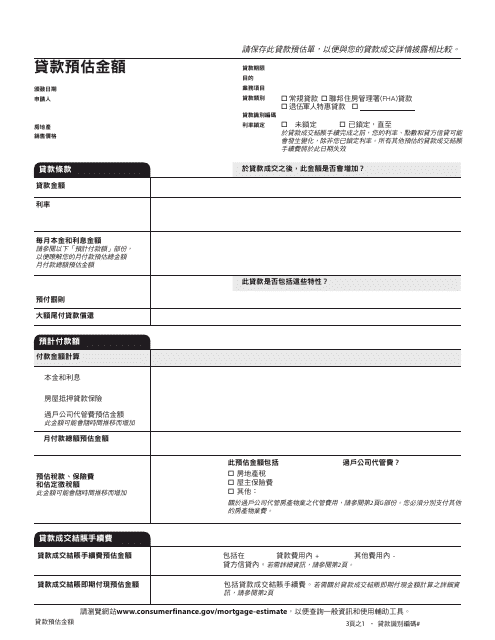

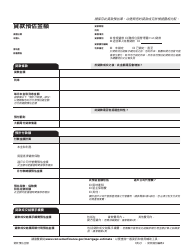

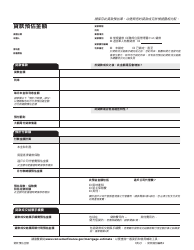

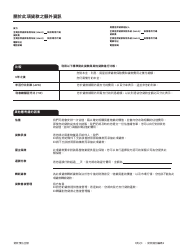

