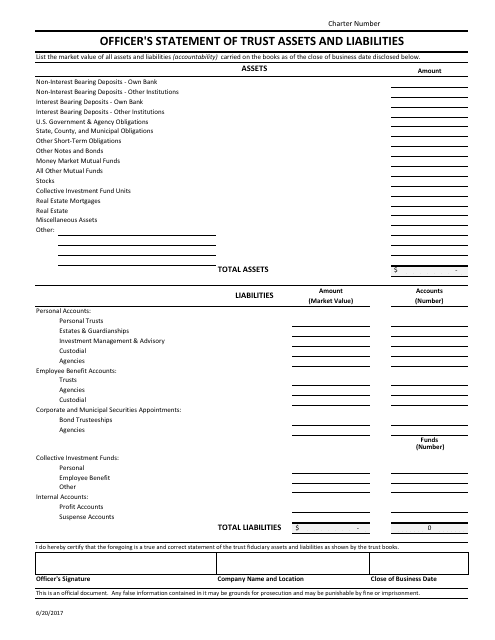

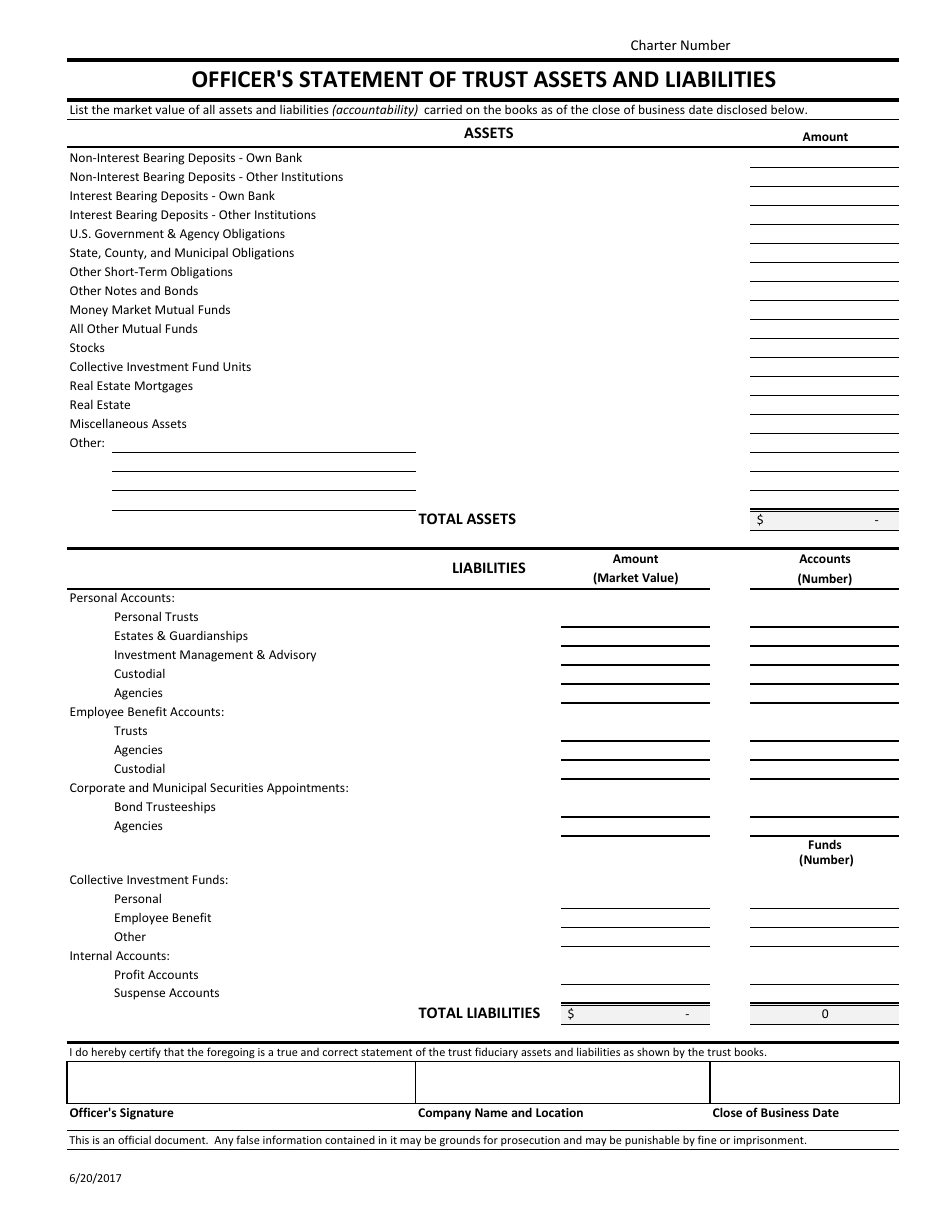

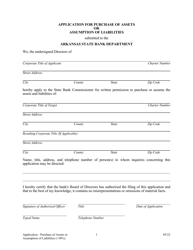

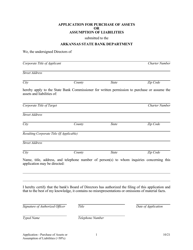

Officer's Statement of Trust Assets and Liabilities - Arkansas

Officer's Statement of Trust Assets and Liabilities is a legal document that was released by the Arkansas State Bank Department - a government authority operating within Arkansas.

