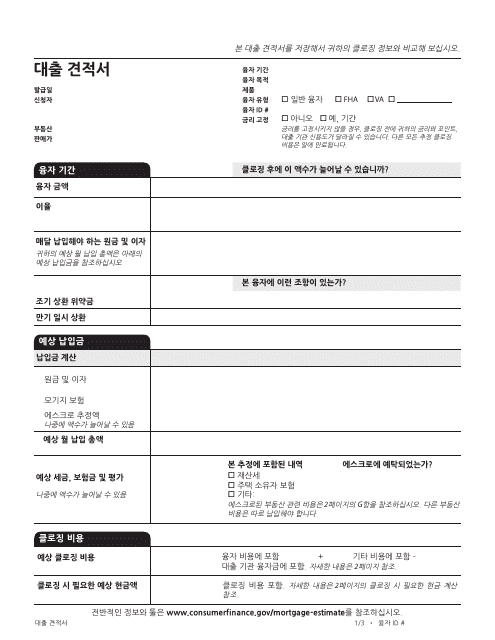

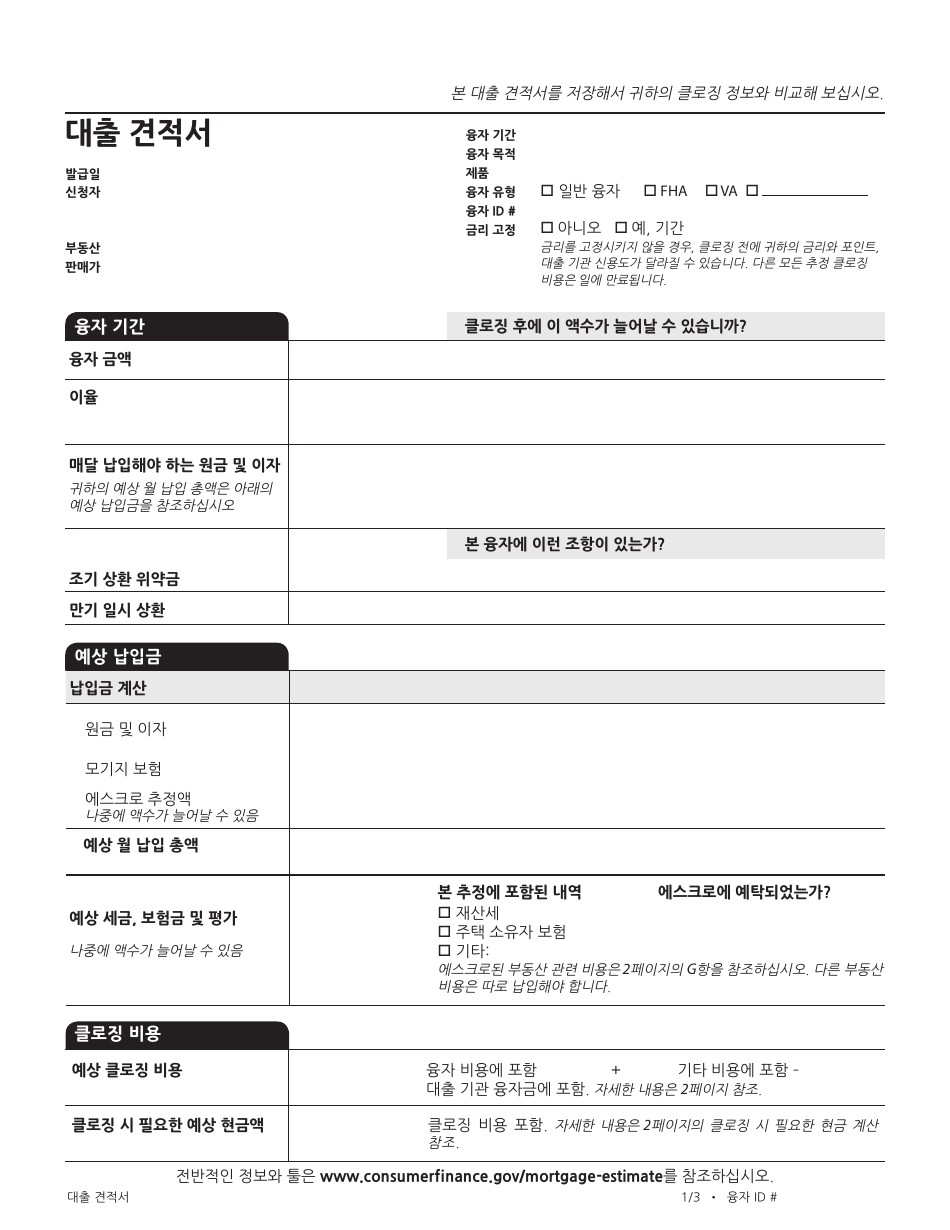

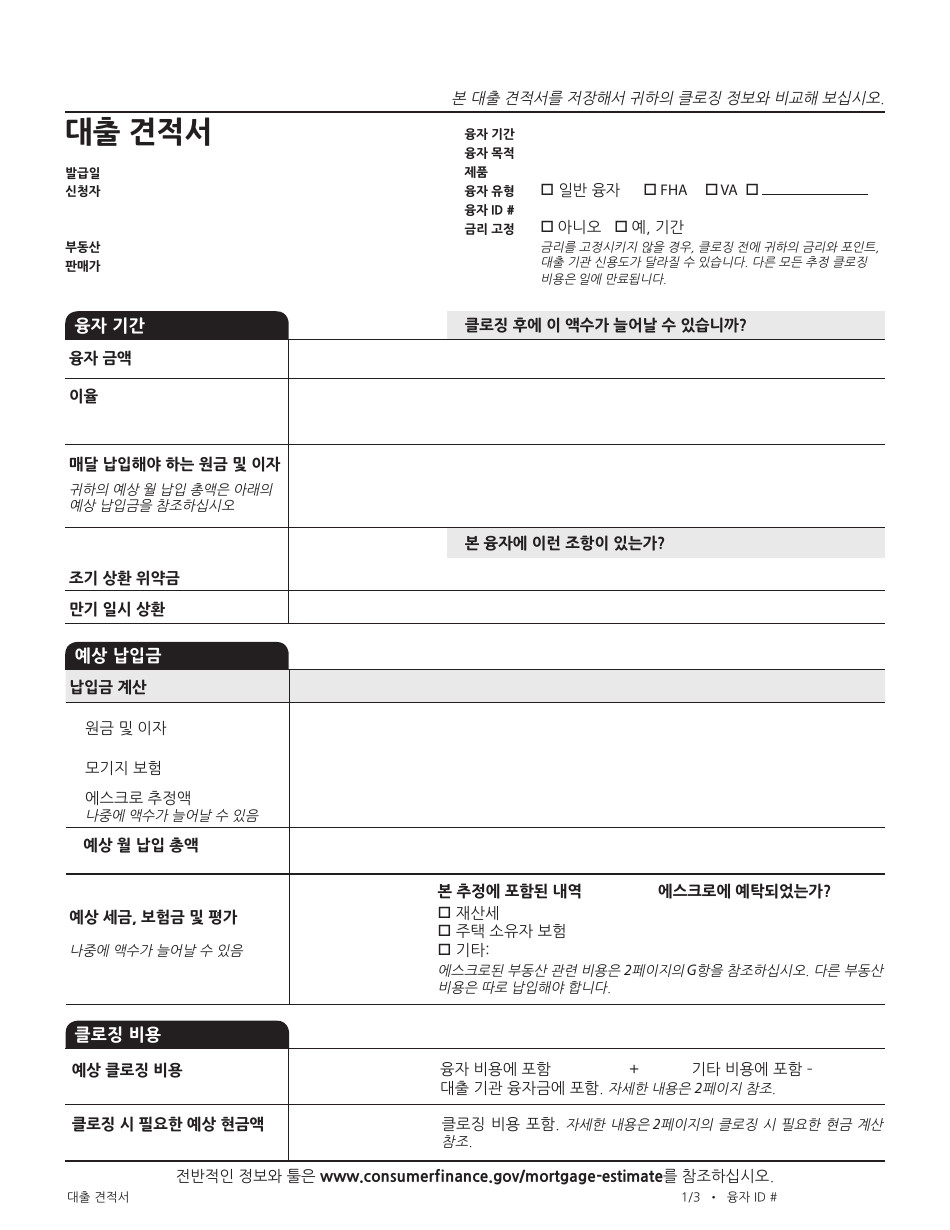

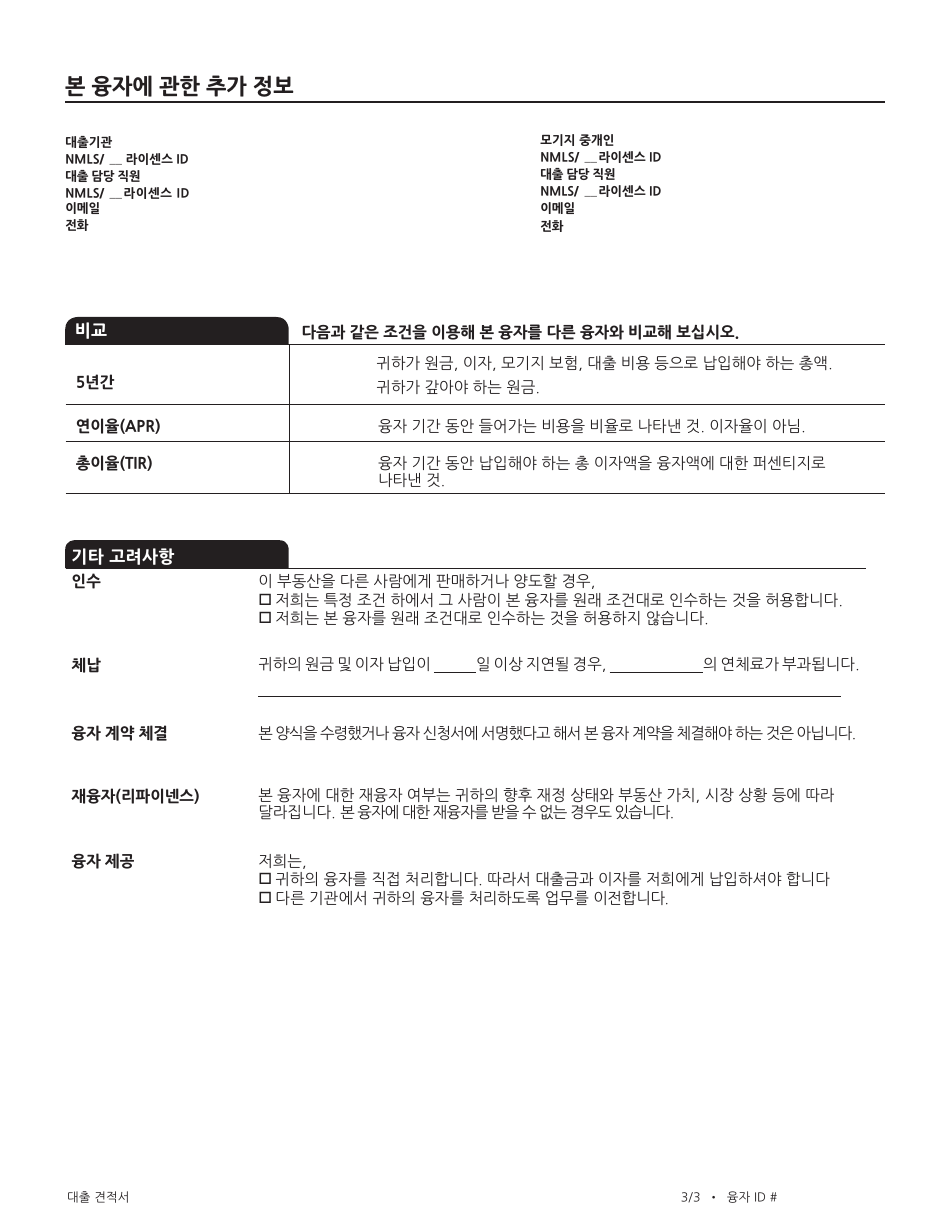

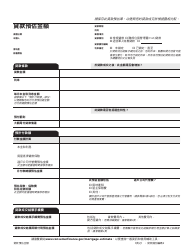

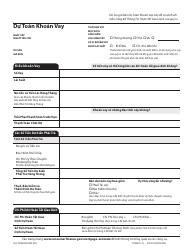

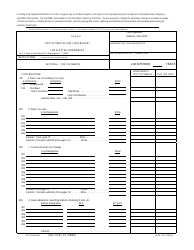

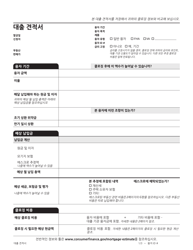

Form CFPB Loan Estimate - California (Korean)

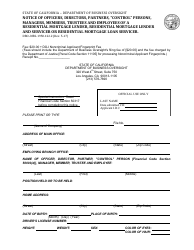

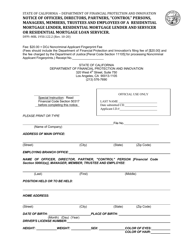

This is a legal form that was released by the California Department of Financial Protection and Innovation - a government authority operating within California.

The document is provided in Korean. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Loan Estimate?

