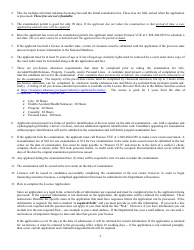

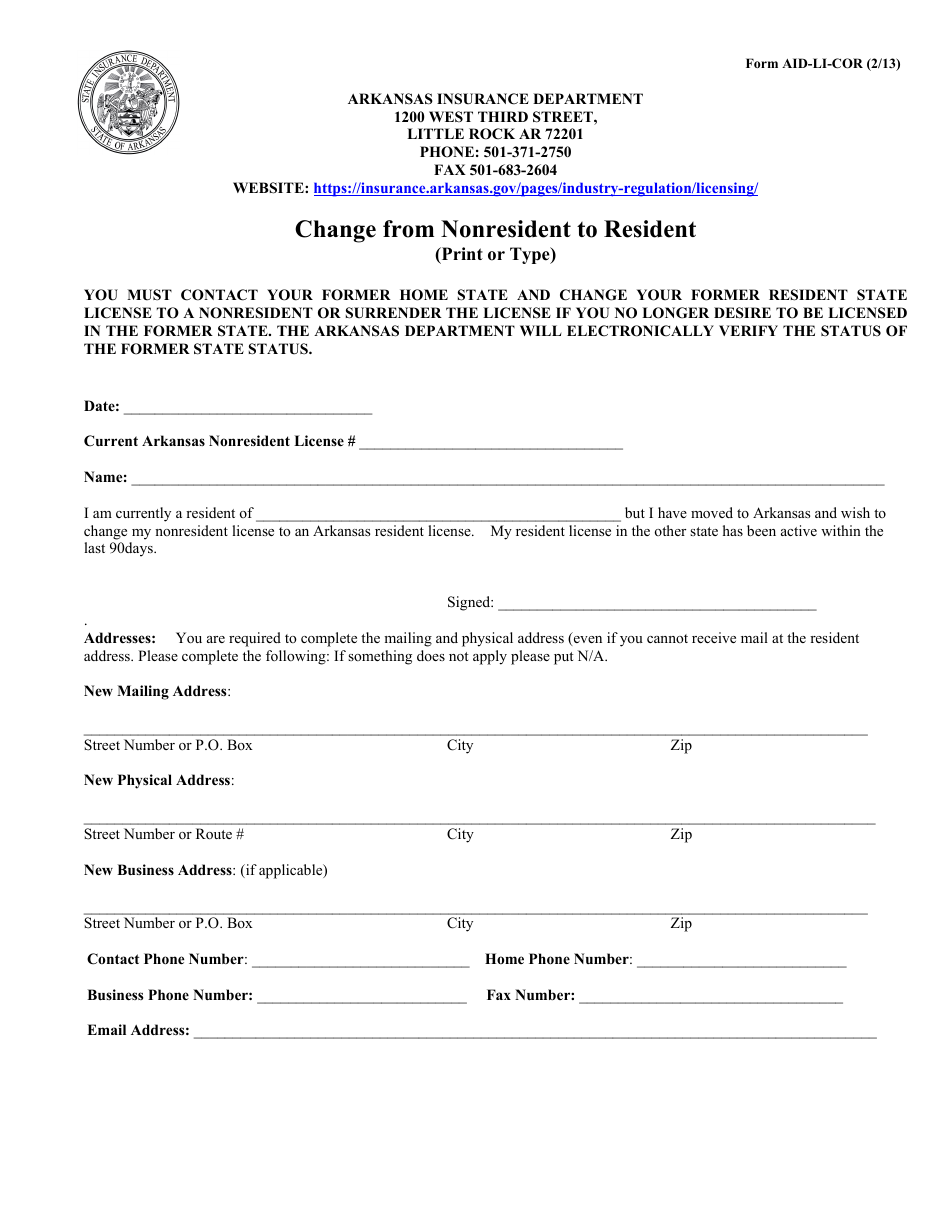

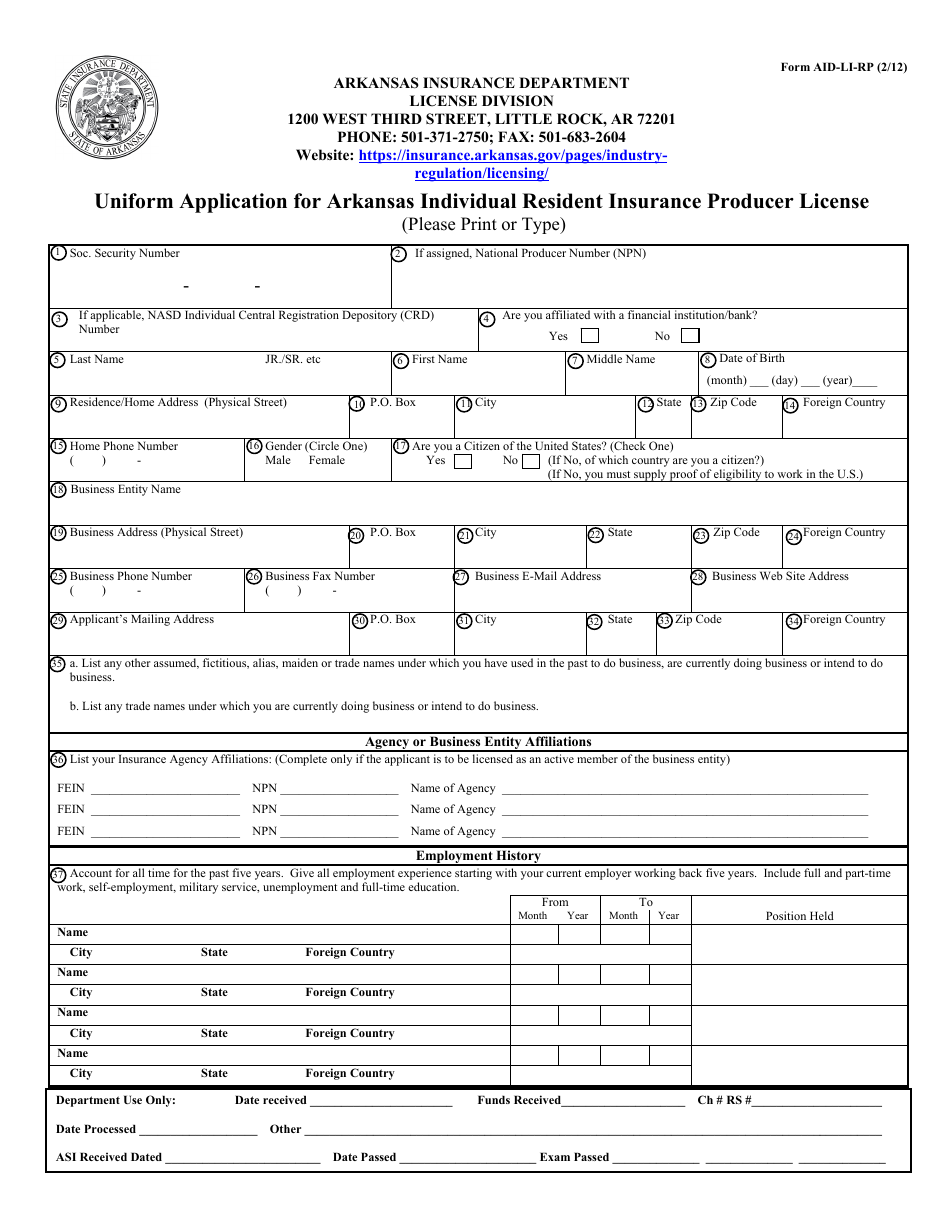

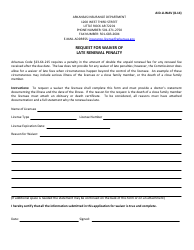

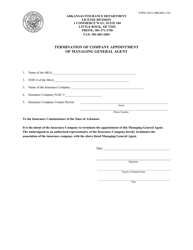

Form AID-LI-COR Change From Nonresident to Resident - Arkansas

What Is Form AID-LI-COR?

