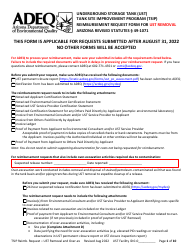

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

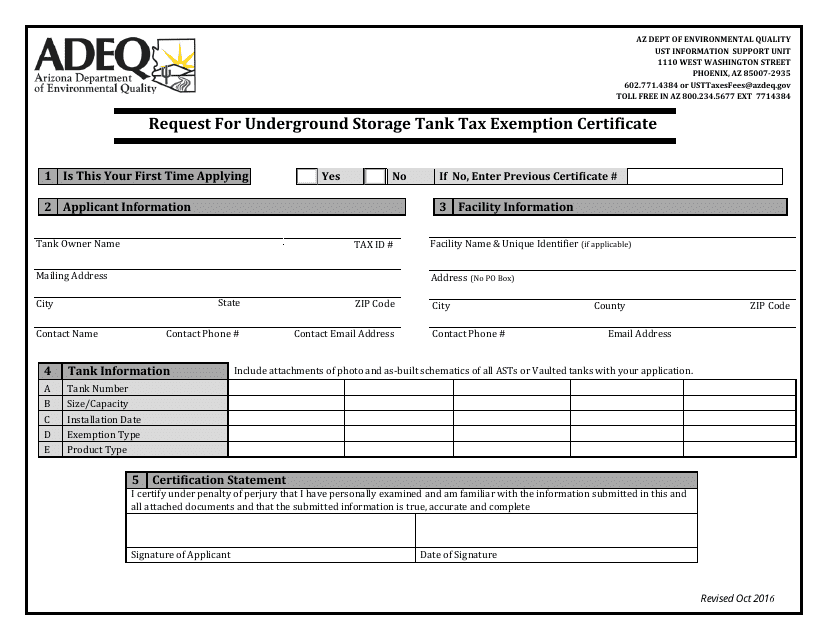

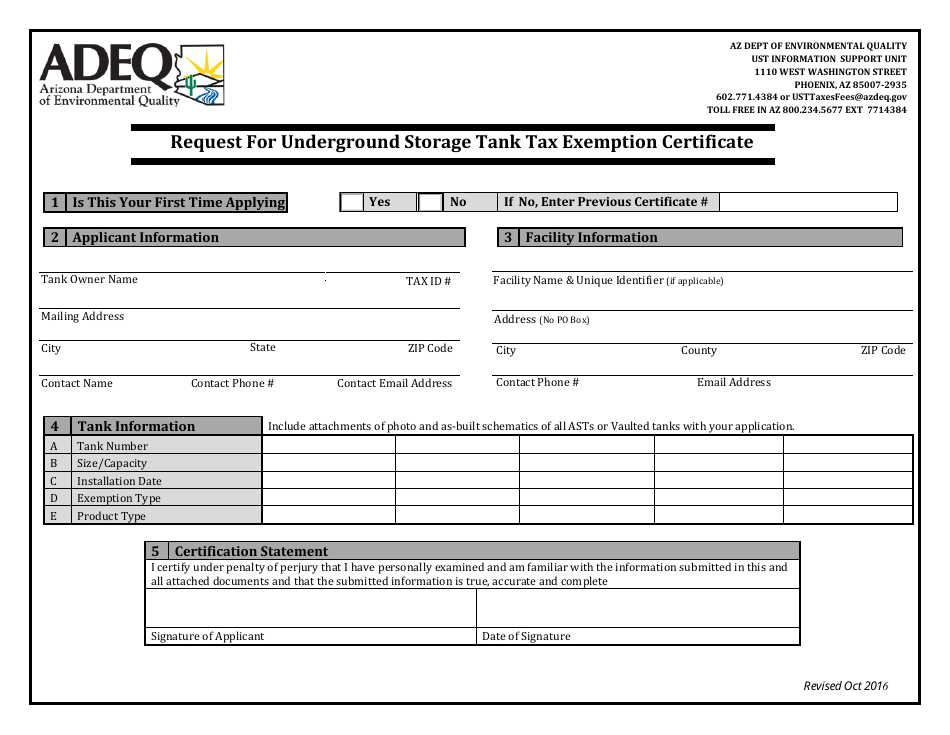

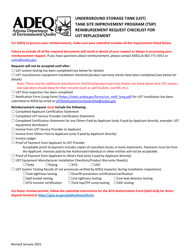

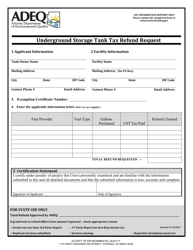

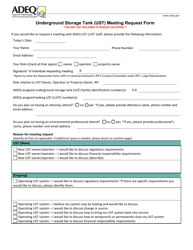

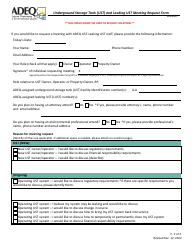

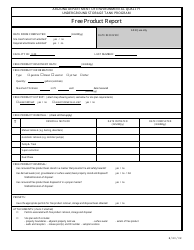

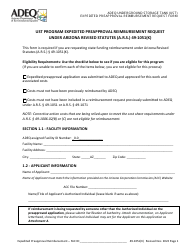

Request for Underground Storage Tank Tax Exemption Certificate - Arizona

Request for Underground Storage Tank Tax Exemption Certificate is a legal document that was released by the Arizona Department of Environmental Quality - a government authority operating within Arizona.

FAQ

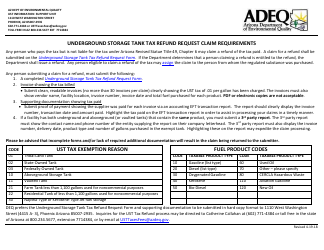

Q: What is an Underground Storage Tank Tax Exemption Certificate?

A: An Underground Storage Tank Tax Exemption Certificate is a document that exempts the owner of an underground storage tank from paying certain taxes related to the tank.

Q: Why would someone need an Underground Storage Tank Tax Exemption Certificate in Arizona?

A: Someone would need an Underground Storage Tank Tax Exemption Certificate in Arizona if they own an underground storage tank and meet the necessary criteria for tax exemption.

Q: What are the criteria for tax exemption?

A: The criteria for tax exemption vary by state and may include requirements such as using the tank exclusively for residential heating, using the tank exclusively for agricultural purposes, or meeting certain size limitations.

Q: How can I request an Underground Storage Tank Tax Exemption Certificate in Arizona?

A: To request an Underground Storage Tank Tax Exemption Certificate in Arizona, you will need to contact the appropriate state agency responsible for overseeing underground storage tanks and follow their application process.

Q: Is there a fee for obtaining an Underground Storage Tank Tax Exemption Certificate in Arizona?

A: The fee for obtaining an Underground Storage Tank Tax Exemption Certificate in Arizona may vary and should be determined by contacting the state agency responsible for overseeing underground storage tanks.

Form Details:

- Released on October 1, 2016;

- The latest edition currently provided by the Arizona Department of Environmental Quality;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Arizona Department of Environmental Quality.