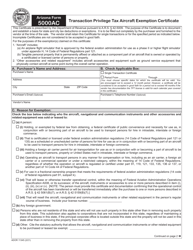

This version of the form is not currently in use and is provided for reference only. Download this version of

Form 05-0502

for the current year.

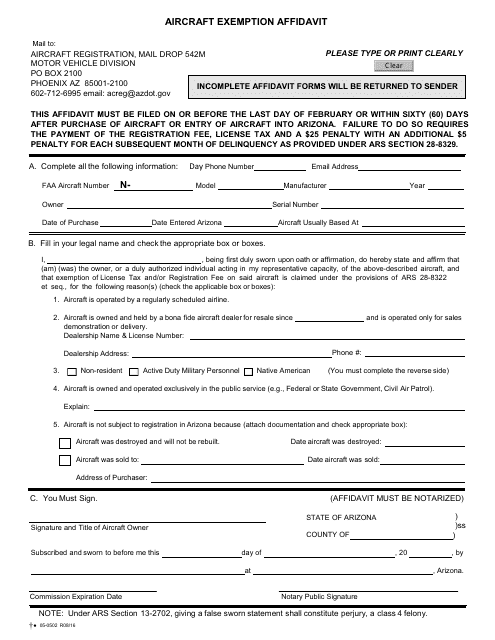

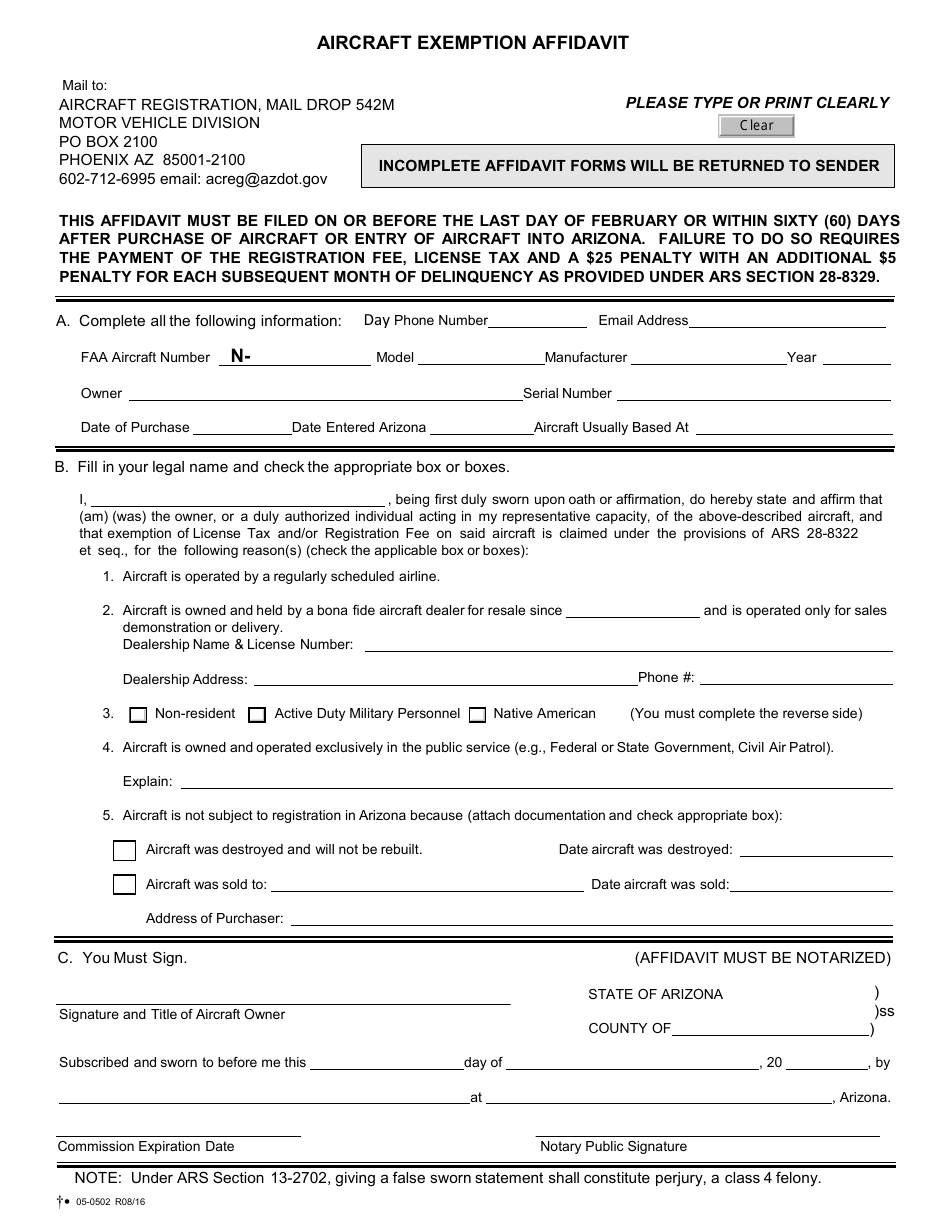

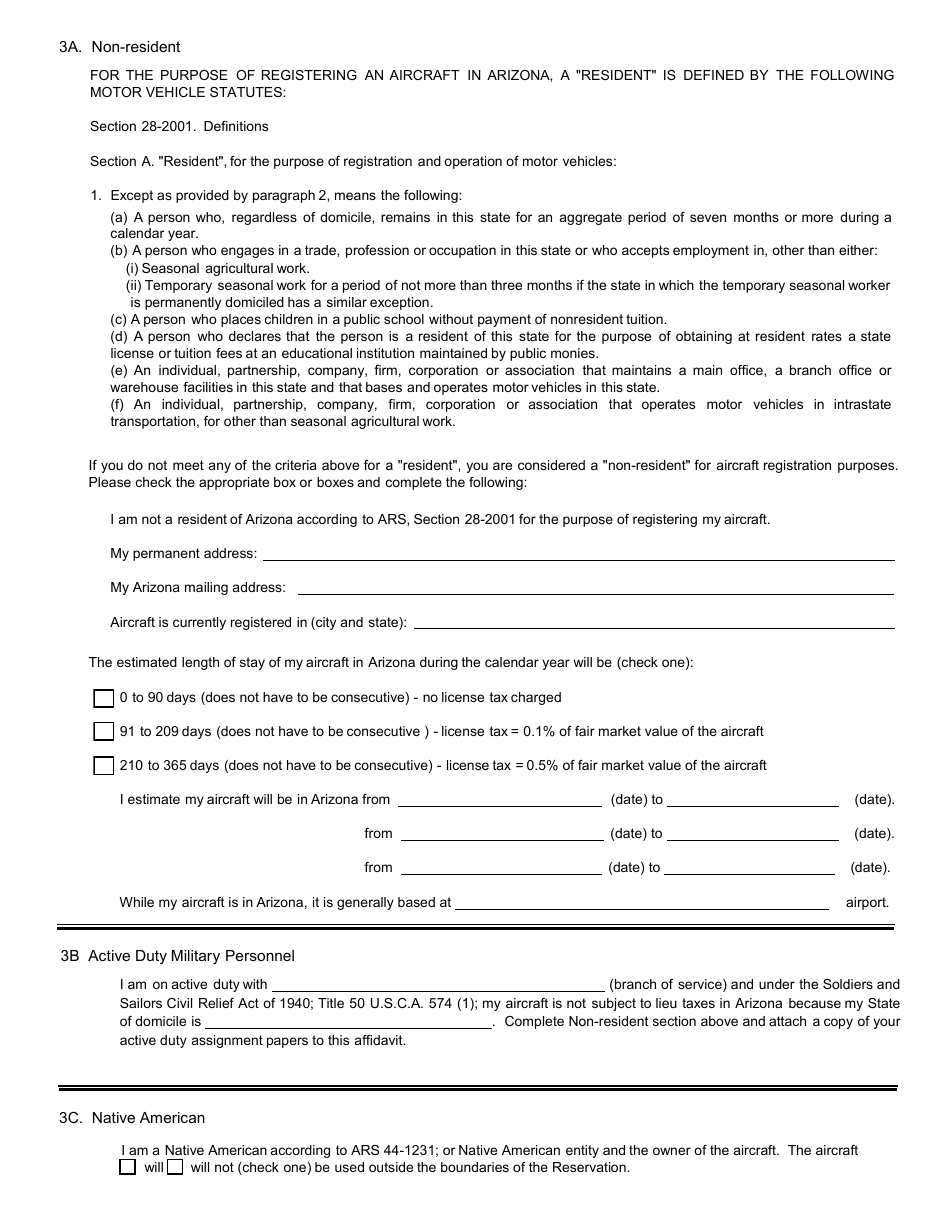

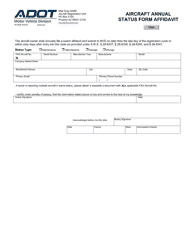

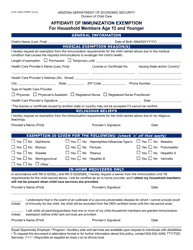

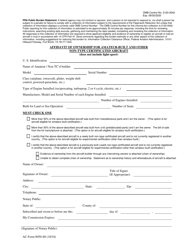

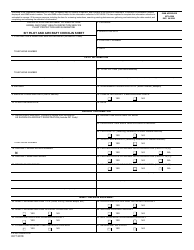

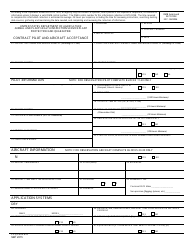

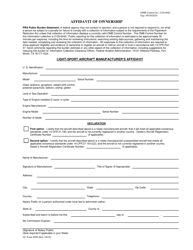

Form 05-0502 Aircraft Exemption Affidavit - Arizona

What Is Form 05-0502?

This is a legal form that was released by the Arizona Department of Transportation - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 05-0502?

A: Form 05-0502 is the Aircraft Exemption Affidavit for the state of Arizona.

Q: Who needs to fill out Form 05-0502?

A: Owners or lessees of aircraft in Arizona who wish to claim an exemption from property tax.

Q: What is the purpose of Form 05-0502?

A: The purpose of Form 05-0502 is to provide documentation for the aircraft exemption from property tax.

Q: What information is required on Form 05-0502?

A: Form 05-0502 requires information such as the aircraft owner's details, aircraft details, and declaration of eligibility for the exemption.

Q: When is the deadline to submit Form 05-0502?

A: Form 05-0502 must be submitted on or before the lien date, which is typically January 1st of each year.

Q: Is there a fee for filing Form 05-0502?

A: No, there is no fee for filing Form 05-0502.

Q: Are there any penalties for not filing Form 05-0502?

A: Yes, failure to file Form 05-0502 may result in the loss of the aircraft exemption and potential penalties.

Q: Can I claim the aircraft exemption if I am not the owner?

A: Yes, lessees of the aircraft may also claim the aircraft exemption by providing the required documentation.

Q: Can I claim the aircraft exemption if my aircraft is based in another state?

A: No, the aircraft exemption can only be claimed for aircraft based in Arizona.

Form Details:

- Released on August 1, 2016;

- The latest edition provided by the Arizona Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 05-0502 by clicking the link below or browse more documents and templates provided by the Arizona Department of Transportation.