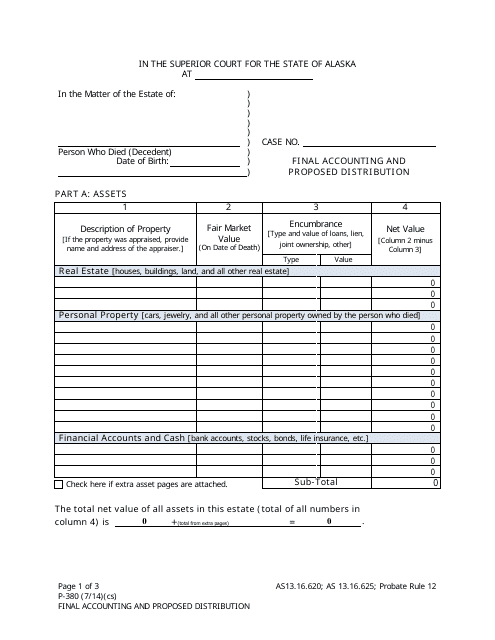

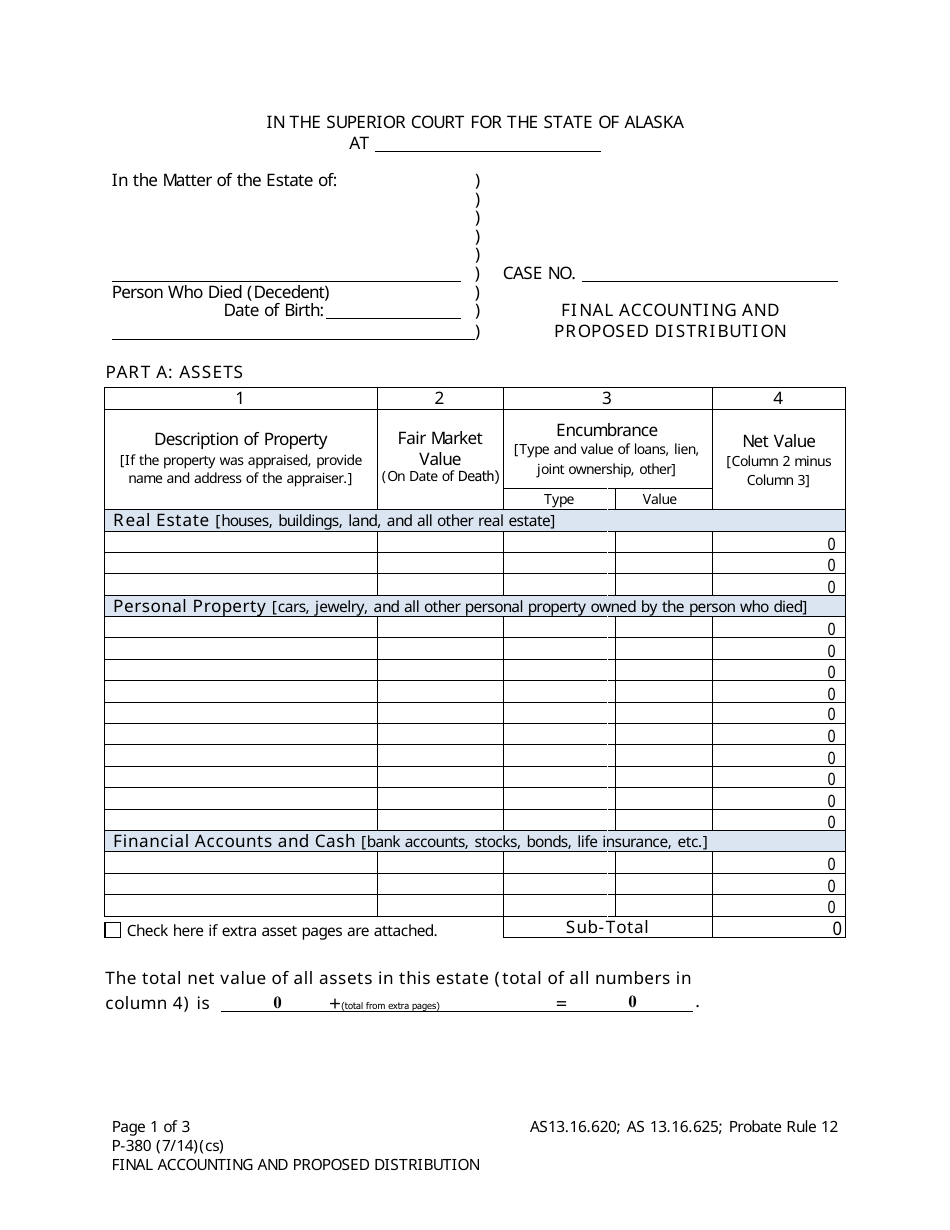

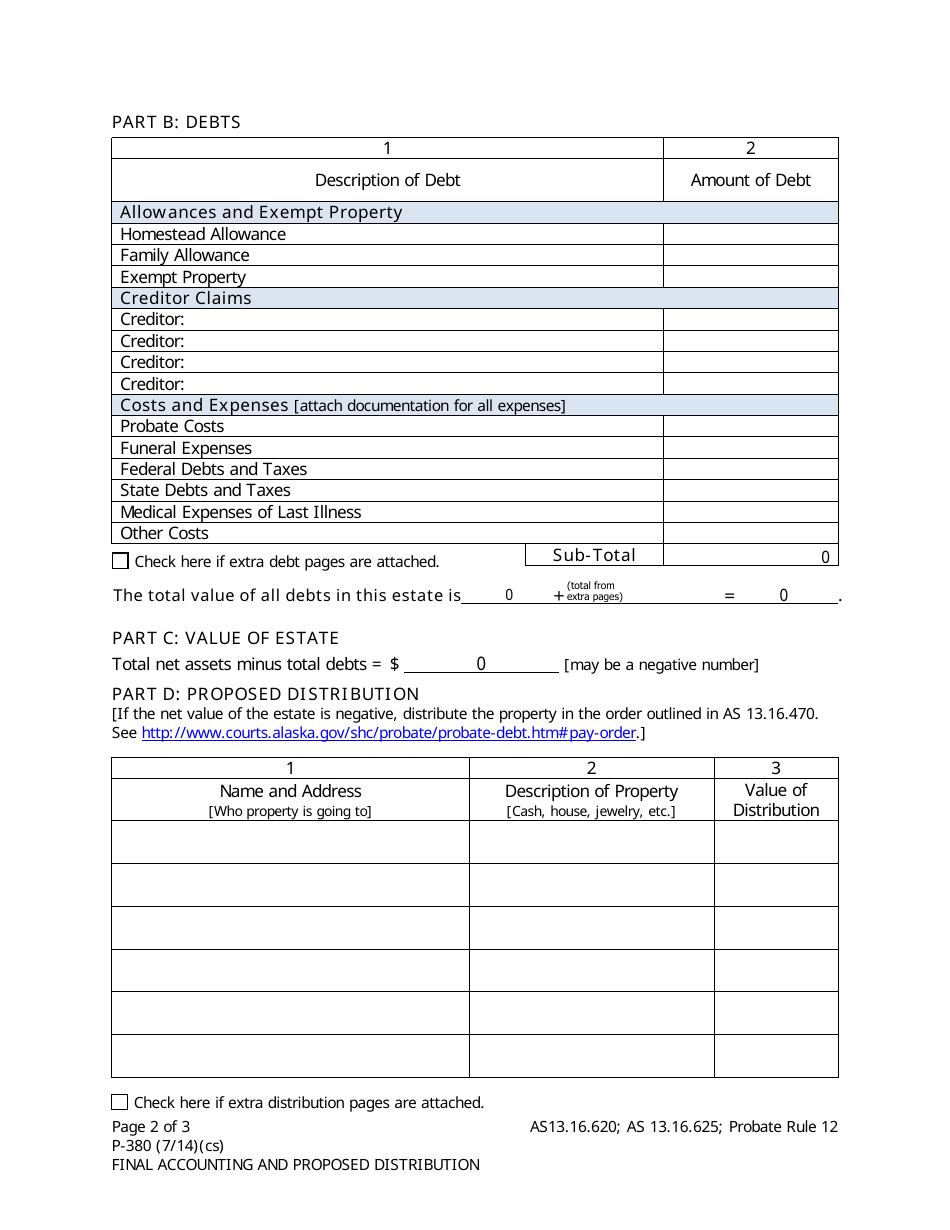

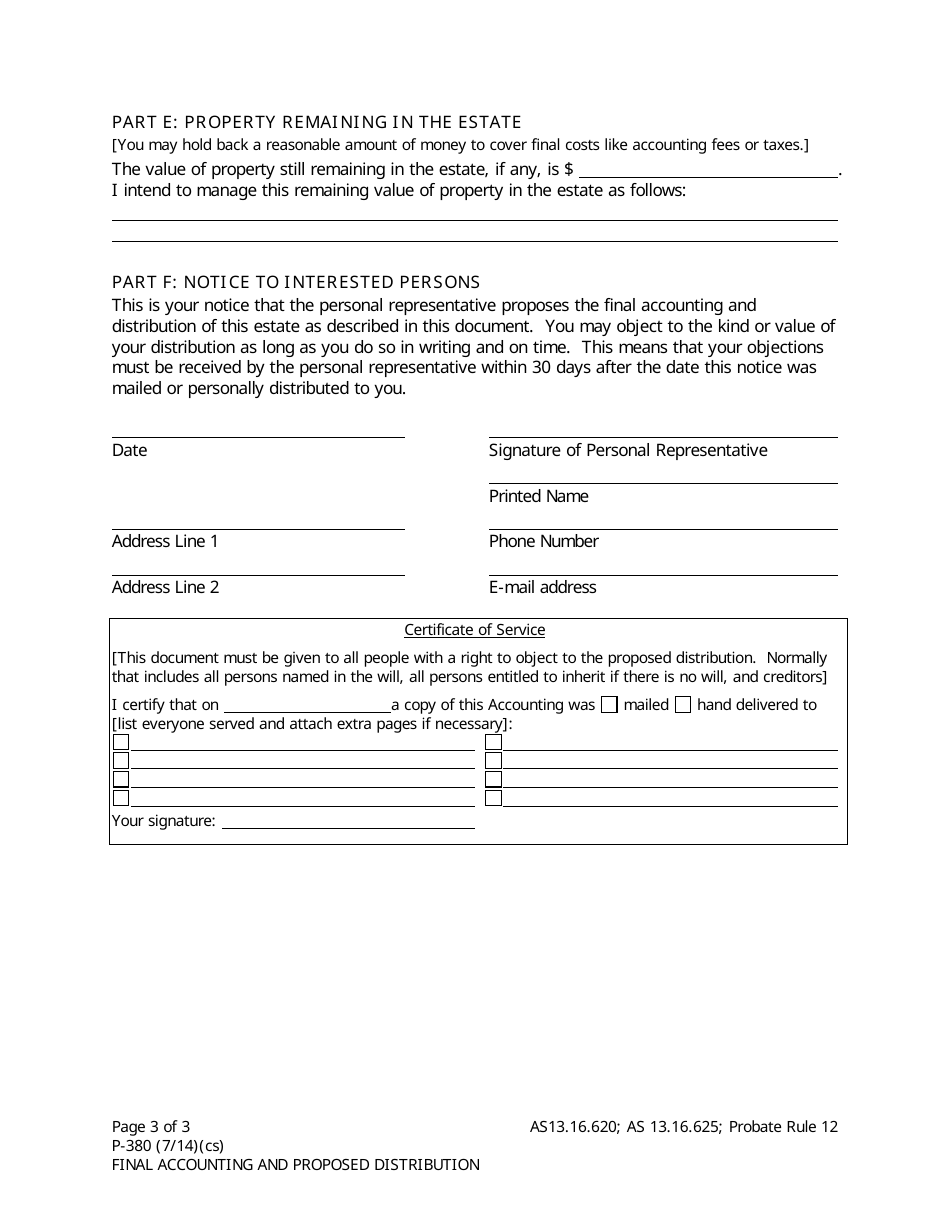

Form P-380 Final Accounting and Proposed Distribution - Alaska

What Is Form P-380?

This is a legal form that was released by the Alaska Superior Court - a government authority operating within Alaska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form P-380?

A: Form P-380 is a document used in Alaska for the final accounting and proposed distribution in a legal matter.

Q: Who uses Form P-380?

A: Form P-380 is typically used by attorneys, executors, and administrators of estates in Alaska.

Q: What is the purpose of Form P-380?

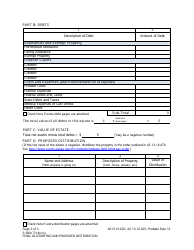

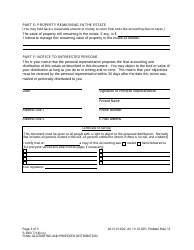

A: The purpose of Form P-380 is to provide a detailed account of all assets, debts, income, and expenses related to an estate and propose the distribution of remaining assets.

Q: When should Form P-380 be filed?

A: Form P-380 should be filed with the Alaska Court System within 30 days of the proposed distribution date.

Q: Are there any fees associated with filing Form P-380?

A: Yes, there may be filing fees associated with submitting Form P-380. The specific fees vary depending on the county and the value of the estate.

Form Details:

- Released on July 1, 2014;

- The latest edition provided by the Alaska Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form P-380 by clicking the link below or browse more documents and templates provided by the Alaska Superior Court.