This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

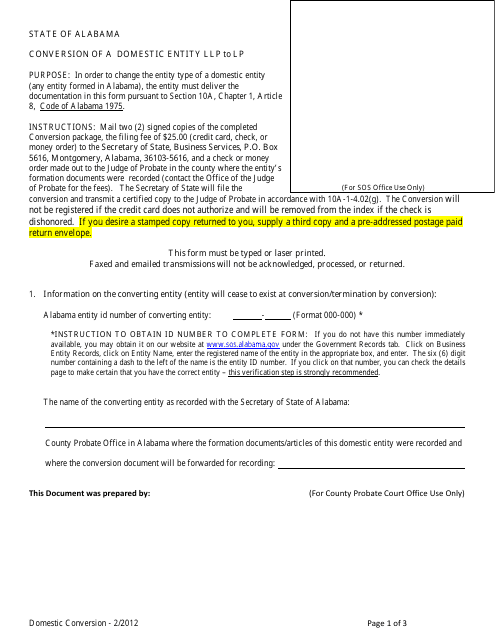

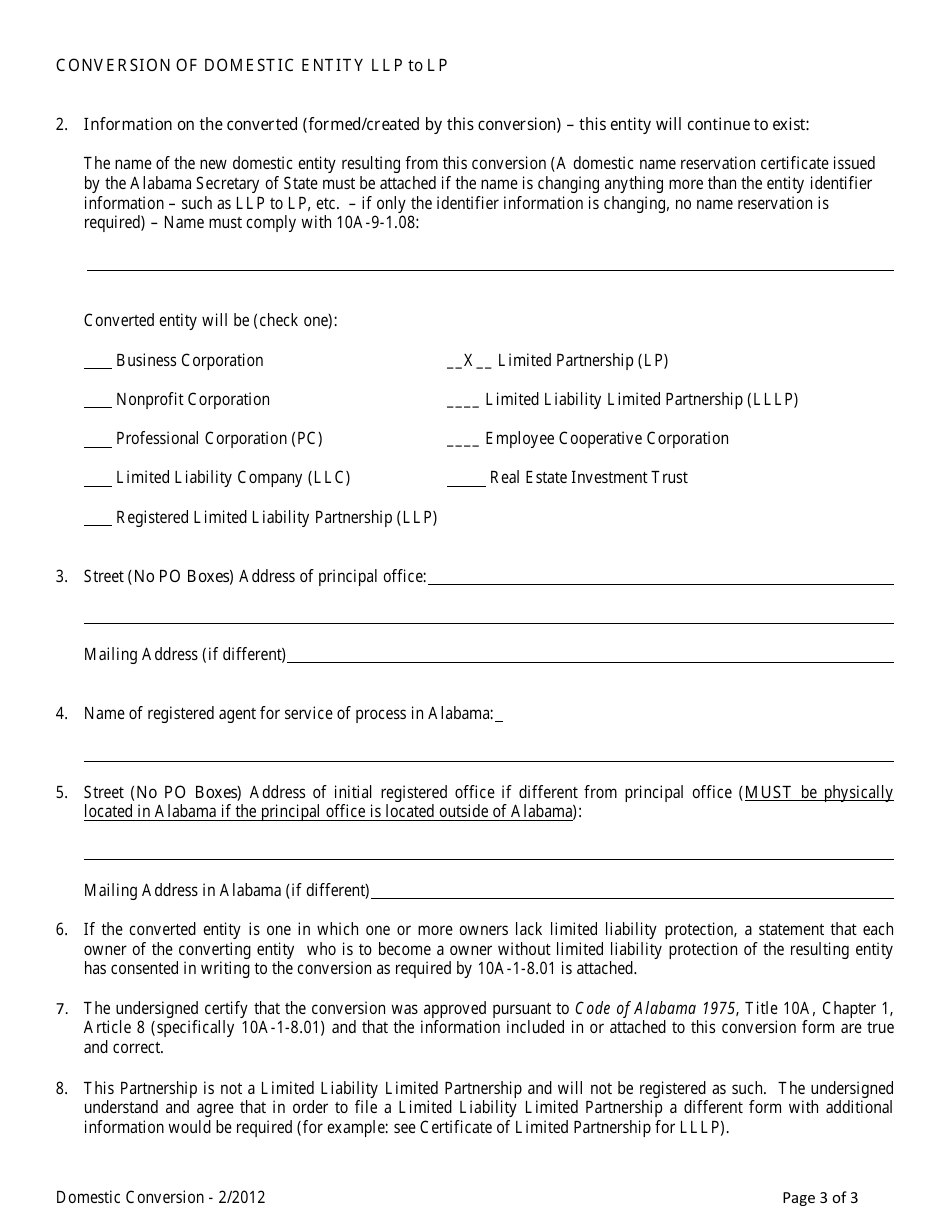

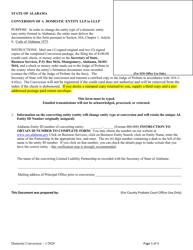

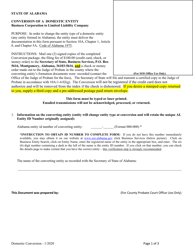

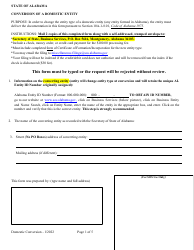

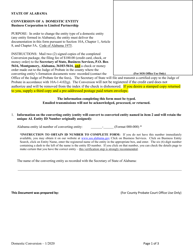

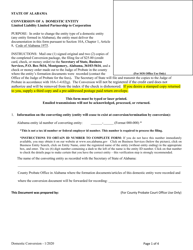

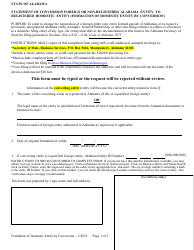

Conversion of a Domestic Entity LLP to Lp - Alabama

Conversion of a Domestic Entity LLP to Lp is a legal document that was released by the Alabama Secretary of State - a government authority operating within Alabama.

FAQ

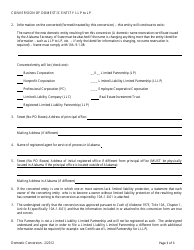

Q: What is the process to convert a Domestic Entity LLP to LP in Alabama?