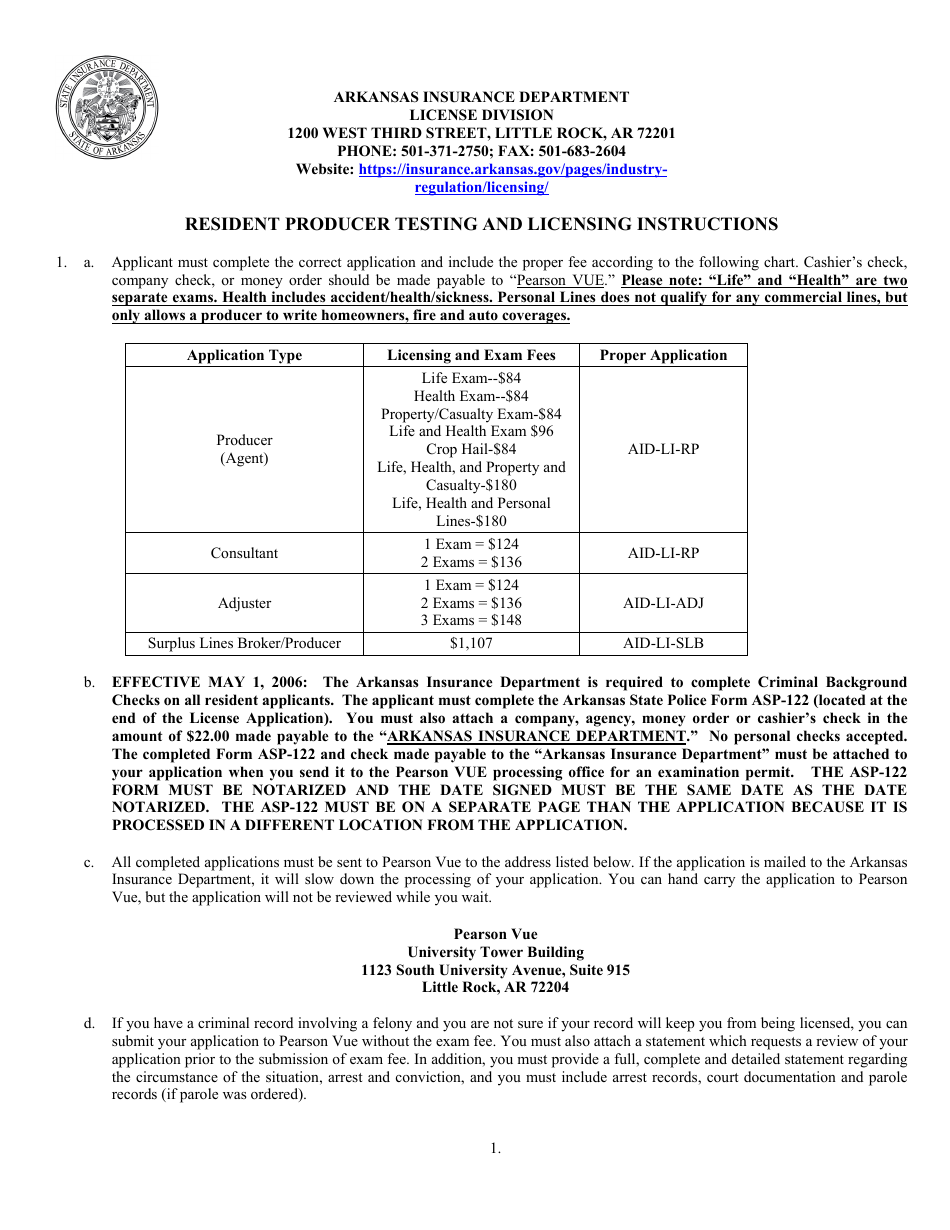

This is a legal form that was released by the Arkansas Insurance Department - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AID-LI-COR?

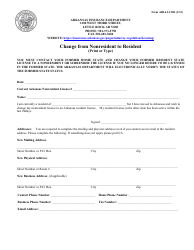

A: Form AID-LI-COR is a form used to change your residency status from nonresident to resident in Arkansas.

Q: When should I file Form AID-LI-COR?

A: You should file Form AID-LI-COR when you become a resident of Arkansas.

Q: How do I file Form AID-LI-COR?

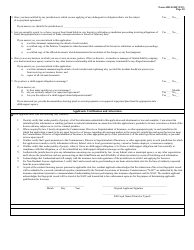

A: To file Form AID-LI-COR, you need to complete the form and submit it to the Arkansas Department of Finance and Administration.

