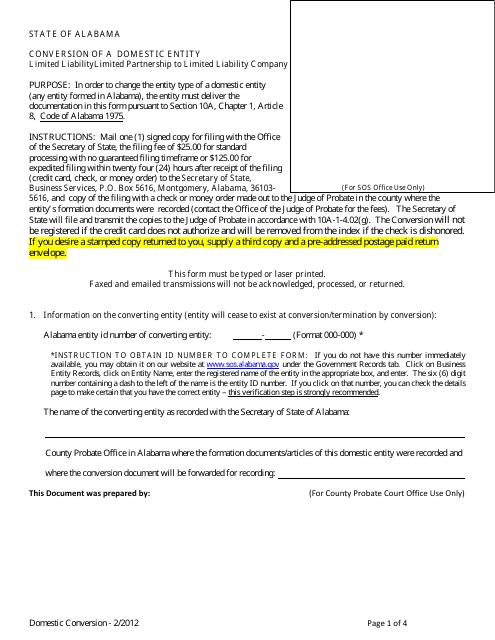

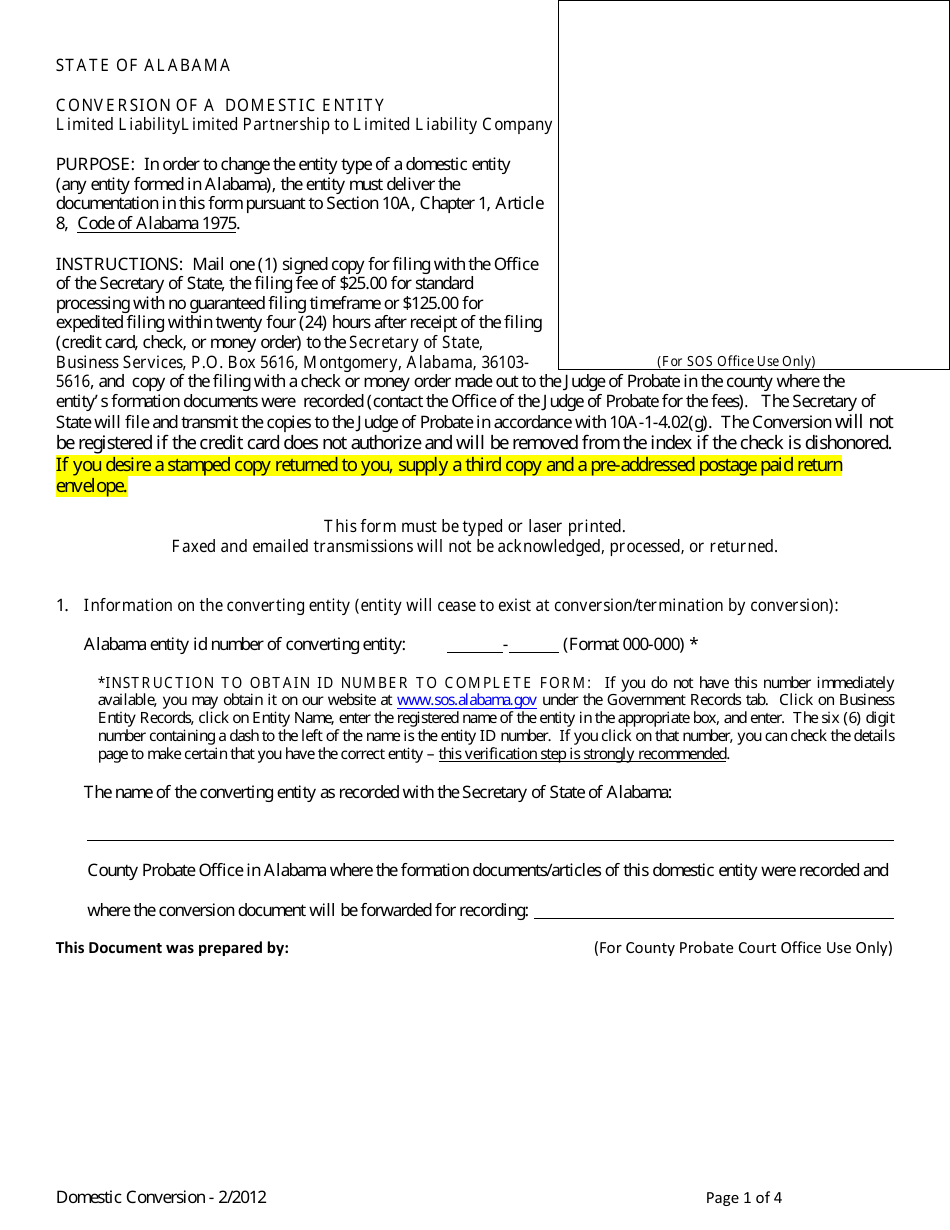

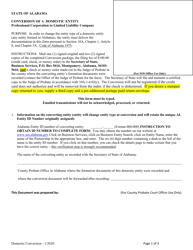

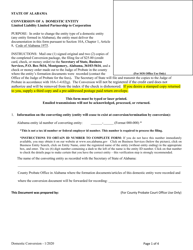

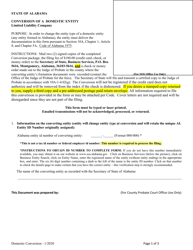

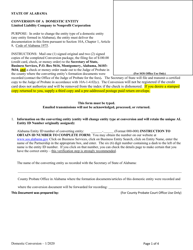

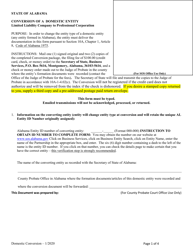

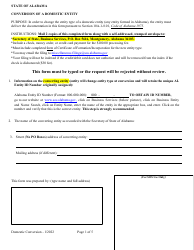

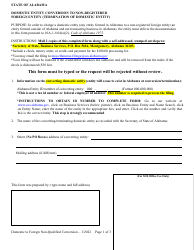

Conversion of a Domestic Entity - Limited Liabilitylimited Partnership to Limited Liability Company - Alabama

Conversion of a Limited Liability Company is a legal document that was released by the Alabama Secretary of State - a government authority operating within Alabama.

FAQ

Q: What is a domestic entity limited liability partnership?

A: A domestic entity limited liability partnership is a type of business structure in Alabama where partners have limited liability for the partnership's debts and obligations.