FAQ

Q: What is an Officer's Statement of Trust Assets and Liabilities?

A: An Officer's Statement of Trust Assets and Liabilities is a document that provides information about the assets and liabilities of a trust.

Q: Who prepares the Officer's Statement of Trust Assets and Liabilities?

A: The Officer's Statement of Trust Assets and Liabilities is prepared by the trustee or an appointed officer of the trust.

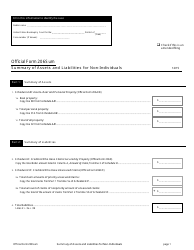

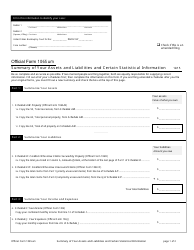

Q: What information is included in the Officer's Statement of Trust Assets and Liabilities?

A: The Officer's Statement of Trust Assets and Liabilities includes details about the assets held by the trust and any liabilities or debts that the trust has.

Q: Why is the Officer's Statement of Trust Assets and Liabilities important?

A: The Officer's Statement of Trust Assets and Liabilities is important because it provides transparency and accountability regarding the financial status of the trust.

Q: When is the Officer's Statement of Trust Assets and Liabilities submitted?

A: The Officer's Statement of Trust Assets and Liabilities is typically submitted annually or as required by state laws or regulations.

Q: Is the Officer's Statement of Trust Assets and Liabilities confidential?

A: The confidentiality of the Officer's Statement of Trust Assets and Liabilities may vary depending on state laws and regulations.

Q: What are the consequences of not submitting the Officer's Statement of Trust Assets and Liabilities?

A: The consequences of not submitting the Officer's Statement of Trust Assets and Liabilities may vary by state, but it could result in penalties or legal consequences.

Q: Can an Officer's Statement of Trust Assets and Liabilities be amended?

A: Yes, an Officer's Statement of Trust Assets and Liabilities can be amended if there are changes to the trust's assets or liabilities.

Q: Who has access to the Officer's Statement of Trust Assets and Liabilities?

A: Access to the Officer's Statement of Trust Assets and Liabilities may vary depending on state laws and regulations. It may be accessible to certain government agencies or parties with a legal interest in the trust.

Q: Is professional assistance required to prepare the Officer's Statement of Trust Assets and Liabilities?

A: While professional assistance is not always required, it may be helpful to consult with an attorney or financial advisor familiar with trust administration to ensure accuracy and compliance.

Q: Are there any fees associated with submitting the Officer's Statement of Trust Assets and Liabilities?

A: There may be filing fees associated with submitting the Officer's Statement of Trust Assets and Liabilities, which can vary by state.

Q: What happens if there are errors or discrepancies in the Officer's Statement of Trust Assets and Liabilities?

A: If errors or discrepancies are discovered in the Officer's Statement of Trust Assets and Liabilities, they should be corrected and amended as soon as possible to ensure accurate reporting.

Q: Can the Officer's Statement of Trust Assets and Liabilities be used as evidence in legal proceedings?

A: Yes, the Officer's Statement of Trust Assets and Liabilities can be used as evidence in legal proceedings related to the trust.

Q: Is the Officer's Statement of Trust Assets and Liabilities the same as a trust account statement?

A: No, the Officer's Statement of Trust Assets and Liabilities is a separate document that provides a comprehensive overview of the trust's assets and liabilities.

Q: What other documents are typically required for trust administration?

A: Other documents that may be required for trust administration include the trust agreement, will, beneficiary designations, and any relevant financial or legal records.

Q: Can the Officer's Statement of Trust Assets and Liabilities be used for tax purposes?

A: The Officer's Statement of Trust Assets and Liabilities may provide information that is relevant for tax purposes, but additional tax-related documents may be required.

Q: Are there any exceptions or exemptions from submitting the Officer's Statement of Trust Assets and Liabilities?

A: There may be exceptions or exemptions from submitting the Officer's Statement of Trust Assets and Liabilities, depending on state laws and regulations. It is advisable to consult with legal professionals for specific guidance.

Q: What is the purpose of disclosing liabilities in the Officer's Statement of Trust Assets and Liabilities?

A: Disclosing liabilities in the Officer's Statement of Trust Assets and Liabilities is important for providing a complete and accurate financial picture of the trust.

Q: Can the Officer's Statement of Trust Assets and Liabilities be used to track changes in the value of trust assets?

A: Yes, the Officer's Statement of Trust Assets and Liabilities can be used to track changes in the value of trust assets over time.

Q: Is there a specific format or template for the Officer's Statement of Trust Assets and Liabilities?

A: There may be specific formats or templates for the Officer's Statement of Trust Assets and Liabilities depending on the jurisdiction. It is advisable to consult with state-specific resources or legal professionals for guidance.

Q: Is the Officer's Statement of Trust Assets and Liabilities only required for certain types of trusts?

A: The requirement for an Officer's Statement of Trust Assets and Liabilities may vary depending on state laws and regulations, but it generally applies to most types of trusts.

Q: How long should the Officer's Statement of Trust Assets and Liabilities be retained?

A: The Officer's Statement of Trust Assets and Liabilities should be retained for as long as the trust is active and relevant, and it is advisable to keep copies of previous statements for reference purposes.

Form Details:

- Released on June 20, 2017;

- The latest edition currently provided by the Arkansas State Bank Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Arkansas State Bank Department.