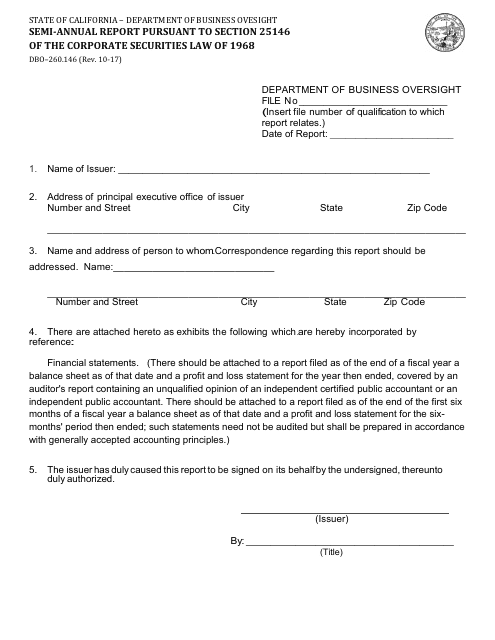

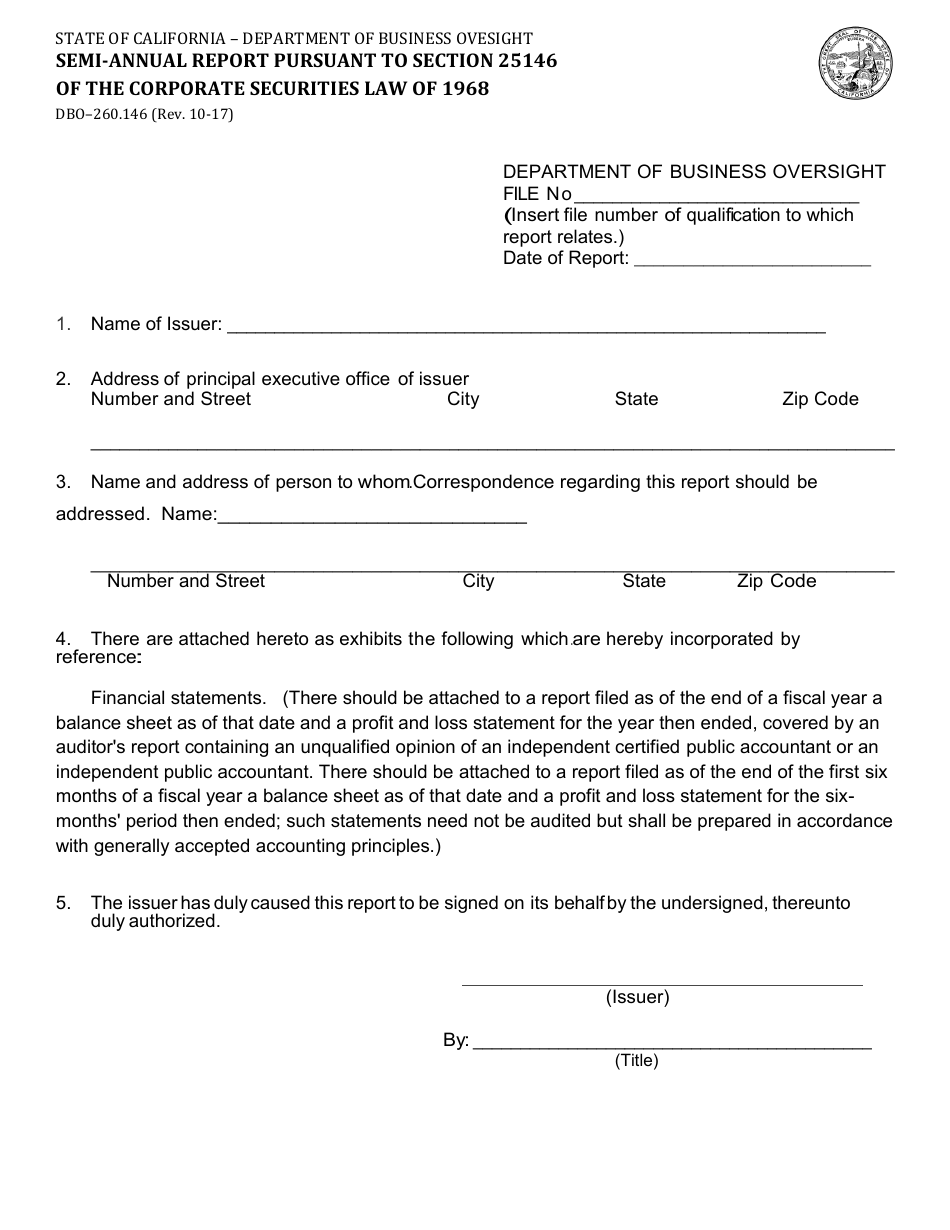

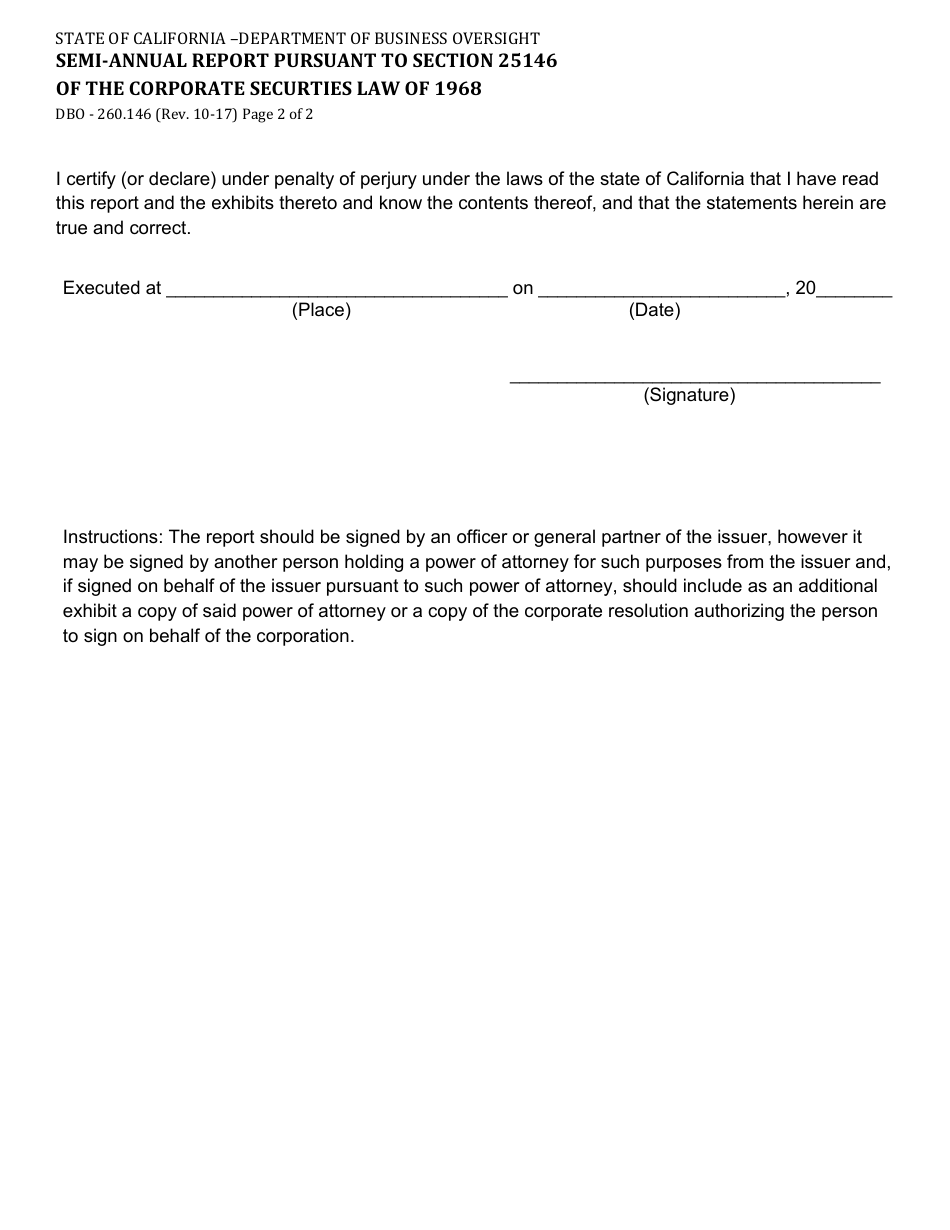

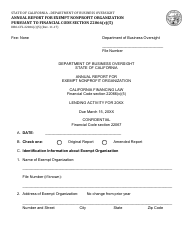

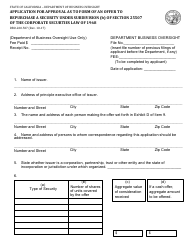

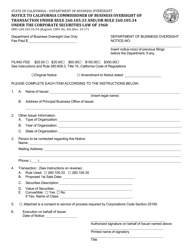

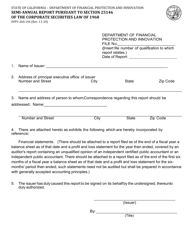

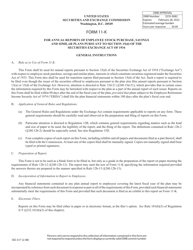

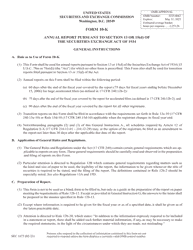

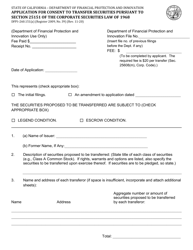

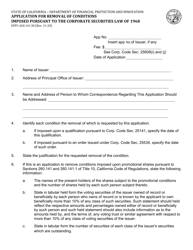

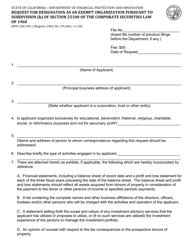

Form DBO-260.146 Semi-annual Report Pursuant to Section 25146 of the Corporate Securities Law of 1968 - California

What Is Form DBO-260.146?

This is a legal form that was released by the California Department of Financial Protection and Innovation - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DBO-260.146?