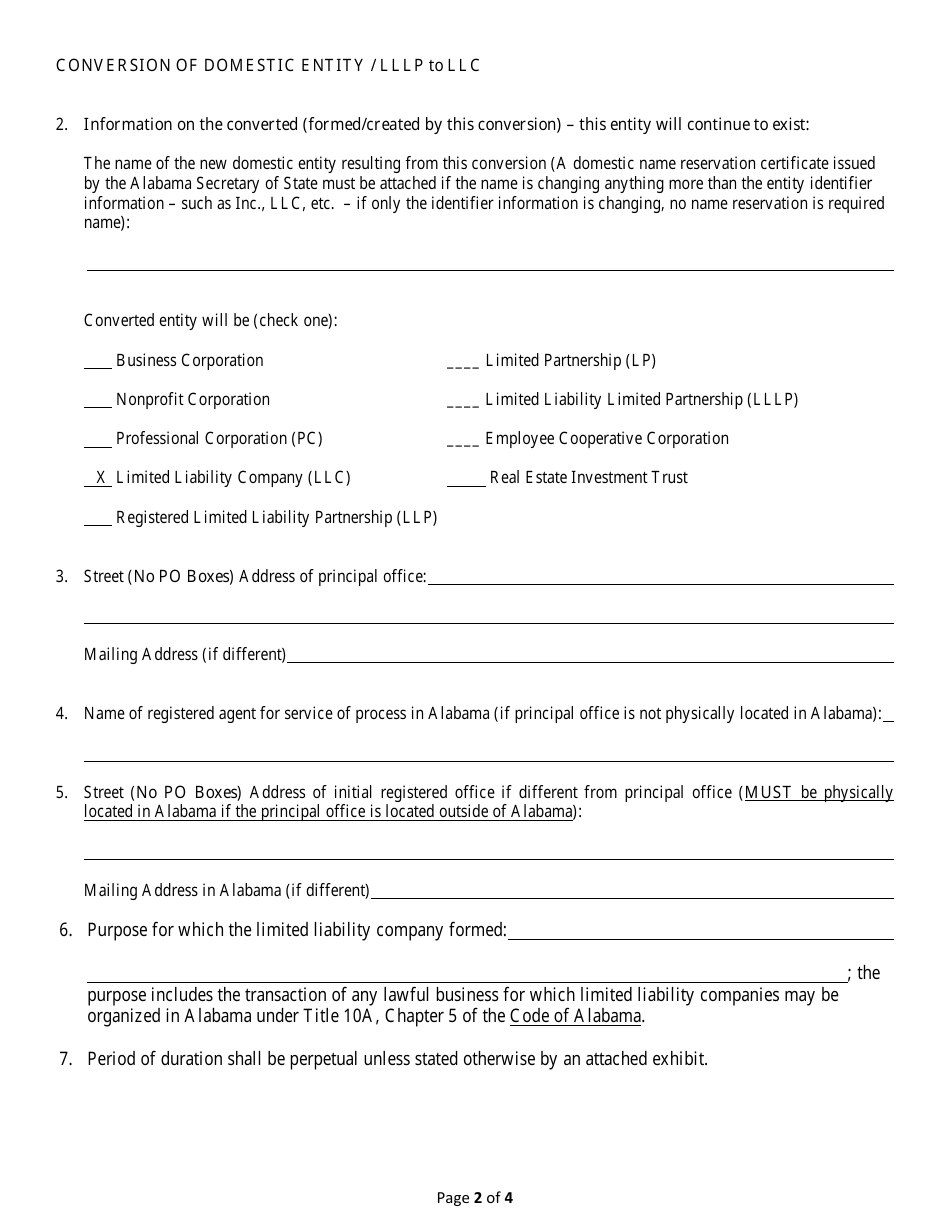

Q: What is a limited liability company?

A: A limited liability company (LLC) is a business structure that combines the limited liability protection of a corporation with the flexibility and tax advantages of a partnership.

Q: Why would a domestic entity limited liability partnership want to convert to a limited liability company?

A: There are several reasons why a domestic entity limited liability partnership may want to convert to a limited liability company. Some reasons include having a simpler and more flexible management structure, reducing personal liability for the owners, and potentially gaining tax advantages.

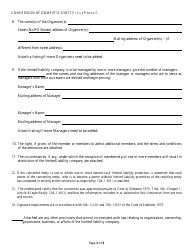

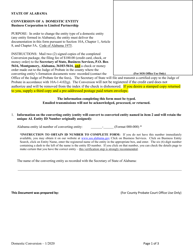

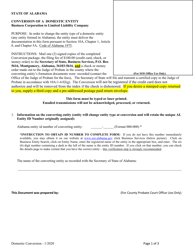

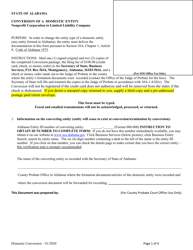

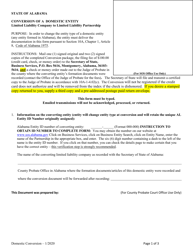

Q: How can a domestic entity limited liability partnership be converted to a limited liability company in Alabama?

