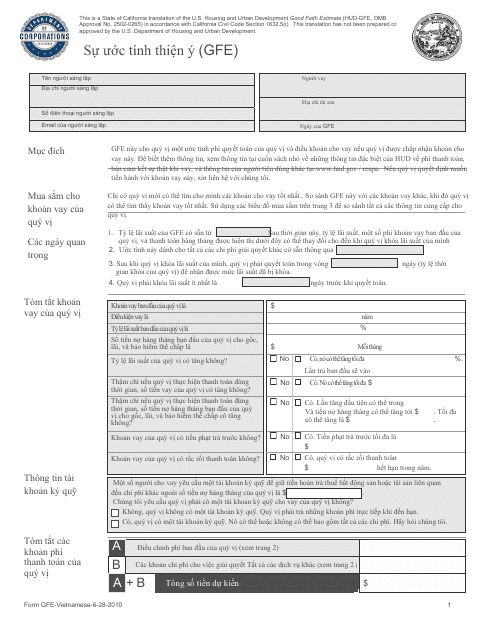

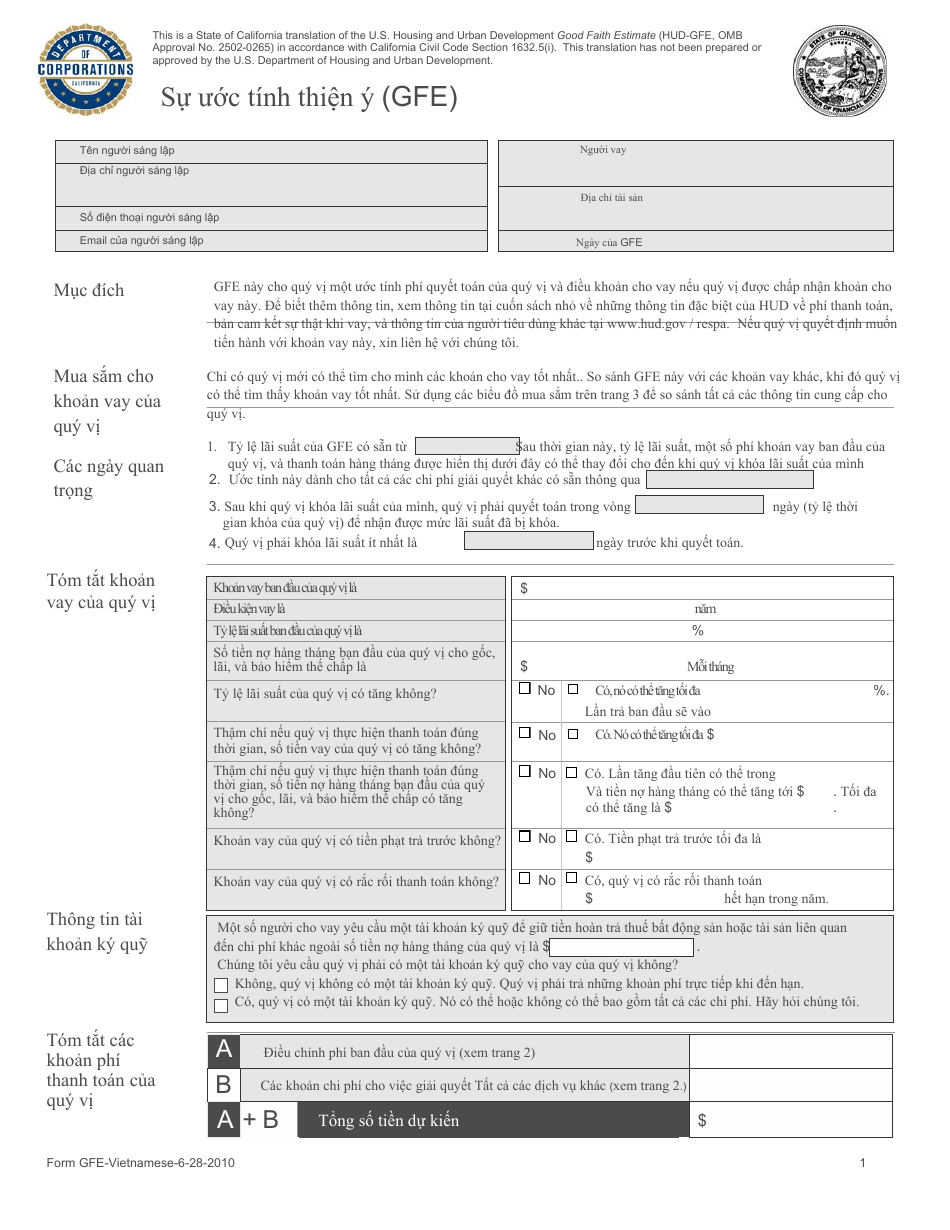

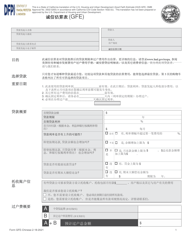

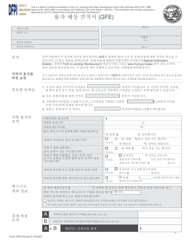

Good Faith Estimate Form - California (Vietnamese)

This is a legal document that was released by the California Department of Financial Protection and Innovation - a government authority operating within California.

