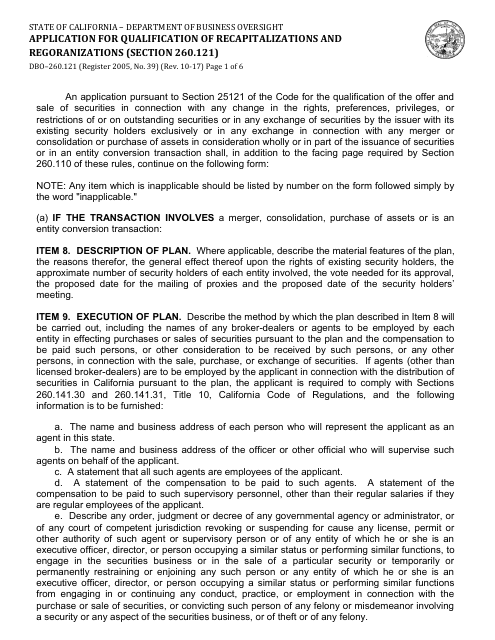

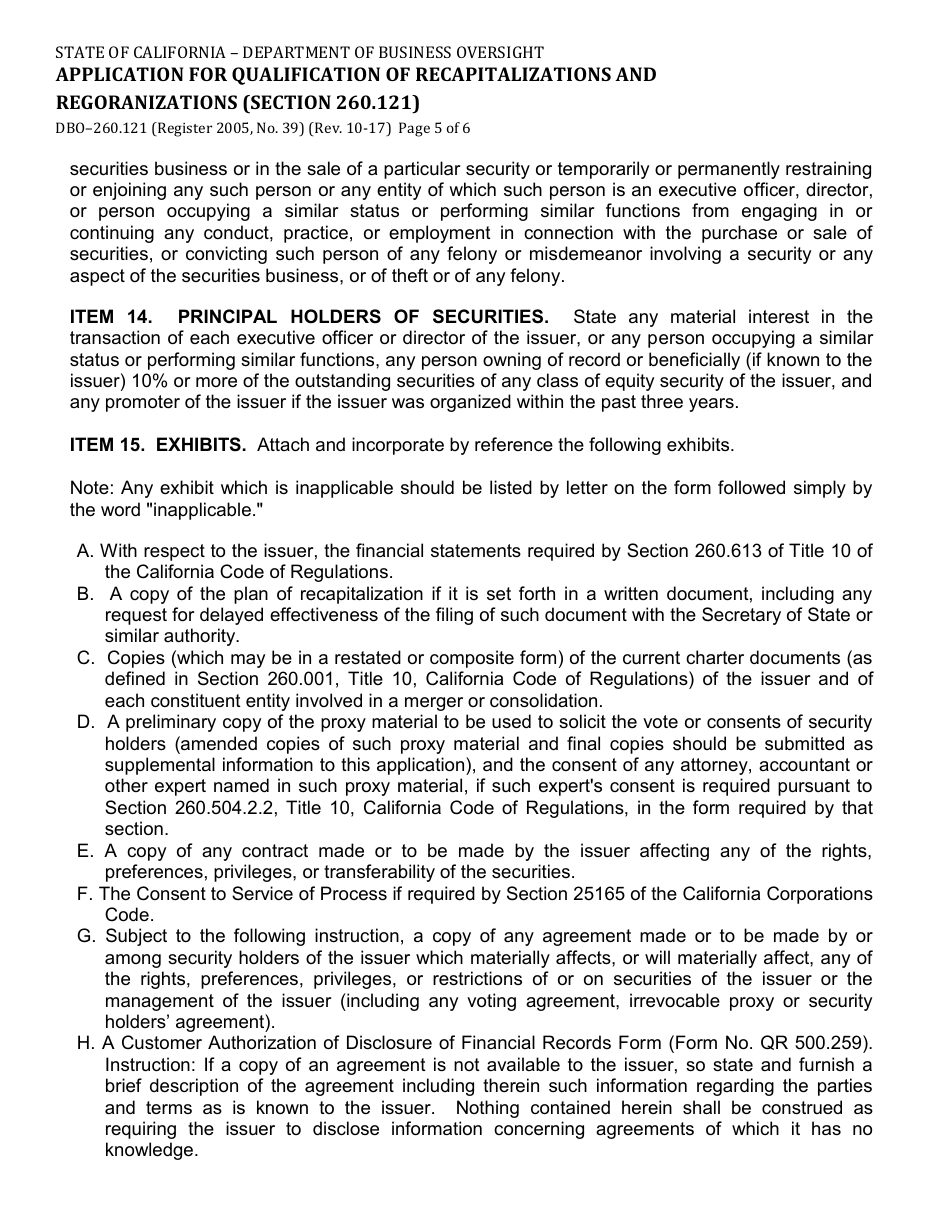

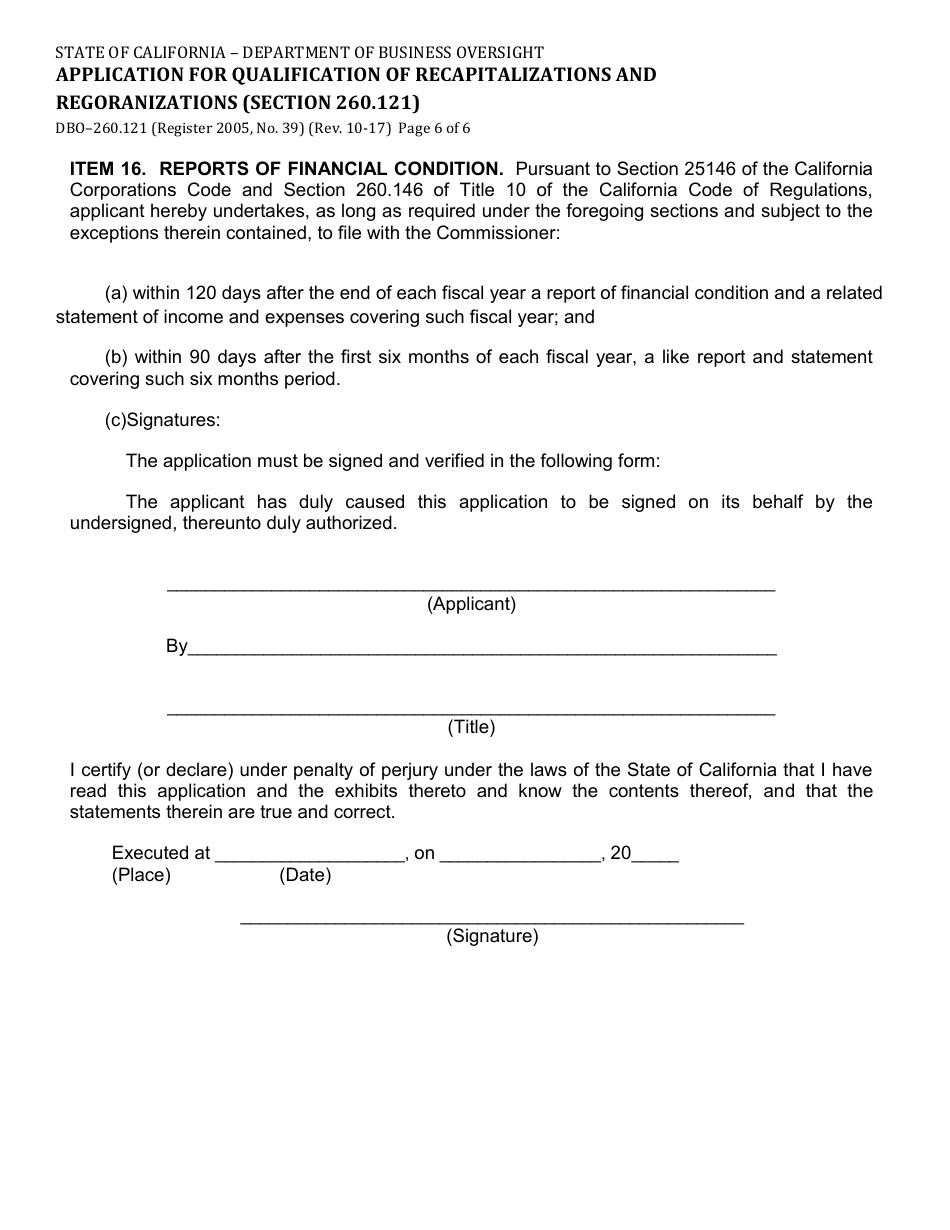

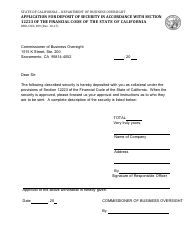

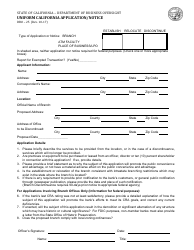

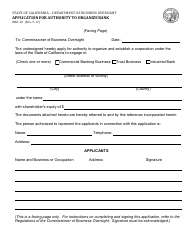

Form DBO-260.121 Application for Qualification of Recapitalizations and Regoranizations (Section 260.121) - California

What Is Form DBO-260.121?

This is a legal form that was released by the California Department of Financial Protection and Innovation - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

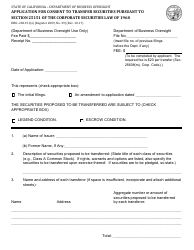

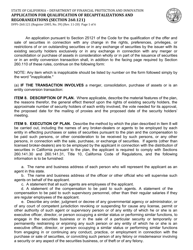

Q: What is Form DBO-260.121?

