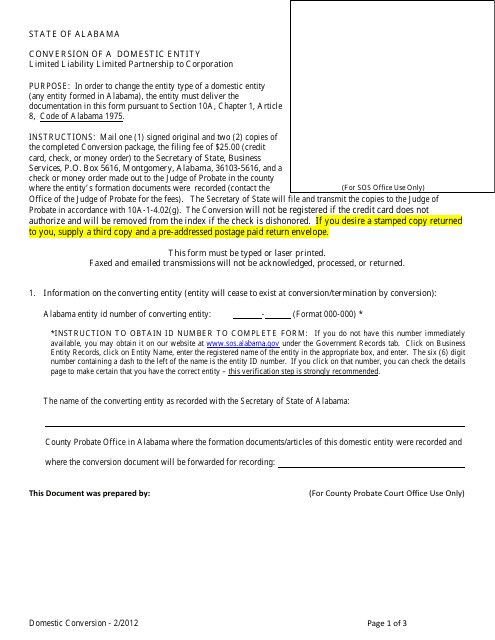

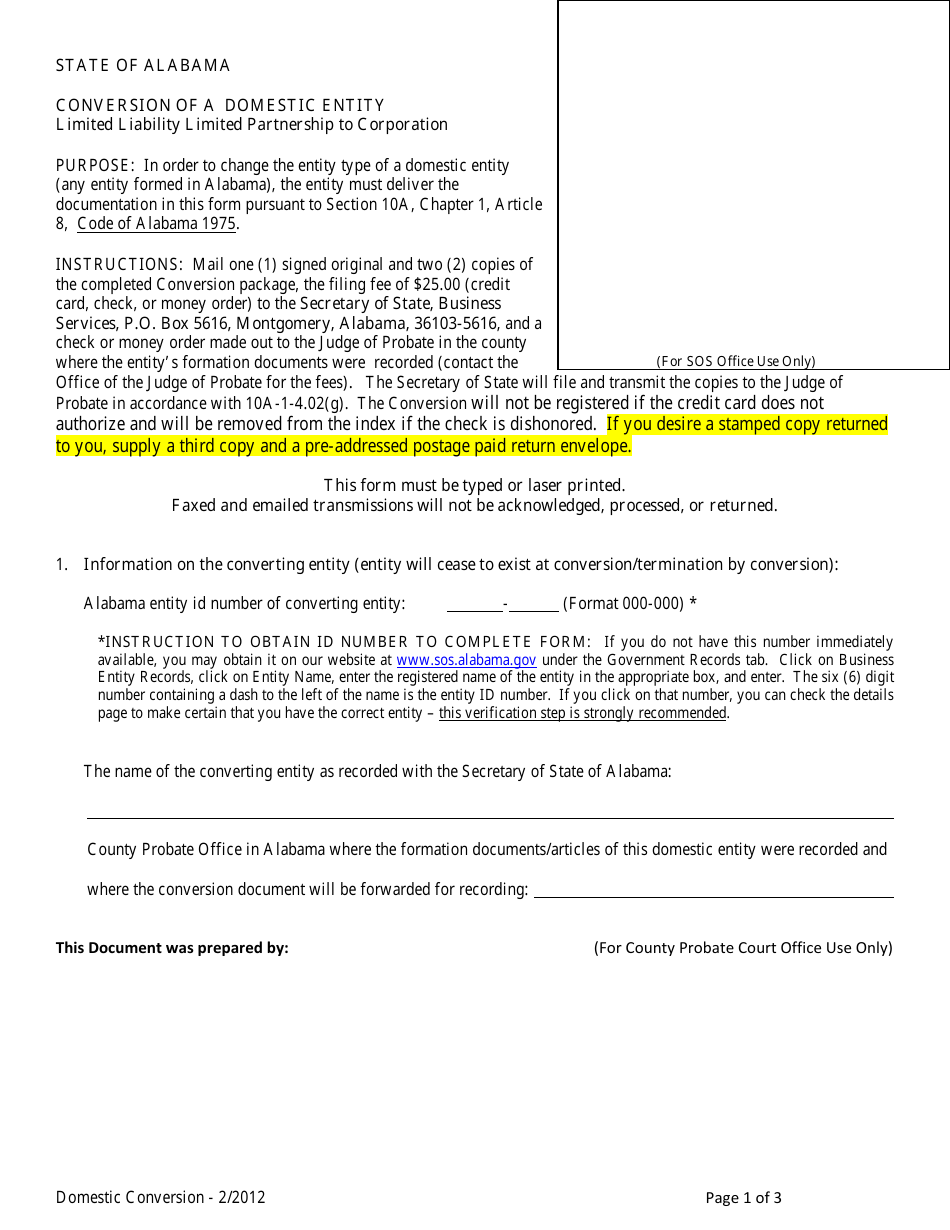

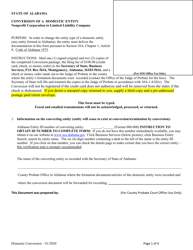

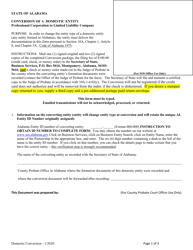

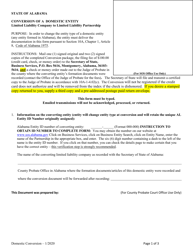

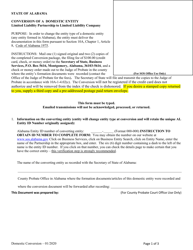

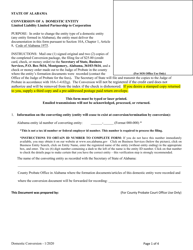

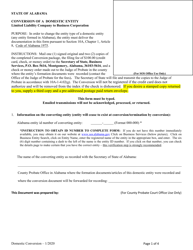

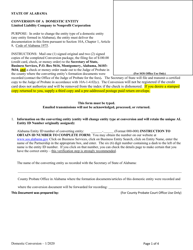

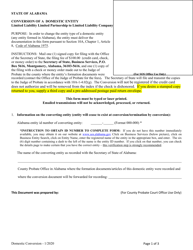

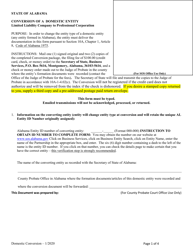

Conversion of a Domestic Entity - Limited Liability Limited Partnership to Corporation - Alabama

Conversion of a Limited Partnership to Corporation is a legal document that was released by the Alabama Secretary of State - a government authority operating within Alabama.

FAQ

Q: What is a Limited Liability Limited Partnership?

A: A Limited Liability Limited Partnership (LLLP) is a type of business entity that combines the limited liability benefits of a limited partnership with the flexibility and management control of a general partnership.

