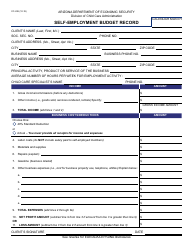

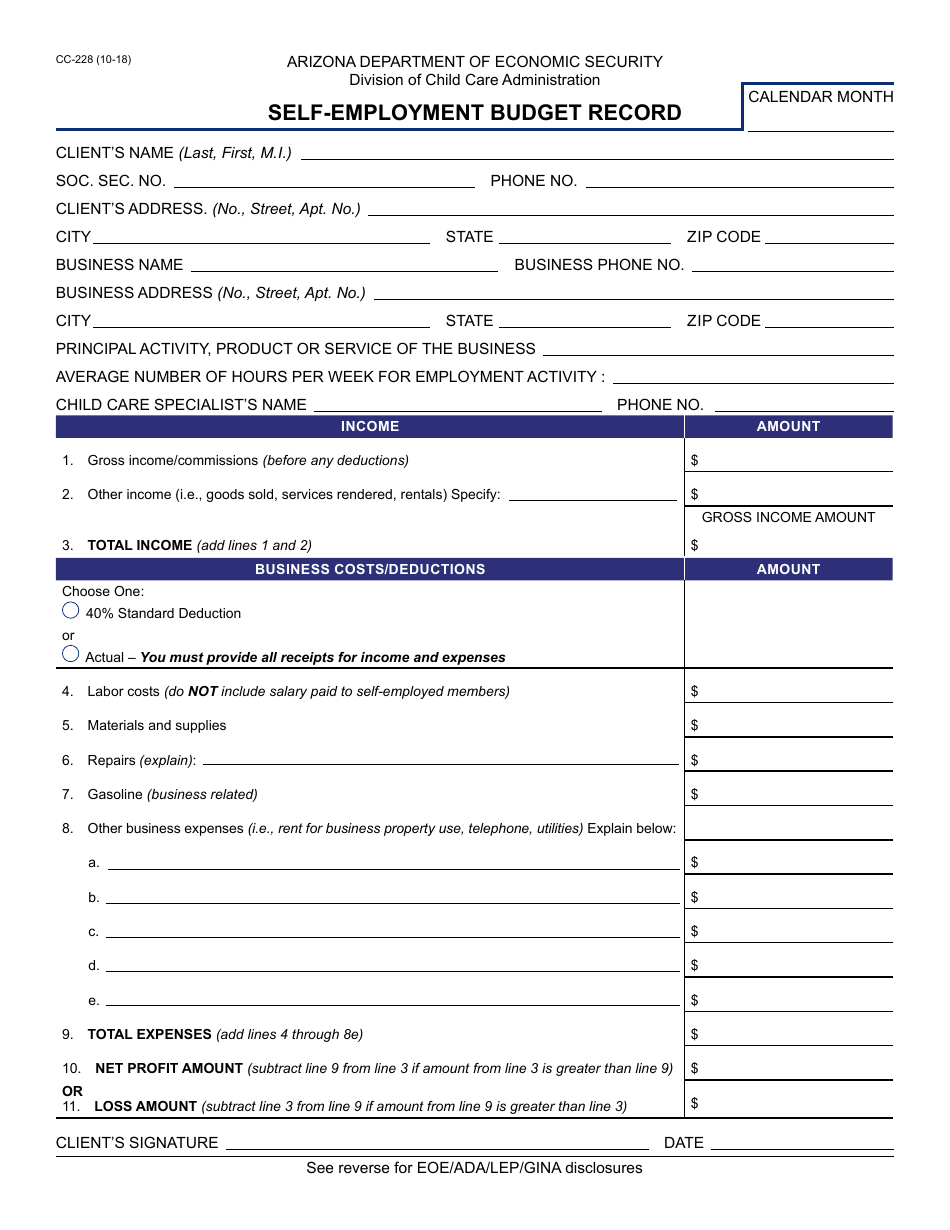

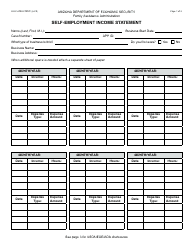

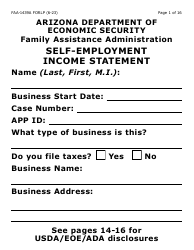

Form CC-228 Self-employment Budget Record - Arizona

What Is Form CC-228?

This is a legal form that was released by the Arizona Department of Economic Security - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CC-228?

A: Form CC-228 is the Self-employment Budget Record for Arizona.

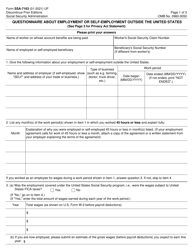

Q: What is the purpose of Form CC-228?

A: The purpose of Form CC-228 is to record self-employment income and expenses in Arizona.

Q: How do I use Form CC-228?

A: You can use Form CC-228 to track your self-employment income and expenses in Arizona.

Q: Is Form CC-228 applicable only to Arizona residents?

A: Yes, Form CC-228 is specific to Arizona residents.

Q: What should I do with Form CC-228 once completed?

A: Once completed, you should keep a copy of Form CC-228 for your records.

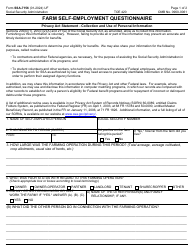

Q: Does Form CC-228 require any supporting documentation?

A: No, Form CC-228 does not require any supporting documentation. However, it is recommended to keep all relevant receipts and records in case of an audit.

Q: Are there any fees associated with filing Form CC-228?

A: No, there are no fees associated with filing Form CC-228.

Q: Who is eligible to use Form CC-228?

A: Any Arizona resident who is self-employed can use Form CC-228.

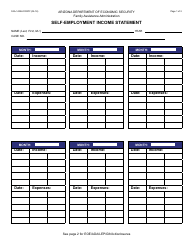

Q: What information is required on Form CC-228?

A: Form CC-228 requires information about your self-employment income and expenses, such as business revenue, deductions, and net profit or loss.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Arizona Department of Economic Security;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CC-228 by clicking the link below or browse more documents and templates provided by the Arizona Department of Economic Security.