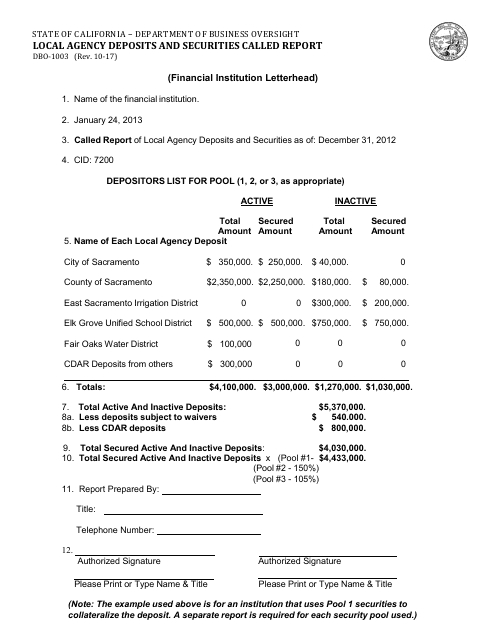

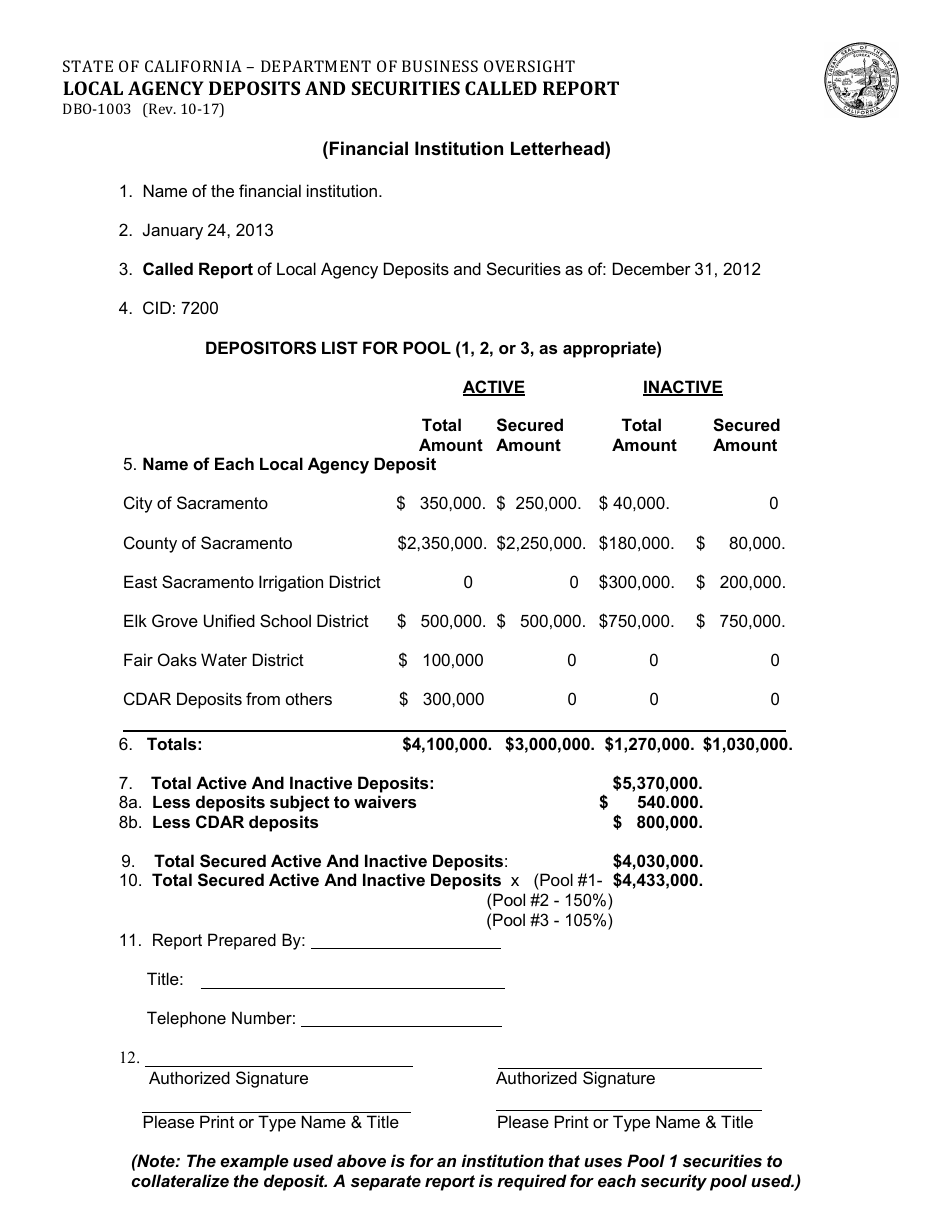

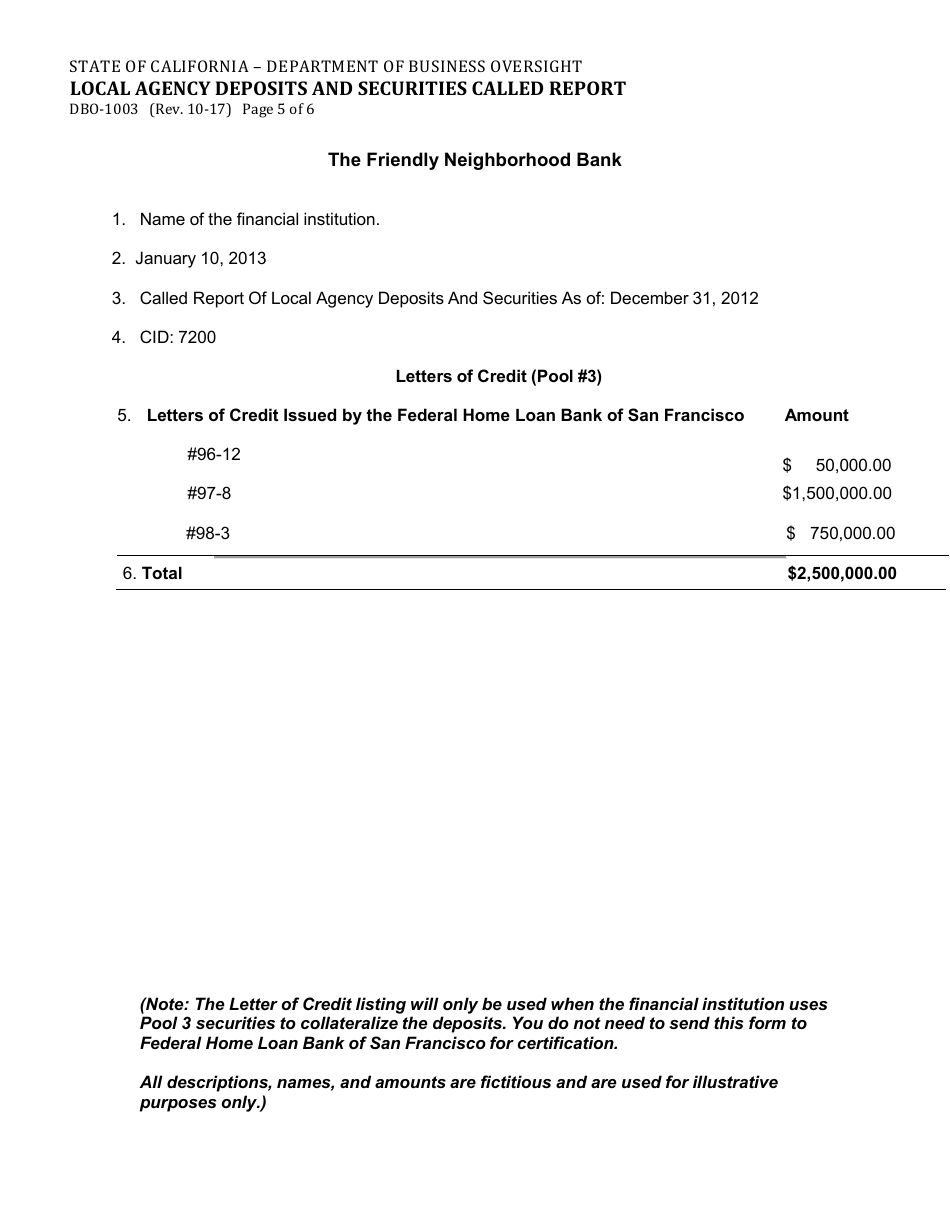

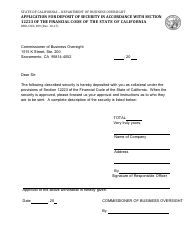

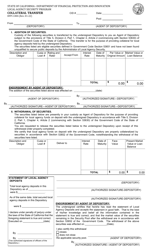

Form DBO-1003 Local Agency Deposits and Securities Called Report - California

What Is Form DBO-1003?

