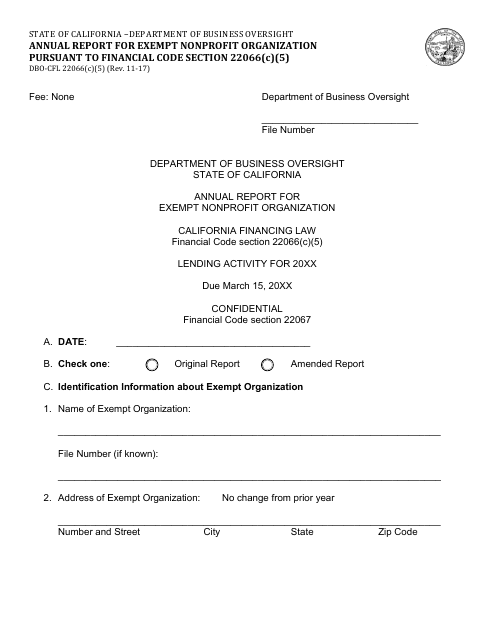

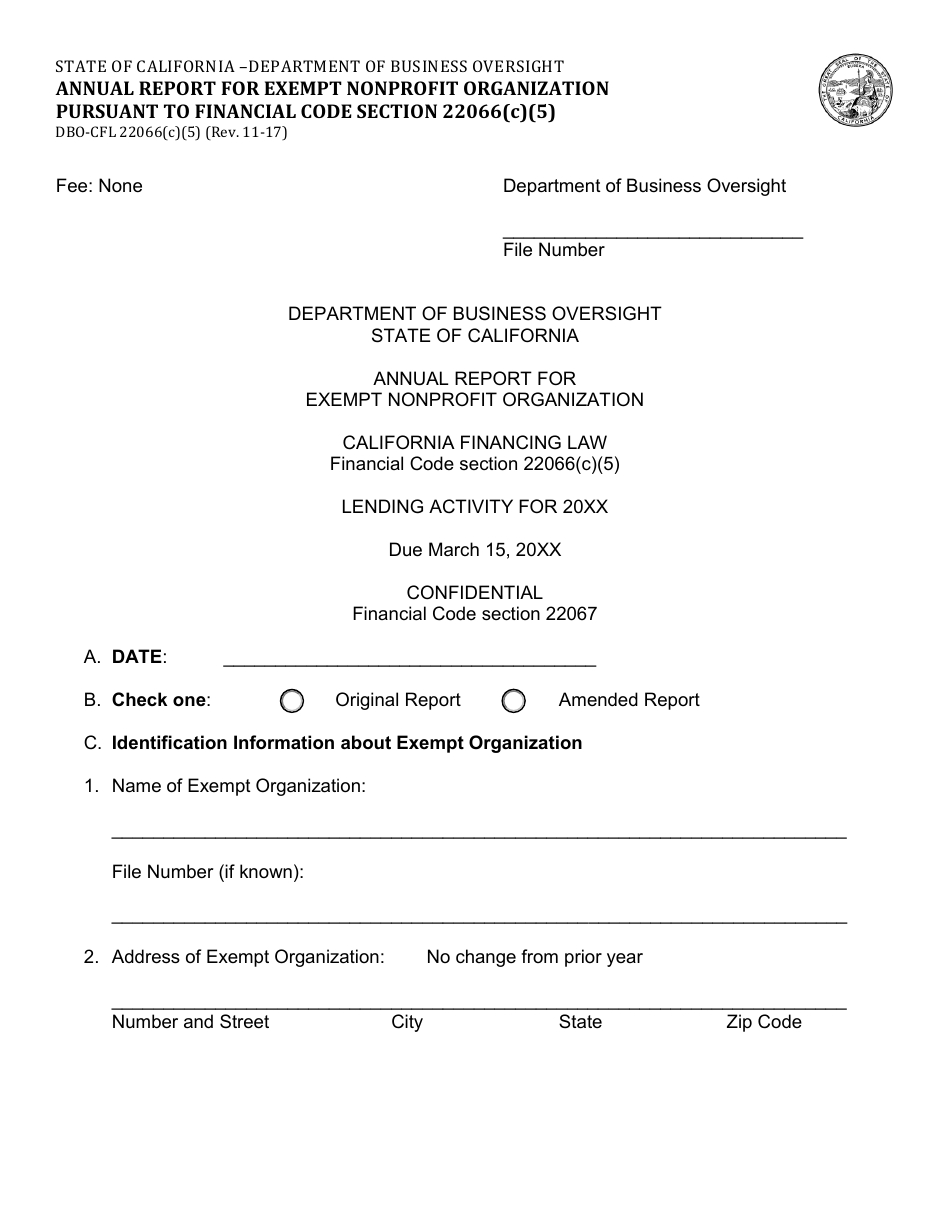

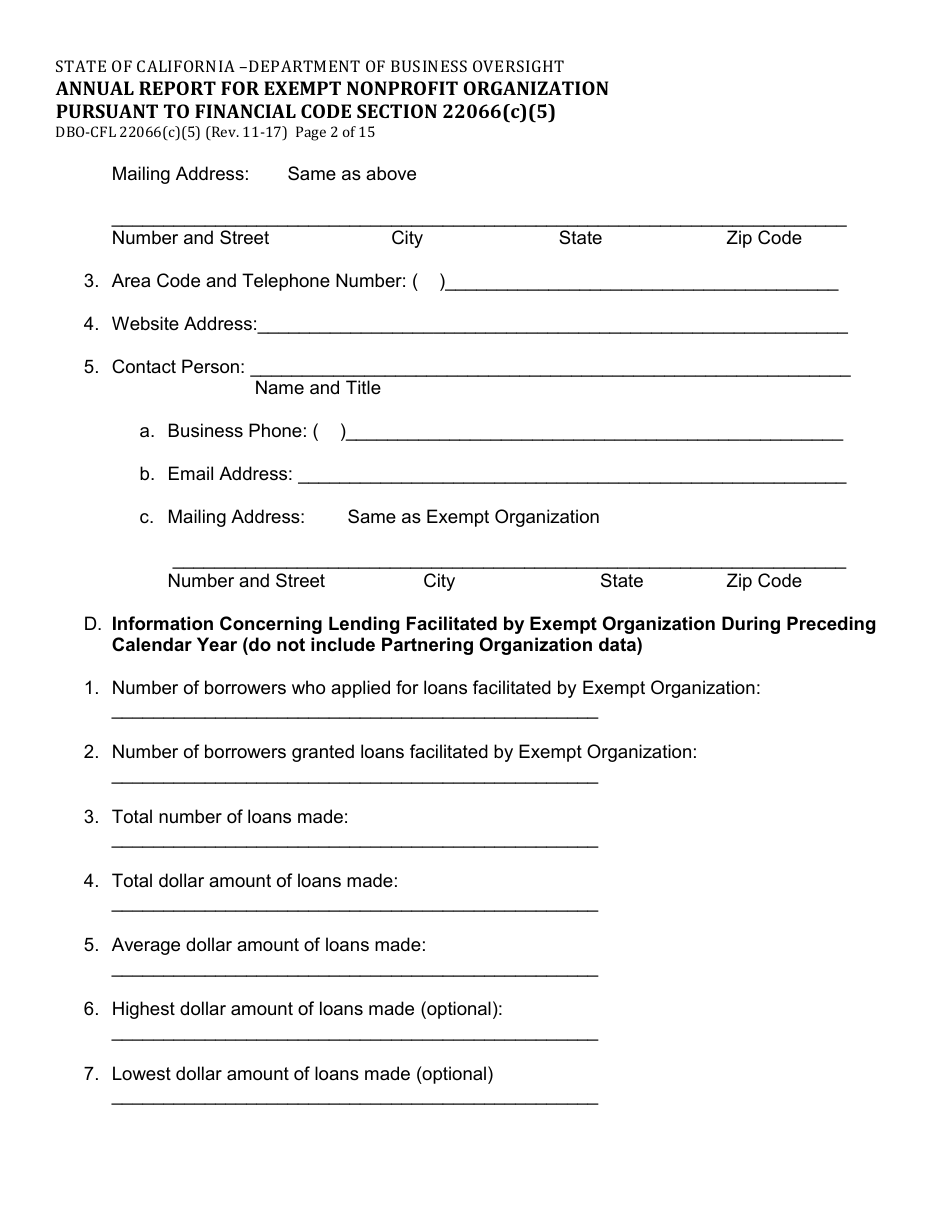

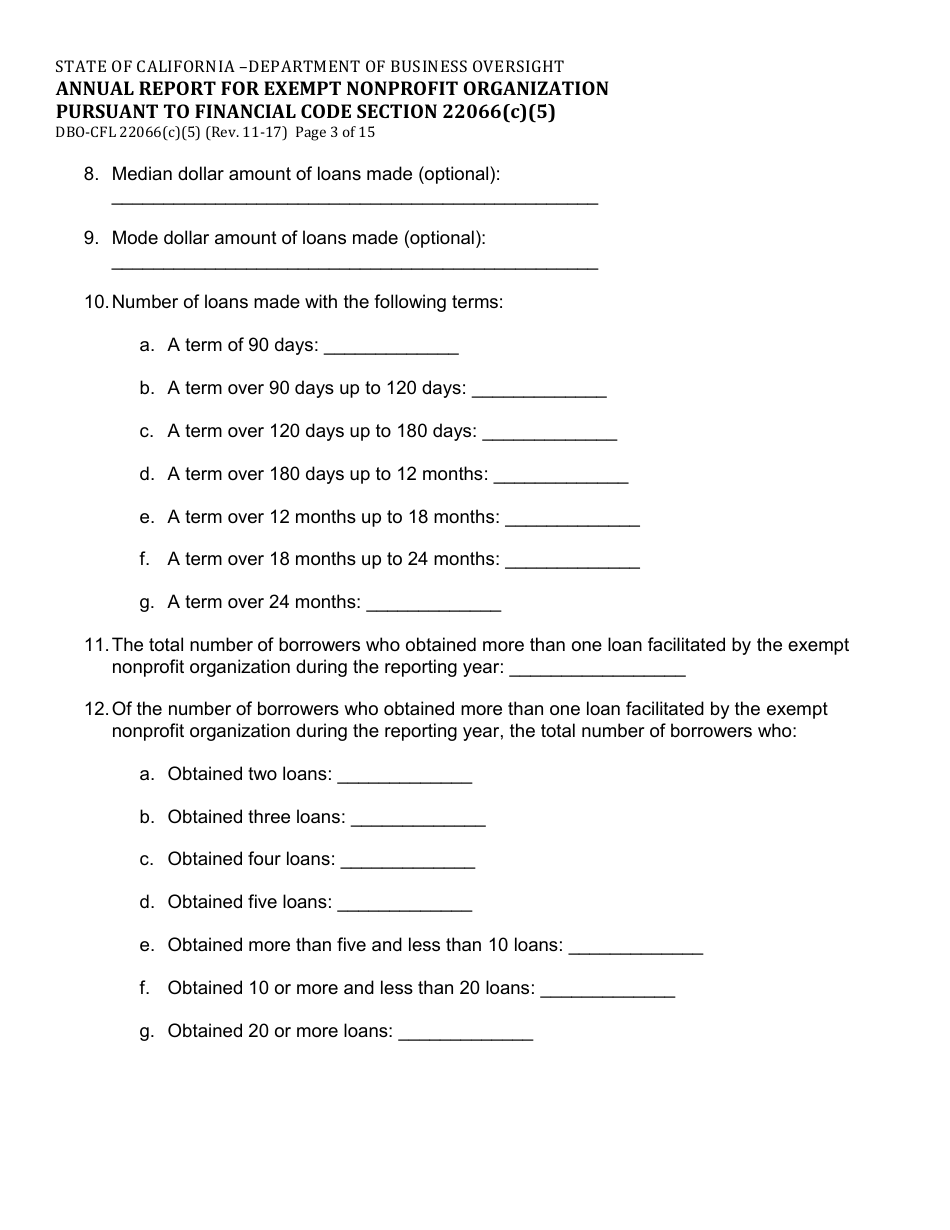

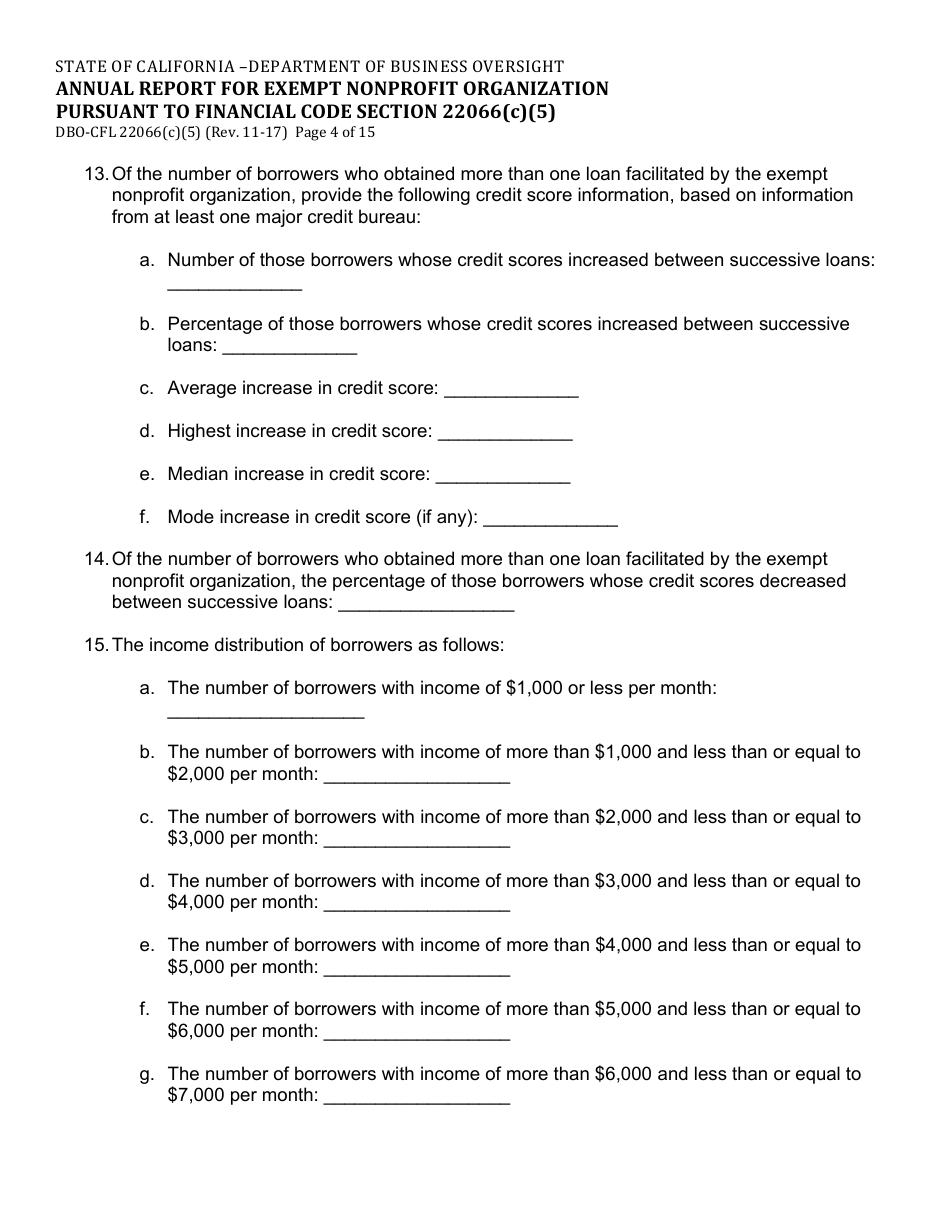

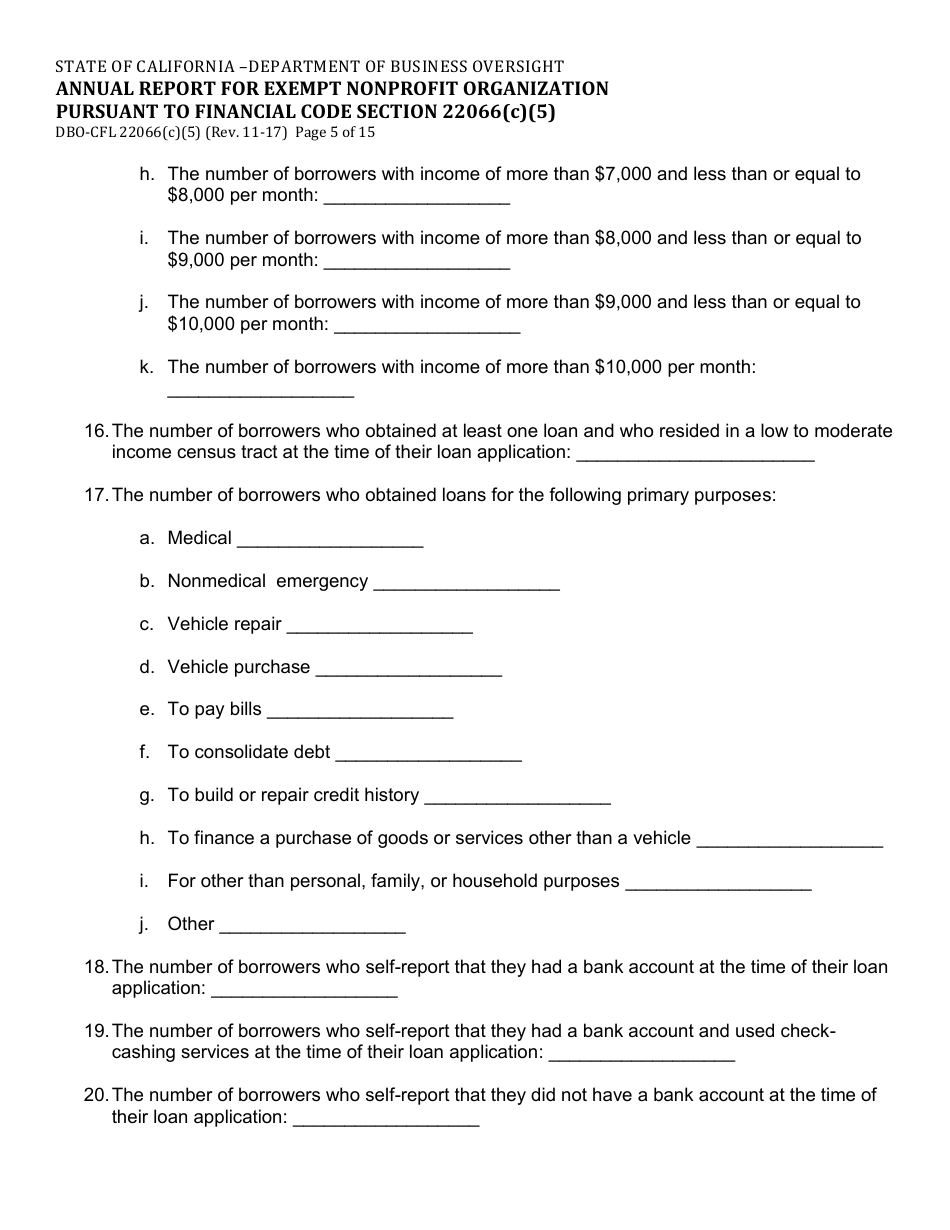

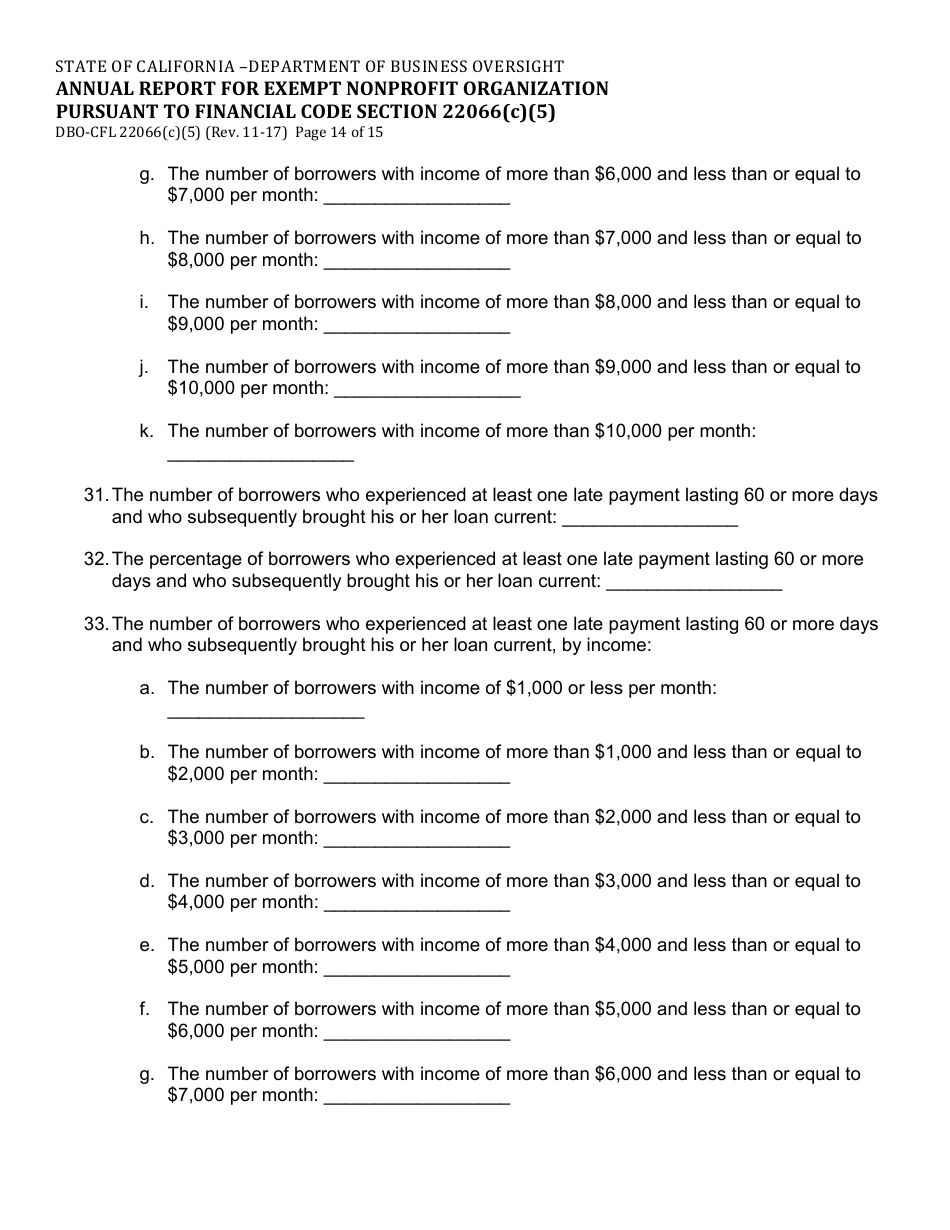

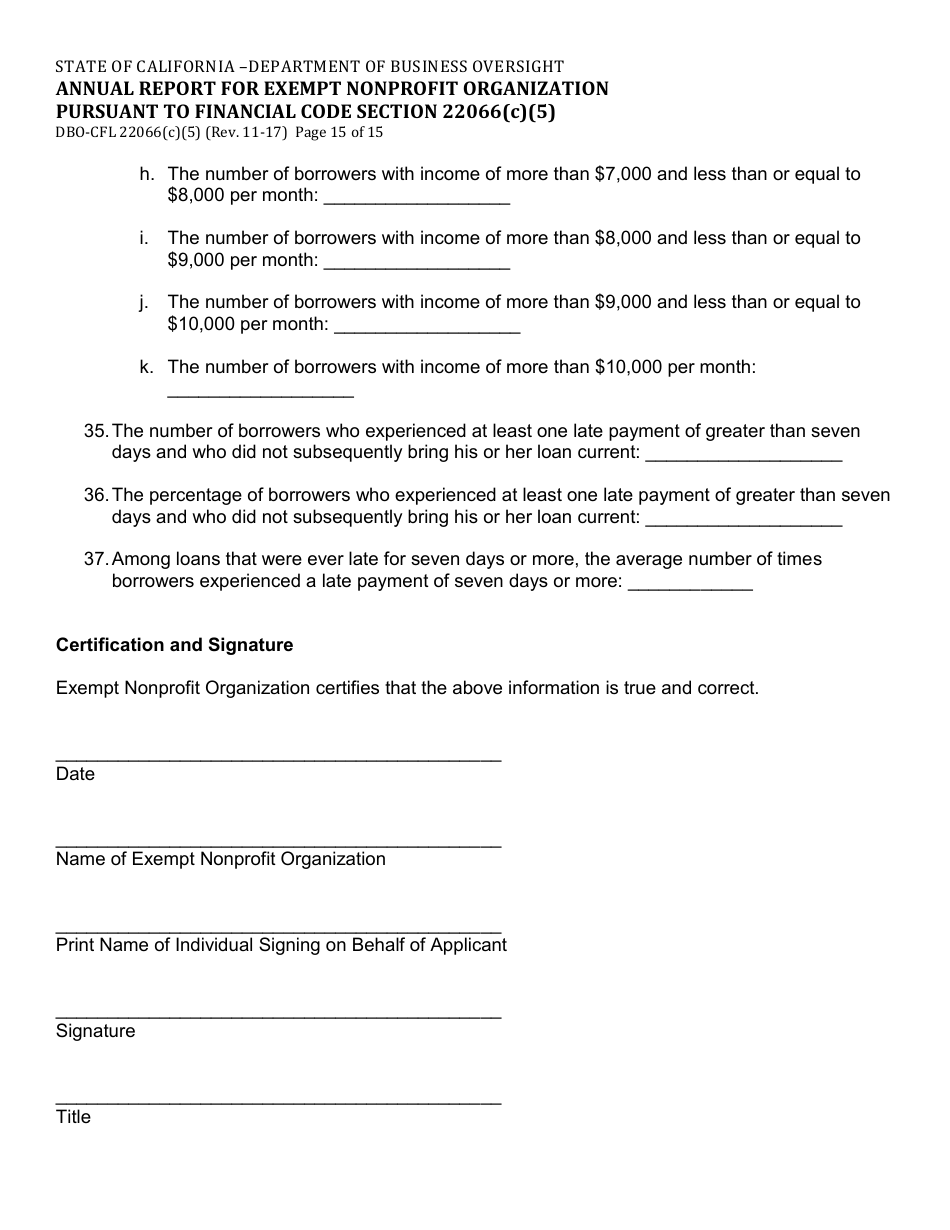

