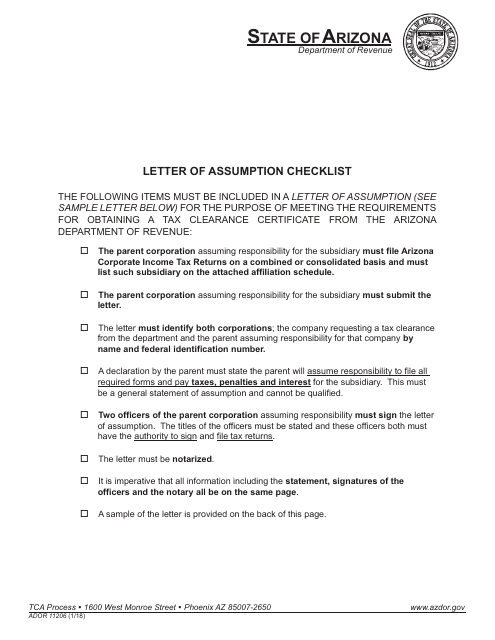

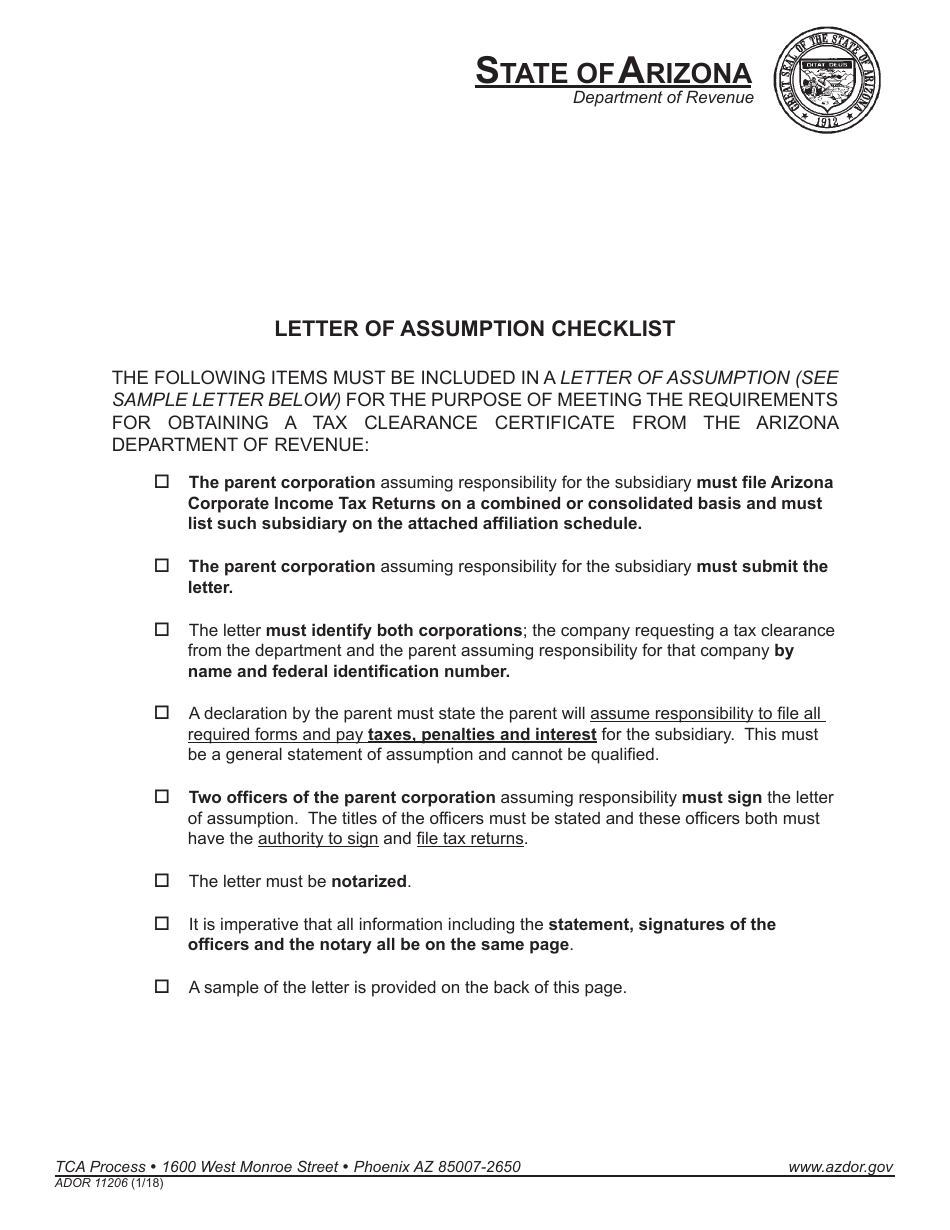

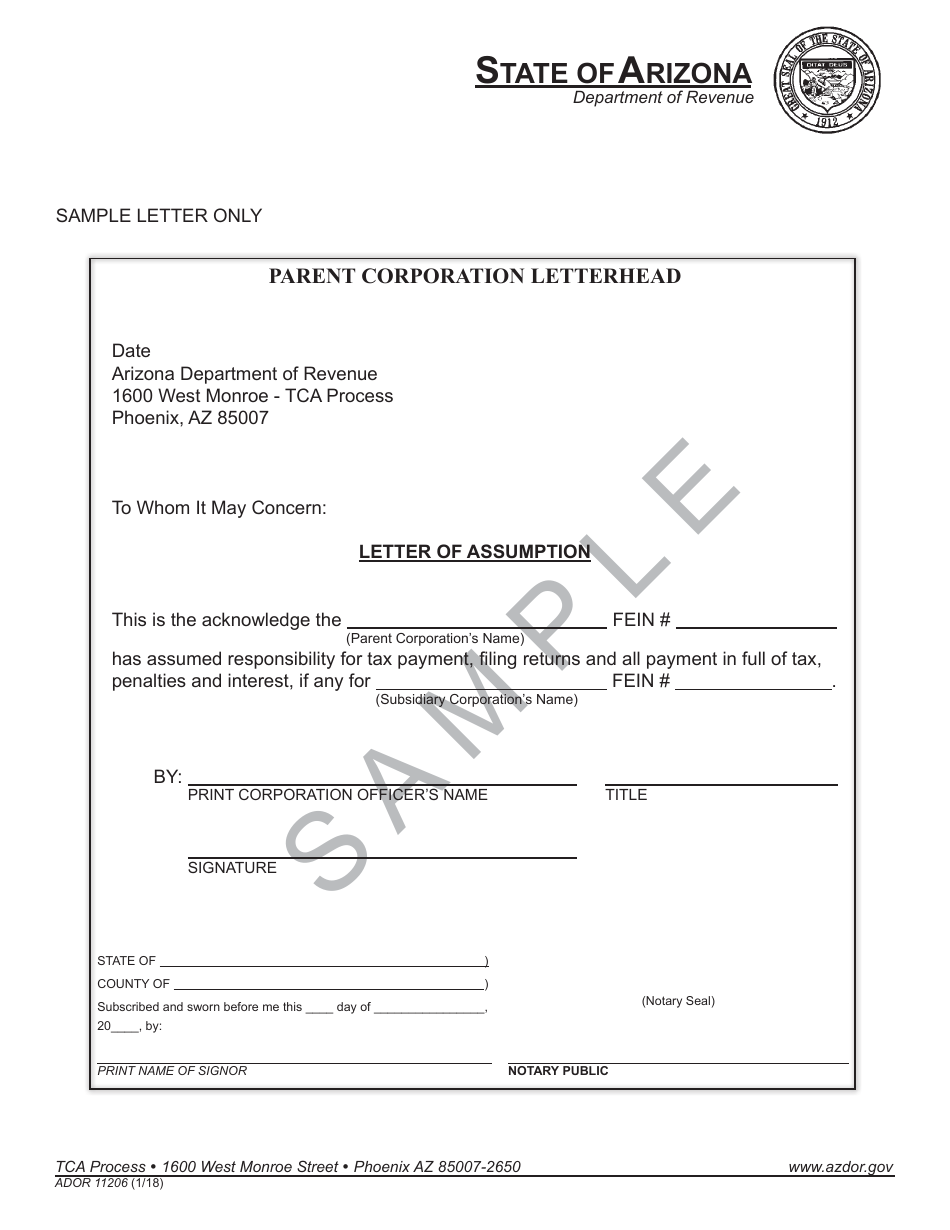

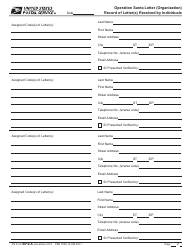

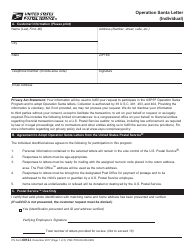

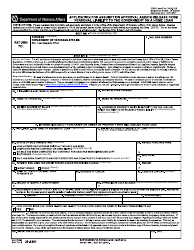

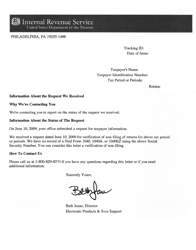

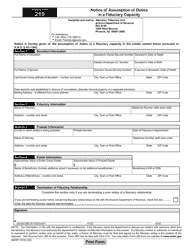

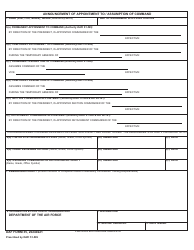

Form ADOR11206 Letter of Assumption - Sample - Arizona

What Is Form ADOR11206?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ADOR11206?

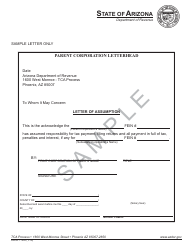

A: Form ADOR11206 is a Letter of Assumption - Sample that is used in Arizona.

Q: What is the purpose of Form ADOR11206?

A: Form ADOR11206 is used to assume the responsibility of a tax liability in the state of Arizona.

Q: Who should use Form ADOR11206?

A: Form ADOR11206 should be used by individuals or entities who want to assume the responsibility of a tax liability in Arizona.

Q: Is Form ADOR11206 mandatory?

A: Form ADOR11206 is not mandatory, but it is required if you want to assume the responsibility of a tax liability in Arizona.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ADOR11206 by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.