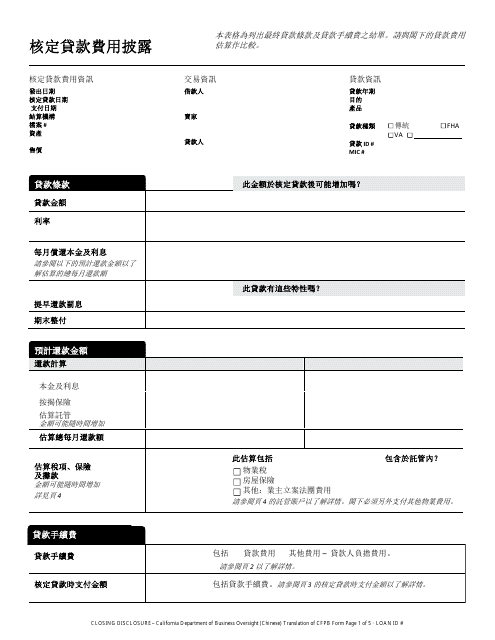

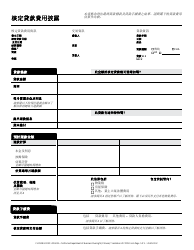

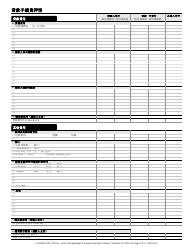

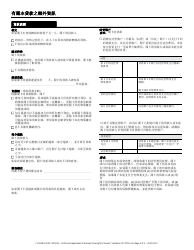

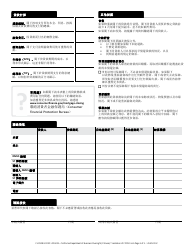

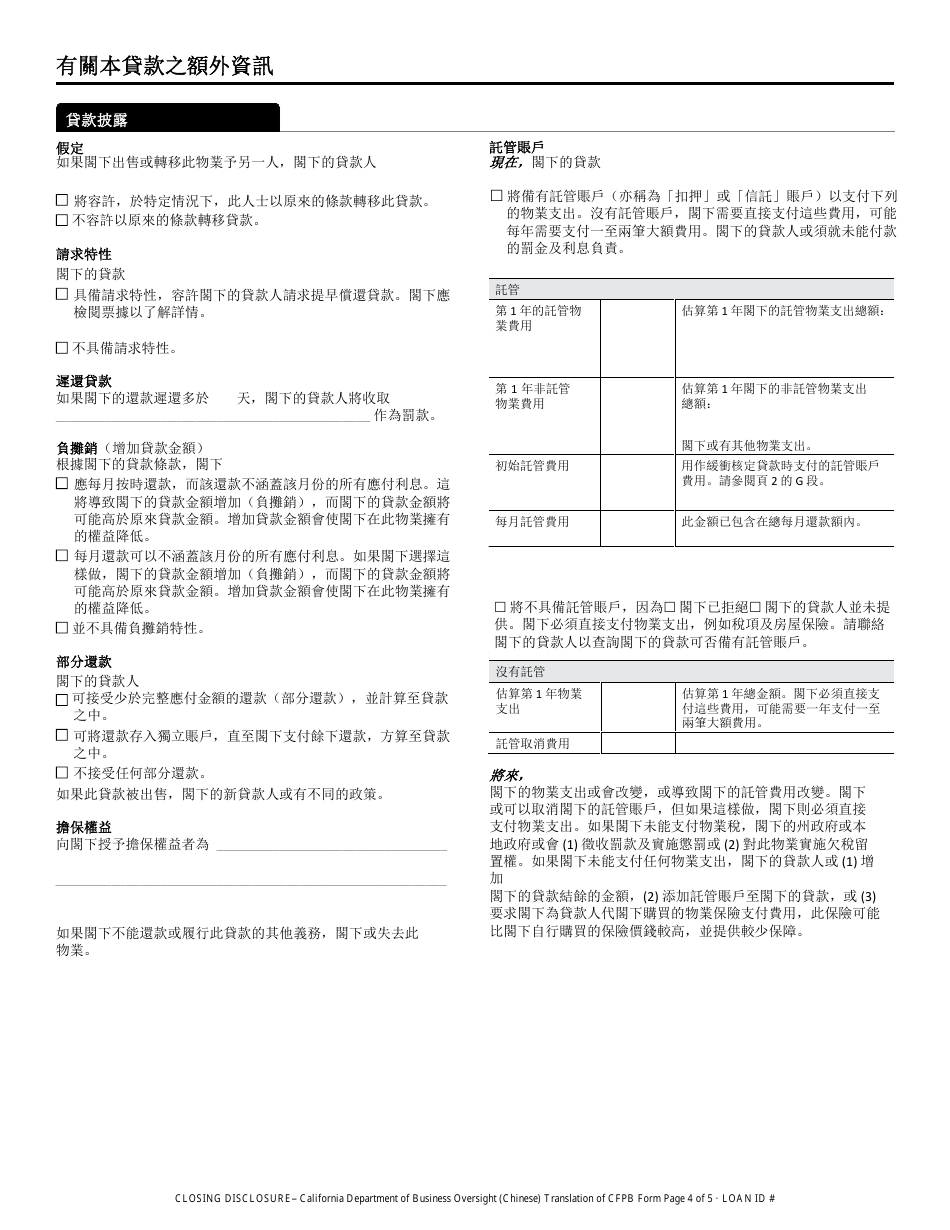

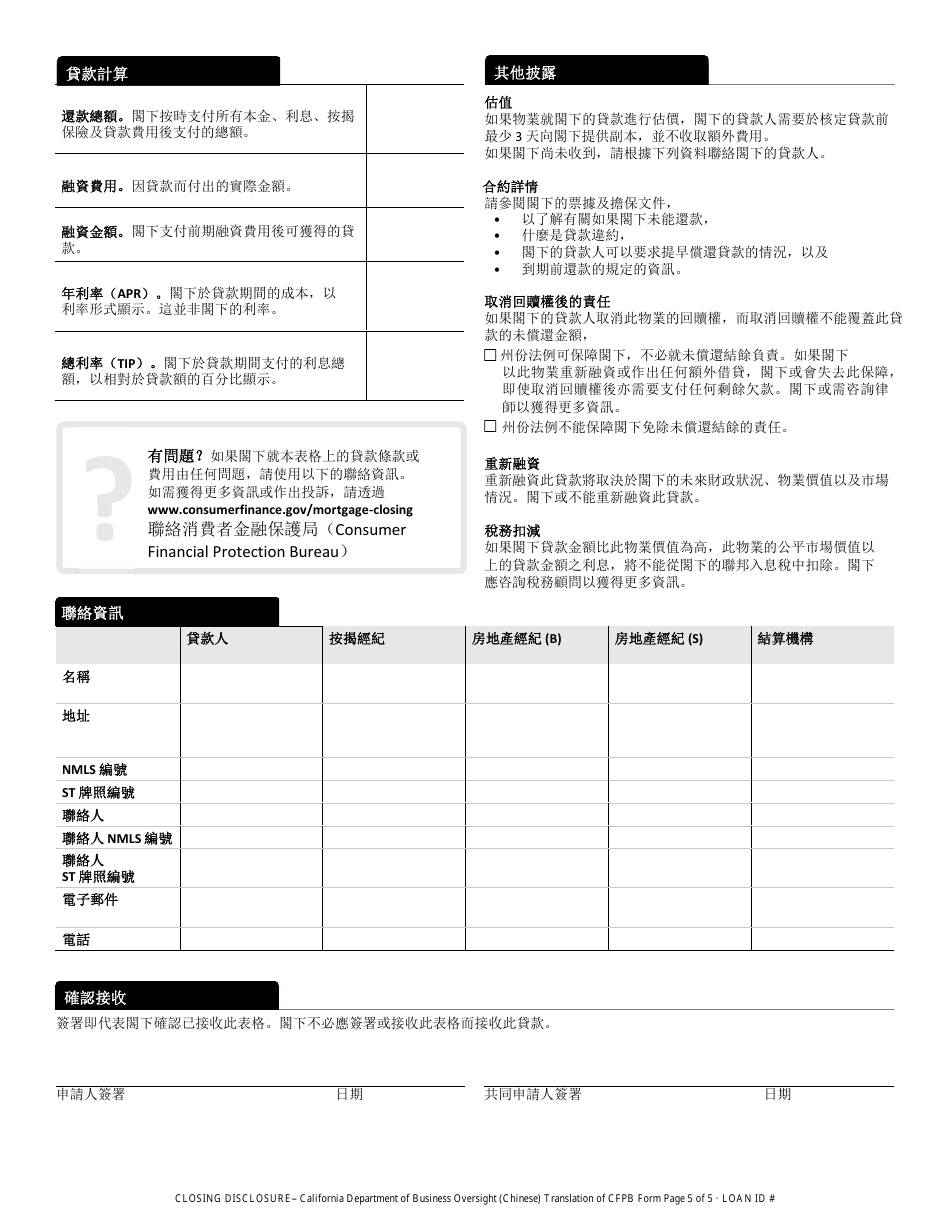

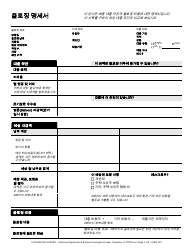

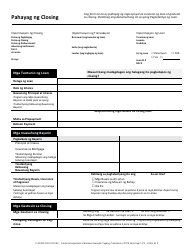

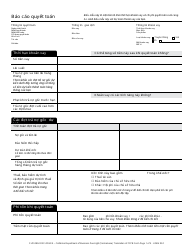

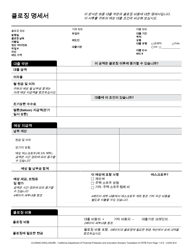

Closing Disclosure Form - California (Chinese)

This is a legal document that was released by the California Department of Financial Protection and Innovation - a government authority operating within California.

The document is provided in Chinese.

FAQ

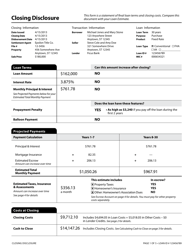

Q: What is the Closing Disclosure form?