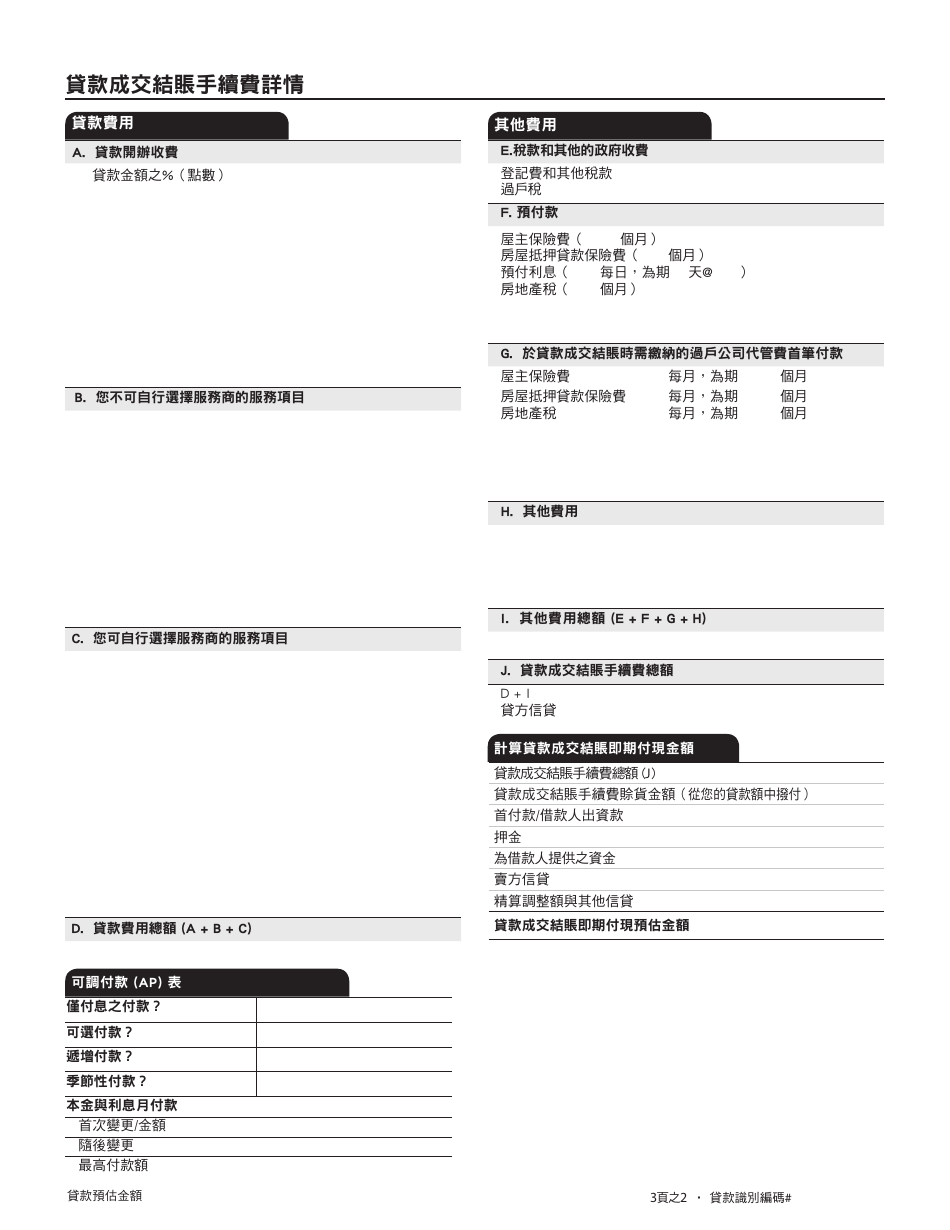

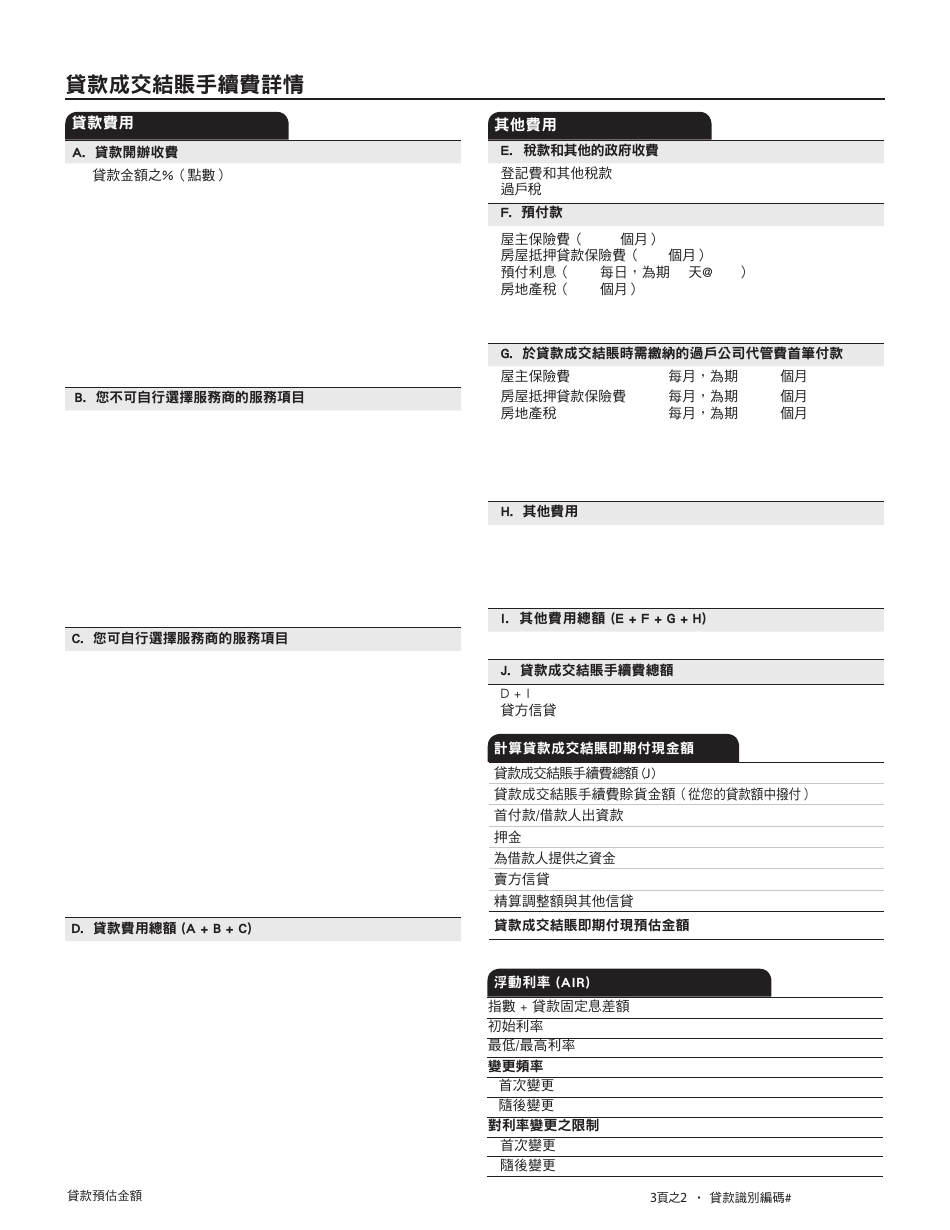

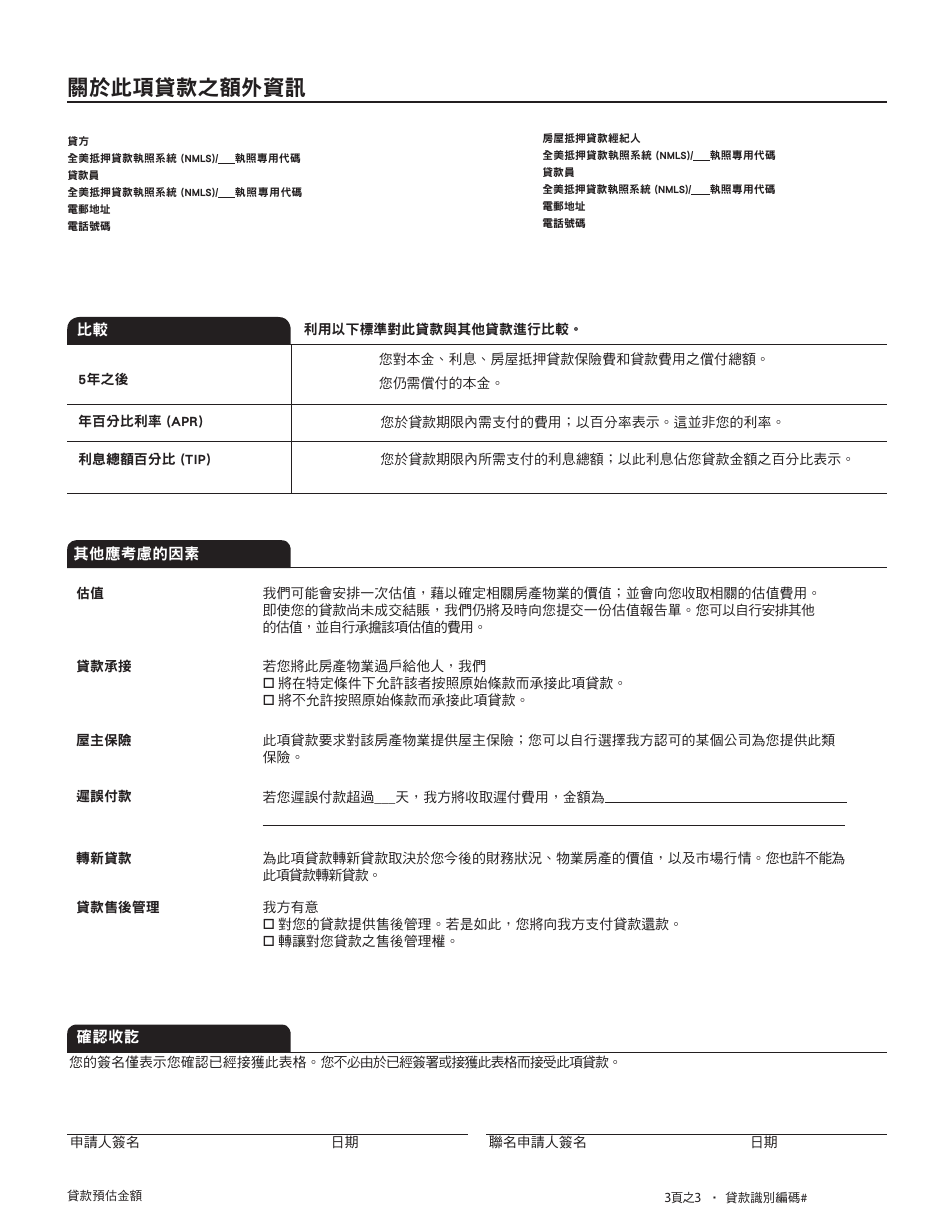

