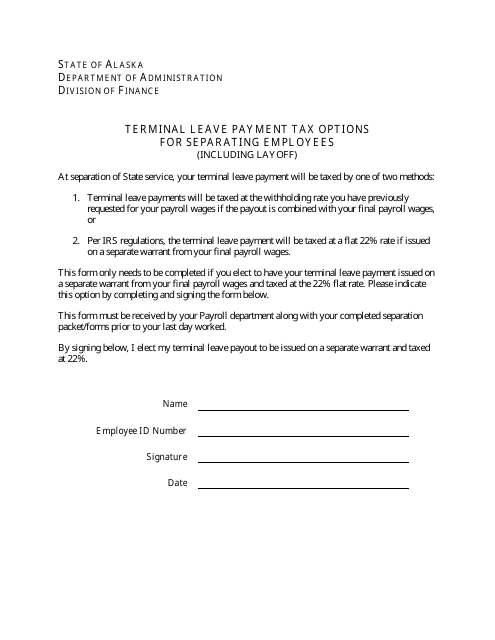

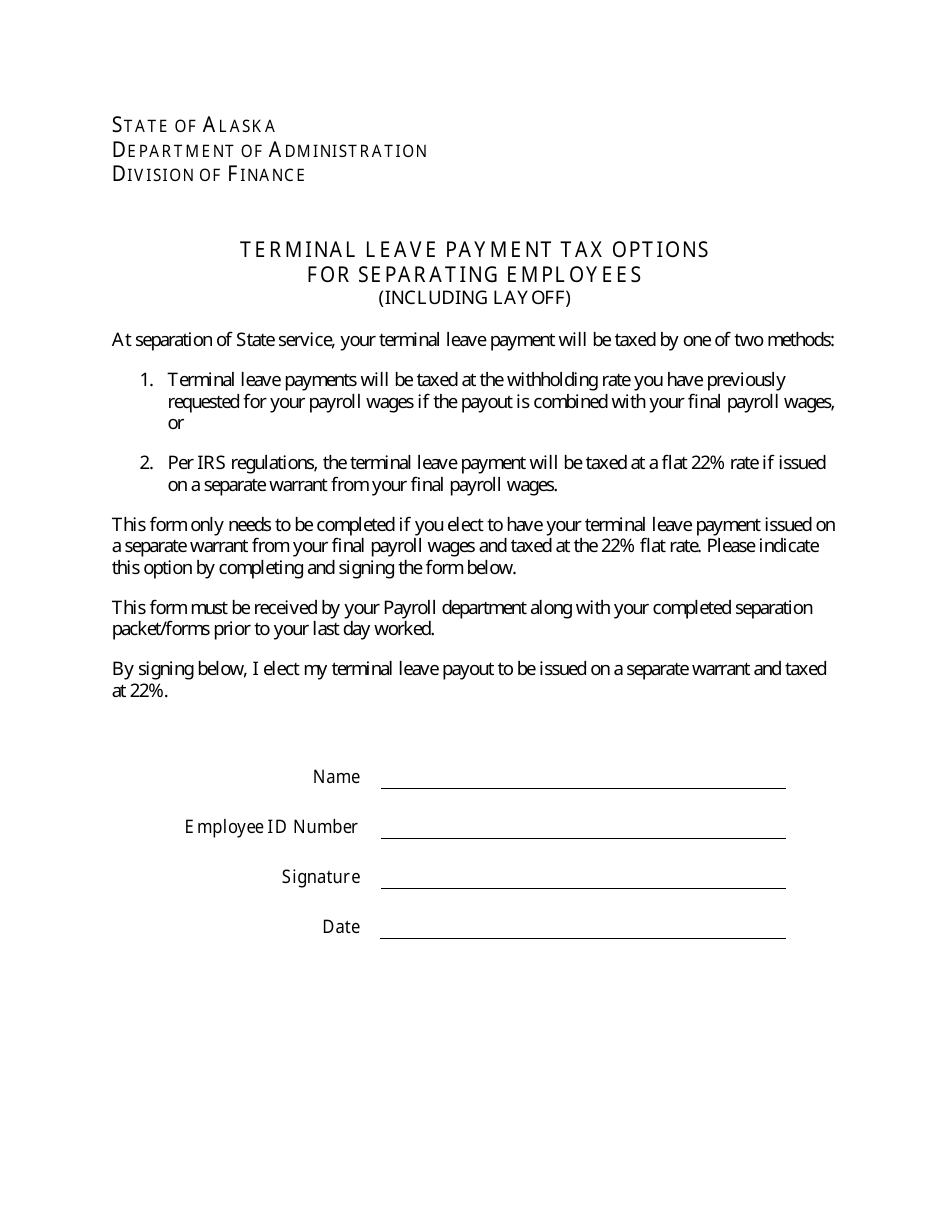

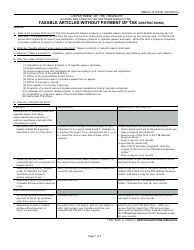

Terminal Leave Payment Tax Options for Separating Employees - Alaska

Terminal Leave Payment Tax Options for Separating Employees is a legal document that was released by the Alaska Department of Administration - a government authority operating within Alaska.

FAQ

Q: What is terminal leave payment?

A: Terminal leave payment refers to the payout of unused annual leave that employees receive upon separation from their employer.

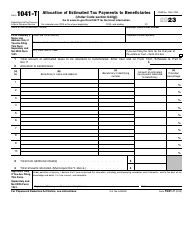

Q: Is terminal leave payment taxable?

A: Yes, terminal leave payment is taxable as it is considered regular income.

Q: Are there any tax options for terminal leave payment in Alaska?

A: No, there are no specific tax options for terminal leave payment in Alaska. It is generally subject to federal and state income taxes.

Q: How is terminal leave payment taxed in Alaska?

A: Terminal leave payment in Alaska is subject to federal and state income taxes, as well as any applicable local taxes.

Q: Can I defer taxes on my terminal leave payment?

A: No, you cannot defer taxes on your terminal leave payment. It is taxable in the year it is received.

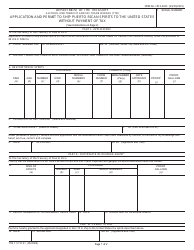

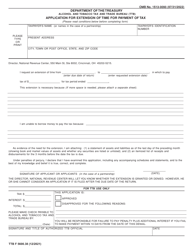

Form Details:

- The latest edition currently provided by the Alaska Department of Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Alaska Department of Administration.