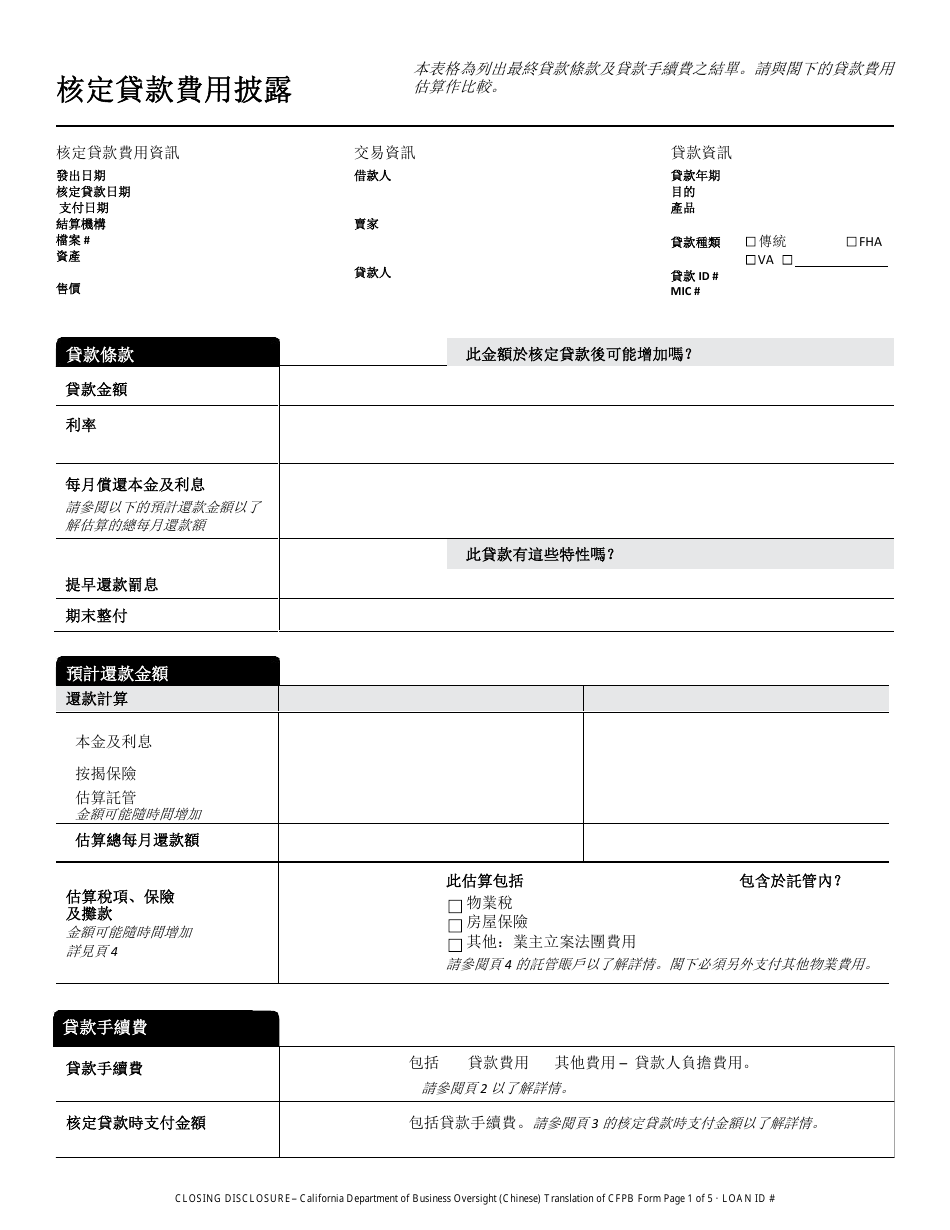

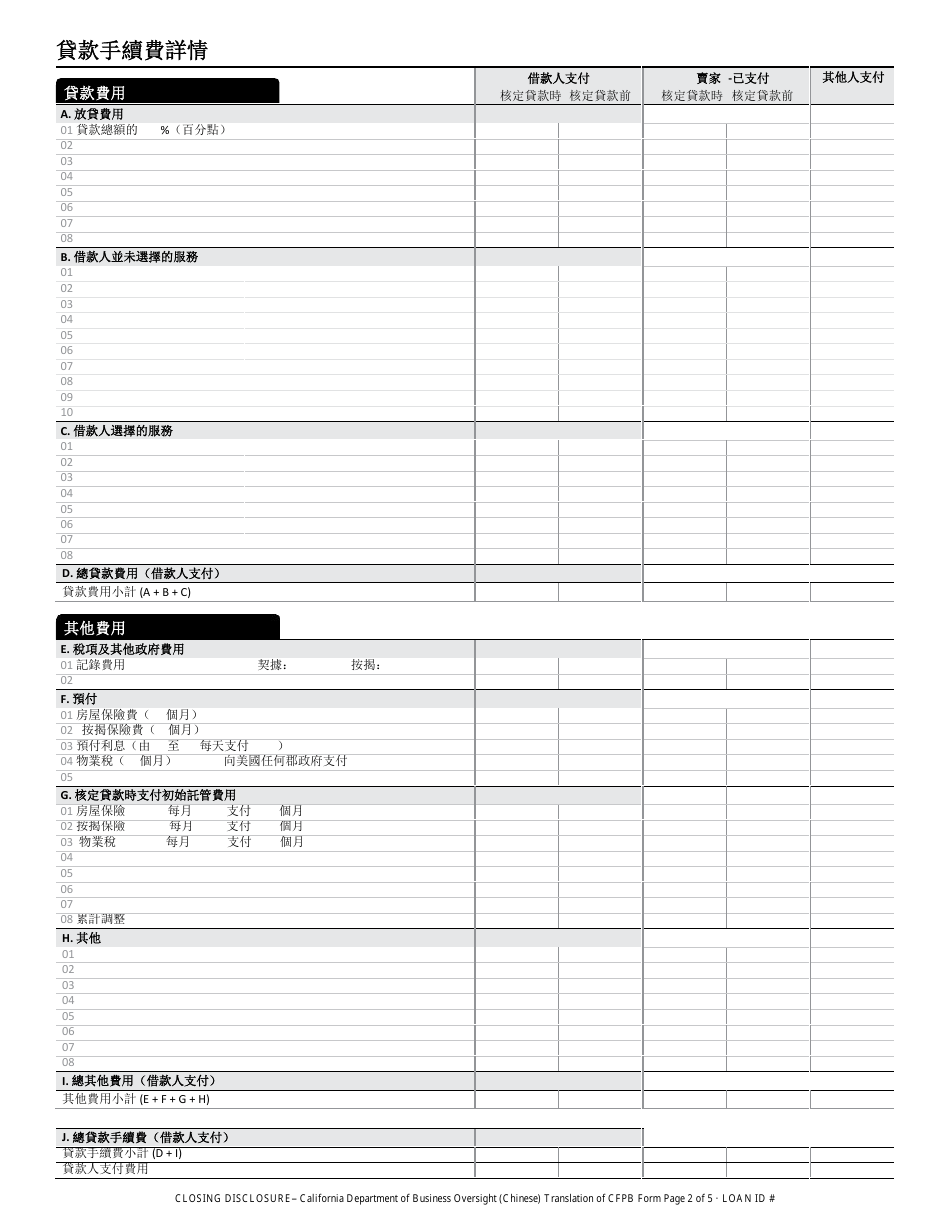

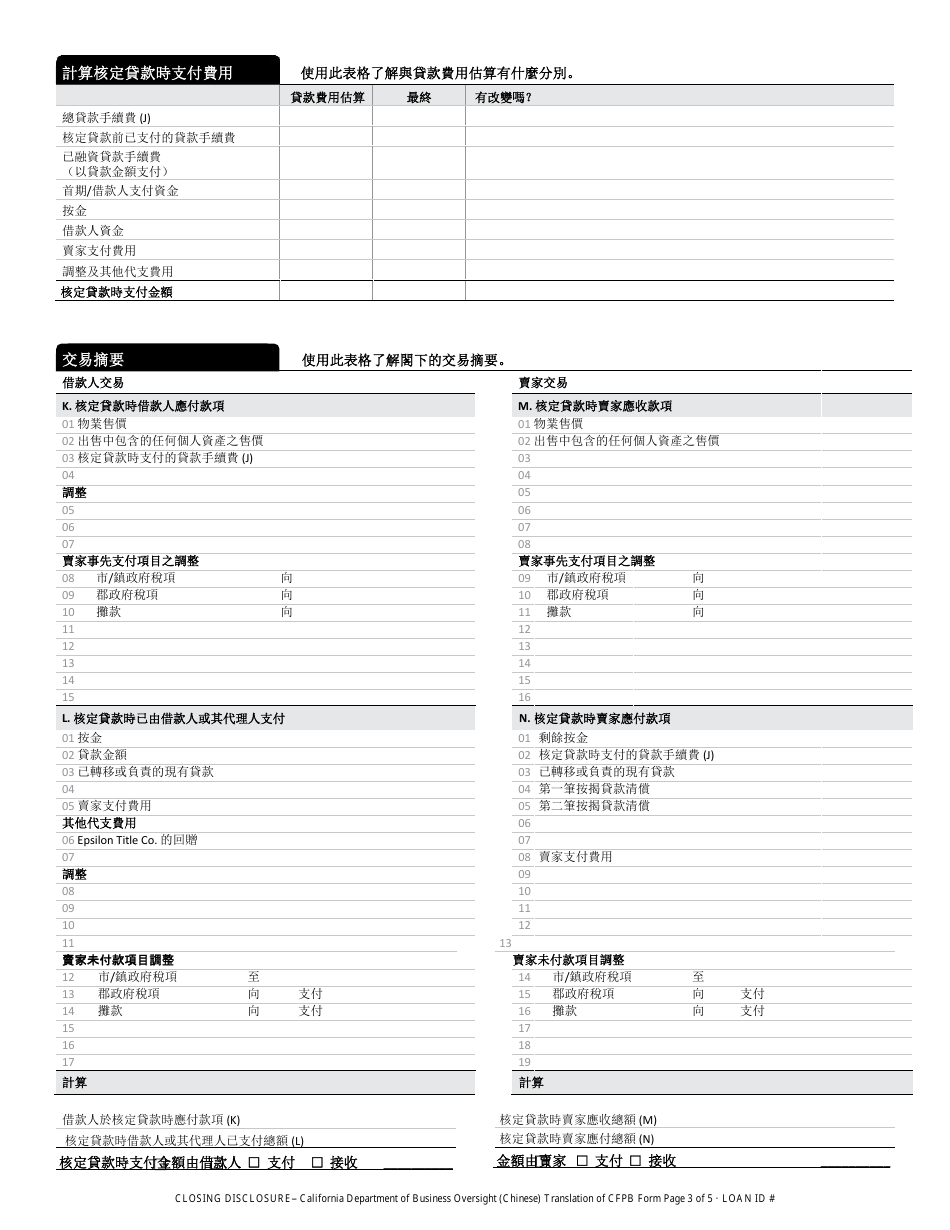

A: The Closing Disclosure form is a document that provides the final details about your mortgage loan, including the loan terms, closing costs, and other important information.

Q: Why is the Closing Disclosure form important?

A: The Closing Disclosure form is important because it helps you understand the costs and terms associated with your mortgage loan, ensuring that you are making an informed decision.

Q: When will I receive the Closing Disclosure form?

A: You should receive the Closing Disclosure form at least three business days before your scheduled closing date, giving you time to review the document before finalizing the loan.

Q: What should I look for in the Closing Disclosure form?

A: When reviewing the Closing Disclosure form, you should pay attention to the loan terms, interest rate, closing costs, and any other fees or charges associated with the loan.

Q: Can I make changes to the Closing Disclosure form?

A: If you find any errors or discrepancies in the Closing Disclosure form, you should notify your lender immediately. They can make the necessary corrections and provide you with an updated form.

Q: What happens after I receive the Closing Disclosure form?

A: After receiving the Closing Disclosure form, you should carefully review all the information and compare it to the Loan Estimate form. If you have any questions or concerns, you should reach out to your lender for clarification.

Form Details:

- The latest edition currently provided by the California Department of Financial Protection and Innovation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the California Department of Financial Protection and Innovation.