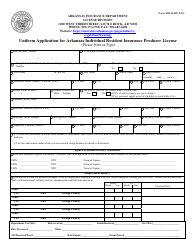

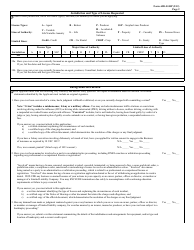

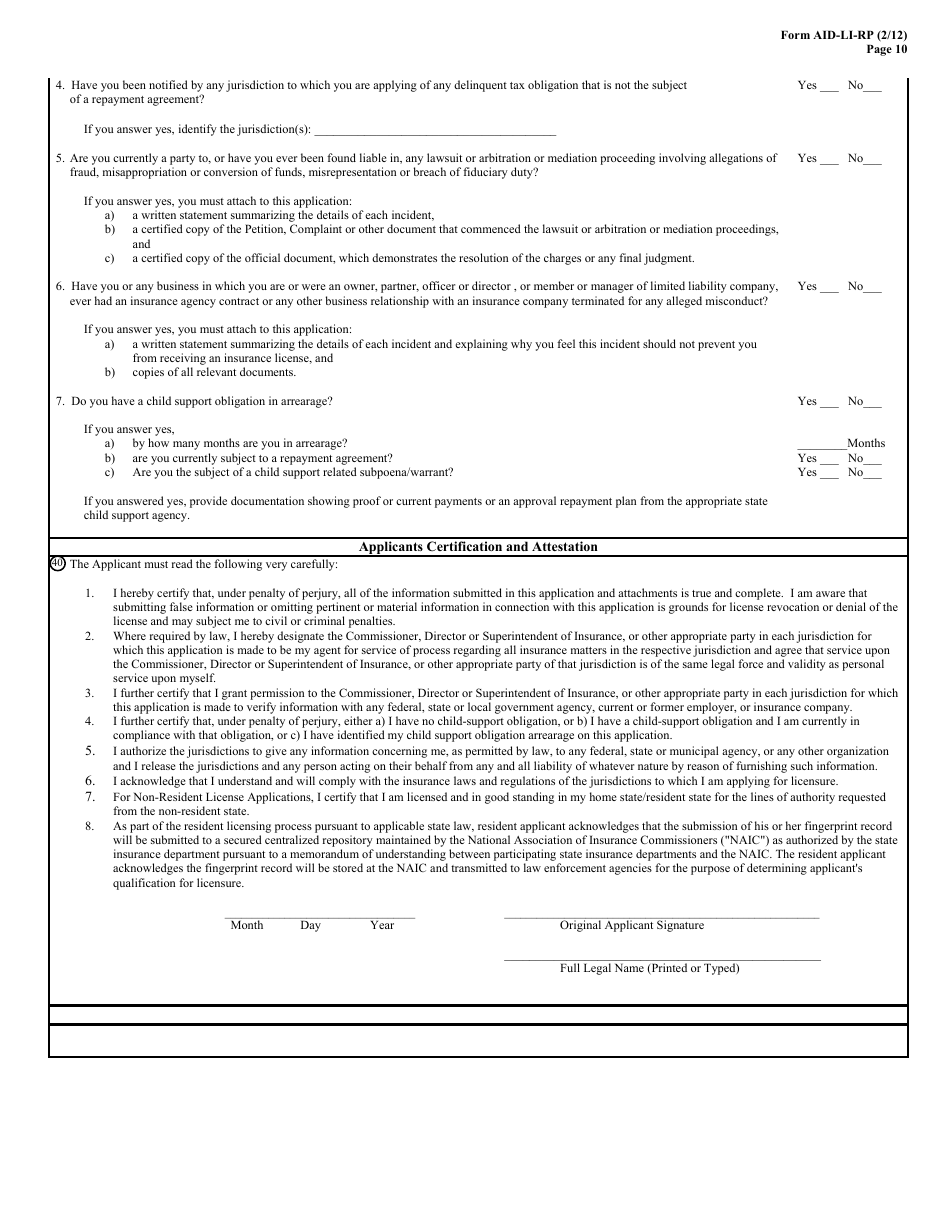

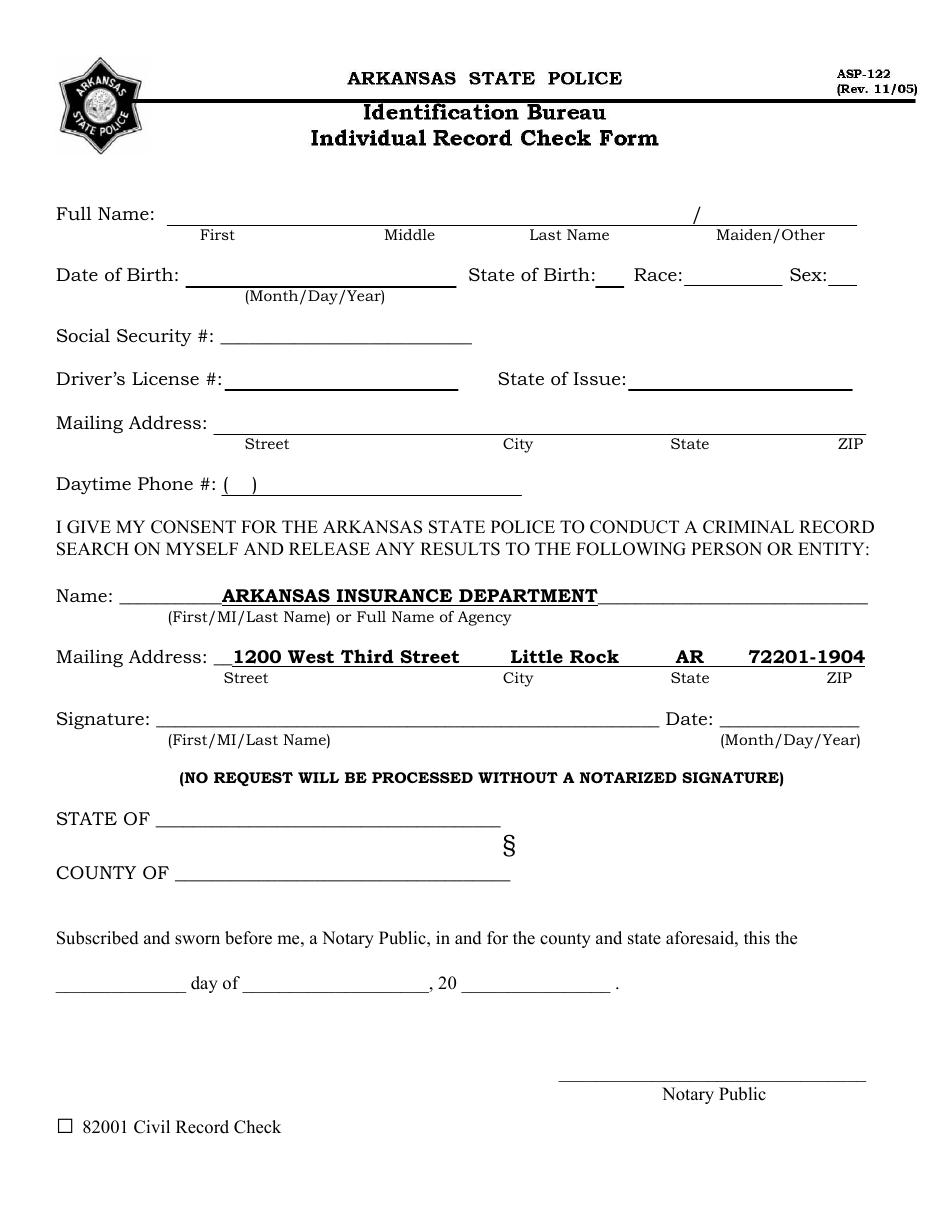

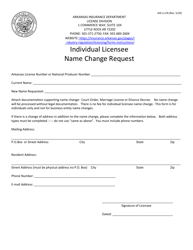

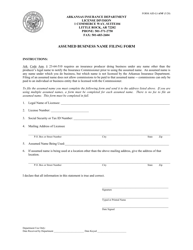

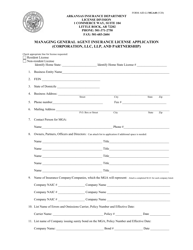

Q: What information do I need to provide on Form AID-LI-COR?

A: You need to provide your personal information, including your name, social security number, and address, as well as information about your residency status.

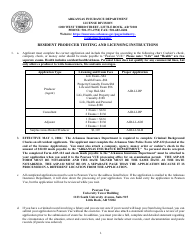

Q: Are there any fees for filing Form AID-LI-COR?

A: No, there are no fees for filing Form AID-LI-COR.

Q: How long does it take to process Form AID-LI-COR?

A: The processing time for Form AID-LI-COR may vary, but it is typically processed within a few weeks.

Q: What happens after I file Form AID-LI-COR?

A: After you file Form AID-LI-COR, the Arkansas Department of Finance and Administration will review your application and determine if you qualify for resident status.

Q: Can I backdate my residency status change with Form AID-LI-COR?

A: No, you cannot backdate your residency status change with Form AID-LI-COR. The effective date of your residency change will be the date you submit the form.

Q: What if my residency status changes again after filing Form AID-LI-COR?

A: If your residency status changes again after filing Form AID-LI-COR, you will need to file another form to update your status.

Form Details:

- Released on February 1, 2013;

- The latest edition provided by the Arkansas Insurance Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AID-LI-COR by clicking the link below or browse more documents and templates provided by the Arkansas Insurance Department.