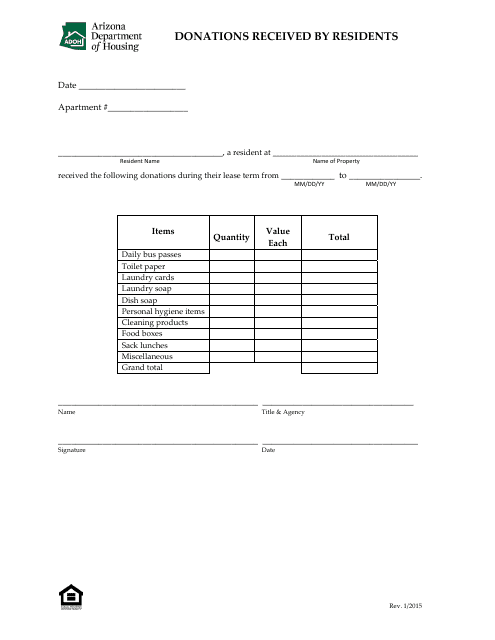

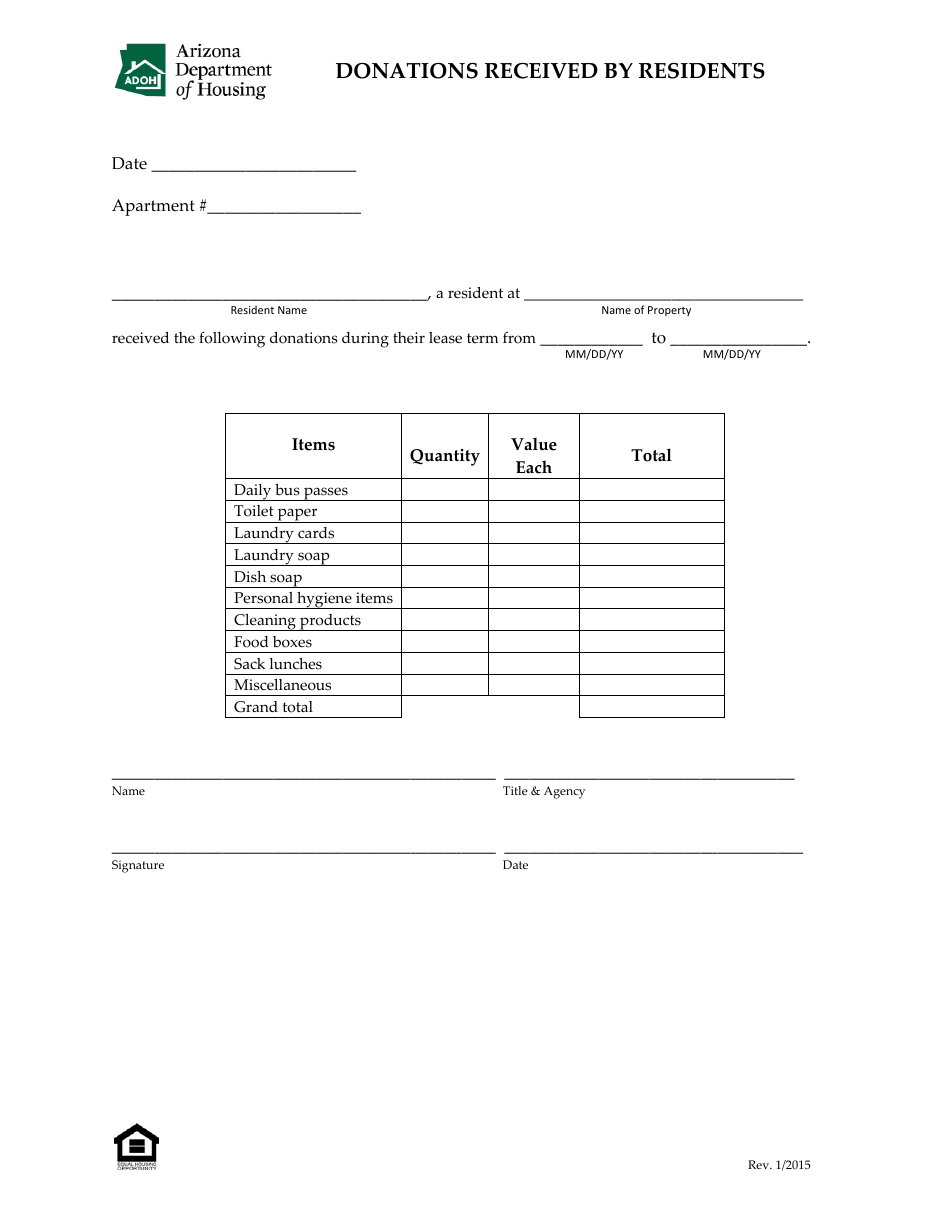

Donations Received by Residents - Arizona

Donations Received by Residents is a legal document that was released by the Arizona Department of Housing - a government authority operating within Arizona.

FAQ

Q: How do I claim a deduction for donations?

A: You can claim a deduction for donations on your federal tax return by itemizing your deductions on Schedule A. Consult a tax professional for more information.

Q: What types of donations are tax-deductible?

A: Generally, donations to qualified charitable organizations are tax-deductible. This includes cash donations, as well as donations of goods or property.

Q: Can I deduct donations made to political campaigns?

A: No, donations made to political campaigns are not tax-deductible.

Q: Do I need a receipt for my donations?

A: For donations of $250 or more, you generally need a written acknowledgment from the charity. However, it's a good practice to keep receipts for all donations.

Q: What is the annual limit for deductible charitable contributions?

A: For most taxpayers, the limit is 60% of their adjusted gross income (AGI). However, there are special rules for certain types of donations and taxpayers.

Q: Can I deduct the value of my time spent volunteering?

A: No, you cannot deduct the value of your time or services spent volunteering. However, you may be able to deduct certain expenses related to your volunteer work.

Q: Are there any limits on how much I can deduct for donations?

A: Yes, there are certain limits depending on the type of donation and your income level. Consult a tax professional for specific details regarding your situation.

Q: What documentation do I need to provide when claiming a deduction for donations?

A: You should keep records of the donations you make, such as receipts, cancelled checks, or bank statements. For donations of $250 or more, you will also need a written acknowledgment from the charity.

Q: Can I deduct donations made to individuals or crowdfunding campaigns?

A: No, donations made to individuals or crowdfunding campaigns are generally not tax-deductible.

Q: Can I carry forward unused deductions for donations?

A: Yes, if your total deductions for donations exceed the annual limit, you can carry forward the excess deduction to future years, subject to certain rules.

Form Details:

- Released on January 1, 2015;

- The latest edition currently provided by the Arizona Department of Housing;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Arizona Department of Housing.