This is a legal form that was released by the California Department of Financial Protection and Innovation - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form DBO-1003?

A: Form DBO-1003 is the Local Agency Deposits and Securities Called Report in California.

Q: What is the purpose of the Form DBO-1003?

A: The Form DBO-1003 is used to report any deposits or securities called by local agencies in California.

Q: Who needs to file the Form DBO-1003?

A: Local agencies in California who have called deposits or securities need to file the Form DBO-1003.

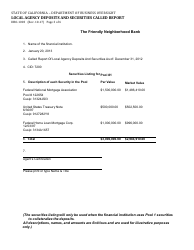

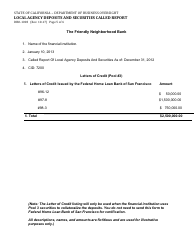

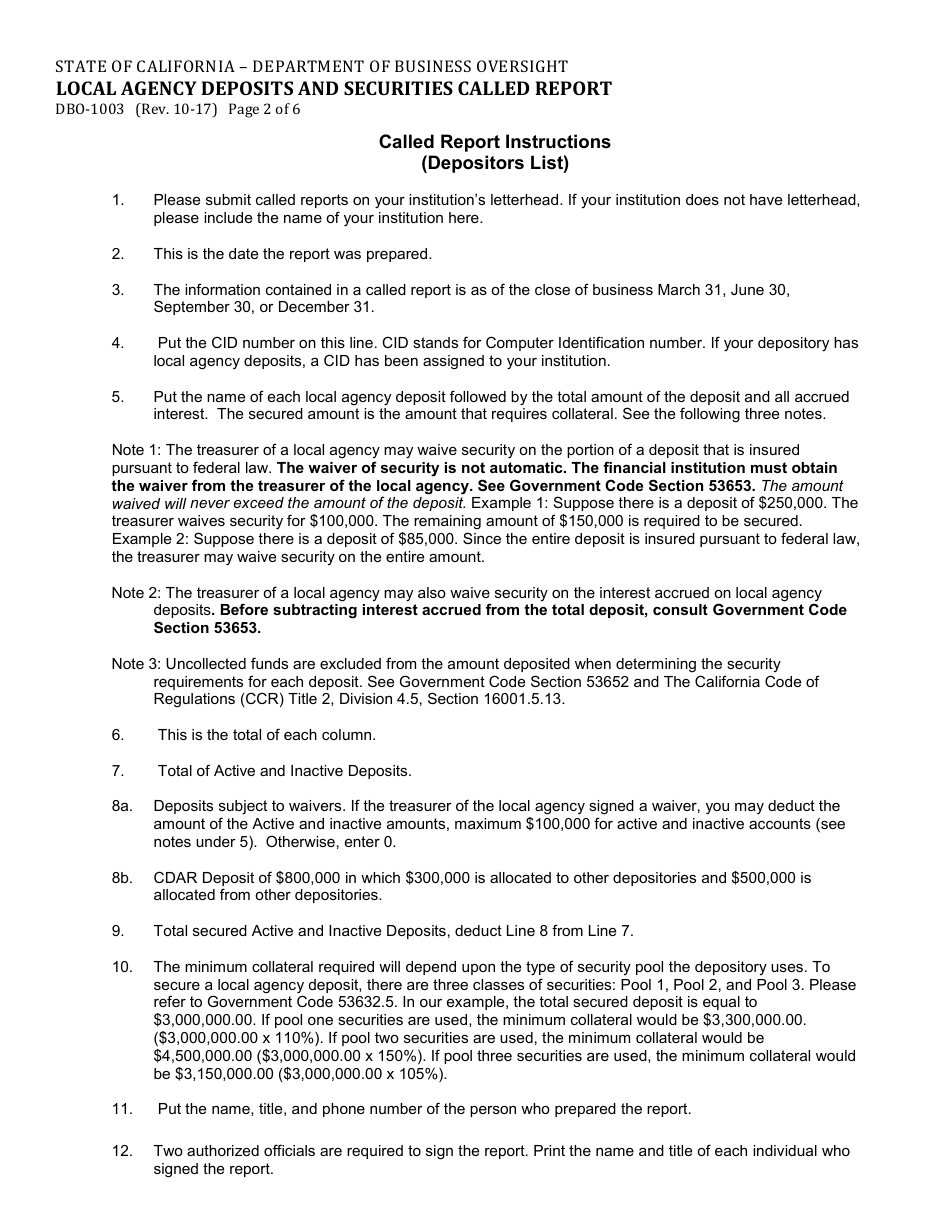

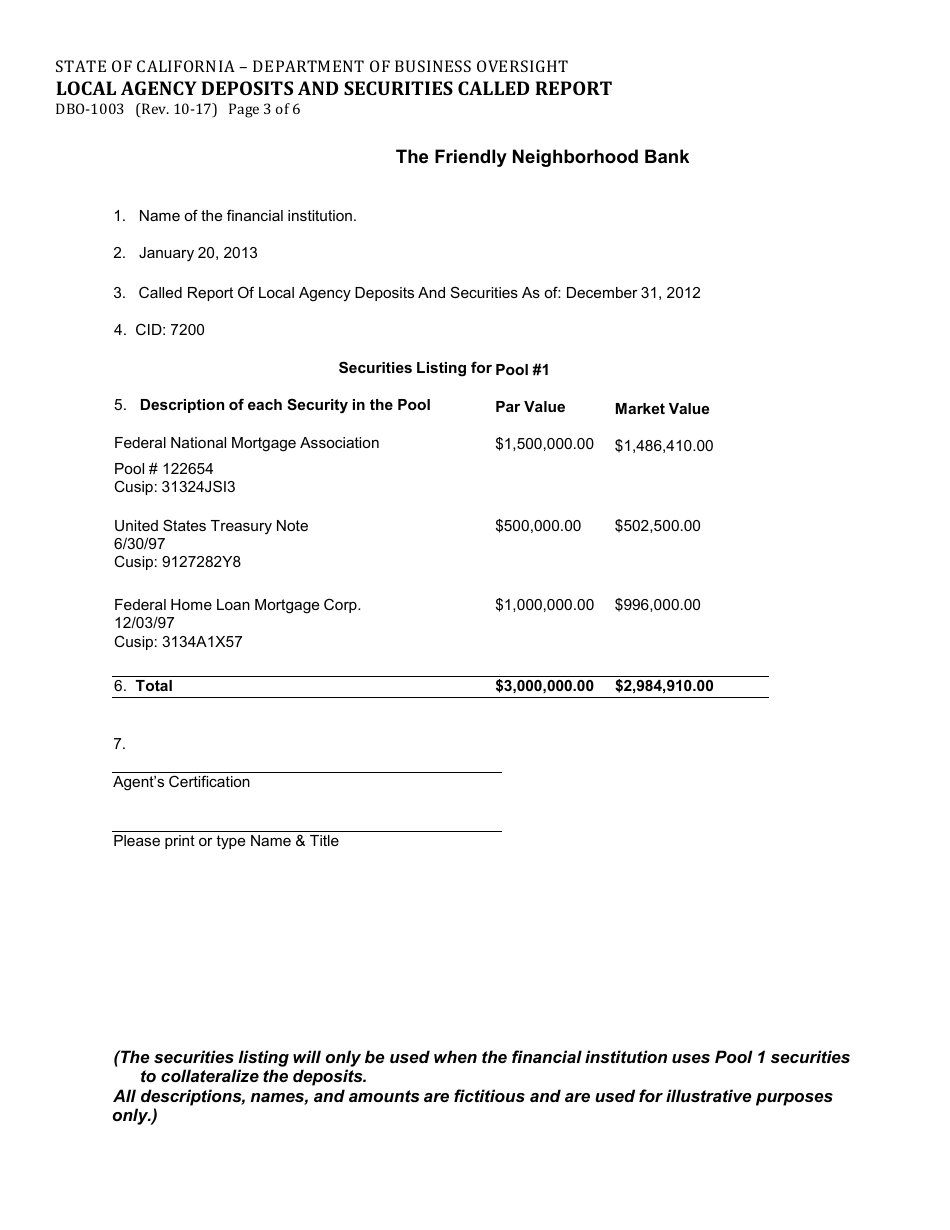

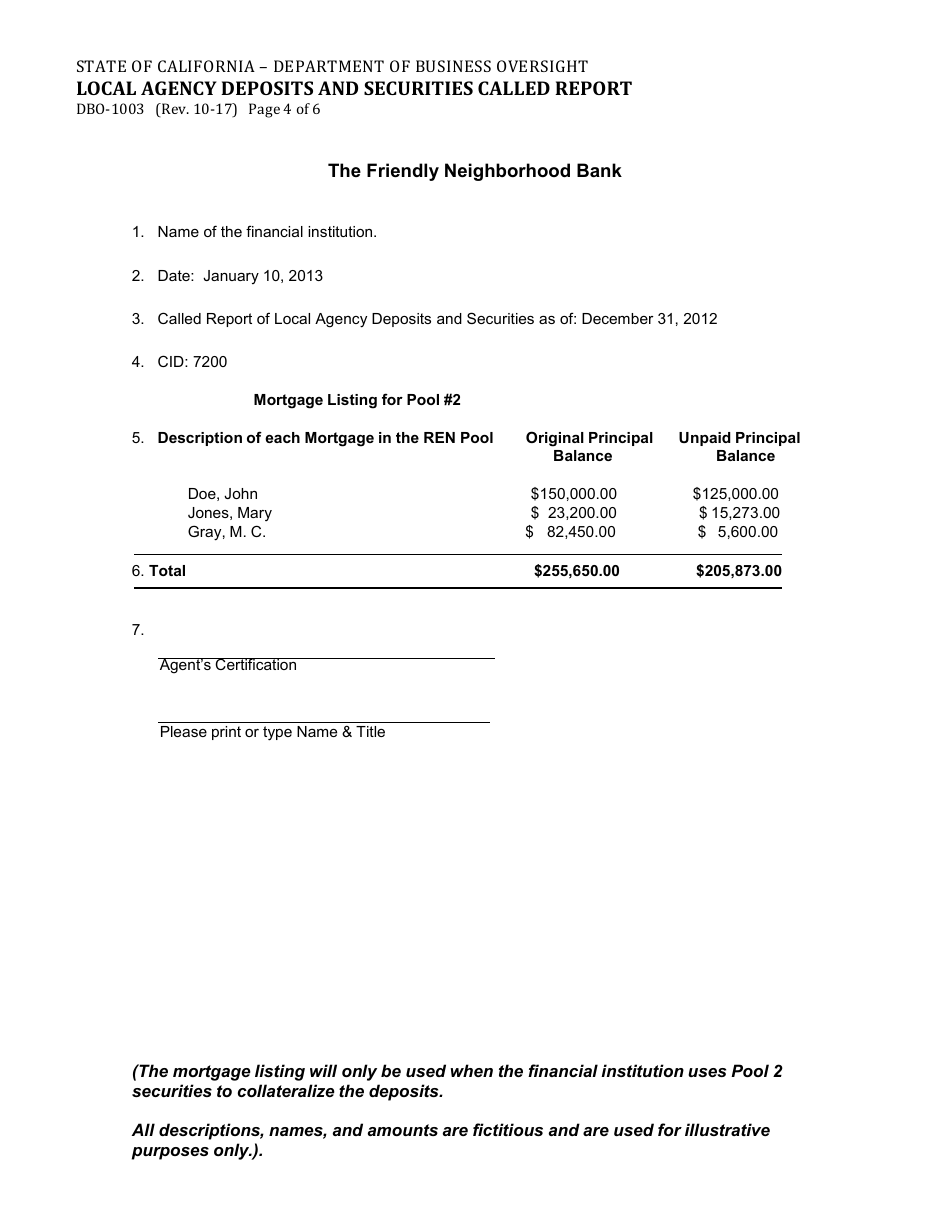

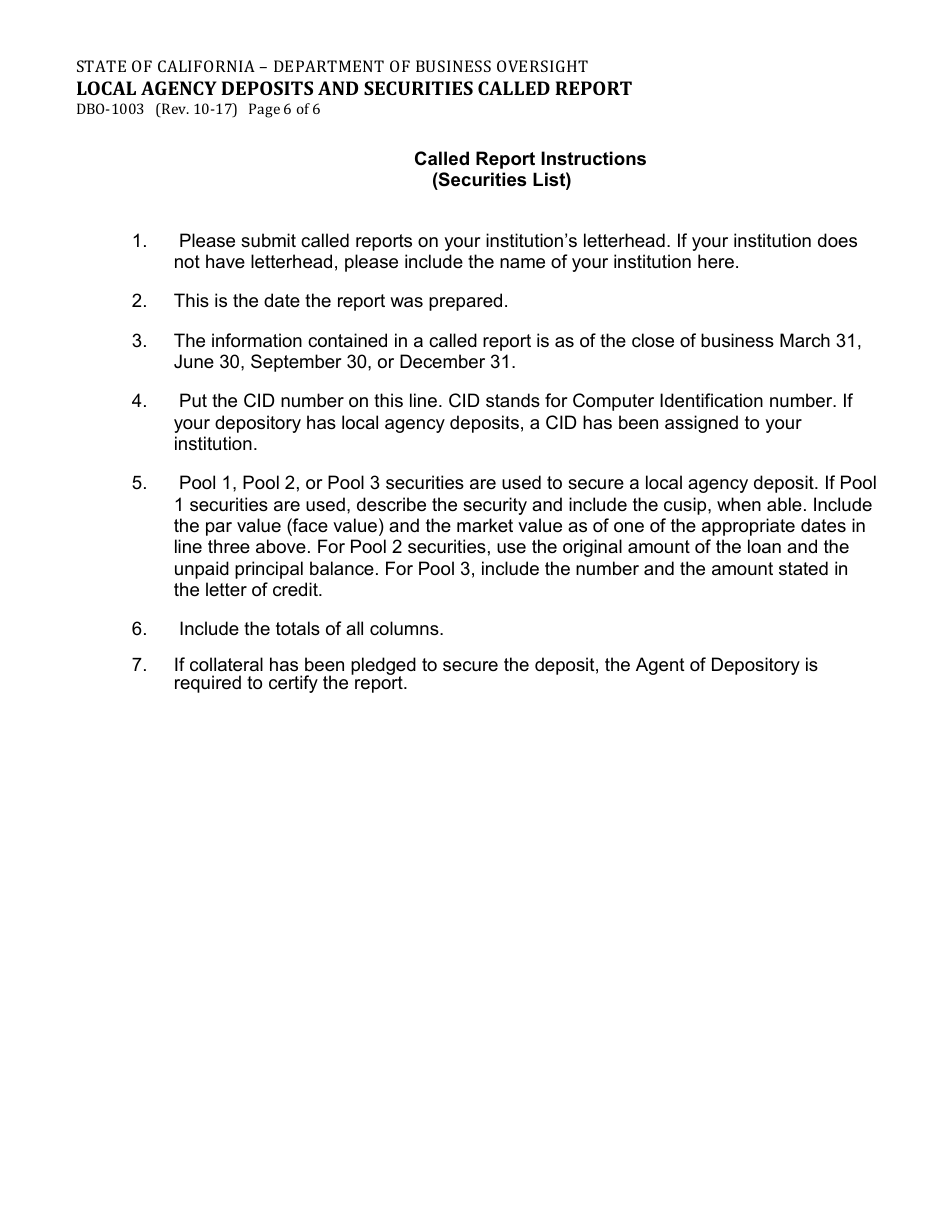

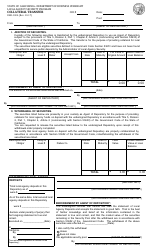

Q: What information is required on the Form DBO-1003?

A: The Form DBO-1003 requires information such as the name of the local agency, the types and amounts of deposits or securities called, and the date of the call.

Q: When is the Form DBO-1003 due?

A: The Form DBO-1003 is due within 15 days after the call of the deposits or securities by the local agency.

Q: Is there a fee for filing the Form DBO-1003?

A: No, there is no fee for filing the Form DBO-1003.

Q: Is filing the Form DBO-1003 mandatory?

A: Yes, filing the Form DBO-1003 is mandatory for local agencies in California who have called deposits or securities.

Q: Are there any penalties for not filing the Form DBO-1003?

A: Failure to file the Form DBO-1003 may result in penalties imposed by the California Department of Business Oversight.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the California Department of Financial Protection and Innovation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DBO-1003 by clicking the link below or browse more documents and templates provided by the California Department of Financial Protection and Innovation.