This version of the form is not currently in use and is provided for reference only. Download this version of

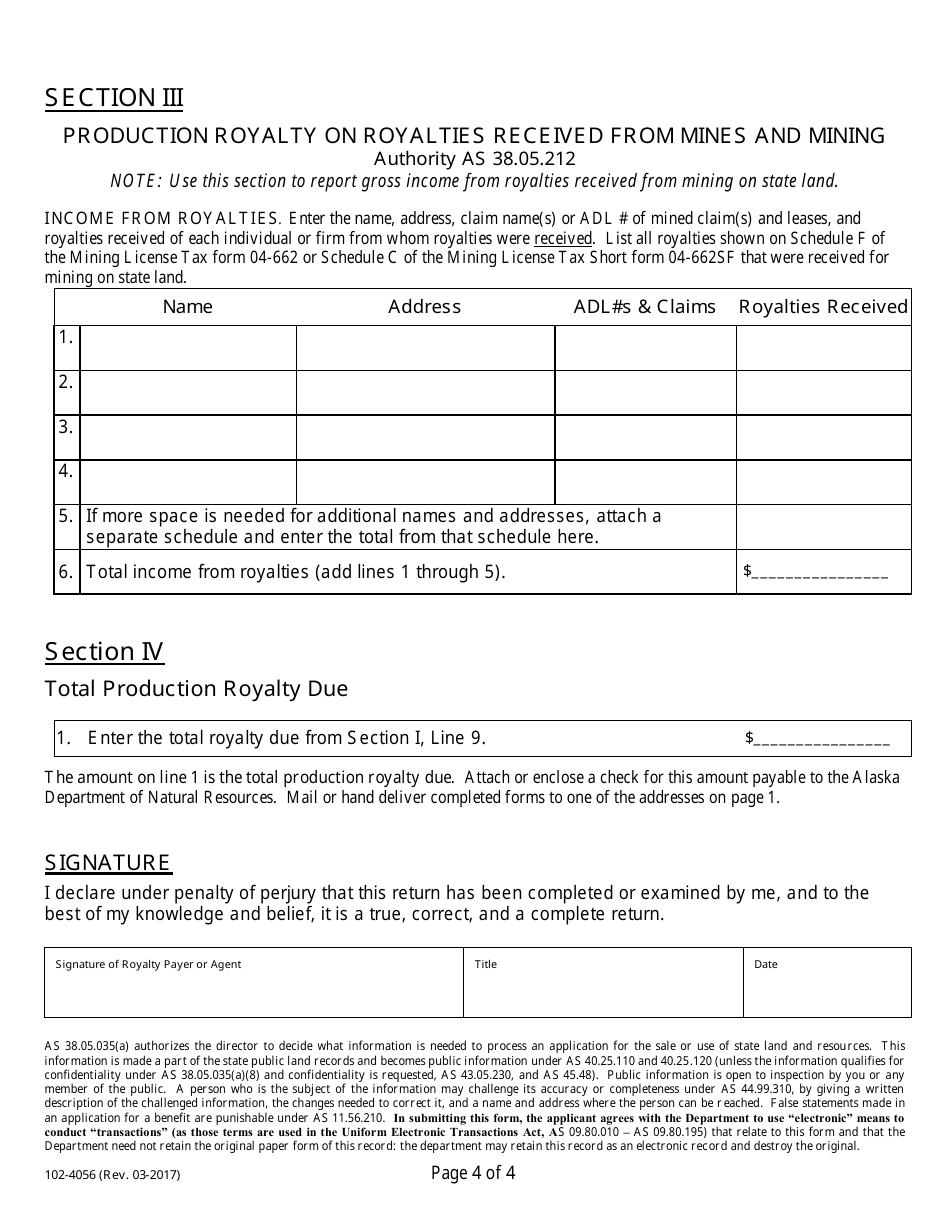

Form 102-4056

for the current year.