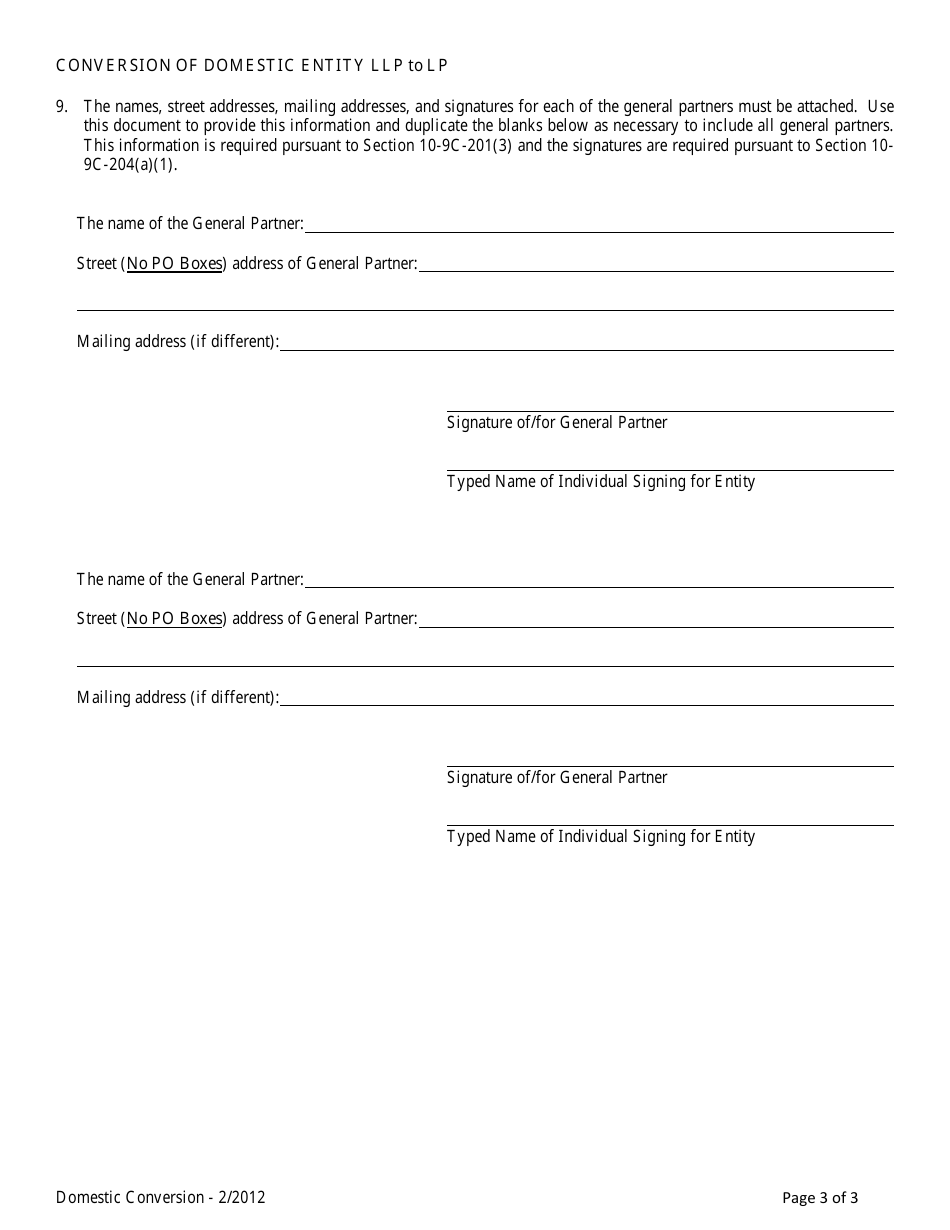

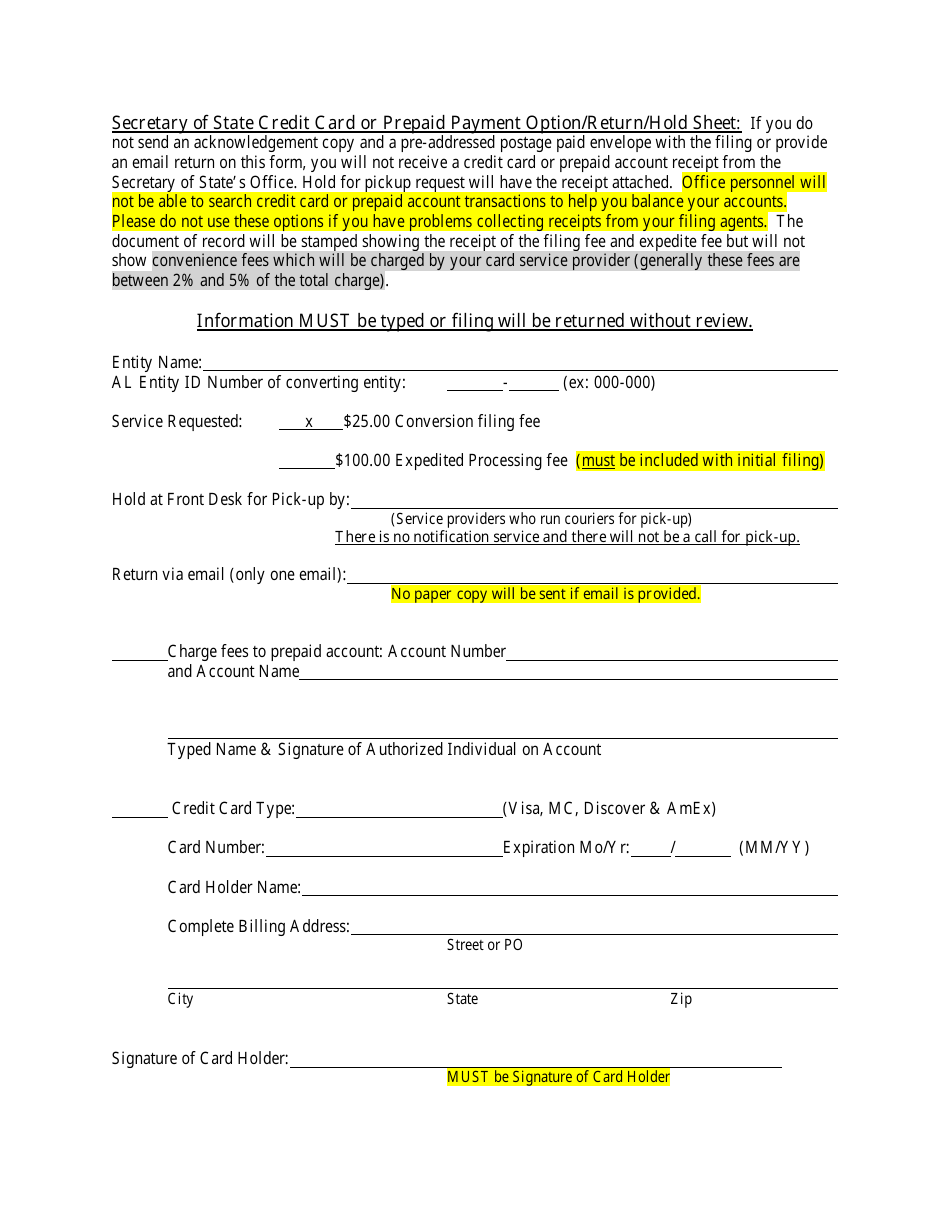

A: The process to convert a Domestic Entity LLP to LP in Alabama involves filing a certificate of conversion with the Secretary of State.

Q: What is a Domestic Entity LLP?

A: A Domestic Entity LLP is a limited liability partnership that is formed and operates within Alabama.

Q: What is an LP?

A: An LP is a limited partnership, which is a business structure that has at least one general partner who manages the business and is personally liable for its debts, and one or more limited partners who contribute capital and have limited liability.

Q: Why would someone want to convert a Domestic Entity LLP to LP?

A: There could be various reasons for wanting to convert a Domestic Entity LLP to LP, such as changing the management structure, liability considerations, or tax benefits.

Q: Are there any specific requirements or criteria for converting a Domestic Entity LLP to LP?

A: Yes, you need to meet certain criteria and fulfill specific requirements as per the Alabama law, such as obtaining the necessary approvals, unanimous consent of the partners, and complying with all applicable filing and fee requirements.

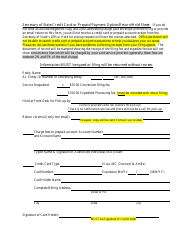

Q: How long does it take to complete the conversion process?

A: The time required to complete the conversion process can vary. It depends on factors such as the workload of the Secretary of State's office and the completeness of the submitted documents. It is advisable to check with the Alabama Secretary of State's office for an estimated processing time.

Q: What are the potential implications or consequences of converting a Domestic Entity LLP to LP?

A: The potential implications or consequences of converting a Domestic Entity LLP to LP can vary depending on various factors, such as taxation, liability, and governance structure. It is recommended to consult with a legal or tax professional to understand the specific implications for your situation.

Q: Can I convert my Domestic Entity LLP to LP without legal assistance?

A: While it is possible to complete the conversion process without legal assistance, it is generally advisable to consult with a legal professional to ensure compliance with all applicable laws and regulations.

Form Details:

- Released on February 1, 2012;

- The latest edition currently provided by the Alabama Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Alabama Secretary of State.