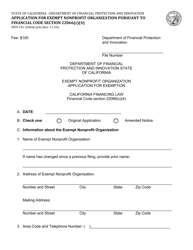

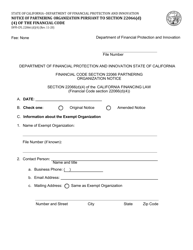

Form DBO-CFL22066(C)(5) Annual Report for Exempt Nonprofit Organization Pursuant to Financial Code Section 22066(C)(5) - California

What Is Form DBO-CFL22066(C)(5)?

This is a legal form that was released by the California Department of Financial Protection and Innovation - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DBO-CFL22066(C)(5)?

A: Form DBO-CFL22066(C)(5) is an annual report for exempt nonprofit organizations in California.

Q: Which organization needs to file Form DBO-CFL22066(C)(5)?

A: Exempt nonprofit organizations in California need to file Form DBO-CFL22066(C)(5).

Q: What is the purpose of filing Form DBO-CFL22066(C)(5)?

A: The purpose of filing Form DBO-CFL22066(C)(5) is to report financial information for exempt nonprofit organizations.

Q: What is Financial Code Section 22066(C)(5)?

A: Financial Code Section 22066(C)(5) is the section of the California Financial Code that mandates the filing of Form DBO-CFL22066(C)(5) for exempt nonprofit organizations.

