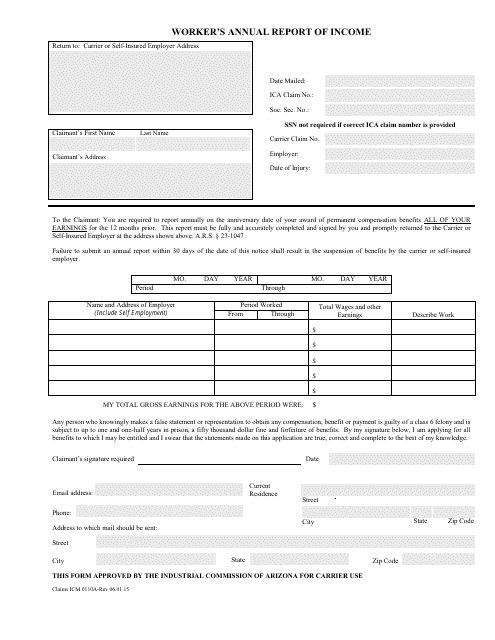

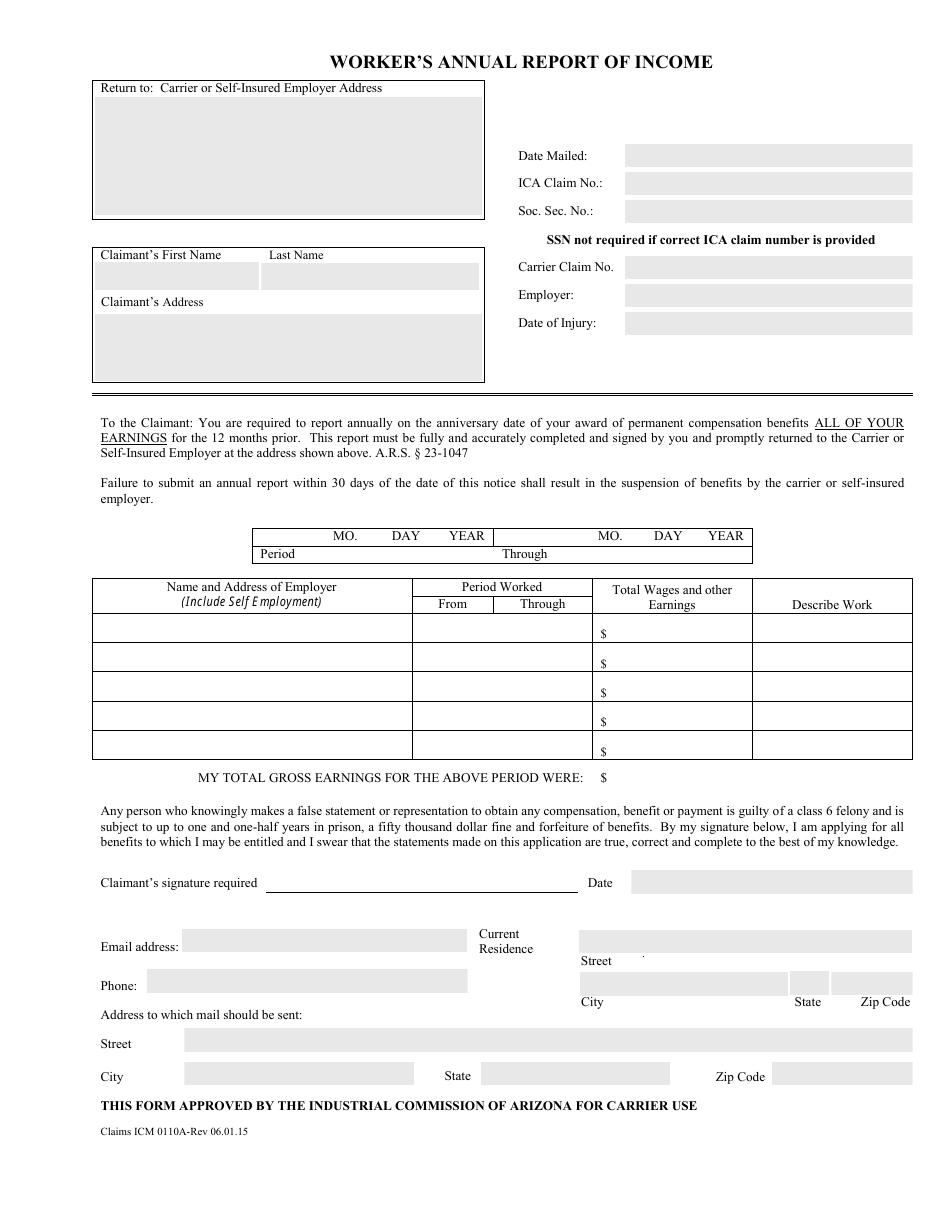

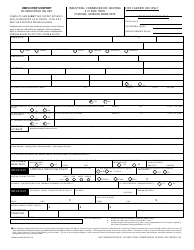

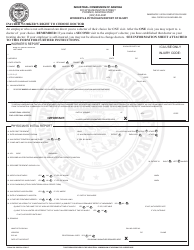

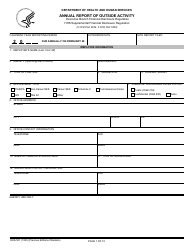

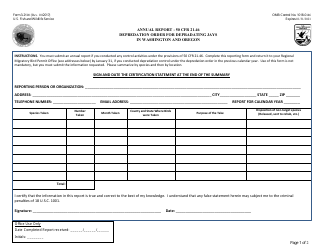

Form Claims ICM0110A Worker's Annual Report of Income - Arizona

What Is Form Claims ICM0110A?

This is a legal form that was released by the Industrial Commission of Arizona - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form Claims ICM0110A?

A: Form Claims ICM0110A is the Worker's Annual Report of Income specific to Arizona.

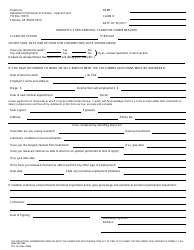

Q: Who needs to file Form Claims ICM0110A?

A: Workers in Arizona who have received unemployment benefits during the year need to file Form Claims ICM0110A.

Q: What information do I need to complete Form Claims ICM0110A?

A: You will need information such as your social security number, total amount of unemployment benefits received, and any other income received during the year.

Q: When is the deadline to file Form Claims ICM0110A?

A: The deadline to file Form Claims ICM0110A is usually April 15th of the following year.

Q: What should I do if I did not receive Form Claims ICM0110A?

A: If you did not receive Form Claims ICM0110A, you should contact the Arizona Department of Economic Security to request a copy.

Q: What happens if I don't file Form Claims ICM0110A?

A: If you fail to file Form Claims ICM0110A, you may face penalties or delays in receiving future unemployment benefits.

Q: Is Form Claims ICM0110A for both the US and Canada?

A: No, Form Claims ICM0110A is specific to Arizona and does not apply to Canada.

Q: What other forms do I need to complete along with Form Claims ICM0110A?

A: You may need to complete other tax forms, such as the federal income tax return and state income tax return, depending on your individual circumstances.

Form Details:

- Released on June 1, 2015;

- The latest edition provided by the Industrial Commission of Arizona;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form Claims ICM0110A by clicking the link below or browse more documents and templates provided by the Industrial Commission of Arizona.