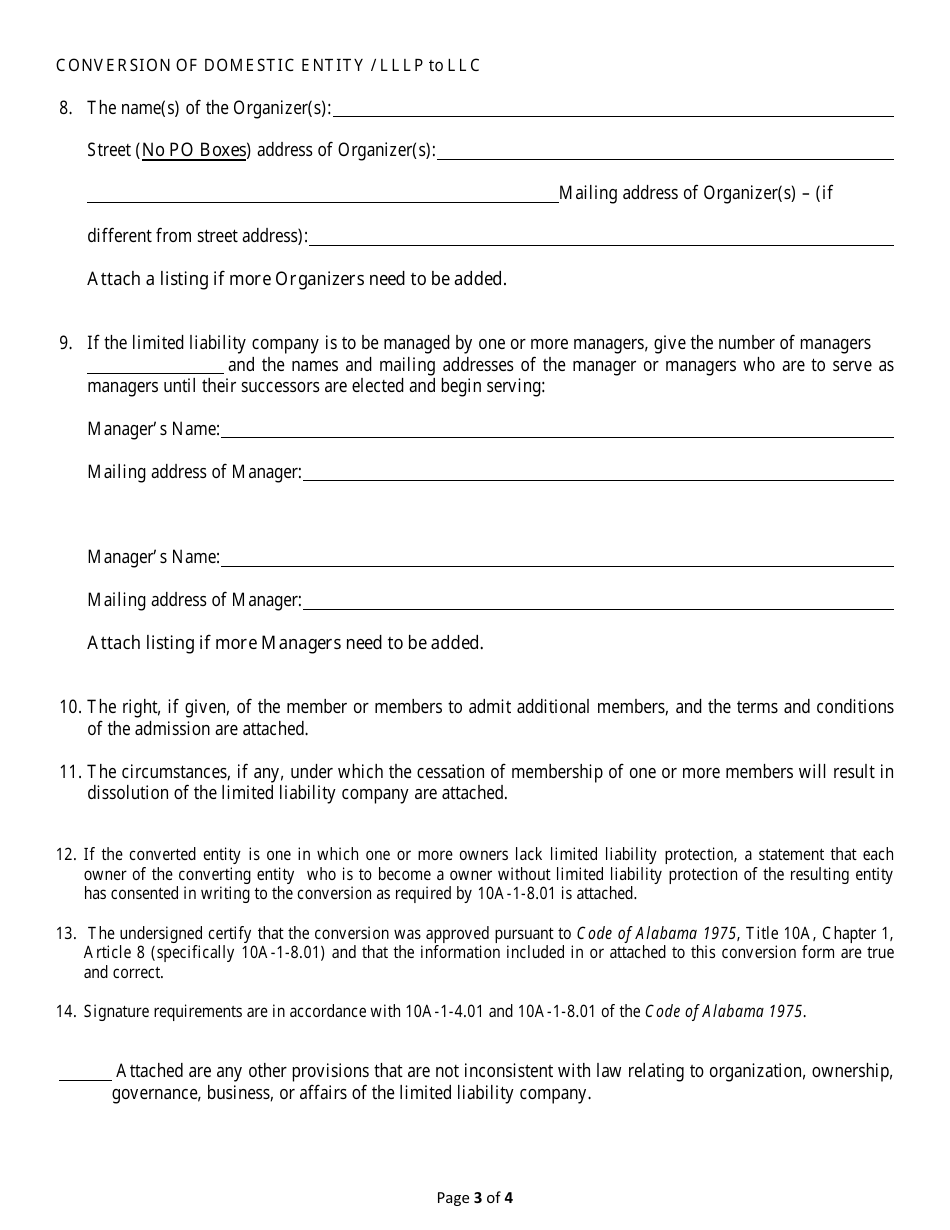

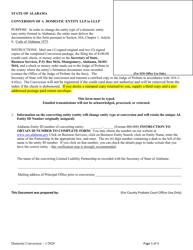

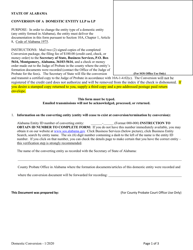

A: To convert a domestic entity limited liability partnership to a limited liability company in Alabama, the partnership must file a certificate of conversion with the Alabama Secretary of State. The certificate of conversion must include certain information about the partnership and its owners.

Q: What is the process for converting a domestic entity limited liability partnership to a limited liability company?

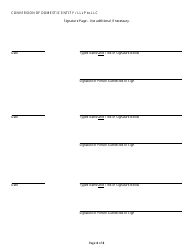

A: The process for converting a domestic entity limited liability partnership to a limited liability company typically involves drafting a conversion plan, obtaining the necessary approvals from the partnership's owners, filing the certificate of conversion with the Alabama Secretary of State, and updating any necessary licenses or permits.