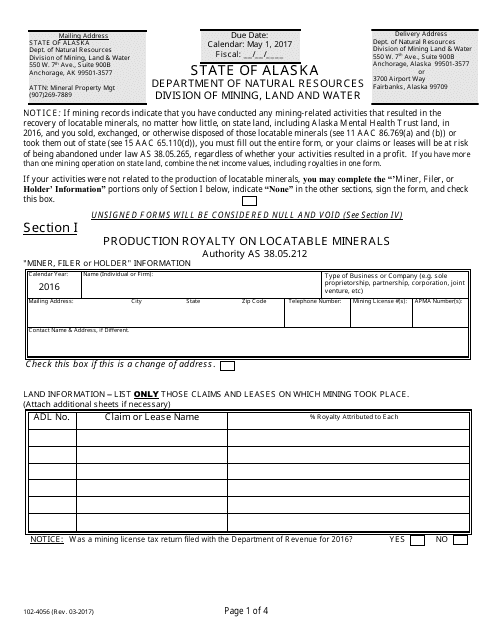

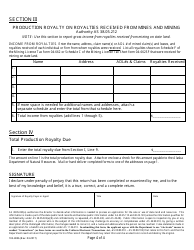

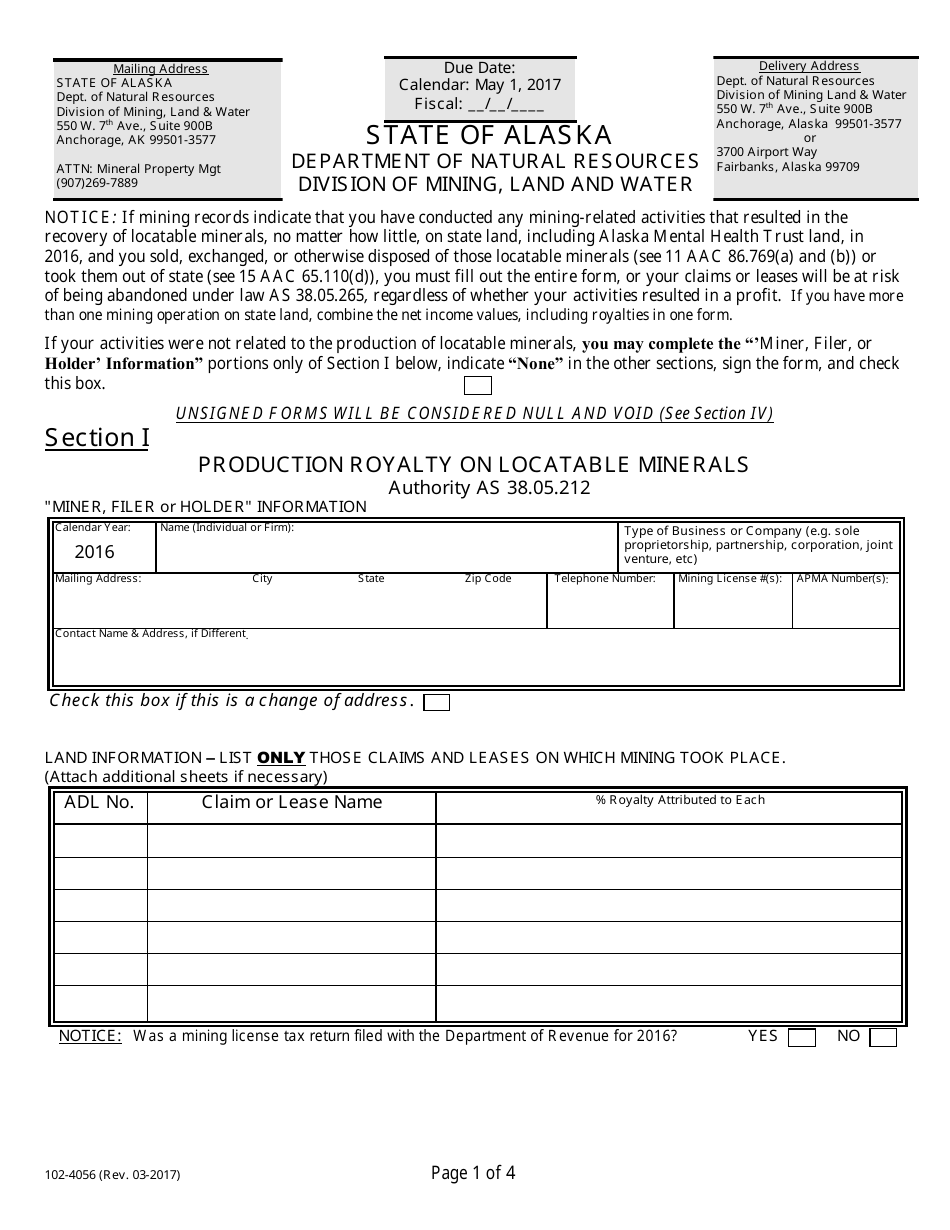

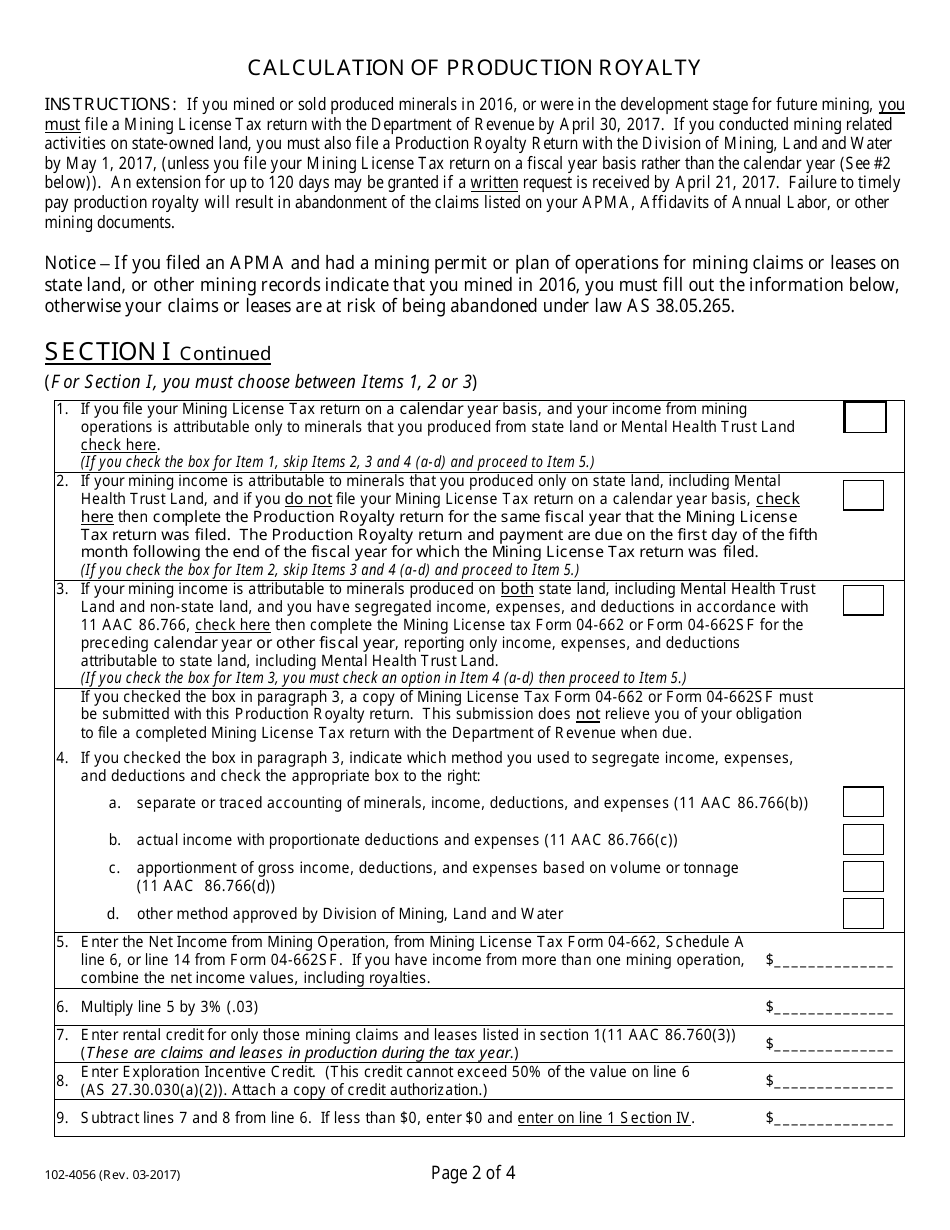

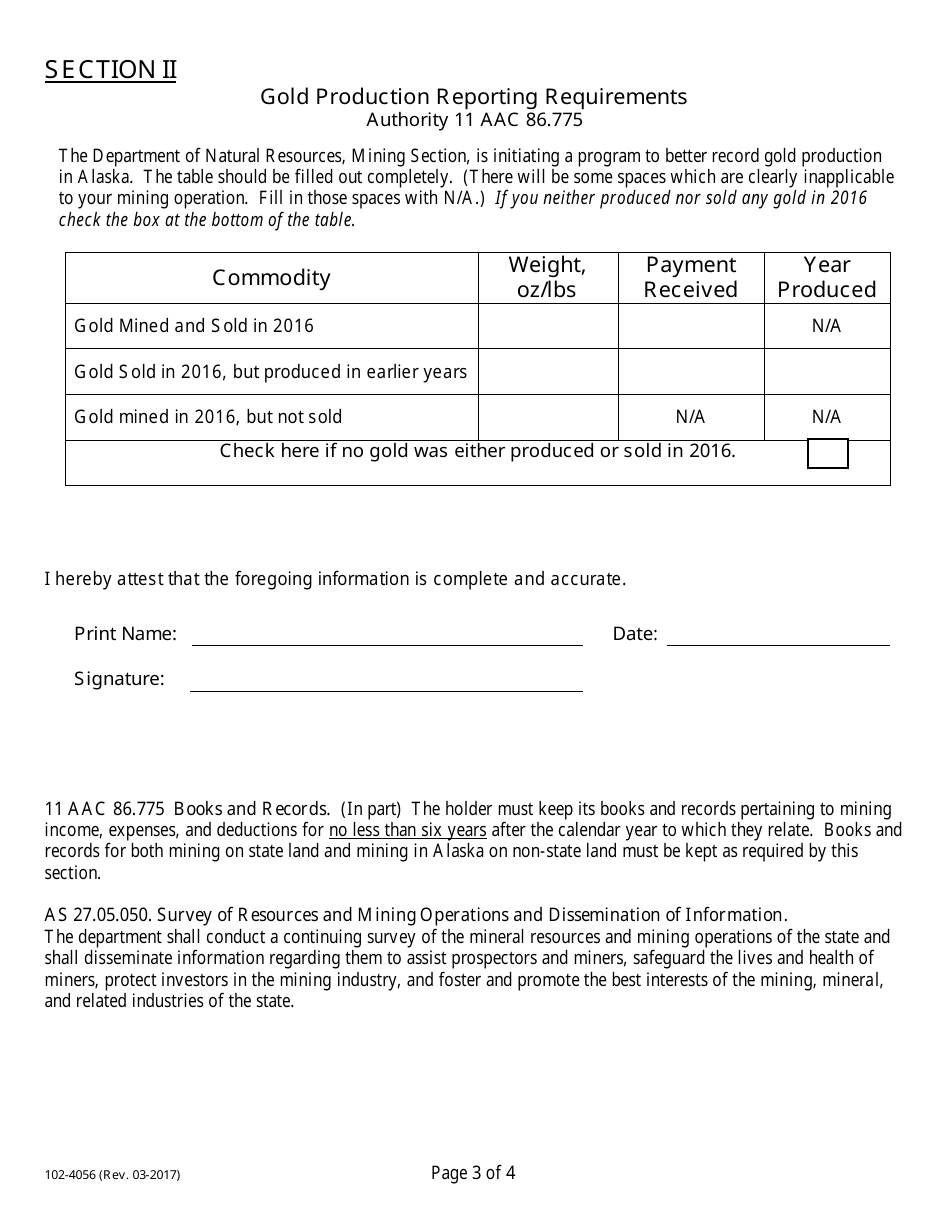

Form 102-4056 Production Royalty on Locatable Minerals - Alaska

What Is Form 102-4056?

This is a legal form that was released by the Alaska Department of Natural Resources - a government authority operating within Alaska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 102-4056?

A: Form 102-4056 is a document related to the production royalty on locatable minerals in Alaska.

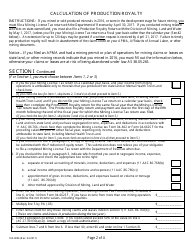

Q: What is a production royalty?

A: A production royalty is a fee paid for the extraction of minerals from public lands.

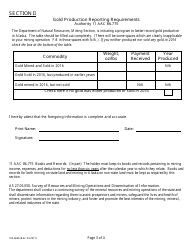

Q: What are locatable minerals?

A: Locatable minerals are minerals that can be claimed and owned by individuals or companies under the General Mining Law of 1872.

Q: Who is required to file Form 102-4056?

A: Individuals or companies that are extracting locatable minerals in Alaska and paying production royalties are required to file Form 102-4056.

Q: Why is Form 102-4056 important?

A: Form 102-4056 is important as it helps the government track and collect the production royalties on locatable minerals in Alaska.

Q: Are there any exemptions to filing Form 102-4056?

A: There may be exemptions for certain small-scale mining operations or specific types of minerals. It is best to consult with the Bureau of Land Management for specific exemption criteria.

Q: What happens if I fail to file Form 102-4056?

A: Failure to file Form 102-4056 or pay the production royalties can result in penalties or legal consequences, including the loss of mining claims.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Alaska Department of Natural Resources;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 102-4056 by clicking the link below or browse more documents and templates provided by the Alaska Department of Natural Resources.