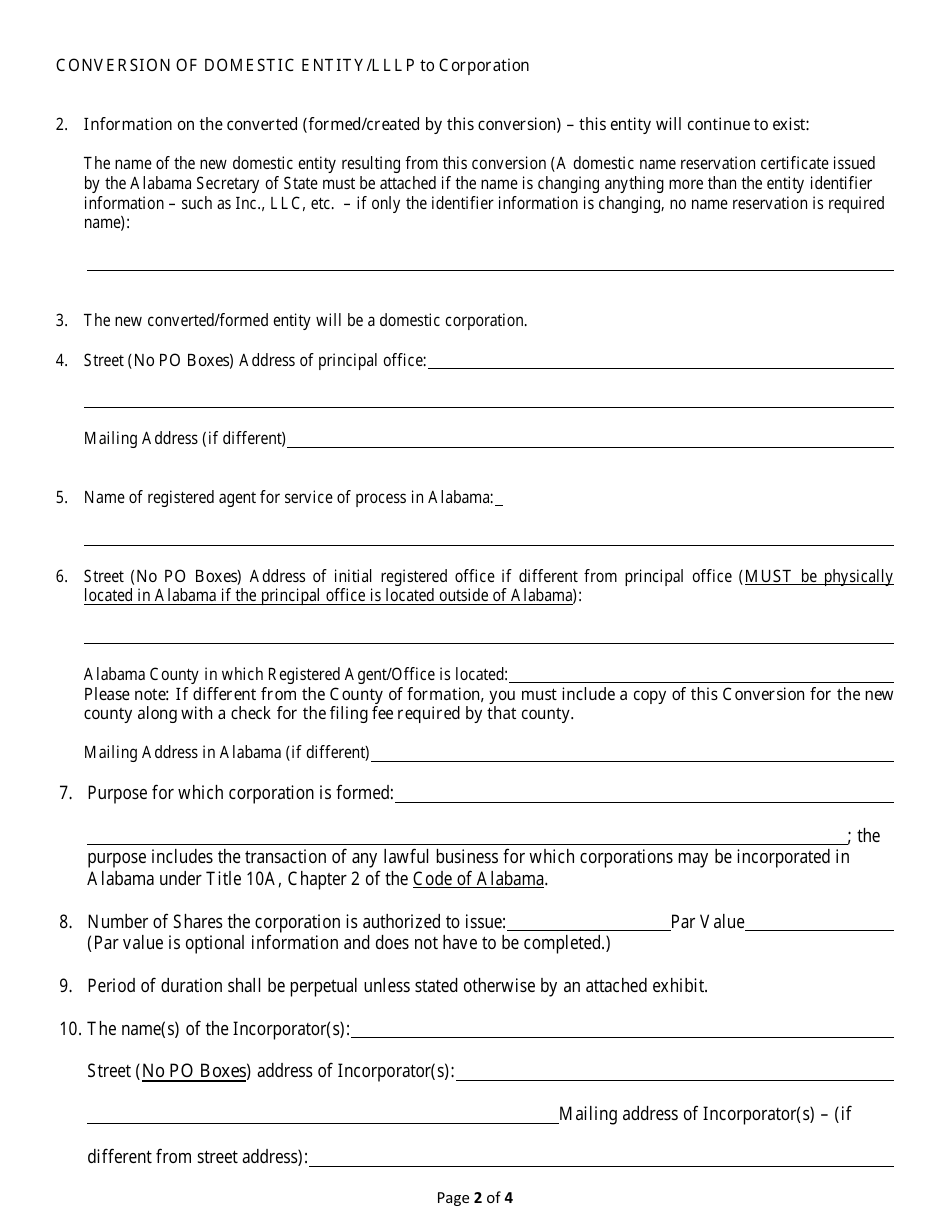

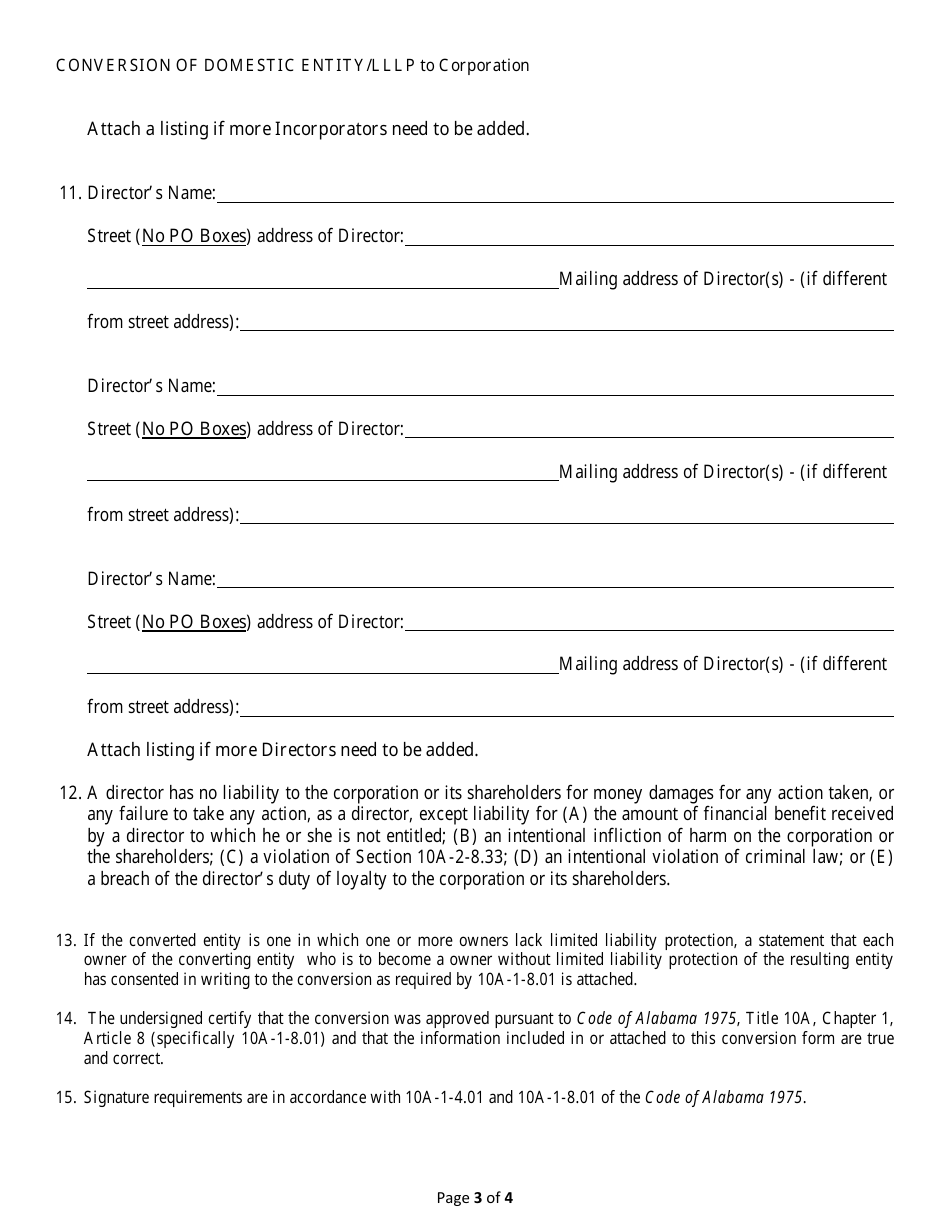

Q: What is a Corporation?

A: A corporation is a legal entity that is separate from its owners or shareholders. It has its own rights, privileges, and liabilities, and is formed by filing certain documents with the state.

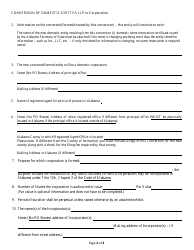

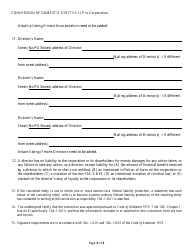

Q: What does it mean to convert a Domestic Entity from an LLLP to a Corporation?

A: Converting a Domestic Limited Liability Limited Partnership (LLLP) to a Corporation means changing the legal structure and status of the business entity from an LLLP to a corporation.

Q: Why might a Domestic LLLP want to convert to a Corporation?