A: Form DBO-260.121 is the application for qualification of recapitalizations and reorganizations under Section 260.121 in California.

Q: What is the purpose of Form DBO-260.121?

A: The purpose of Form DBO-260.121 is to apply for qualification of recapitalizations and reorganizations under Section 260.121 in California.

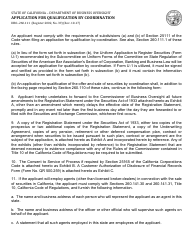

Q: Who needs to file Form DBO-260.121?

A: Any entity planning a recapitalization or reorganization under Section 260.121 in California needs to file Form DBO-260.121.

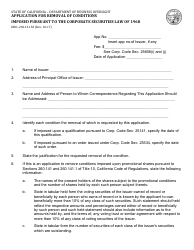

Q: What information should be included in Form DBO-260.121?

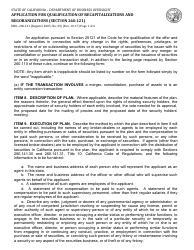

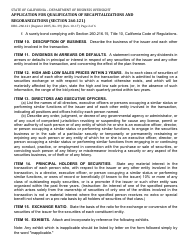

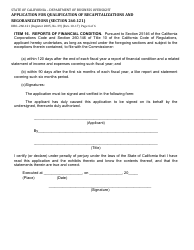

A: Form DBO-260.121 requires information about the entity, the recapitalization or reorganization transaction, and any other relevant details.

Q: Are there any fees associated with filing Form DBO-260.121?

A: Yes, there are fees associated with filing Form DBO-260.121. The exact amount depends on the nature of the recapitalization or reorganization.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the California Department of Financial Protection and Innovation;

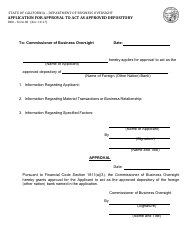

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DBO-260.121 by clicking the link below or browse more documents and templates provided by the California Department of Financial Protection and Innovation.