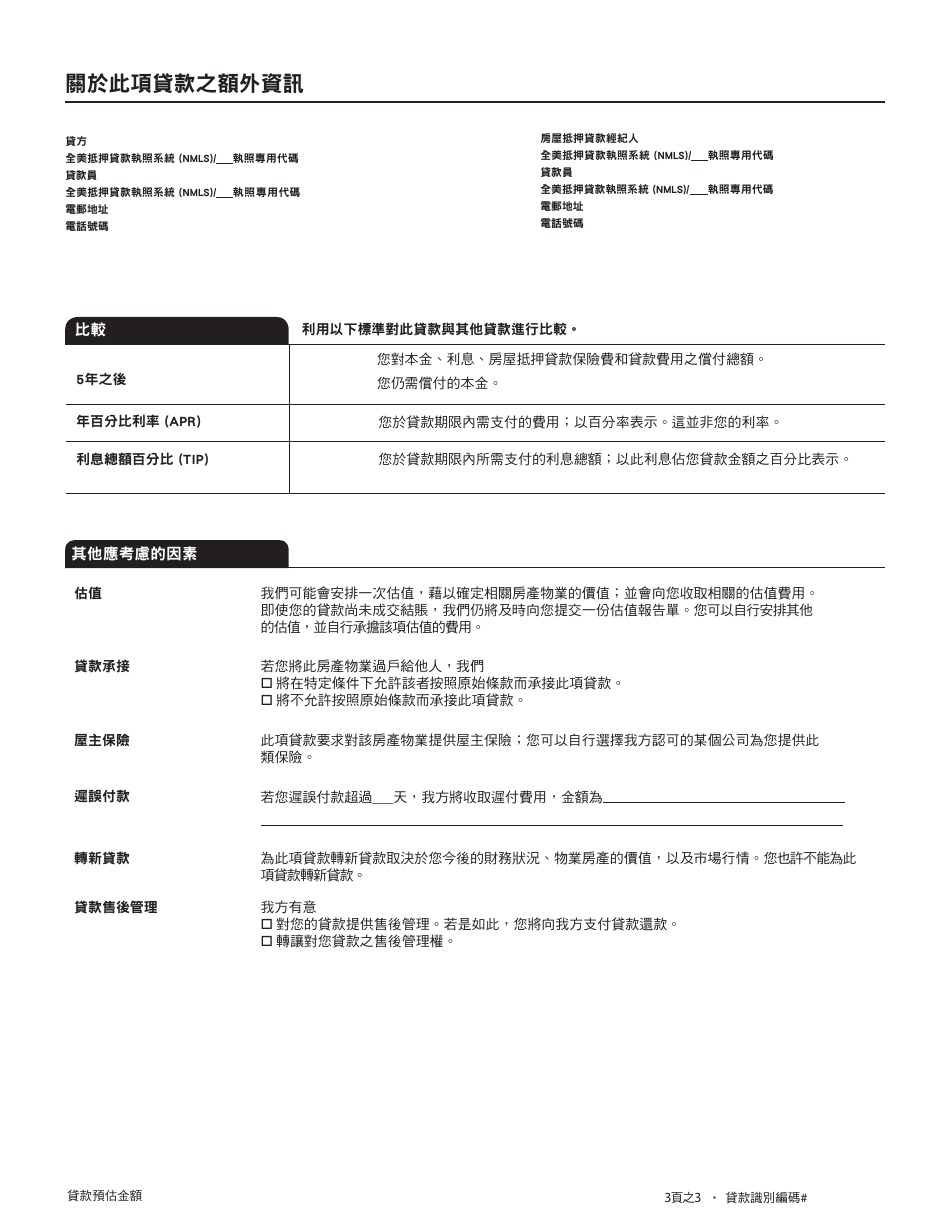

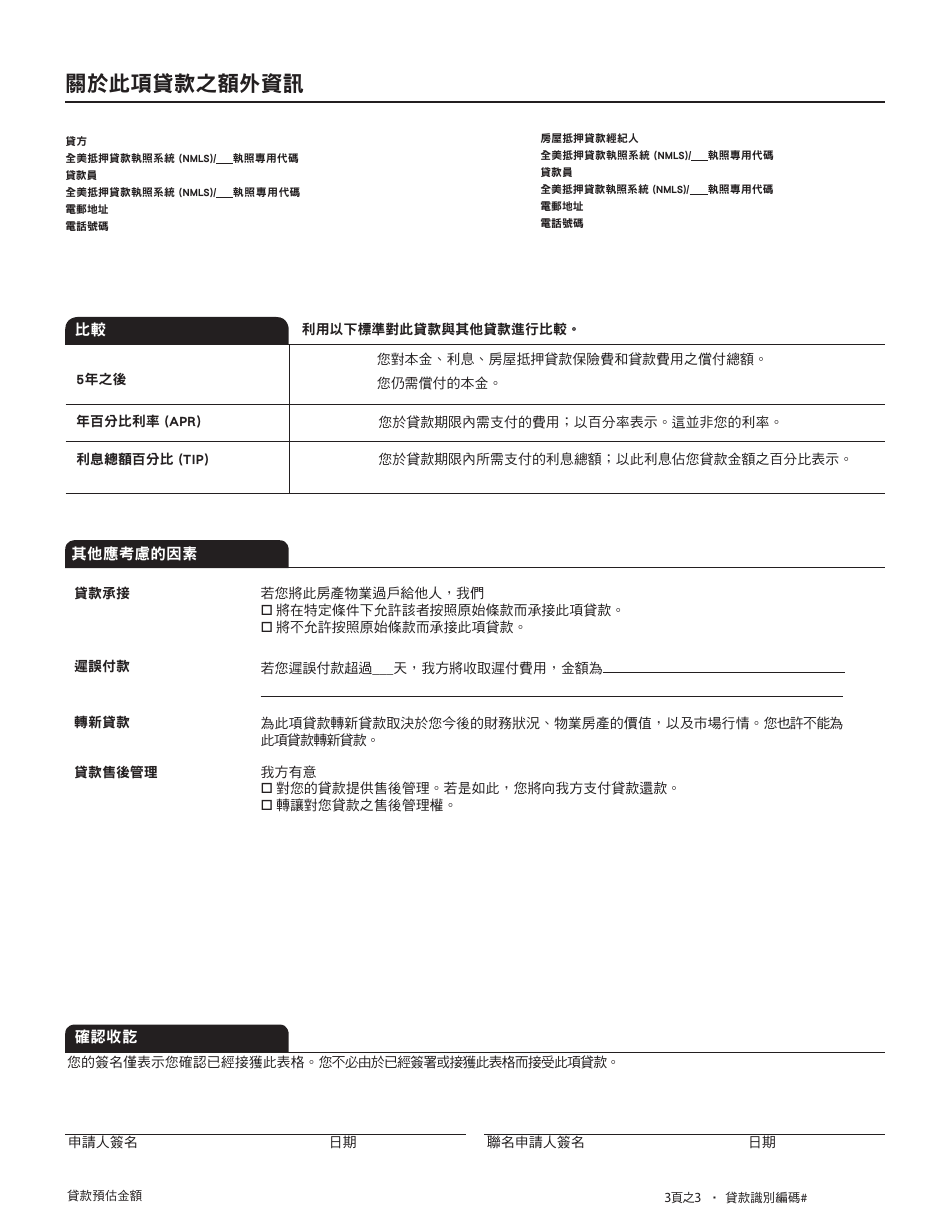

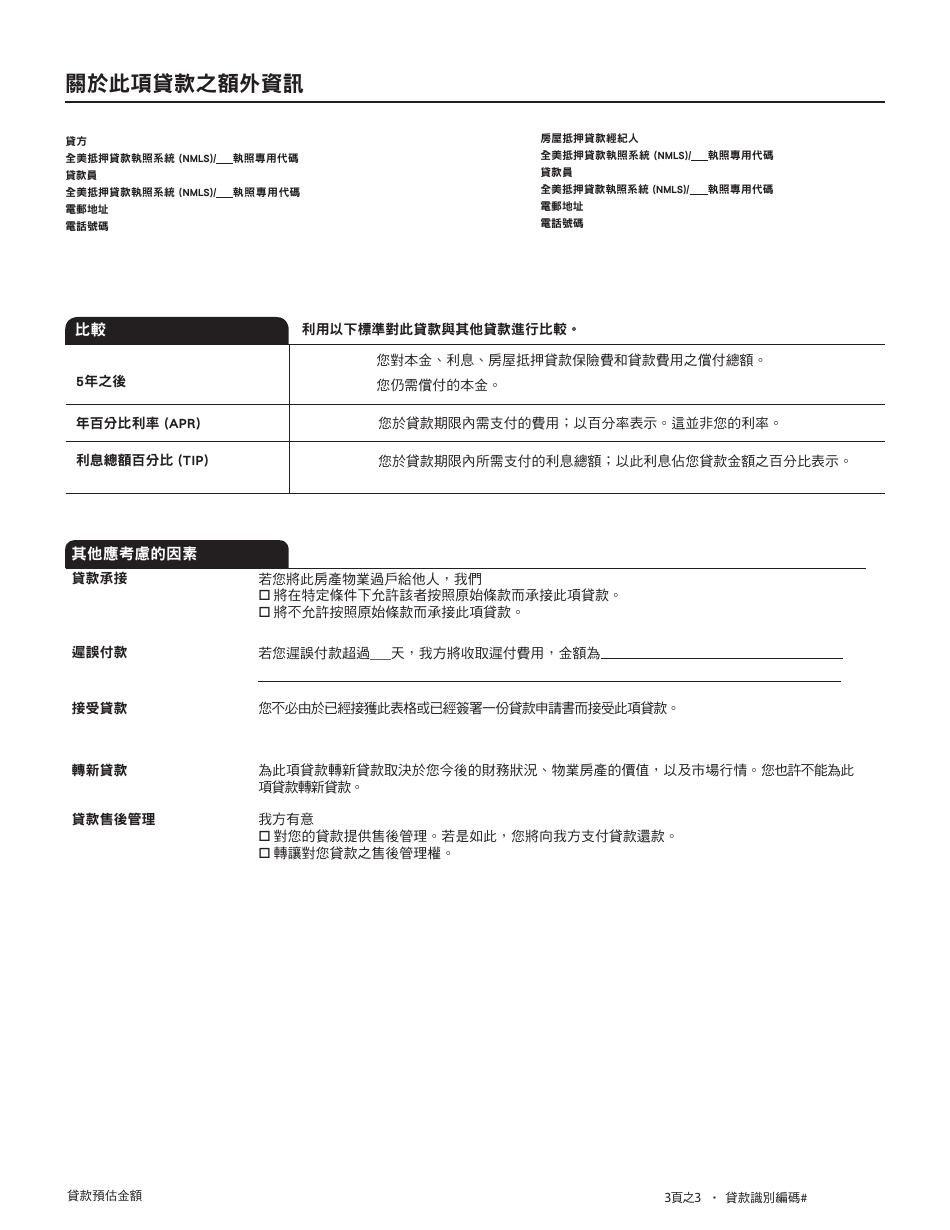

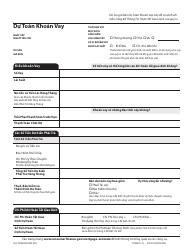

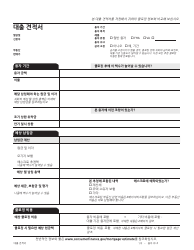

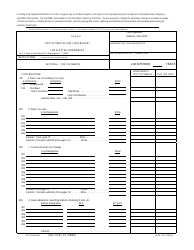

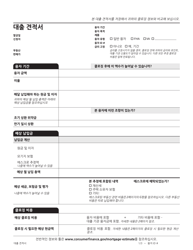

Form CFPB Loan Estimate - California (Chinese)

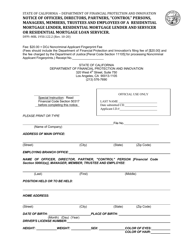

This is a legal form that was released by the California Department of Financial Protection and Innovation - a government authority operating within California.

The document is provided in Chinese. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Loan Estimate?