A: There are several reasons why a Domestic Limited Liability Limited Partnership (LLLP) might want to convert to a Corporation, including accessing greater financing options, attracting investors, and limiting personal liability for business debts.

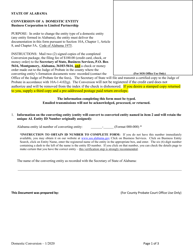

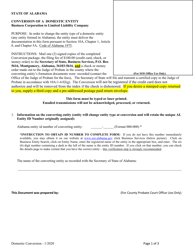

Q: How can a Domestic LLLP convert to a Corporation in Alabama?

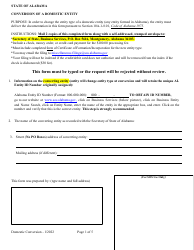

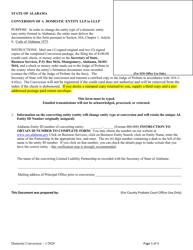

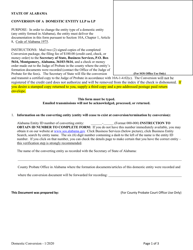

A: To convert a Domestic Limited Liability Limited Partnership (LLLP) to a Corporation in Alabama, you will need to file the necessary conversion documents with the Alabama Secretary of State and meet any requirements or regulations set by the state.