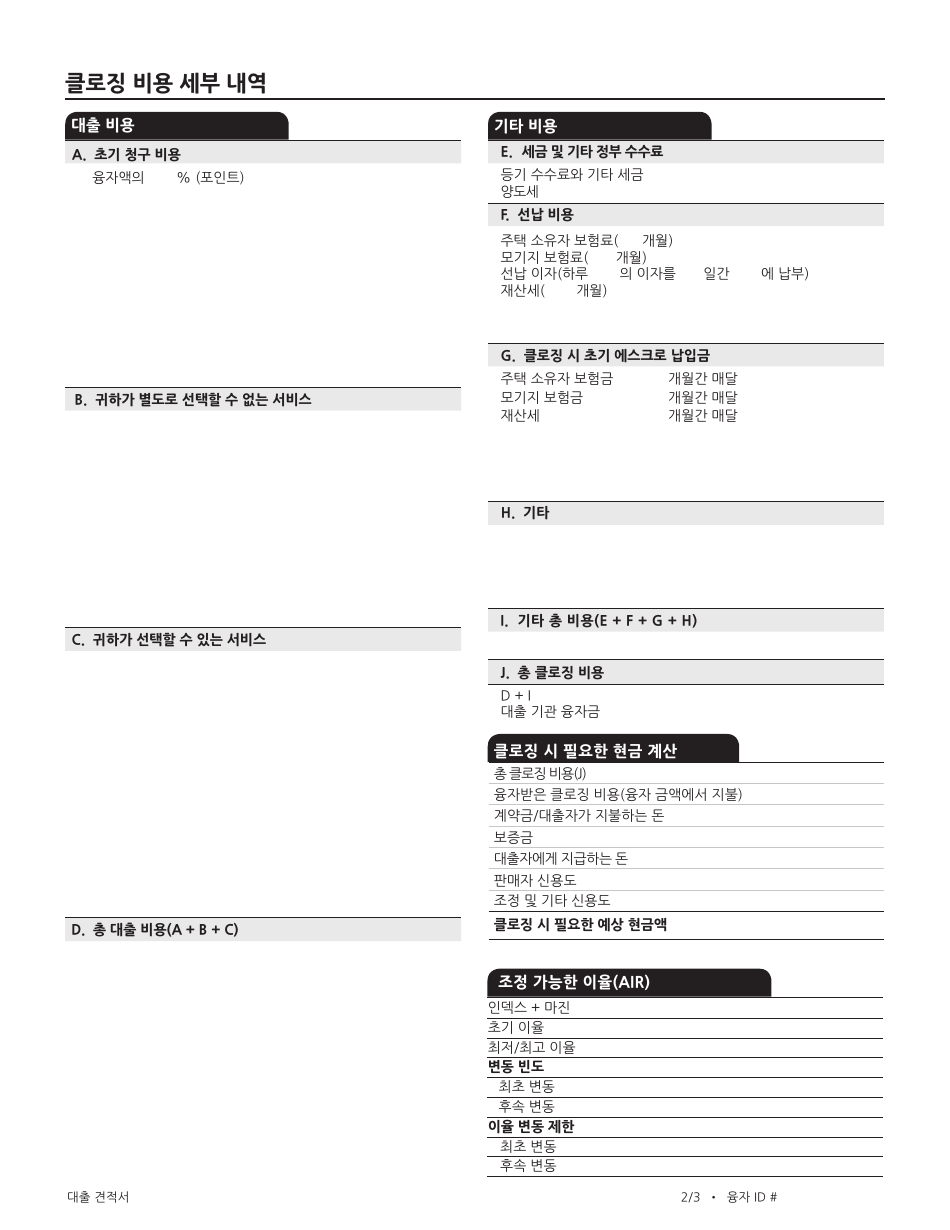

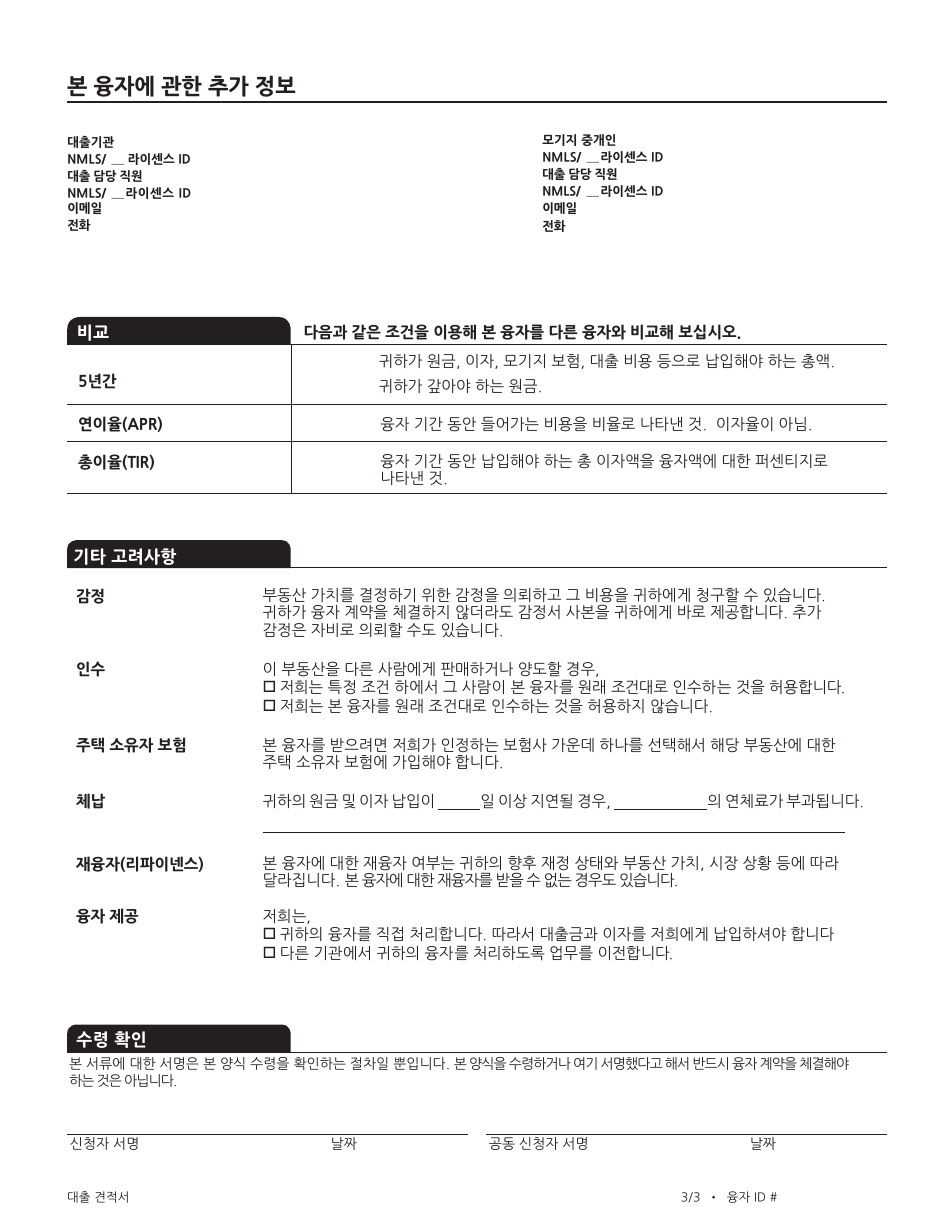

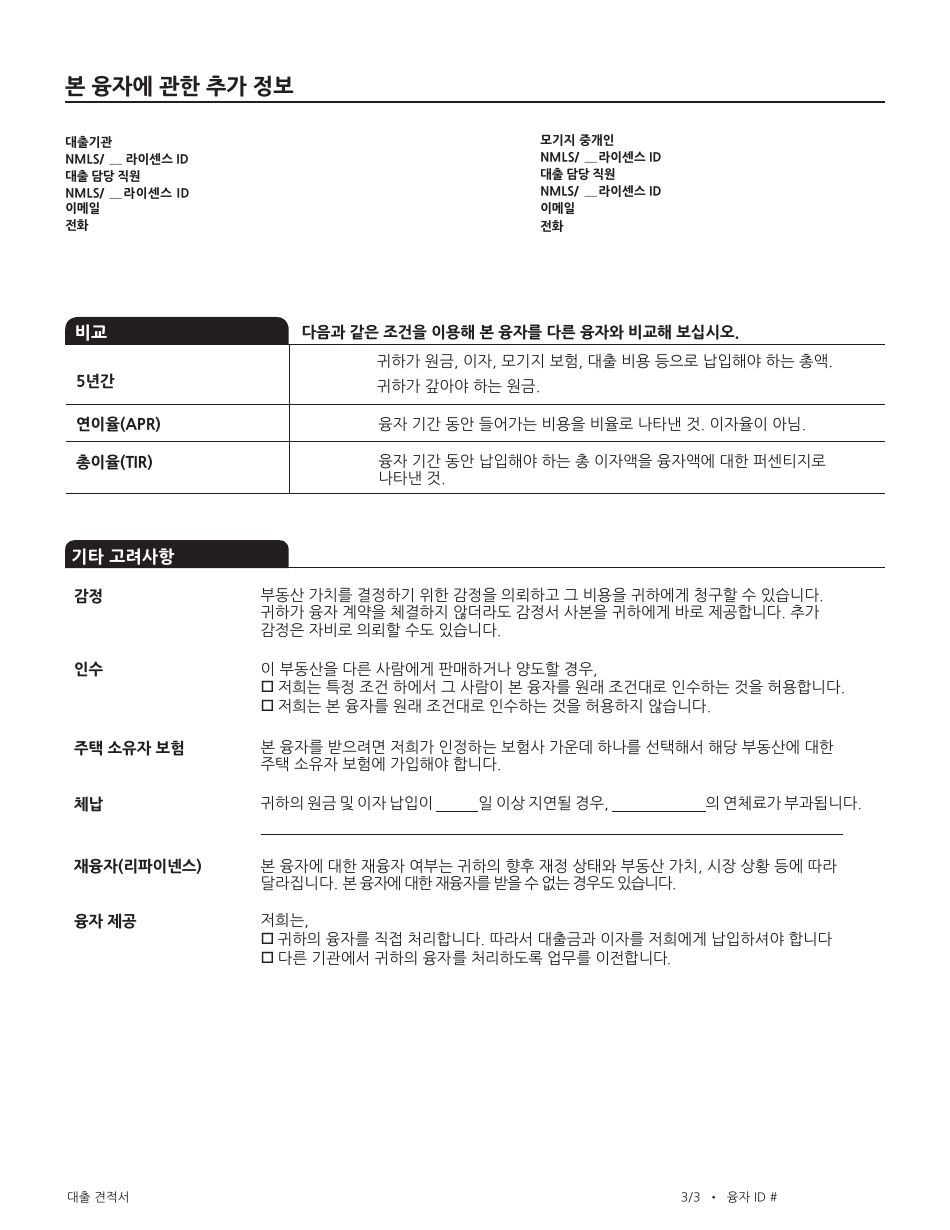

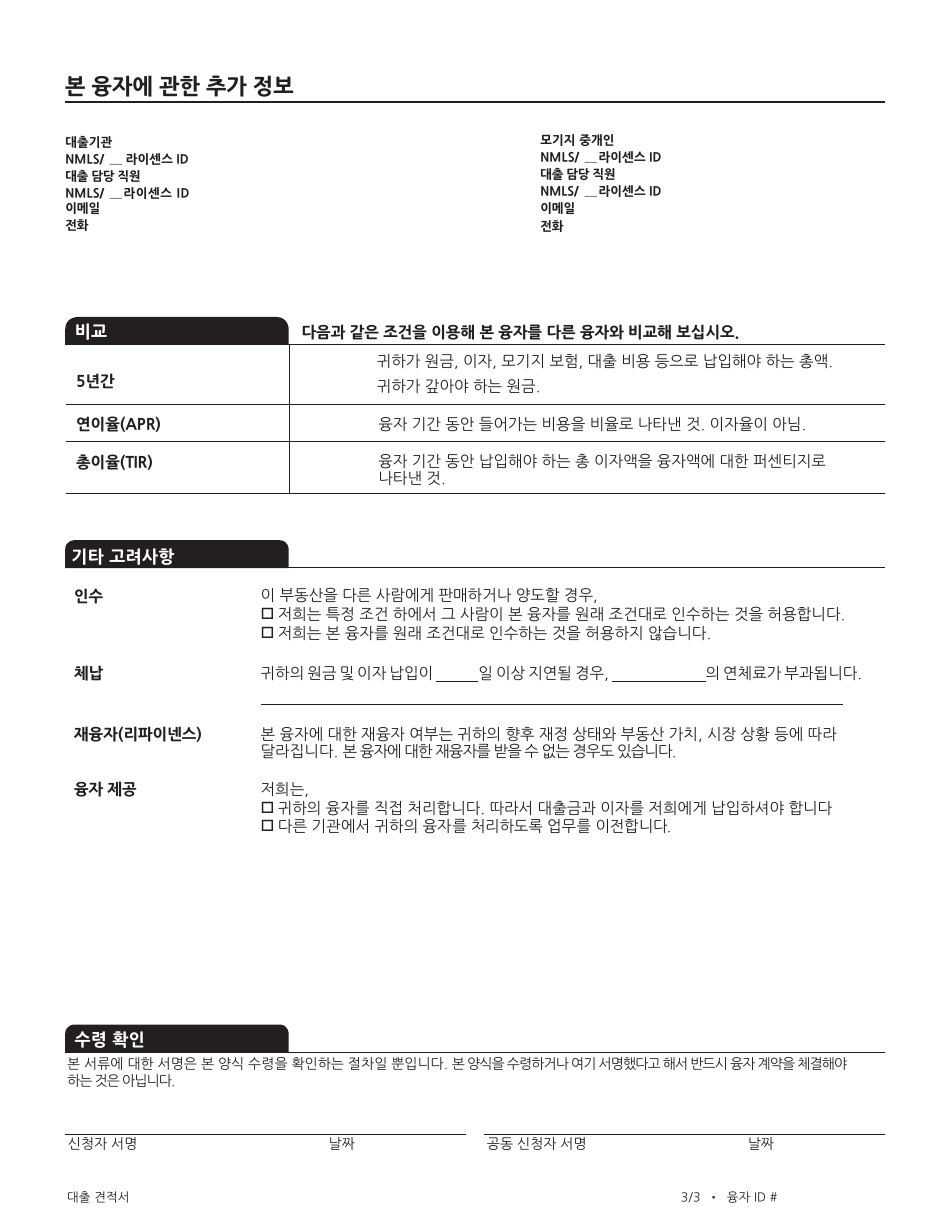

A: A Loan Estimate is a document that provides the costs and terms of a mortgage loan. It includes information such as interest rate, loan amount, and closing costs.

Q: Why do I need a Loan Estimate?

A: You need a Loan Estimate to understand the costs and terms of the mortgage loan you are considering. It helps you compare offers from different lenders.

Q: Can I get a Loan Estimate before choosing a lender?

A: Yes, you can request a Loan Estimate from multiple lenders to compare their offers before making a decision.

