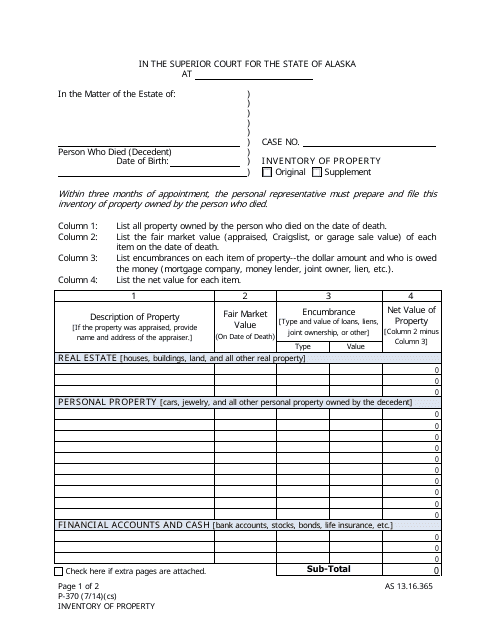

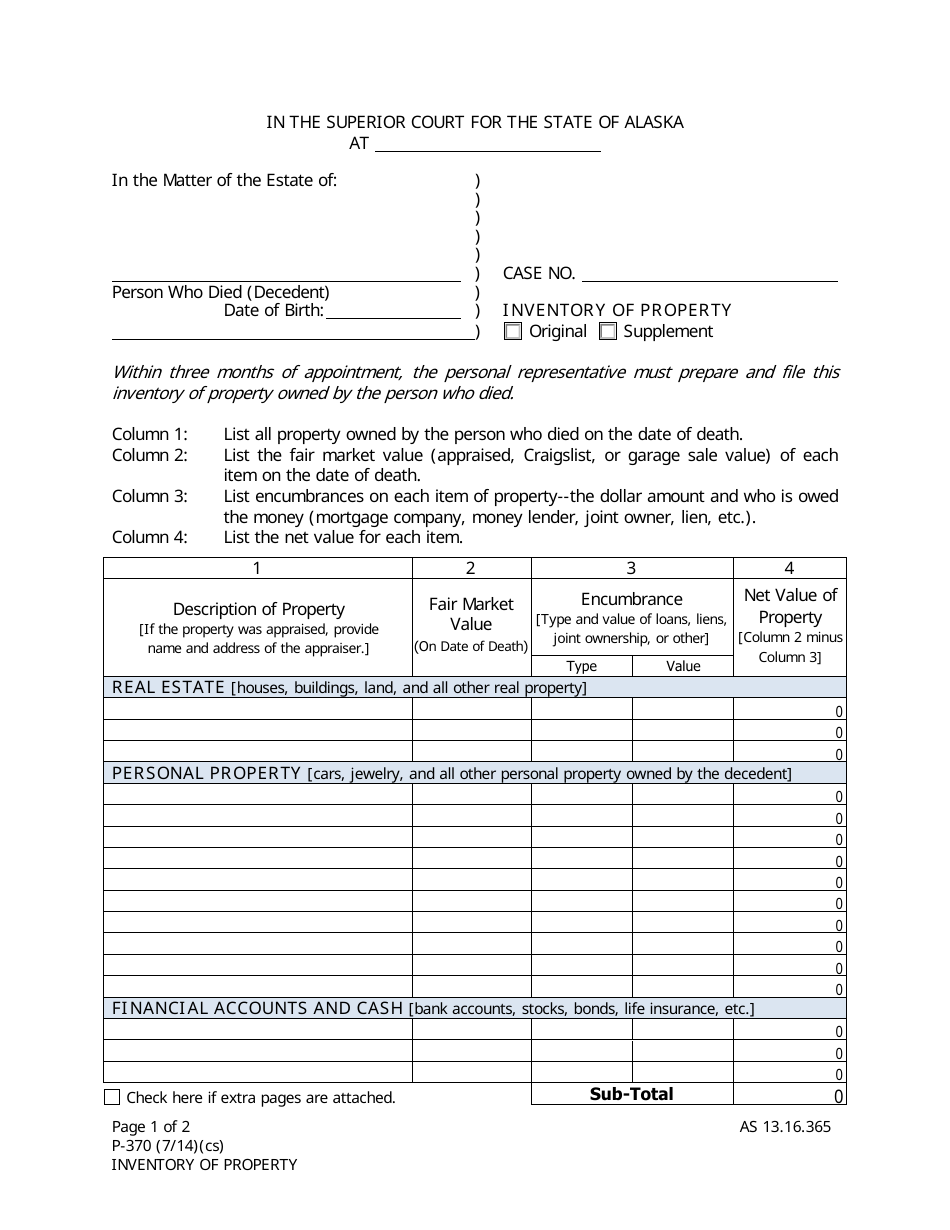

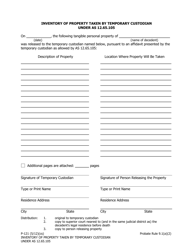

Form P-370 Inventory of Property - Alaska

What Is Form P-370?