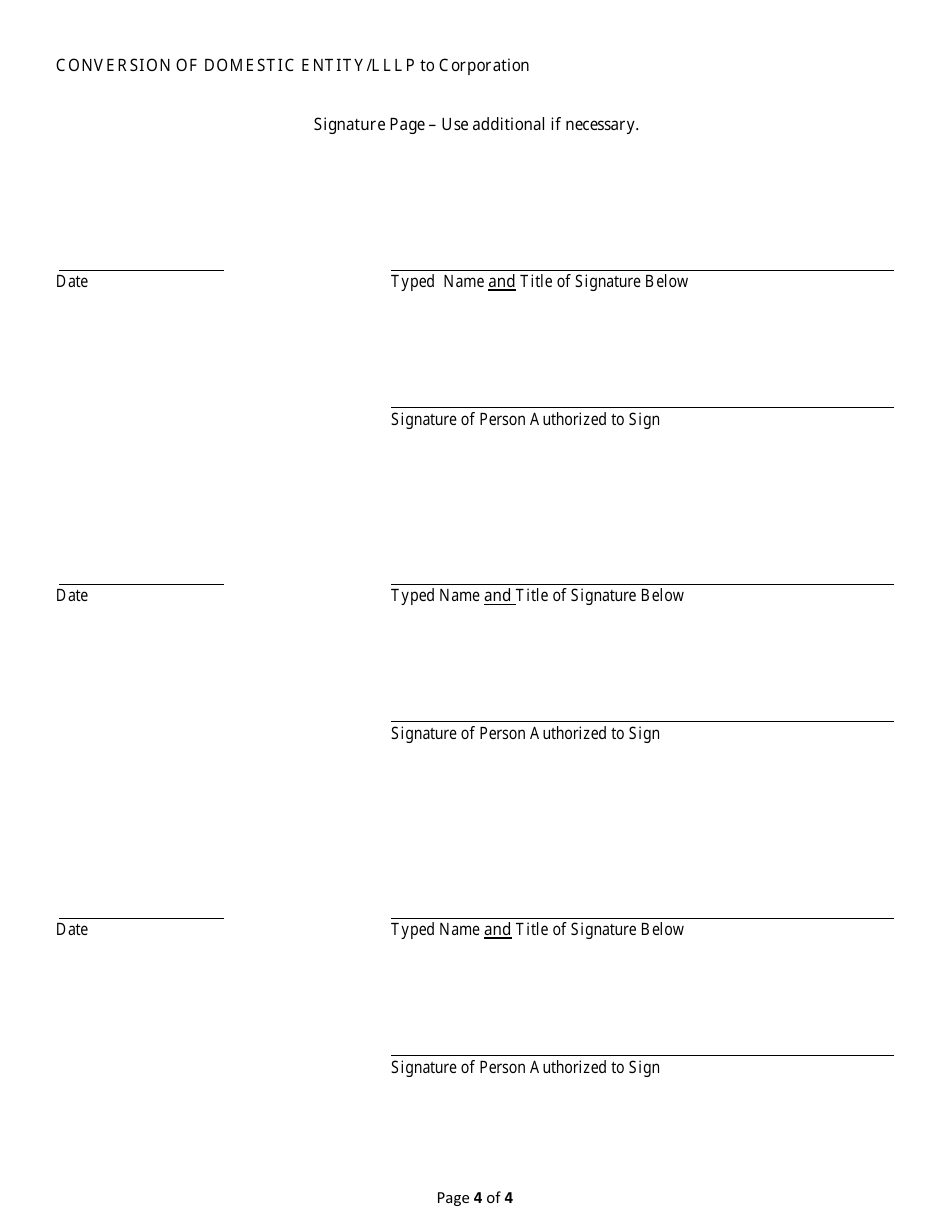

Q: What documents are required to convert a Domestic LLLP to a Corporation in Alabama?

A: The specific documents required to convert a Domestic Limited Liability Limited Partnership (LLLP) to a Corporation in Alabama may vary, but generally, you will need to file a certificate of conversion and a certificate of incorporation or articles of incorporation with the Alabama Secretary of State.

