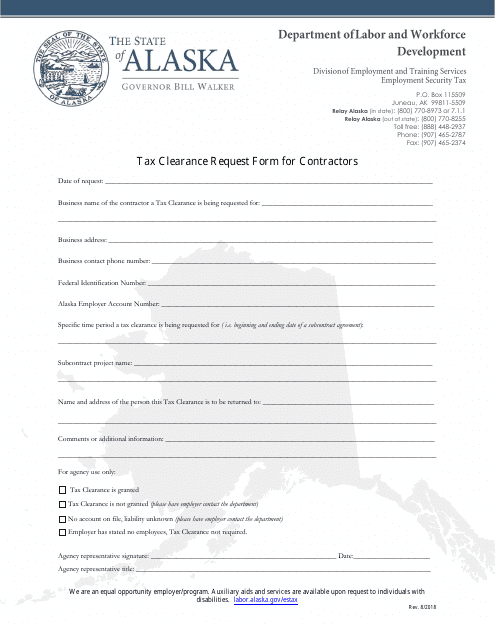

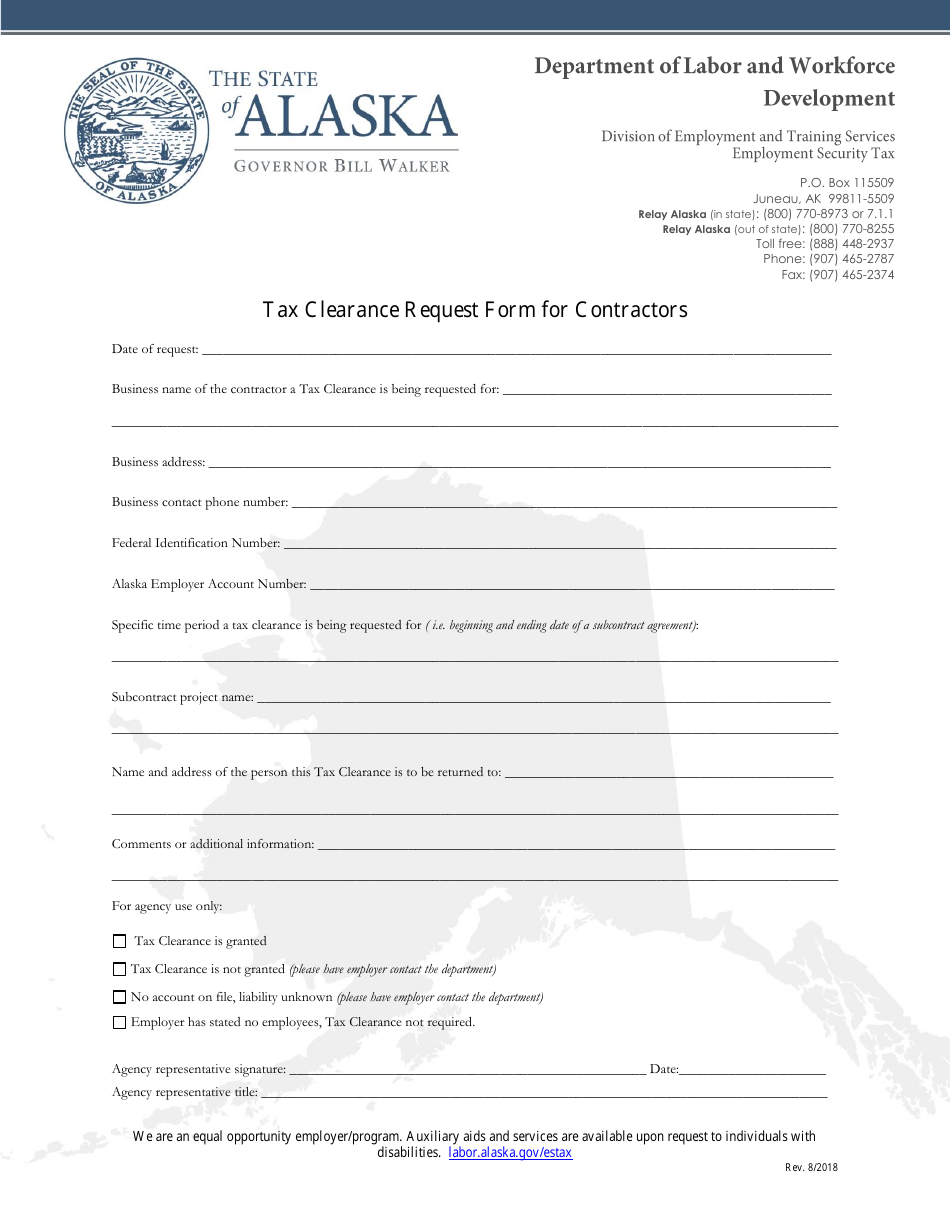

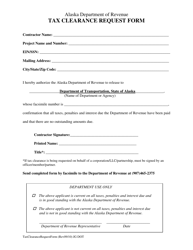

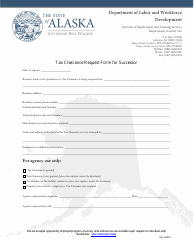

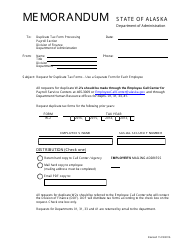

Tax Clearance Request Form for Contractors - Alaska

Tax Clearance Request Form for Contractors is a legal document that was released by the Alaska Department of Labor and Workforce Development - a government authority operating within Alaska.

FAQ

Q: What is a Tax Clearance Request Form for Contractors?

A: A Tax Clearance Request Form for Contractors is a form used in Alaska to verify that a contractor has paid all required taxes before entering into contracts with the state.

Q: Why is a Tax Clearance Request Form required?

A: The form is required to ensure that contractors are in compliance with their tax obligations before being awarded contracts.

Q: Who needs to fill out the Tax Clearance Request Form?

A: Contractors who are seeking to enter into contracts with the state of Alaska need to fill out the form.

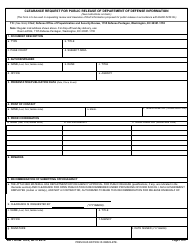

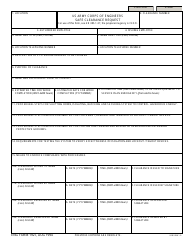

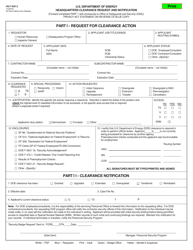

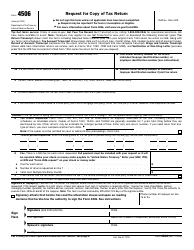

Q: What information is needed on the form?

A: The form requires basic information about the contractor, such as their name, address, and identification number.

Q: What happens after the form is submitted?

A: The Alaska Department of Revenue will review the form and verify the contractor's tax compliance status. If all taxes are paid, a tax clearance will be issued.

Q: Is there a fee for submitting the form?

A: No, there is no fee for submitting the Tax Clearance Request Form.

Q: How long does it take to process the form?

A: The processing time can vary, but it generally takes a few weeks to receive a tax clearance.

Q: What if I have outstanding tax liabilities?

A: If you have outstanding tax liabilities, you will need to resolve them before a tax clearance can be issued.

Q: Can I start working on contracts while waiting for the tax clearance?

A: No, contractors are required to have a tax clearance before entering into contracts with the state.

Q: Can I use the tax clearance from another state?

A: No, the tax clearance must be obtained specifically from the state of Alaska.

Form Details:

- Released on August 1, 2018;

- The latest edition currently provided by the Alaska Department of Labor and Workforce Development;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Alaska Department of Labor and Workforce Development.