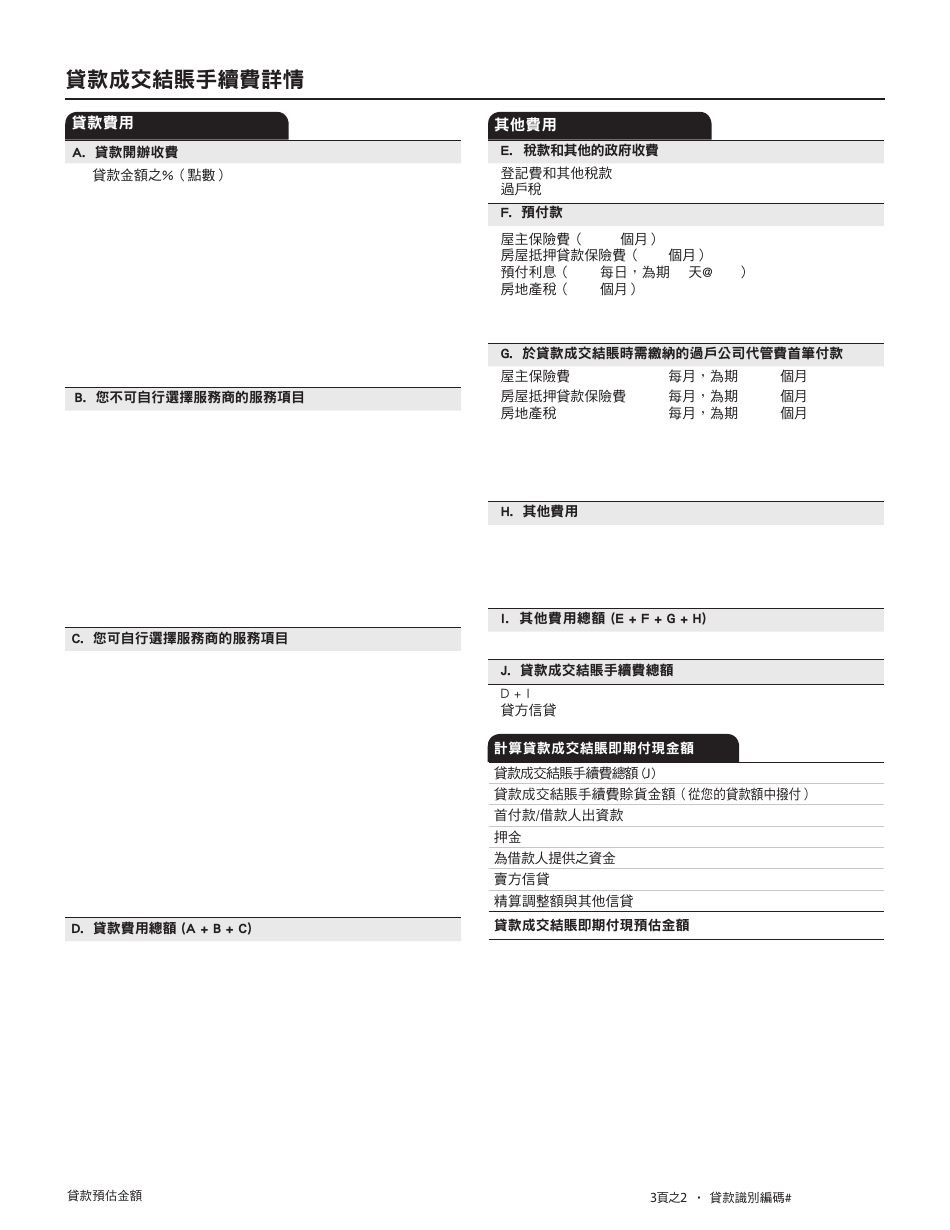

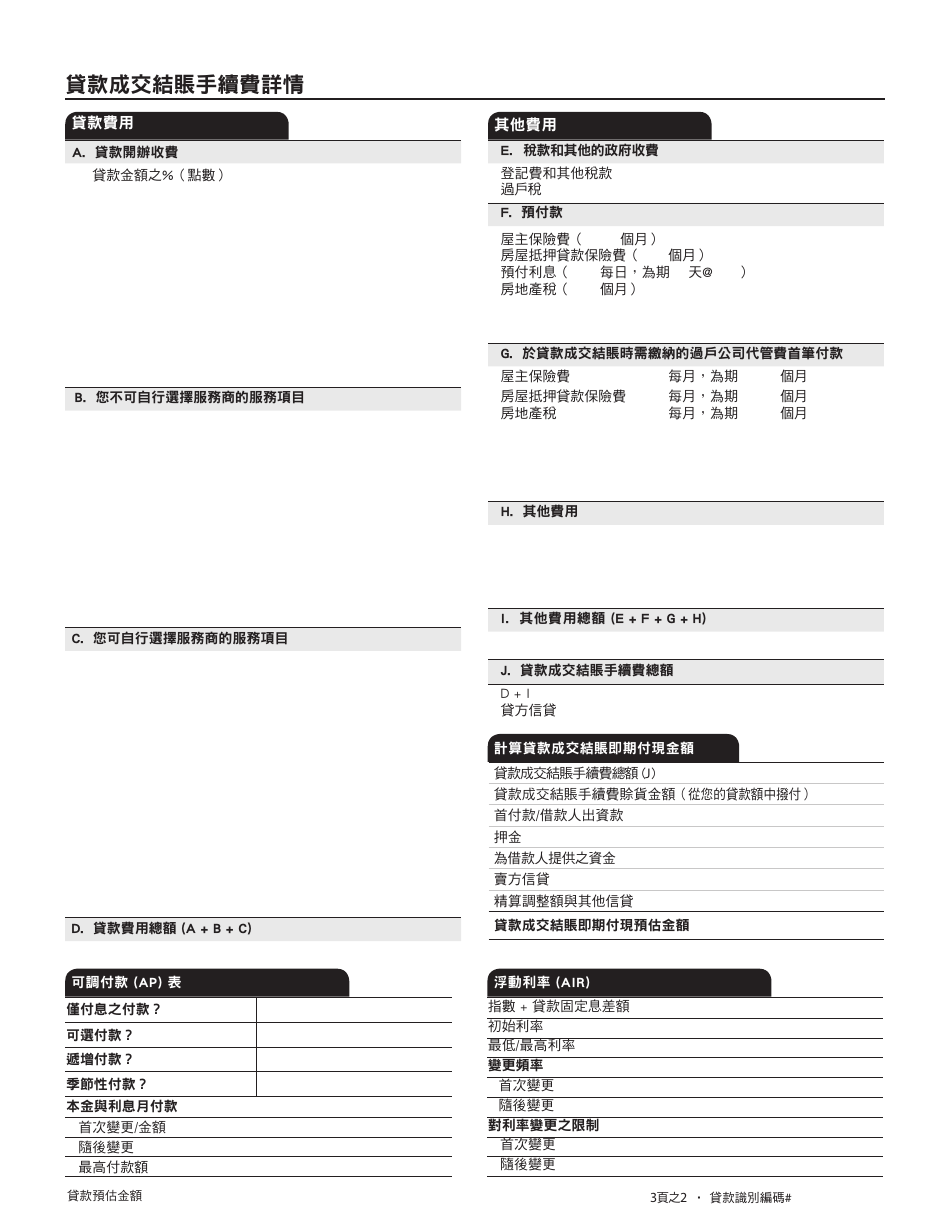

A: A Loan Estimate is a document that provides details about the terms of a mortgage loan, including the estimated interest rate, monthly payment, and closing costs.

Q: Who provides the Loan Estimate?

A: The Loan Estimate is provided by the lender or mortgage broker.

Q: What information is included in the Loan Estimate?

A: The Loan Estimate includes information about the loan amount, interest rate, monthly payment, and estimated closing costs.

Q: When should I receive the Loan Estimate?

A: You should receive the Loan Estimate within three business days of submitting a mortgage loan application.

Q: What should I do after receiving the Loan Estimate?

A: After receiving the Loan Estimate, you should review it carefully and compare it to other loan offers to make an informed decision.

Q: Can the Loan Estimate change?

A: Yes, the Loan Estimate can change if there are changes in your financial circumstances or if you choose a different loan option.

Q: Are there any fees associated with obtaining a Loan Estimate?

A: No, lenders are not allowed to charge any fees for providing a Loan Estimate.

Q: Is the Loan Estimate binding?

A: No, the Loan Estimate is not binding. It is an estimate of the loan terms and costs and may change before closing.

Q: What should I do if I have questions or concerns about the Loan Estimate?

A: If you have questions or concerns about the Loan Estimate, you should contact the lender or mortgage broker for clarification.

Form Details:

- Released on February 1, 2014;

- The latest edition provided by the California Department of Financial Protection and Innovation;

- Easy to use and ready to print;

- Available in Spanish;

- Quick to customize;

- Compatible with most PDF-viewing applications;

Download a printable version of Form CFPB by clicking the link below or browse more documents and templates provided by the California Department of Financial Protection and Innovation.