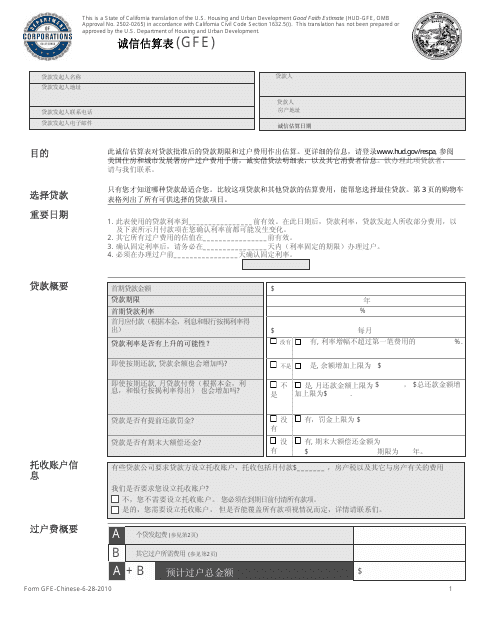

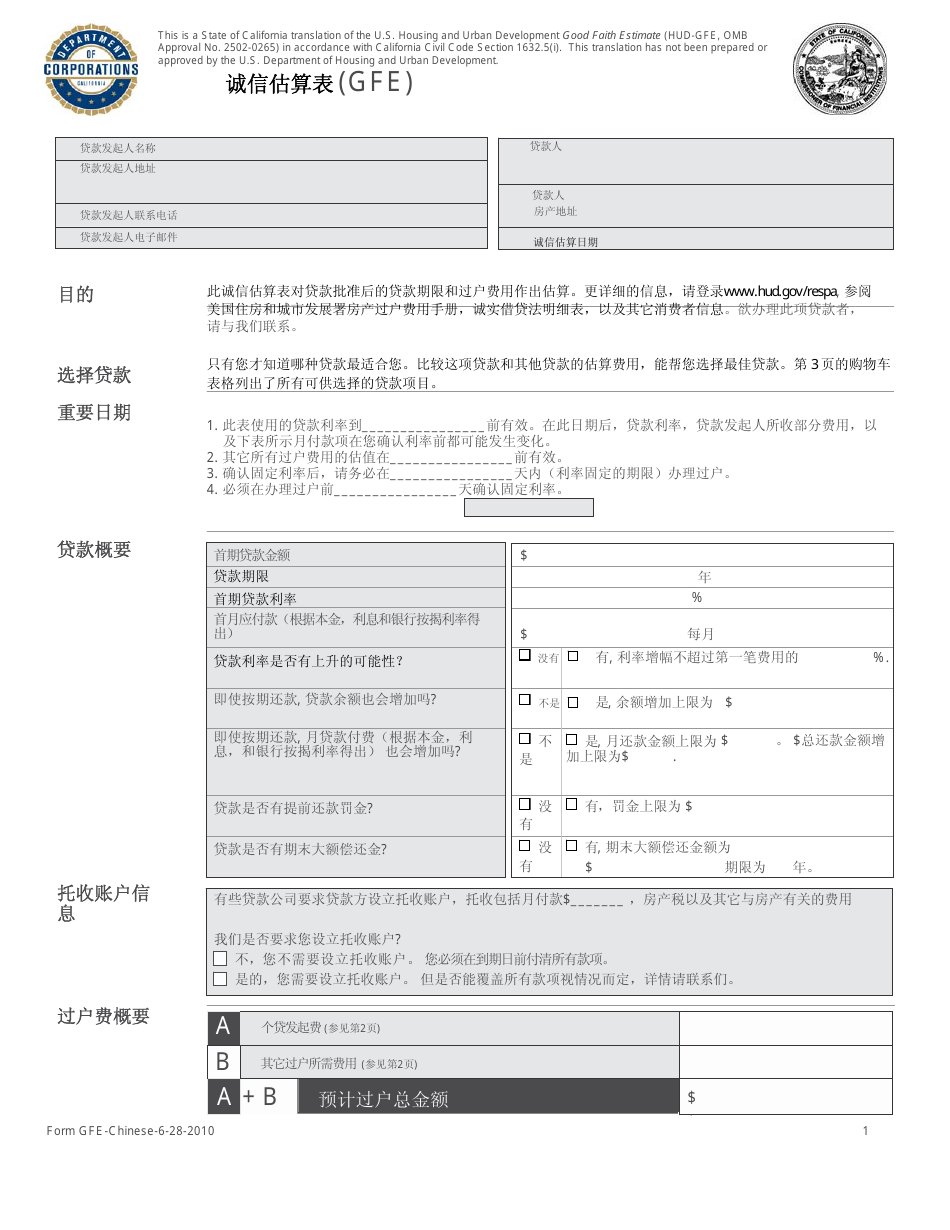

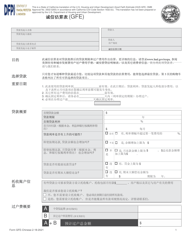

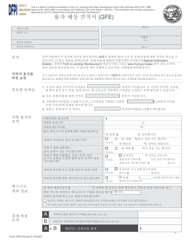

Good Faith Estimate Form - California (Chinese)

This is a legal document that was released by the California Department of Financial Protection and Innovation - a government authority operating within California.