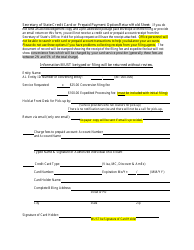

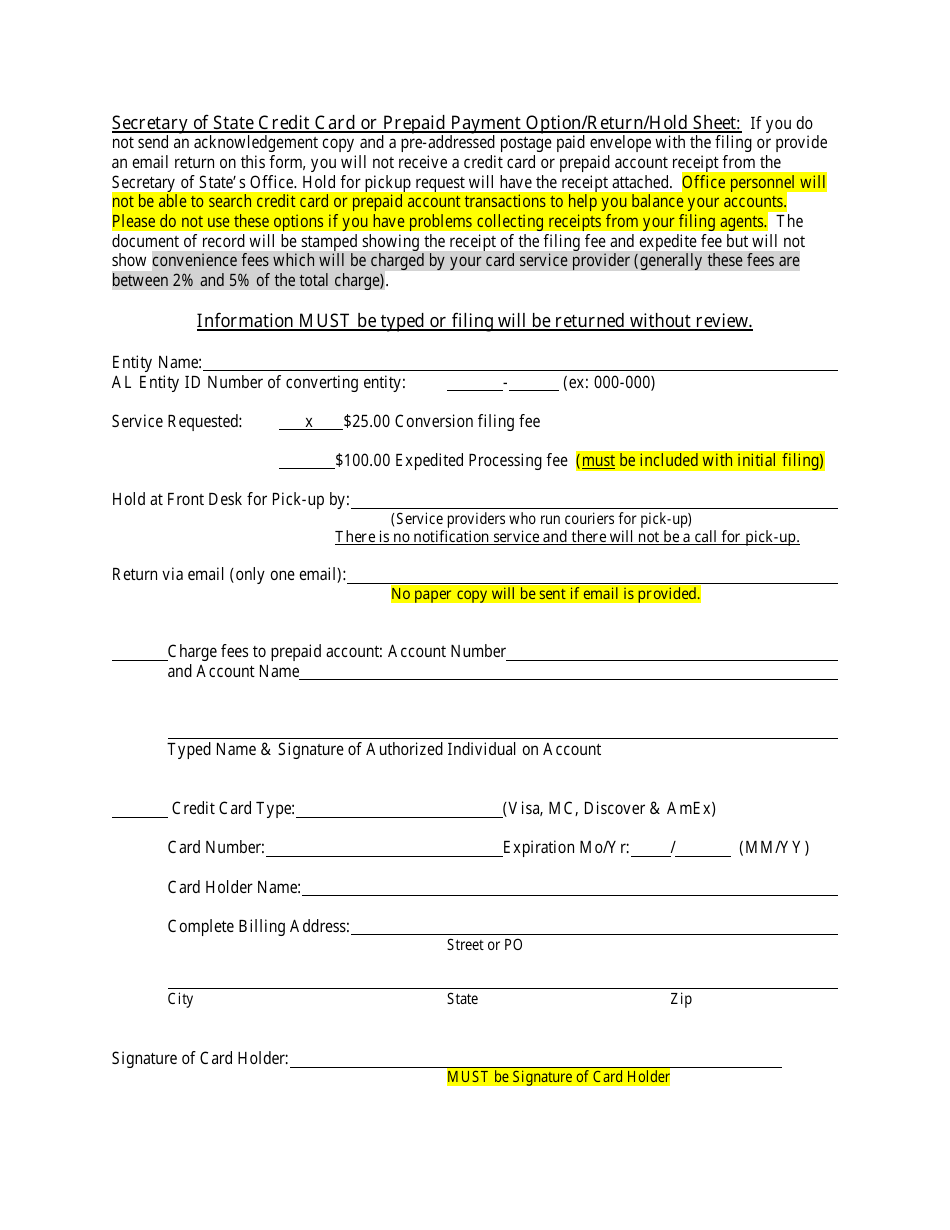

Q: Are there any fees associated with converting a Domestic LLLP to a Corporation in Alabama?

A: Yes, there are usually fees associated with converting a Domestic Limited Liability Limited Partnership (LLLP) to a Corporation in Alabama. The exact fees may vary, so it's best to check with the Alabama Secretary of State for the current fee schedule.

Q: What are the potential benefits of converting a Domestic LLLP to a Corporation in Alabama?

A: Some potential benefits of converting a Domestic Limited Liability Limited Partnership (LLLP) to a Corporation in Alabama include increased credibility, access to more financing options, limited personal liability for business debts, and the ability to attract investors.

Q: Are there any potential downsides or considerations to converting a Domestic LLLP to a Corporation in Alabama?

A: There may be potential downsides or considerations to converting a Domestic Limited Liability Limited Partnership (LLLP) to a Corporation in Alabama, such as additional record-keeping and compliance requirements, potential tax implications, and changes to the management and control of the business.

Q: Can I convert a Domestic LLLP to a Corporation on my own, or do I need legal assistance?

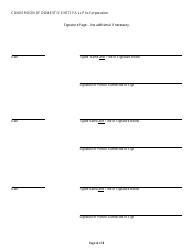

A: While it is possible to convert a Domestic Limited Liability Limited Partnership (LLLP) to a Corporation on your own, it is recommended to seek legal assistance to ensure that the conversion process is done correctly and in compliance with all laws and regulations.

Form Details:

- Released on February 1, 2012;

- The latest edition currently provided by the Alabama Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Alabama Secretary of State.