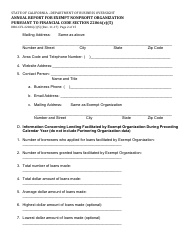

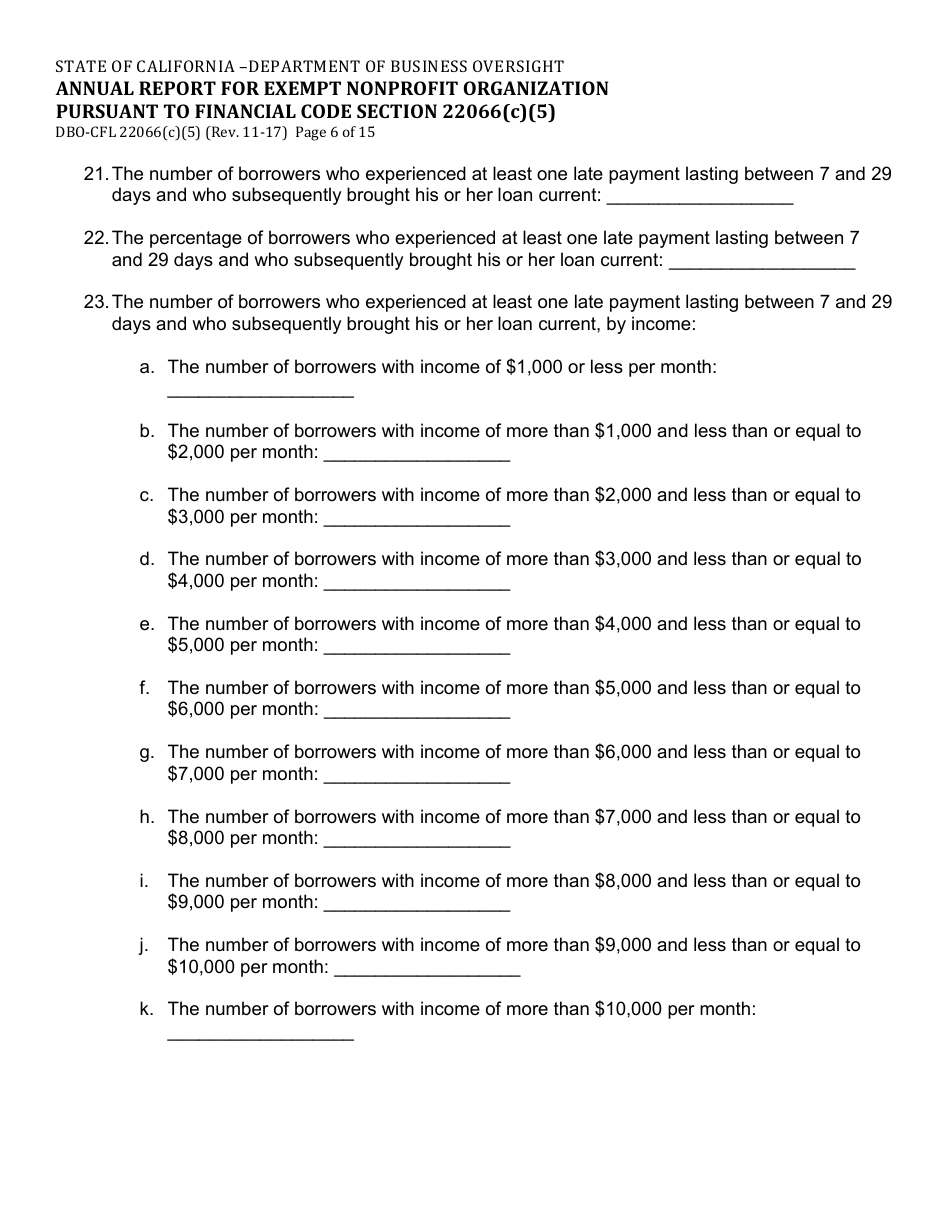

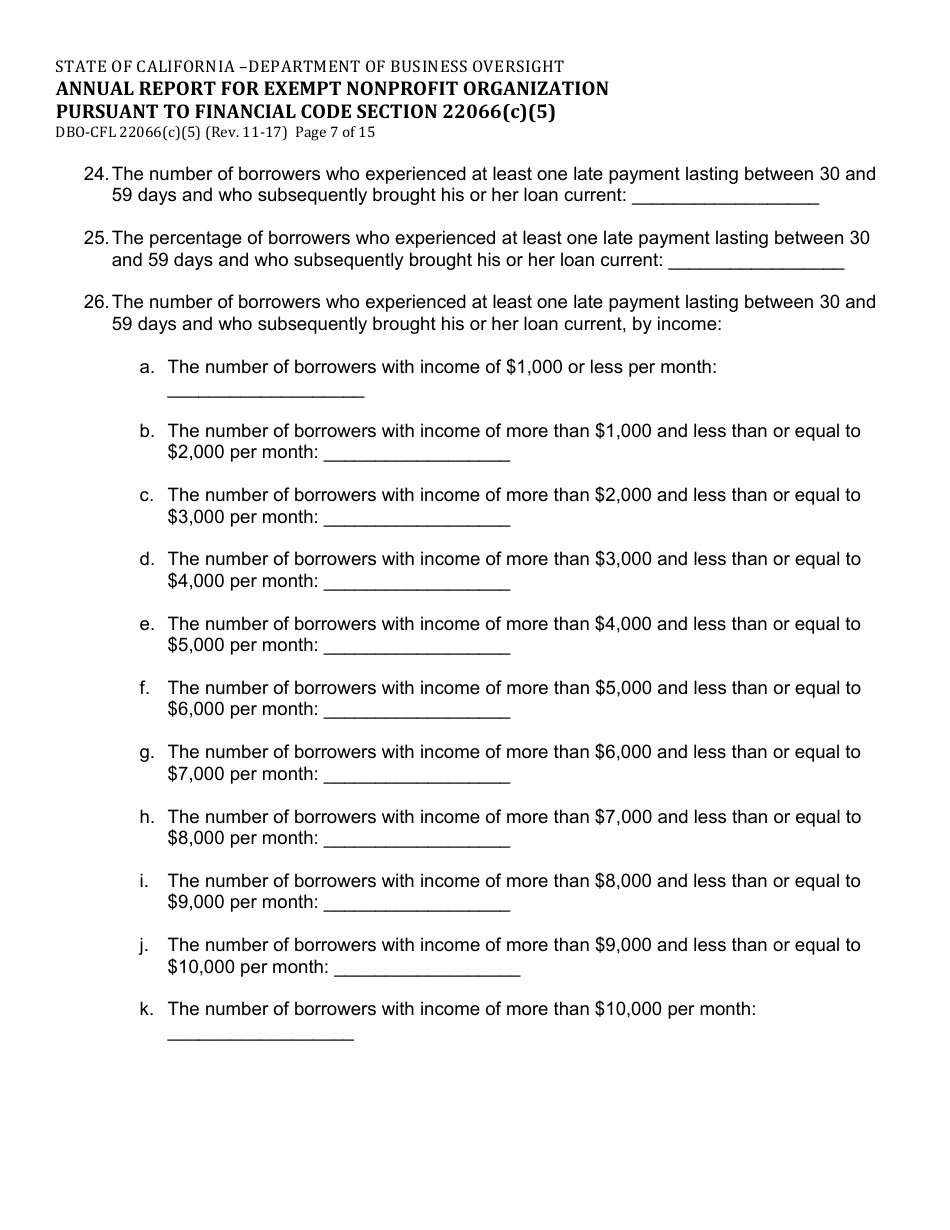

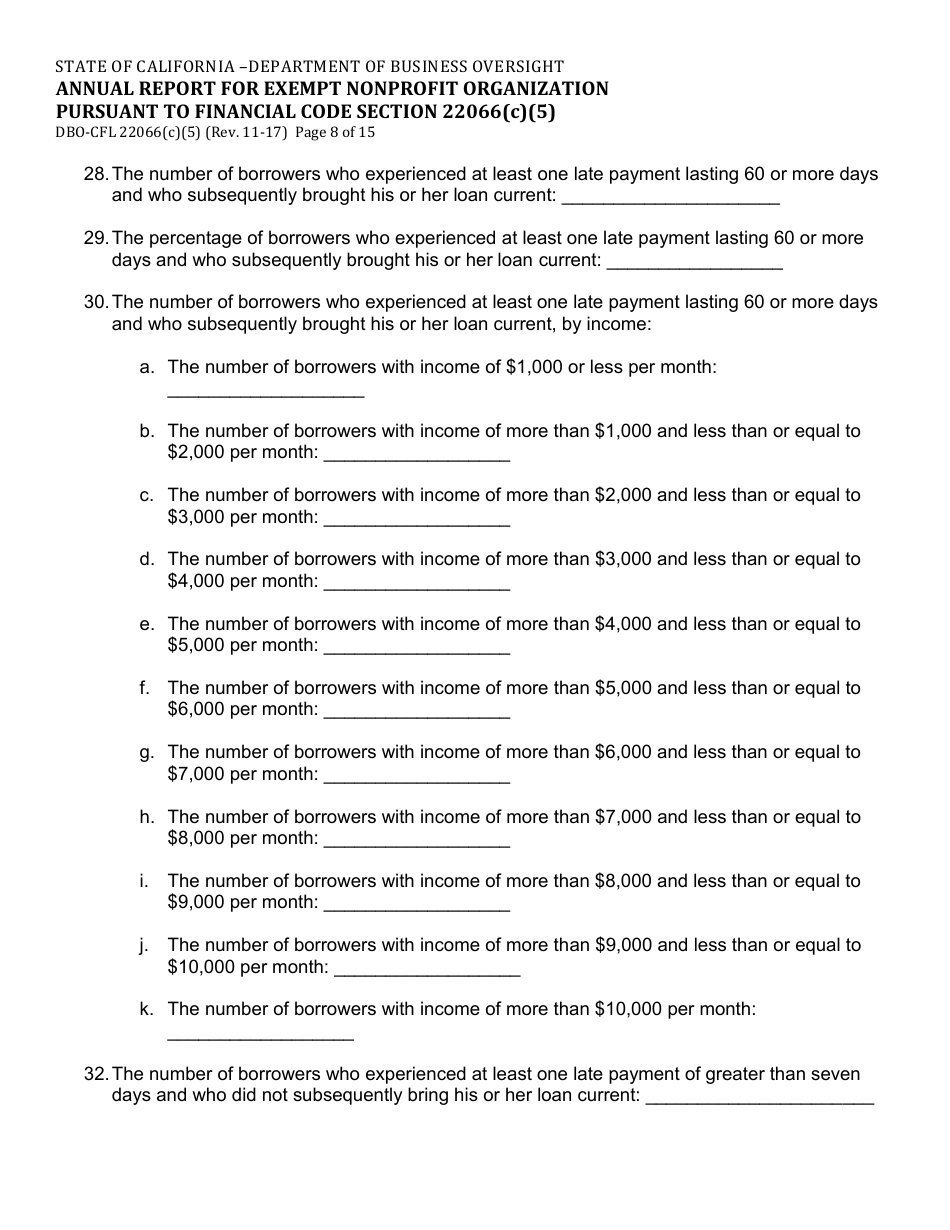

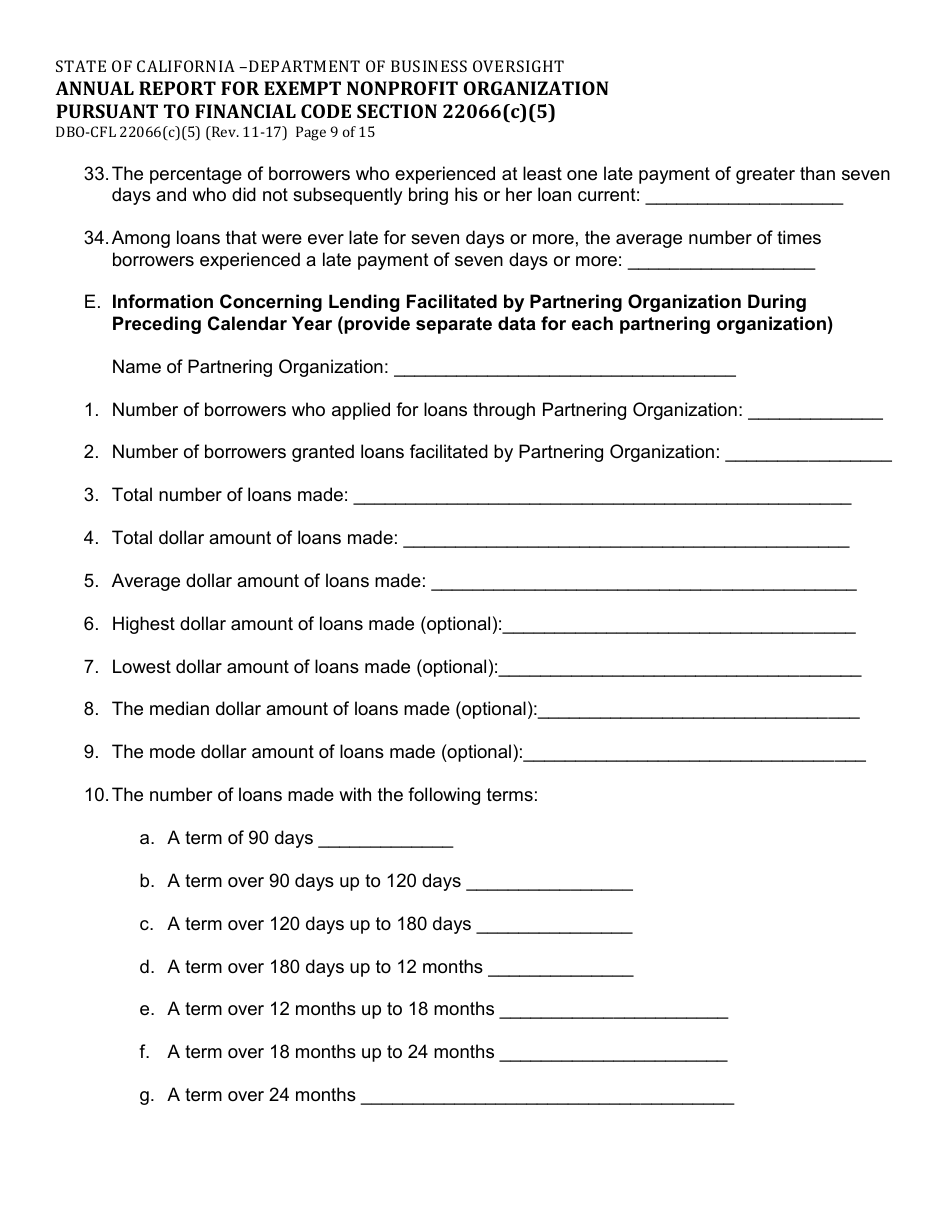

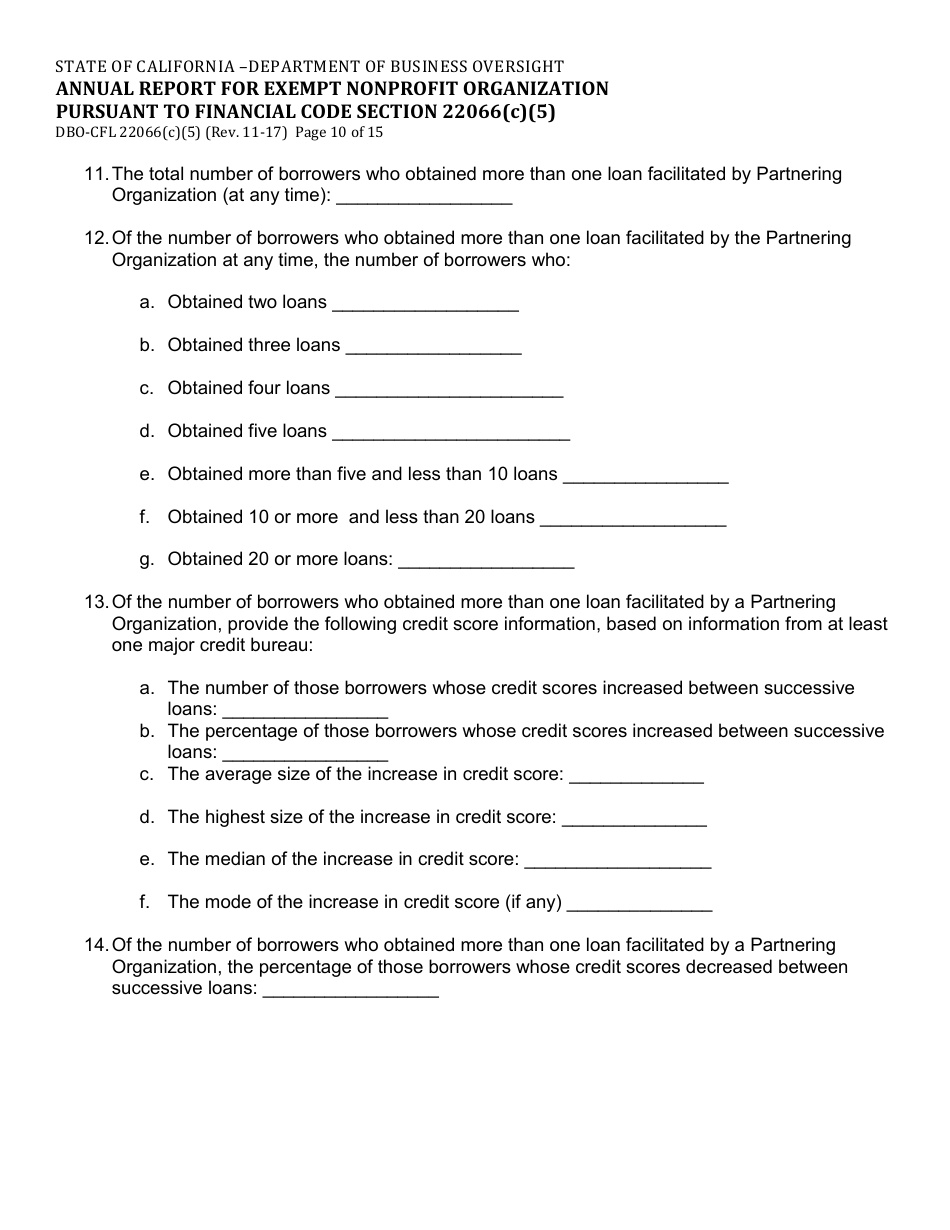

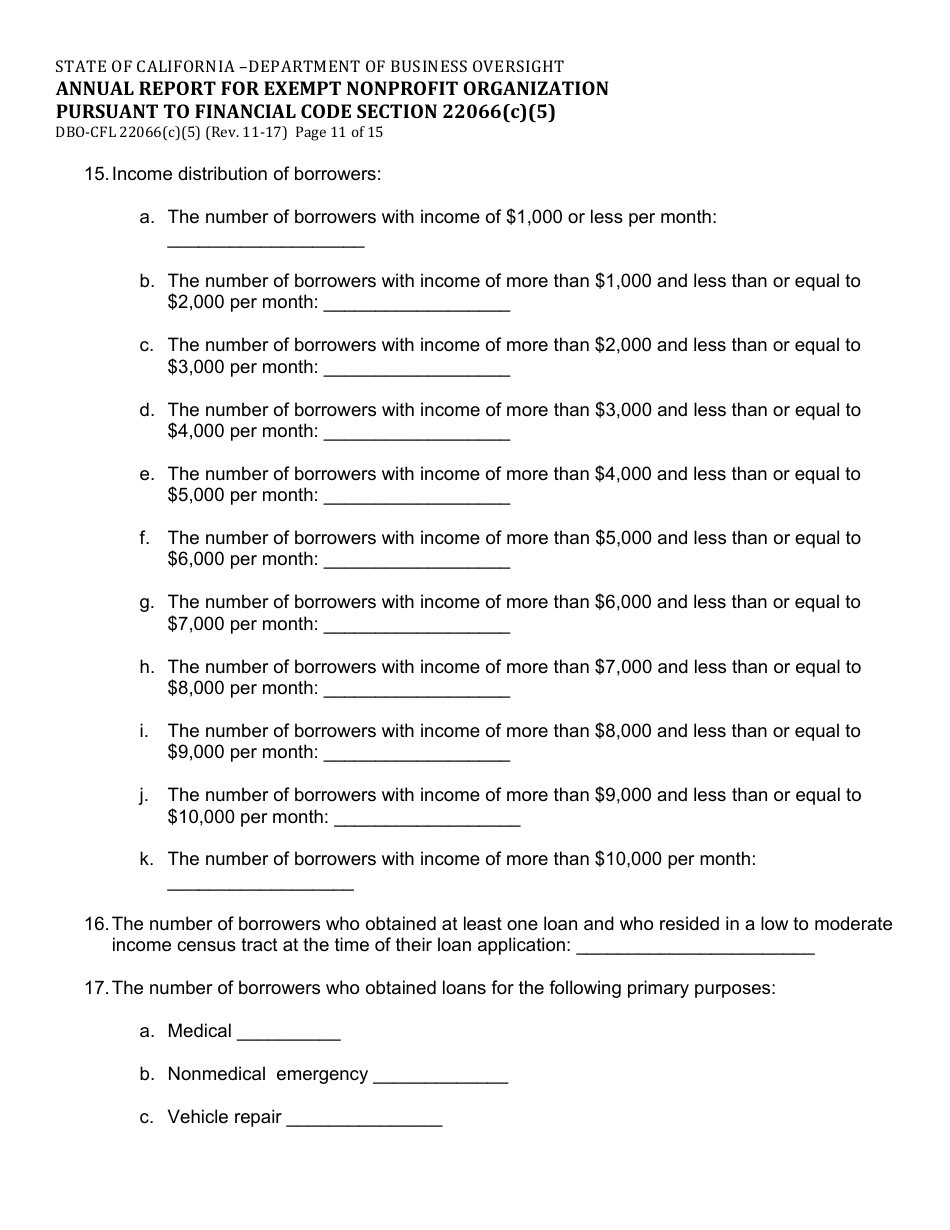

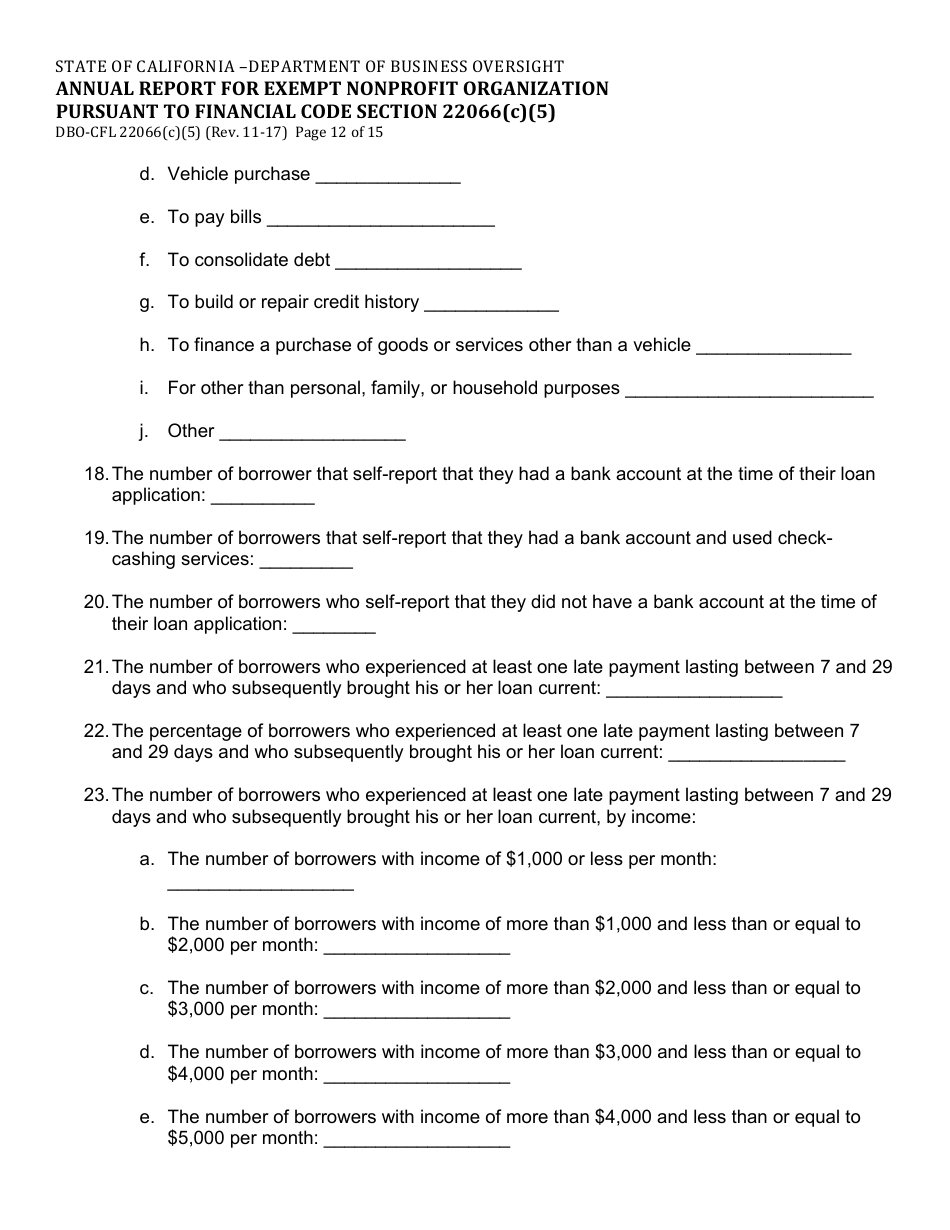