The document is provided in Chinese.

FAQ

Q: What is a Good Faith Estimate form?

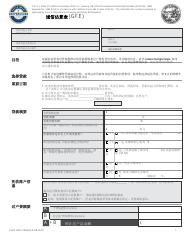

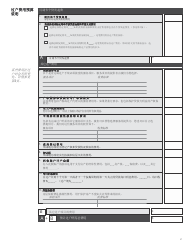

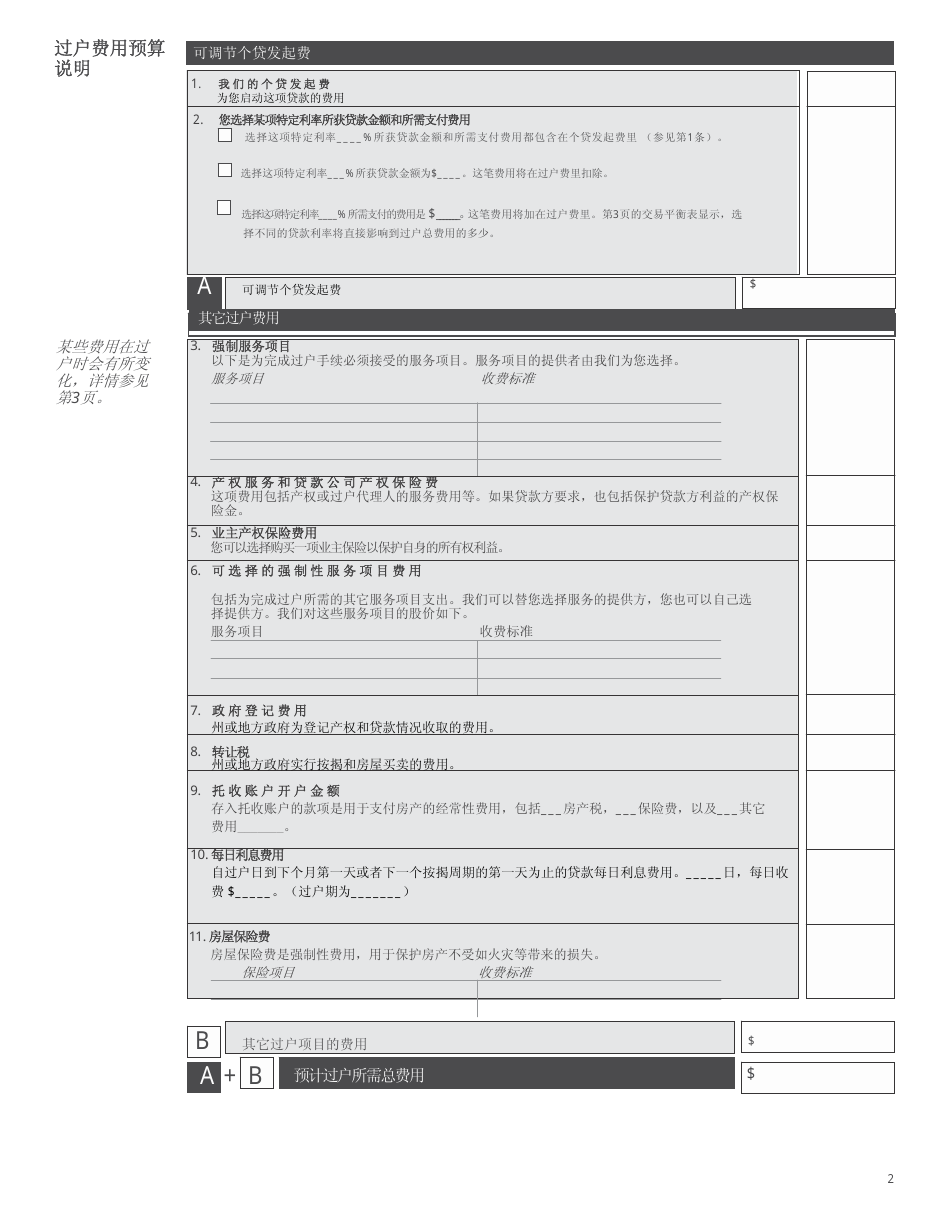

A: The Good Faith Estimate form is used in California to provide an estimate of loan terms and closing costs to borrowers.

Q: Who uses the Good Faith Estimate form?

A: Lenders use the Good Faith Estimate form to disclose the estimated costs associated with a mortgage loan.

Q: What information does the Good Faith Estimate form include?

A: The Good Faith Estimate form includes information about loan terms, estimated closing costs, and other details related to the mortgage loan.