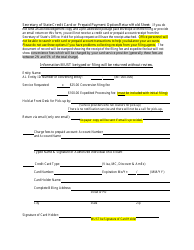

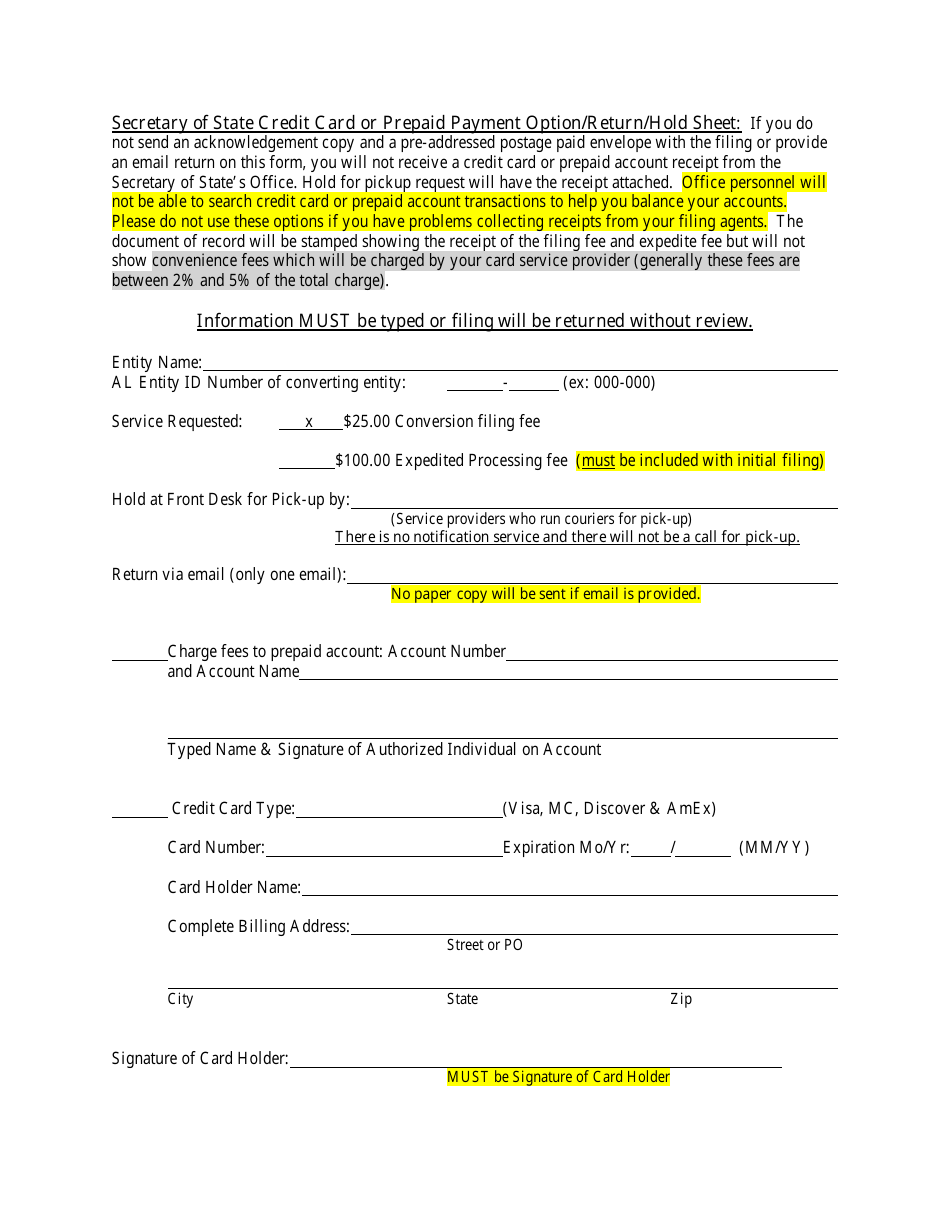

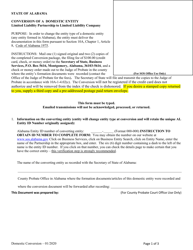

Q: Are there any fees or taxes associated with converting a domestic entity limited liability partnership to a limited liability company?

A: Yes, there may be fees and taxes associated with converting a domestic entity limited liability partnership to a limited liability company. The exact fees and taxes will depend on the specific requirements of the conversion and should be confirmed with the Alabama Secretary of State.

Q: Can the partnership continue operating during the conversion process?

A: Yes, the partnership can continue operating during the conversion process. However, it is important to comply with all legal and regulatory requirements during the conversion to avoid any complications.

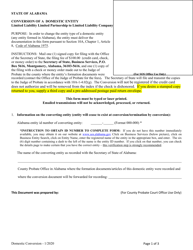

Q: Is it necessary to consult with an attorney or accountant for the conversion process?

A: While it is not necessary to consult with an attorney or accountant for the conversion process, it is highly recommended. They can provide guidance on the legal and financial implications of the conversion and ensure the process is completed correctly.

Q: What are the advantages of converting to a limited liability company?

A: Some advantages of converting to a limited liability company include simplified management structure, limited personal liability for owners, potential tax advantages, and increased flexibility in ownership and profit distribution.

Q: Are there any disadvantages of converting to a limited liability company?

A: There can be some disadvantages of converting to a limited liability company, such as potential tax implications and the need to comply with additional regulations and reporting requirements. It is important to consider these factors before making the conversion.

Form Details:

- Released on February 1, 2012;

- The latest edition currently provided by the Alabama Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Alabama Secretary of State.