The document is provided in Vietnamese.

FAQ

Q: What is a Good Faith Estimate (GFE) form?

A: A Good Faith Estimate (GFE) form is a document that provides an estimate of the costs associated with a mortgage loan.

Q: Who needs to use a GFE form?

A: Homebuyers who are applying for a mortgage loan in California.

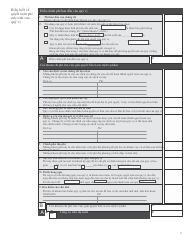

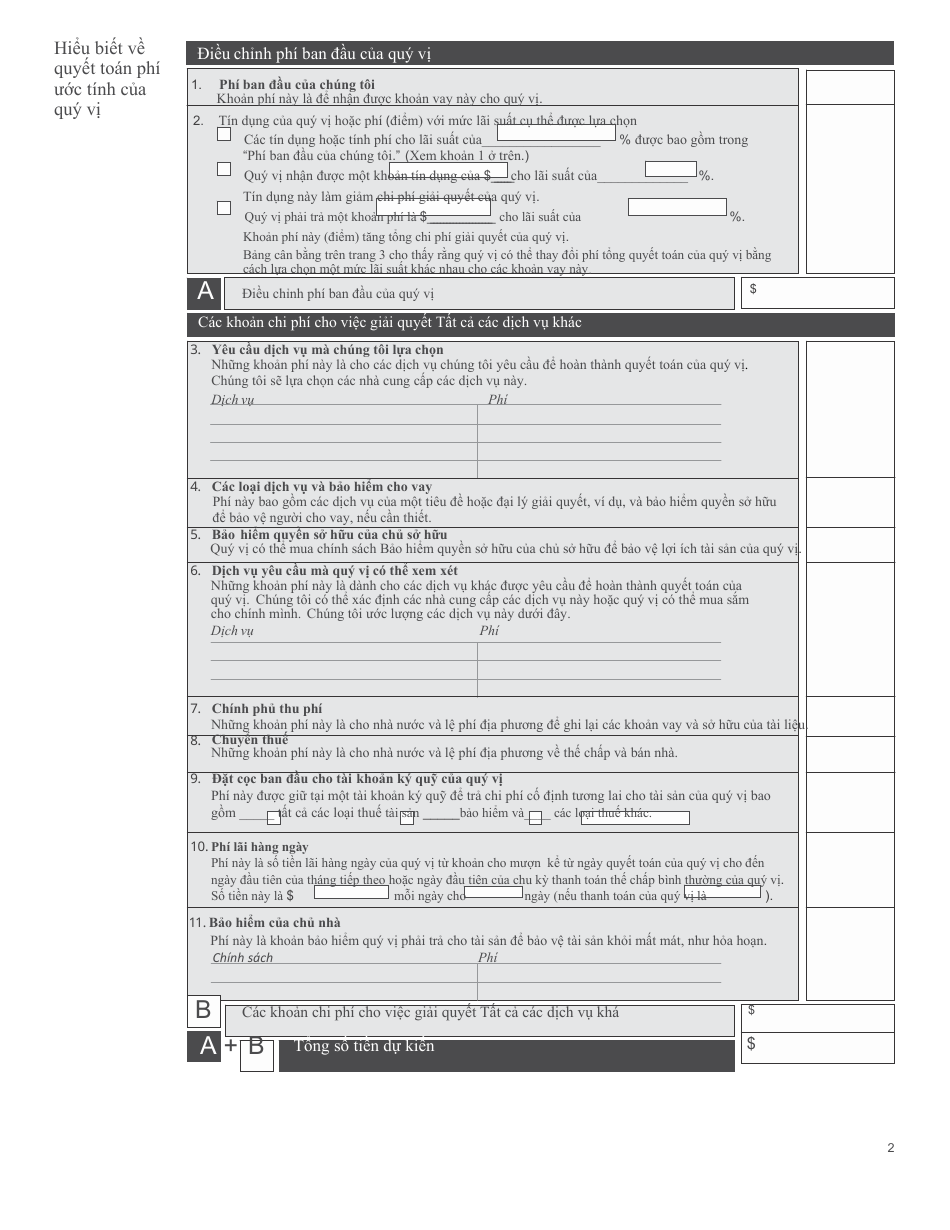

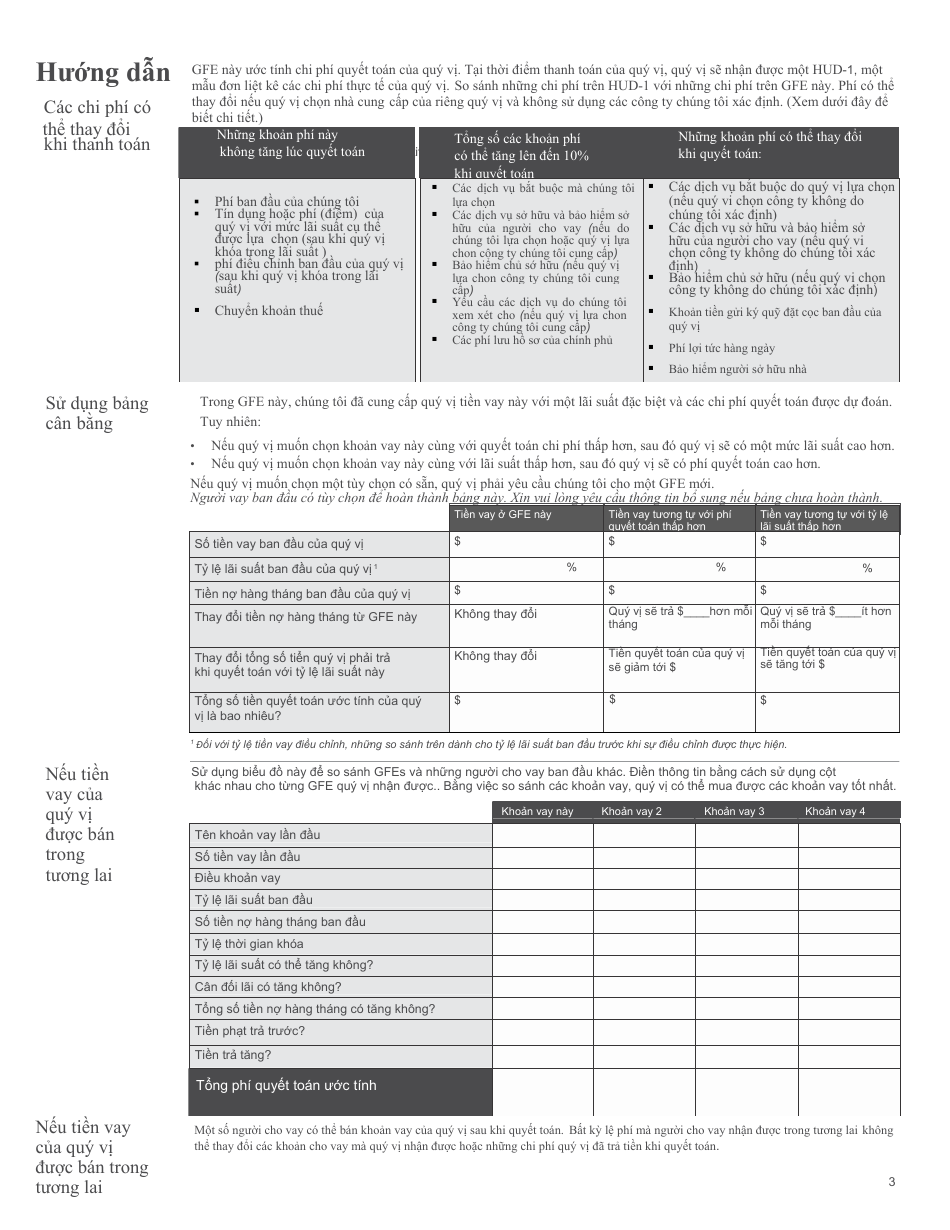

Q: What information is included in a GFE form?

A: A GFE form includes information about the loan amount, interest rate, loan terms, and estimated closing costs.

Q: Why is a GFE form important?

A: A GFE form helps homebuyers understand the costs associated with their mortgage loan and allows them to compare offers from different lenders.

Q: Is a GFE form legally binding?

A: No, a GFE form is not legally binding. It is an estimate and the actual costs may vary at closing.

Q: Can I negotiate the costs listed on the GFE form?

A: Yes, you can negotiate some of the costs listed on the GFE form, such as the interest rate or loan origination fees.

Q: When should I receive a GFE form?

A: You should receive a GFE form within three business days of submitting a mortgage loan application.

Q: What should I do if I have questions about the GFE form?

A: If you have questions about the GFE form, you should reach out to your mortgage lender for clarification.

Form Details:

- Released on June 28, 2010;

- The latest edition currently provided by the California Department of Financial Protection and Innovation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the California Department of Financial Protection and Innovation.