Q: Why is the Good Faith Estimate form important?

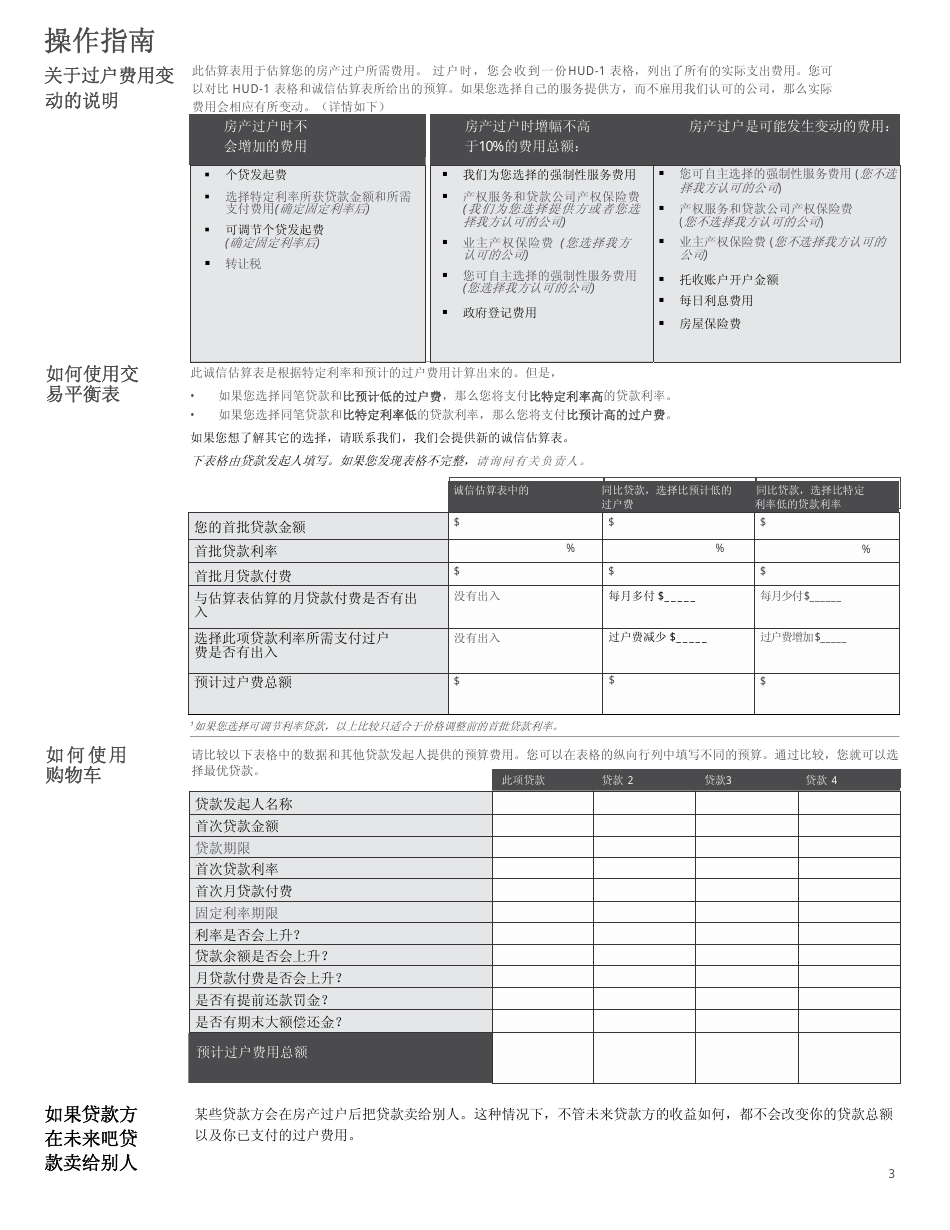

A: The Good Faith Estimate form helps borrowers understand the costs associated with their mortgage loan and compare offers from different lenders.

Q: Is the Good Faith Estimate form legally binding?

A: No, the Good Faith Estimate form is not legally binding. It is an estimate and actual costs may vary.

Q: Can the Good Faith Estimate form change?

A: Yes, the Good Faith Estimate form can change. If there are significant changes to the loan terms or closing costs, a revised form may be provided.

Q: When should I receive a Good Faith Estimate form?

A: You should receive a Good Faith Estimate form within three business days of applying for a mortgage loan.

Q: Can I use the Good Faith Estimate form to compare loan offers?

A: Yes, the Good Faith Estimate form can be used to compare loan offers from different lenders and help you make an informed decision.

Q: Are there any fees associated with obtaining a Good Faith Estimate form?

A: No, lenders are not allowed to charge any fees for providing a Good Faith Estimate form.

Form Details:

- Released on June 28, 2010;

- The latest edition currently provided by the California Department of Financial Protection and Innovation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the California Department of Financial Protection and Innovation.