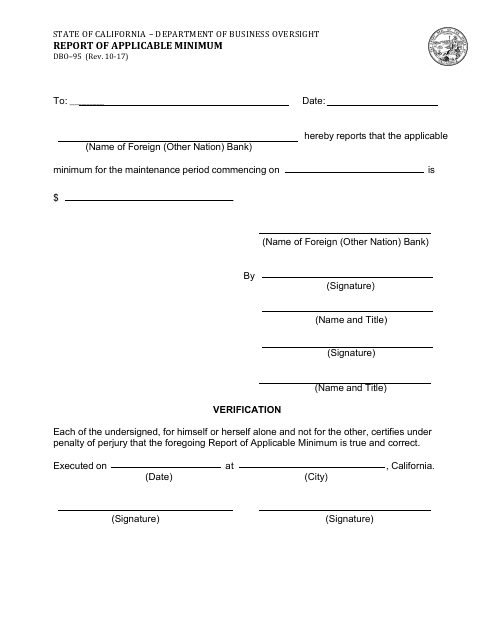

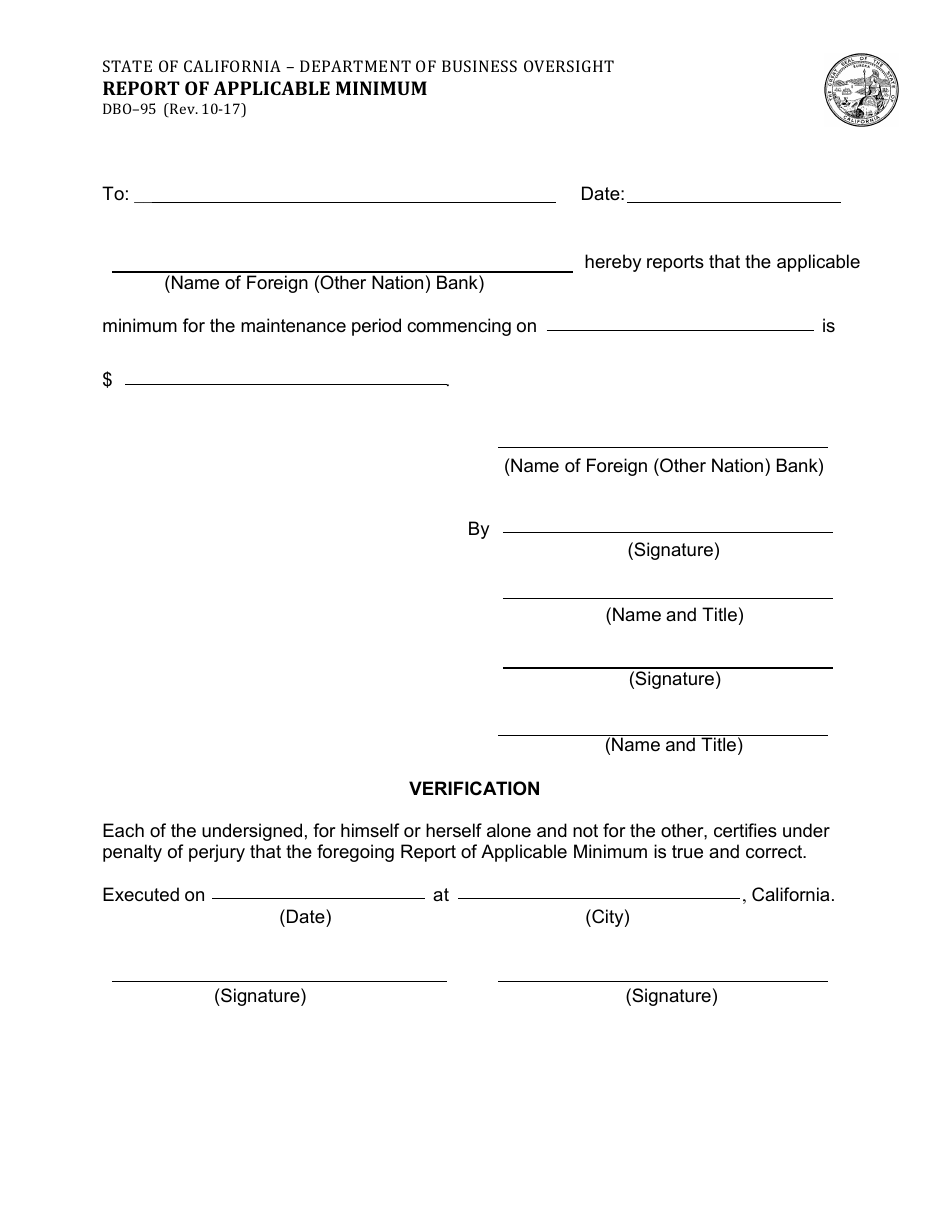

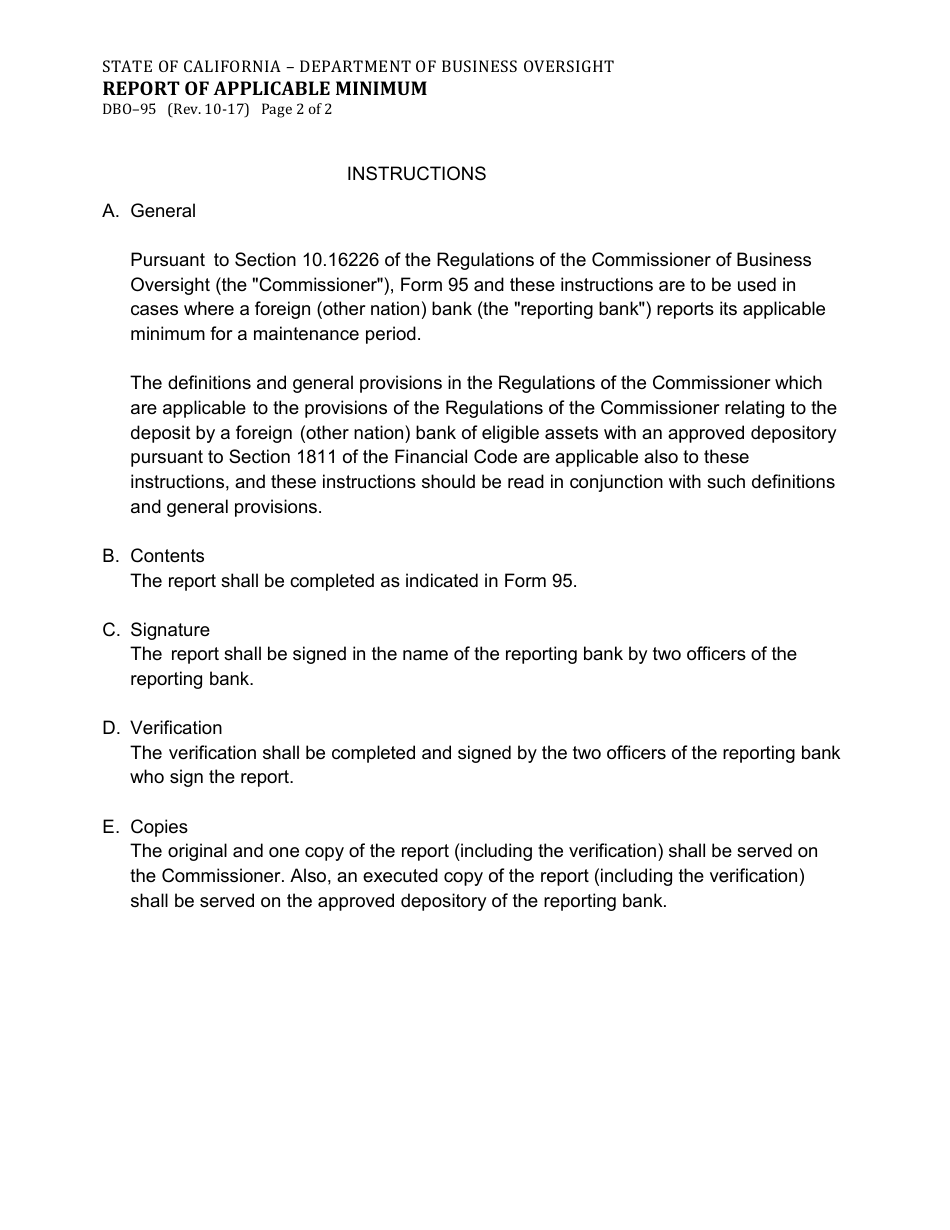

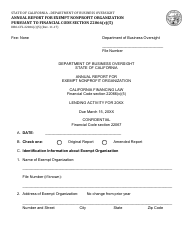

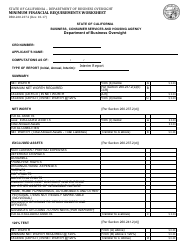

Form DBO-95 Report of Applicable Minimum - California

What Is Form DBO-95?

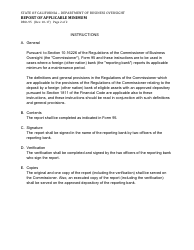

This is a legal form that was released by the California Department of Financial Protection and Innovation - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

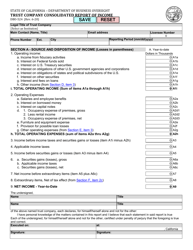

Q: What is Form DBO-95?

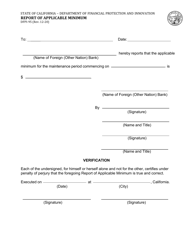

A: Form DBO-95 is a report used in California to disclose the applicable minimum dollar amount for certain types of financial transactions.

Q: Who needs to file Form DBO-95?

A: Certain types of financial institutions in California, such as banks and credit unions, are required to file Form DBO-95.

Q: What is the purpose of Form DBO-95?

A: The purpose of Form DBO-95 is to provide transparency and ensure compliance with California financial laws by disclosing the applicable minimum dollar amount for financial transactions.

Q: When is Form DBO-95 due?

A: Form DBO-95 is typically due on an annual basis, but the specific due date may vary. It is important to refer to the instructions provided with the form for the most accurate deadline.

Q: Is there a fee for filing Form DBO-95?

A: There may be a filing fee associated with Form DBO-95. The amount of the fee can vary depending on the type of financial institution and the applicable minimum dollar amount.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the California Department of Financial Protection and Innovation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DBO-95 by clicking the link below or browse more documents and templates provided by the California Department of Financial Protection and Innovation.