A: Form DBO-260.146 is a semi-annual report that is required under Section 25146 of the California Corporate Securities Law of 1968.

Q: Who is required to file Form DBO-260.146?

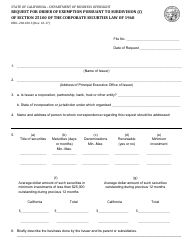

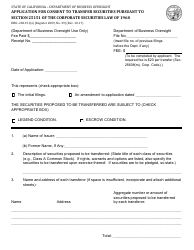

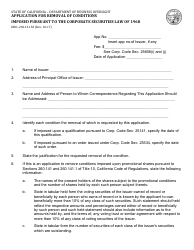

A: Any company or entity that is subject to the California Corporate Securities Law of 1968 and meets the criteria for filing a semi-annual report is required to file Form DBO-260.146.

Q: What is the purpose of Form DBO-260.146?

A: The purpose of Form DBO-260.146 is to provide the California Department of Business Oversight with important information about the financial and operational condition of the company or entity.

Q: What information is required in Form DBO-260.146?

A: Form DBO-260.146 requires information such as the company's financial statements, details about any changes in ownership or control, and other relevant operational information.

Q: When is Form DBO-260.146 due?

A: Form DBO-260.146 is typically due within a specified time period after the end of the reporting period, usually within 60 days.

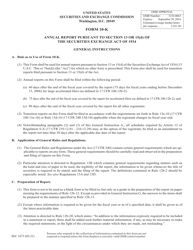

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the California Department of Financial Protection and Innovation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DBO-260.146 by clicking the link below or browse more documents and templates provided by the California Department of Financial Protection and Innovation.