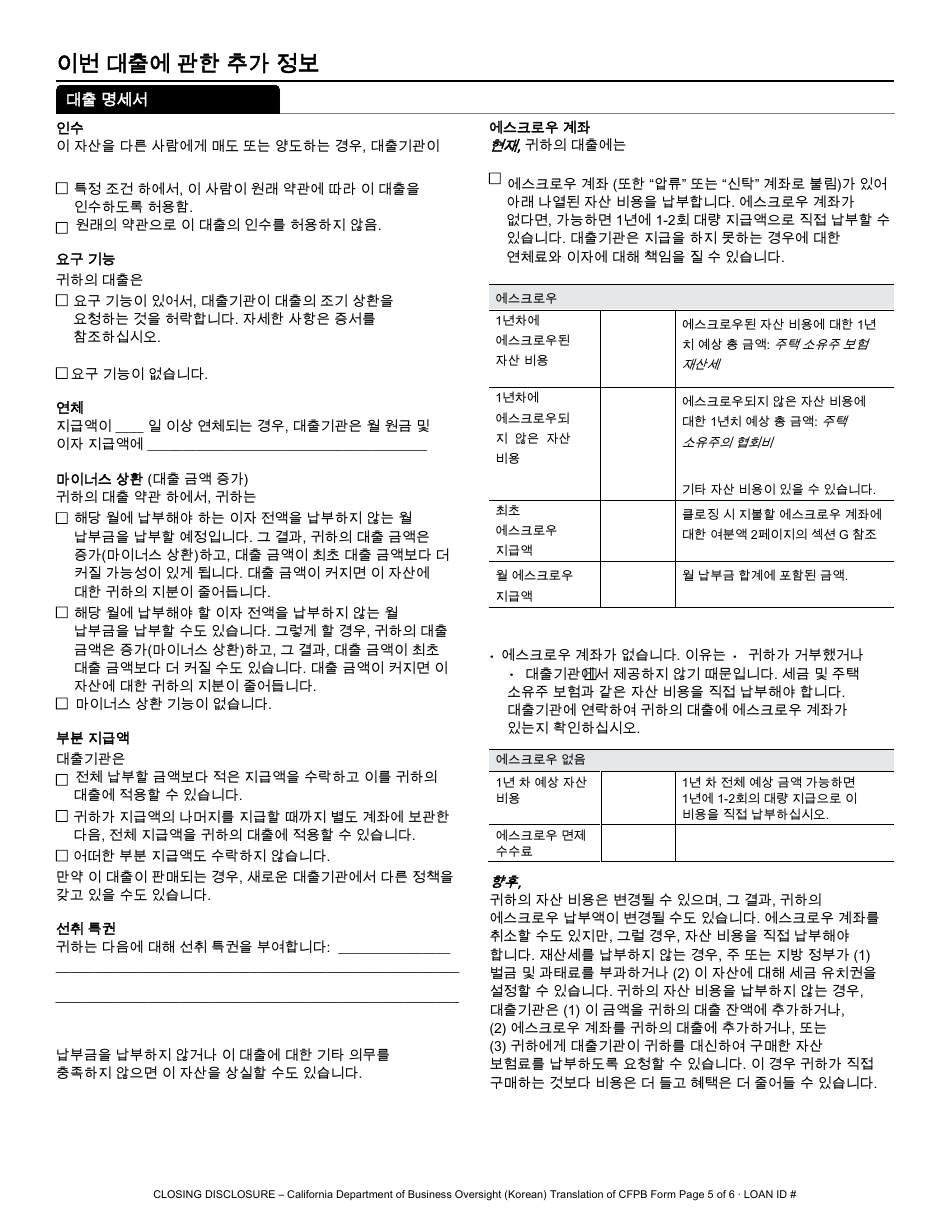

Q: What information is included in the Closing Disclosure form?

A: The Closing Disclosure form includes information about the loan terms, projected payment schedule, closing costs, and other details related to the mortgage loan.

Q: Can the mortgage loan terms change after the Closing Disclosure form is provided?

A: In most cases, the mortgage loan terms cannot change after the Closing Disclosure form is provided, unless certain circumstances occur.

Q: What should a borrower do if they have questions or concerns about the Closing Disclosure form?

A: If a borrower has questions or concerns about the Closing Disclosure form, they should contact their lender for clarification or assistance.

Form Details:

- The latest edition currently provided by the California Department of Financial Protection and Innovation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the California Department of Financial Protection and Innovation.