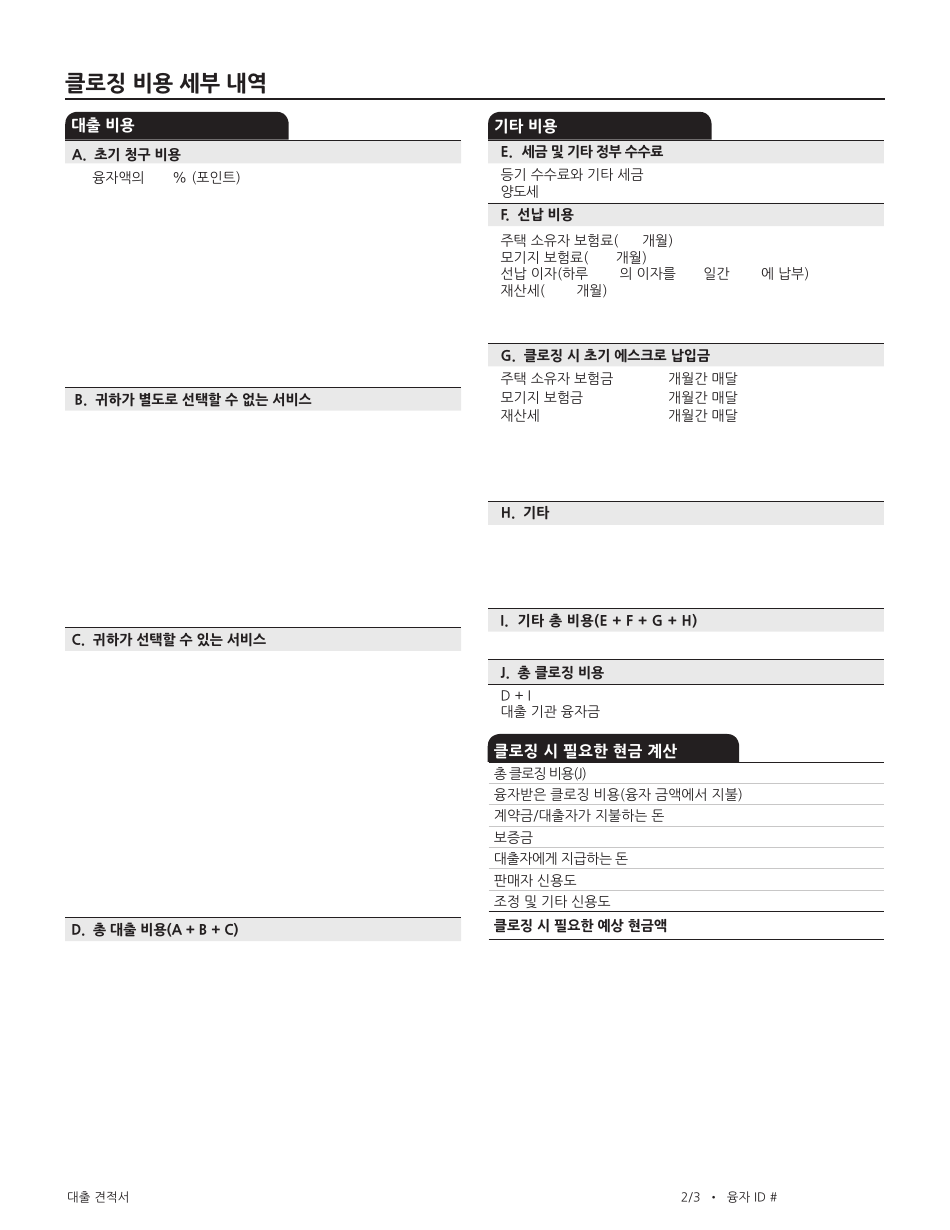

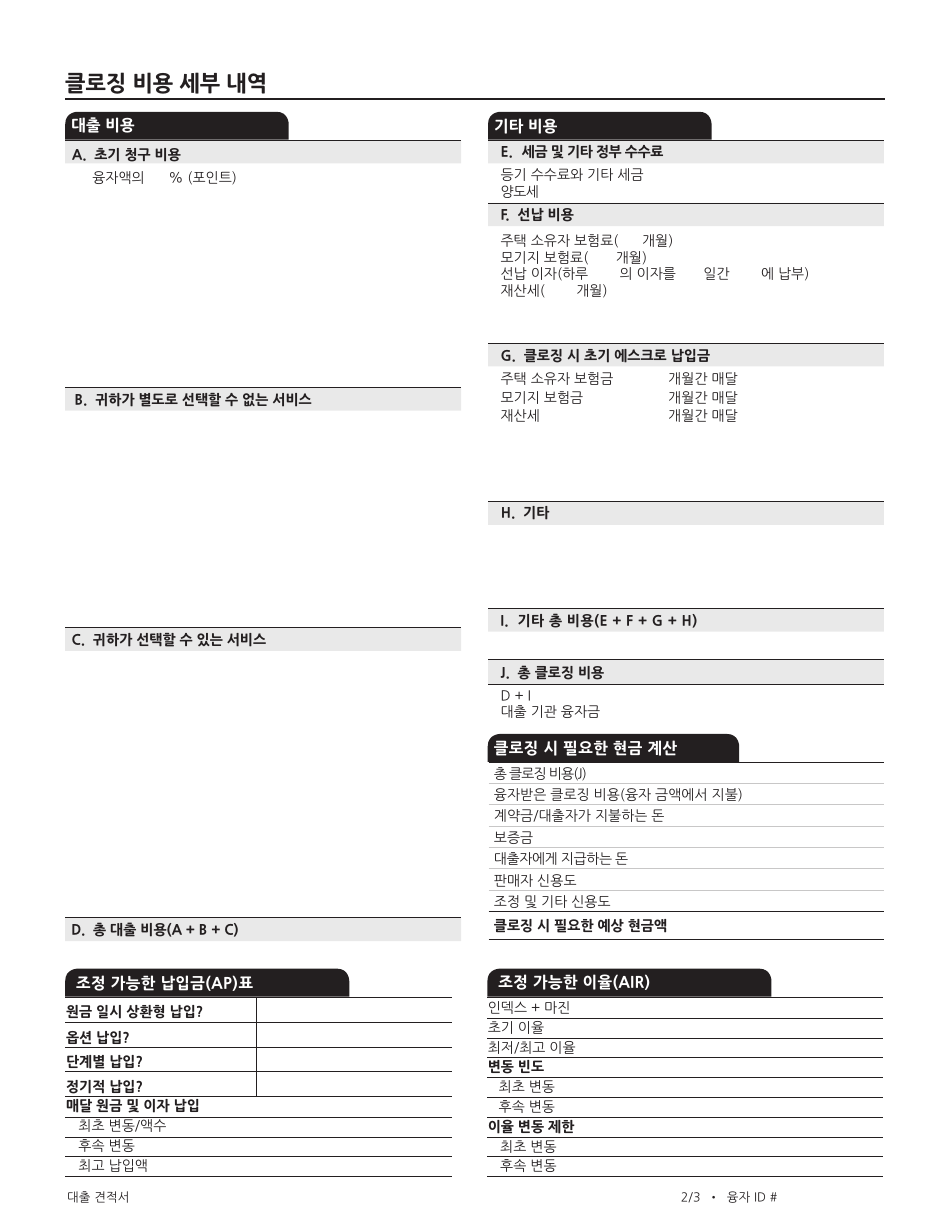

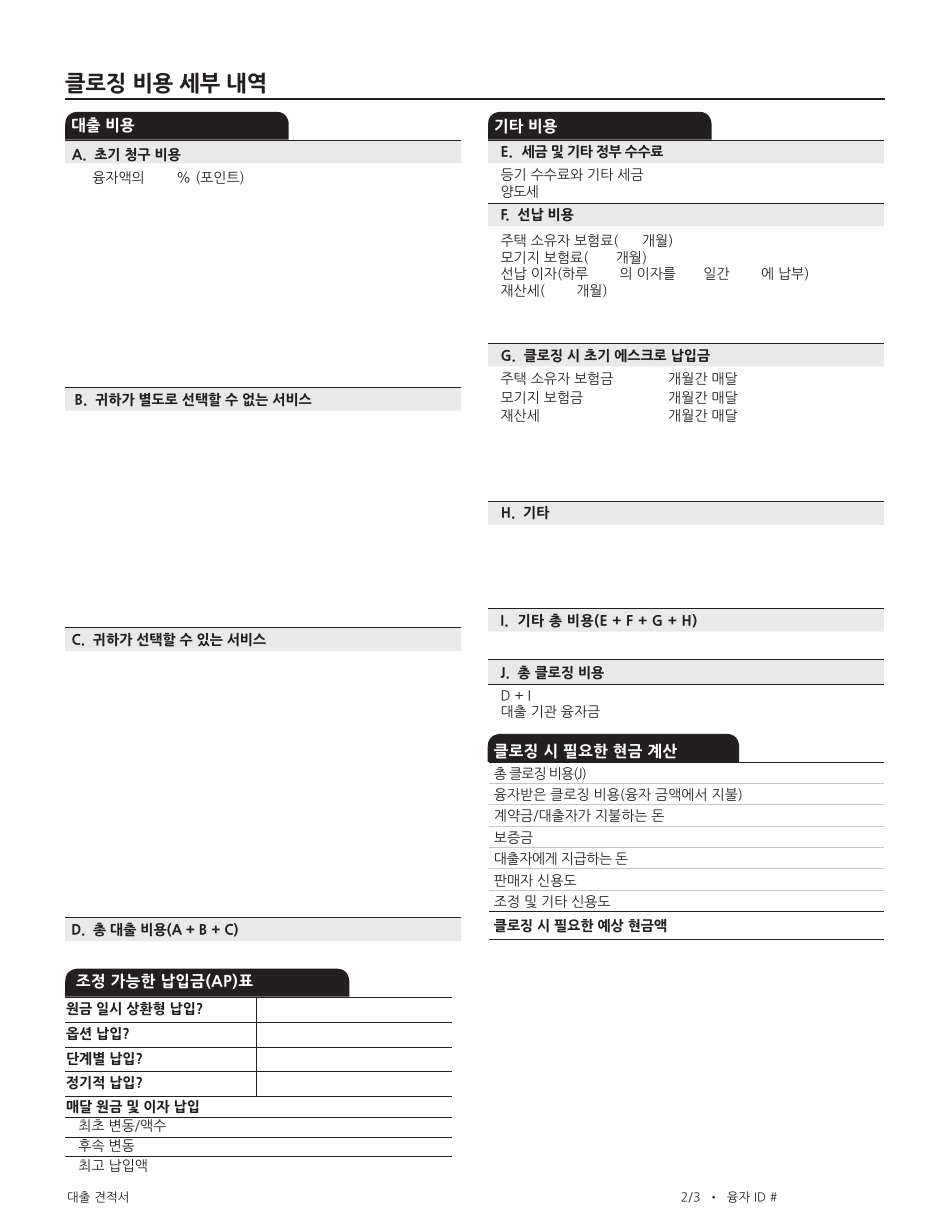

Q: What information is included in a Loan Estimate?

A: A Loan Estimate includes details about the loan amount, interest rate, monthly payment, closing costs, and other fees.

Q: How can I get a Loan Estimate?

A: You can ask a lender for a Loan Estimate by providing them with your relevant financial information and the details of the property you are purchasing or refinancing.

Q: How much does a Loan Estimate cost?

A: There is no cost for receiving a Loan Estimate from a lender. It is a document that lenders are required to provide to borrowers.

Q: Can the terms of the loan change after receiving a Loan Estimate?

A: Yes, the terms of the loan can change after receiving a Loan Estimate. However, any significant changes must be explained by the lender in a revised loan estimate or other disclosure forms.

Q: How long is a Loan Estimate valid for?

A: A Loan Estimate is generally valid for 10 business days. After that, the lender may be required to provide an updated Loan Estimate if there are any changes in the terms of the loan.

Q: What should I do after receiving a Loan Estimate?

A: After receiving a Loan Estimate, you should carefully review the terms and costs of the loan. Compare it with offers from other lenders and ask any questions you may have before making a decision.

Form Details:

- Released on February 1, 2014;

- The latest edition provided by the California Department of Financial Protection and Innovation;

- Easy to use and ready to print;

- Available in Spanish;

- Quick to customize;

- Compatible with most PDF-viewing applications;

Download a printable version of Form CFPB by clicking the link below or browse more documents and templates provided by the California Department of Financial Protection and Innovation.