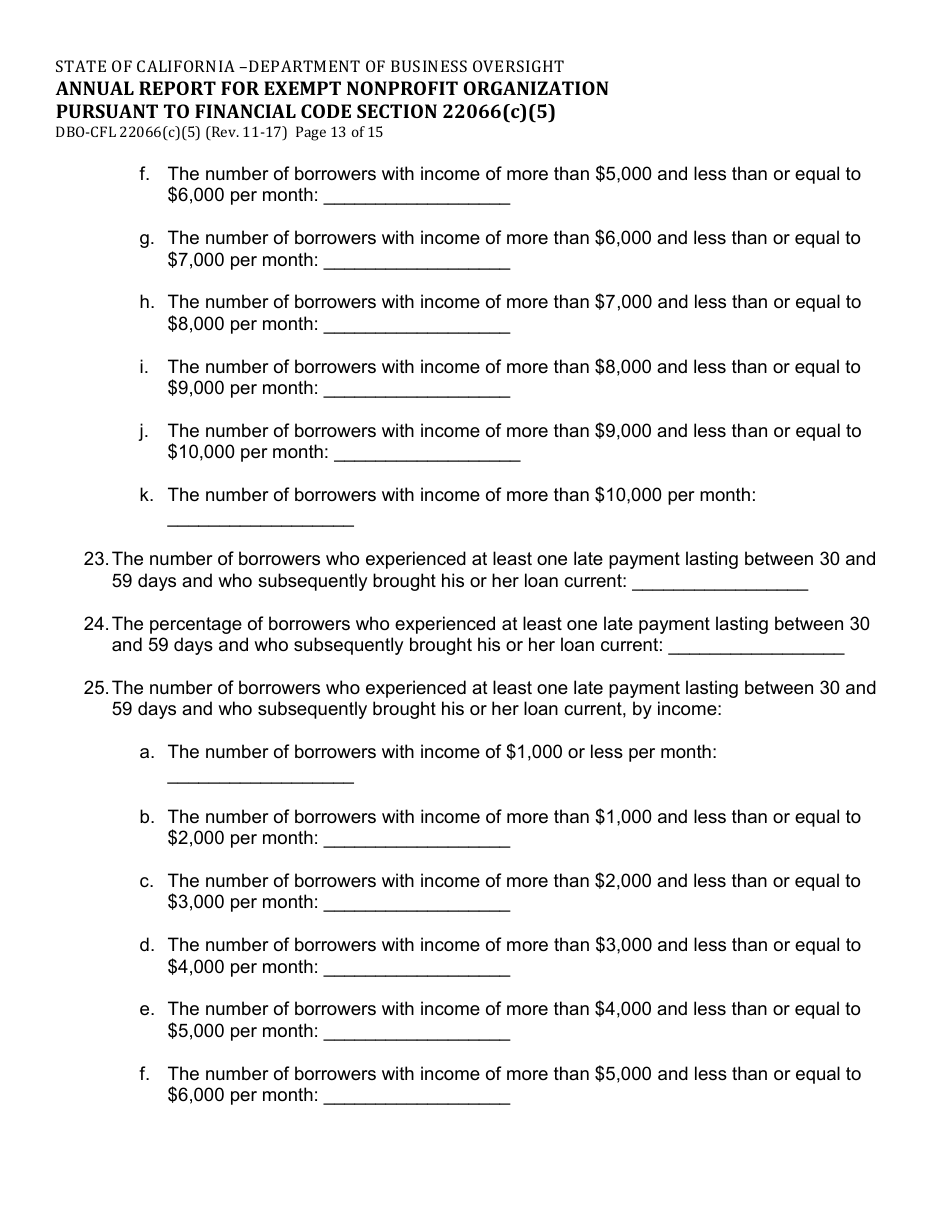

Q: What information is required in Form DBO-CFL22066(C)(5)?

A: Form DBO-CFL22066(C)(5) requires financial information such as revenue, expenses, assets, and liabilities of the exempt nonprofit organization.

Q: When is Form DBO-CFL22066(C)(5) due?

A: Form DBO-CFL22066(C)(5) is due annually by a specific deadline determined by the California Financial Code.

Q: Are there any penalties for not filing Form DBO-CFL22066(C)(5)?

A: Yes, there may be penalties for not filing Form DBO-CFL22066(C)(5) as required by the California Financial Code.

Form Details:

- Released on November 1, 2017;

- The latest edition provided by the California Department of Financial Protection and Innovation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DBO-CFL22066(C)(5) by clicking the link below or browse more documents and templates provided by the California Department of Financial Protection and Innovation.