This is a legal form that was released by the Alaska Superior Court - a government authority operating within Alaska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form P-370?

A: Form P-370 is the Inventory of Property form used in Alaska.

Q: When is Form P-370 used?

A: Form P-370 is used when inventorying and valuing property owned by an individual or business in Alaska.

Q: Who needs to fill out Form P-370?

A: Individuals and businesses in Alaska who own taxable property need to fill out Form P-370.

Q: What information is required on Form P-370?

A: Form P-370 requires information such as property descriptions, values, and ownership details.

Q: When is the deadline to submit Form P-370?

A: The deadline to submit Form P-370 in Alaska is typically March 31st of each year.

Q: What happens if I don't file Form P-370?

A: Failure to file Form P-370 or providing false information may result in penalties or fines in Alaska.

Q: Are there any exemptions or special circumstances for Form P-370?

A: Exemptions and special circumstances may apply, so it's best to consult the Alaska Department of Revenue for more information.

Q: Can I e-file Form P-370?

A: As of now, electronic filing for Form P-370 is not available – it must be filed by mail or in-person.

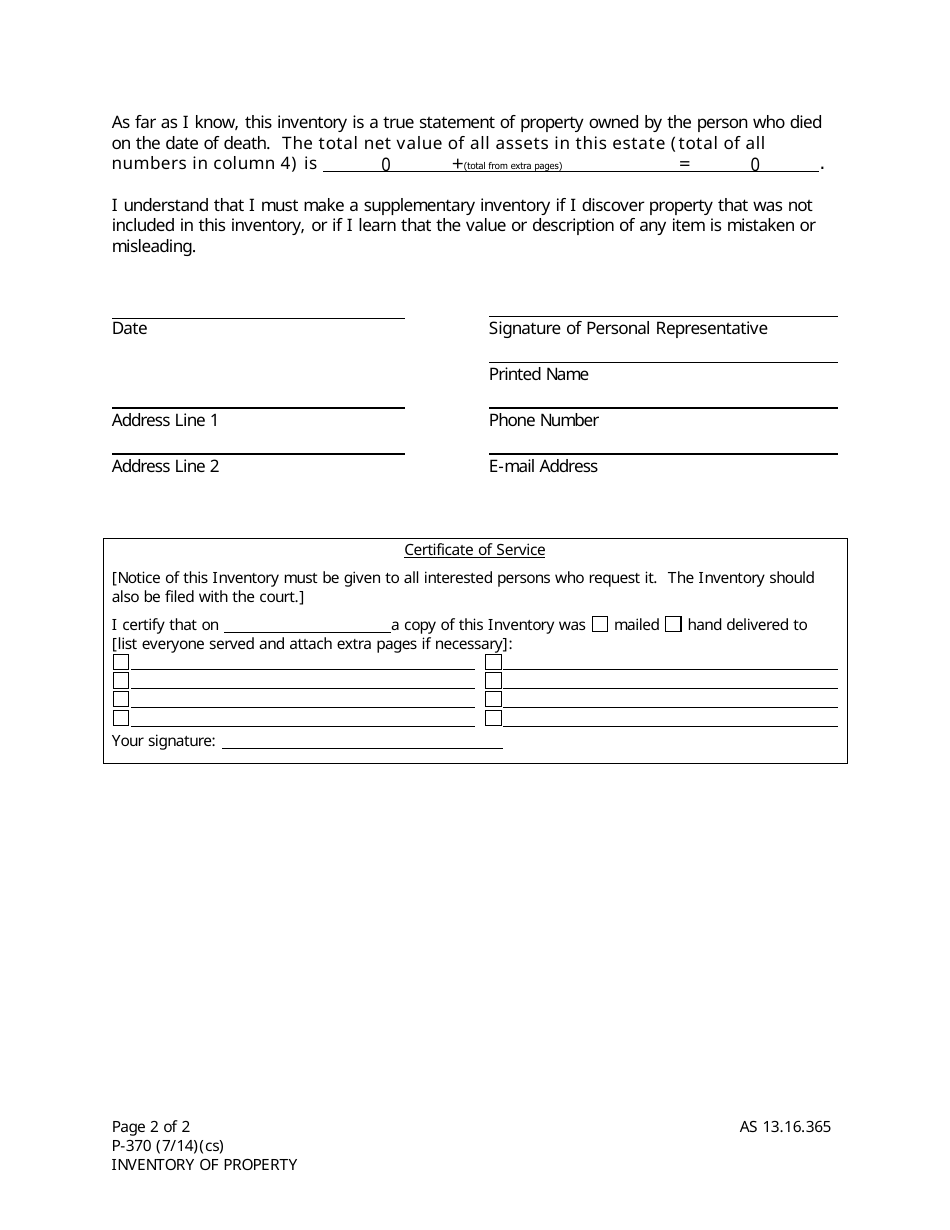

Form Details:

- Released on July 1, 2014;

- The latest edition provided by the Alaska Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form P-370 by clicking the link below or browse more documents and templates provided by the Alaska Superior Court.