This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

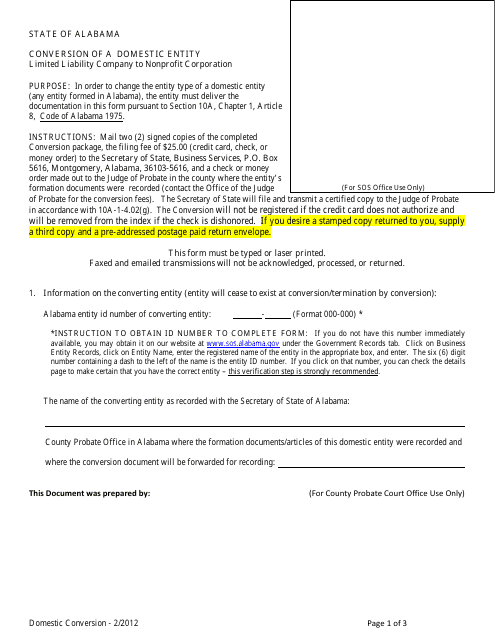

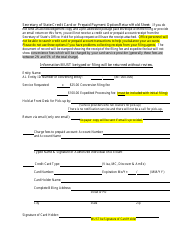

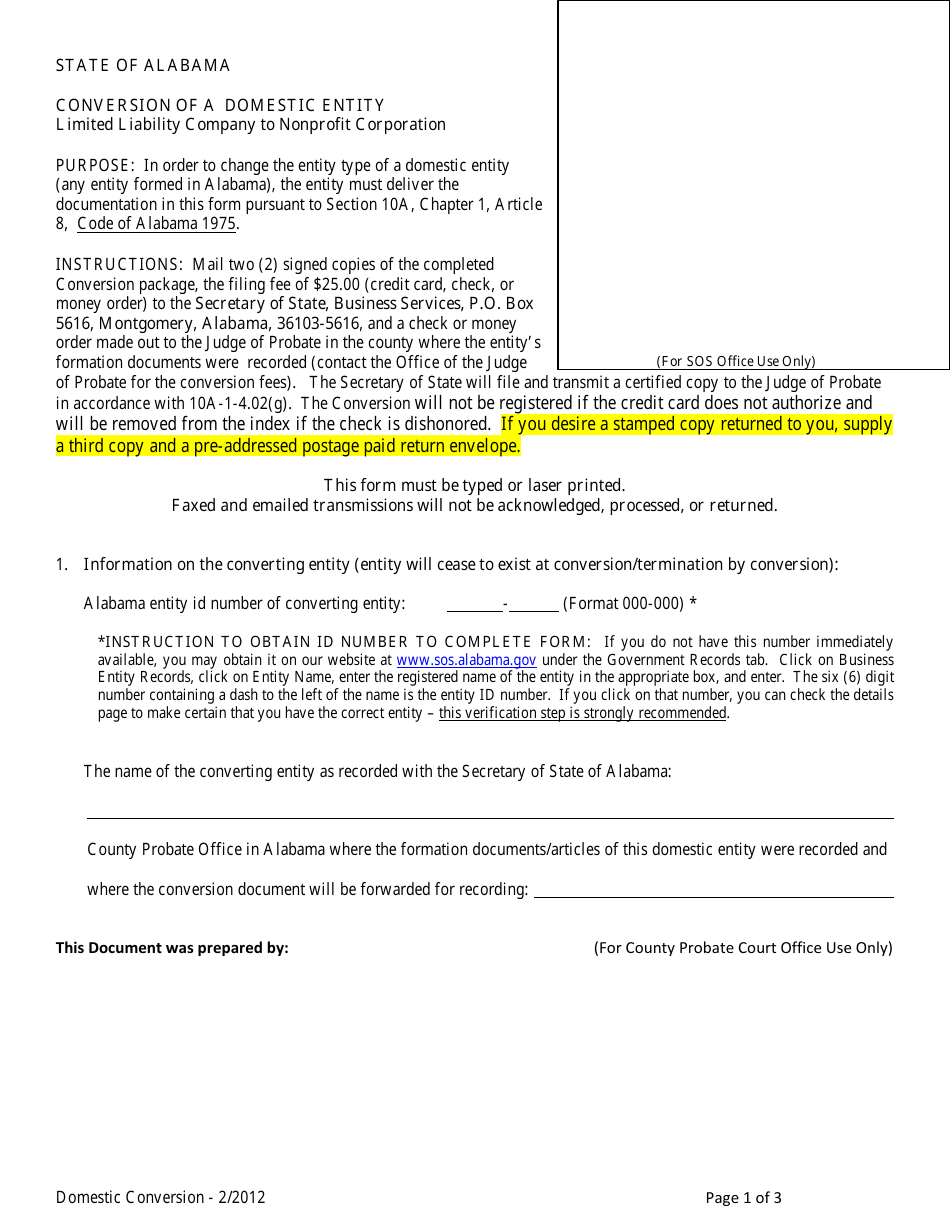

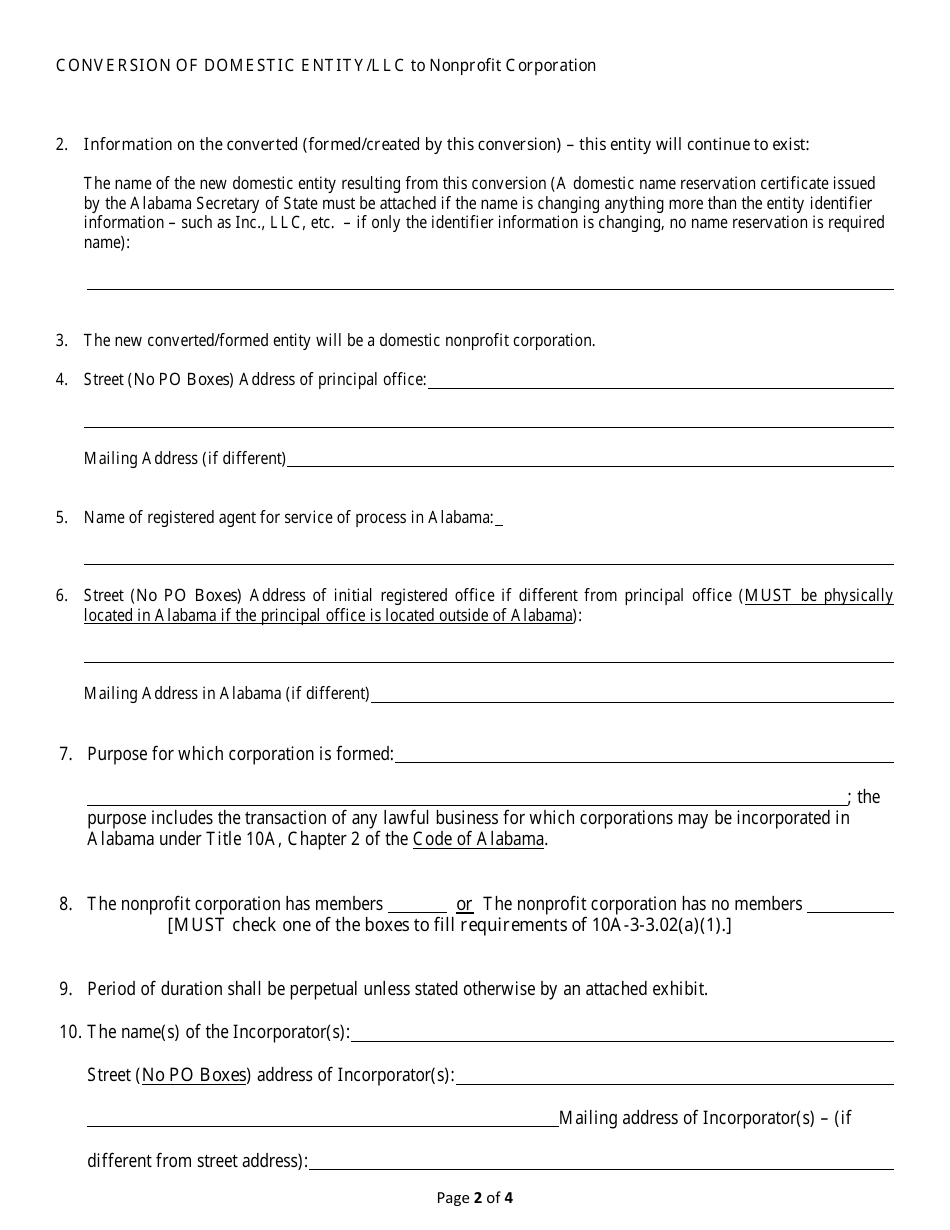

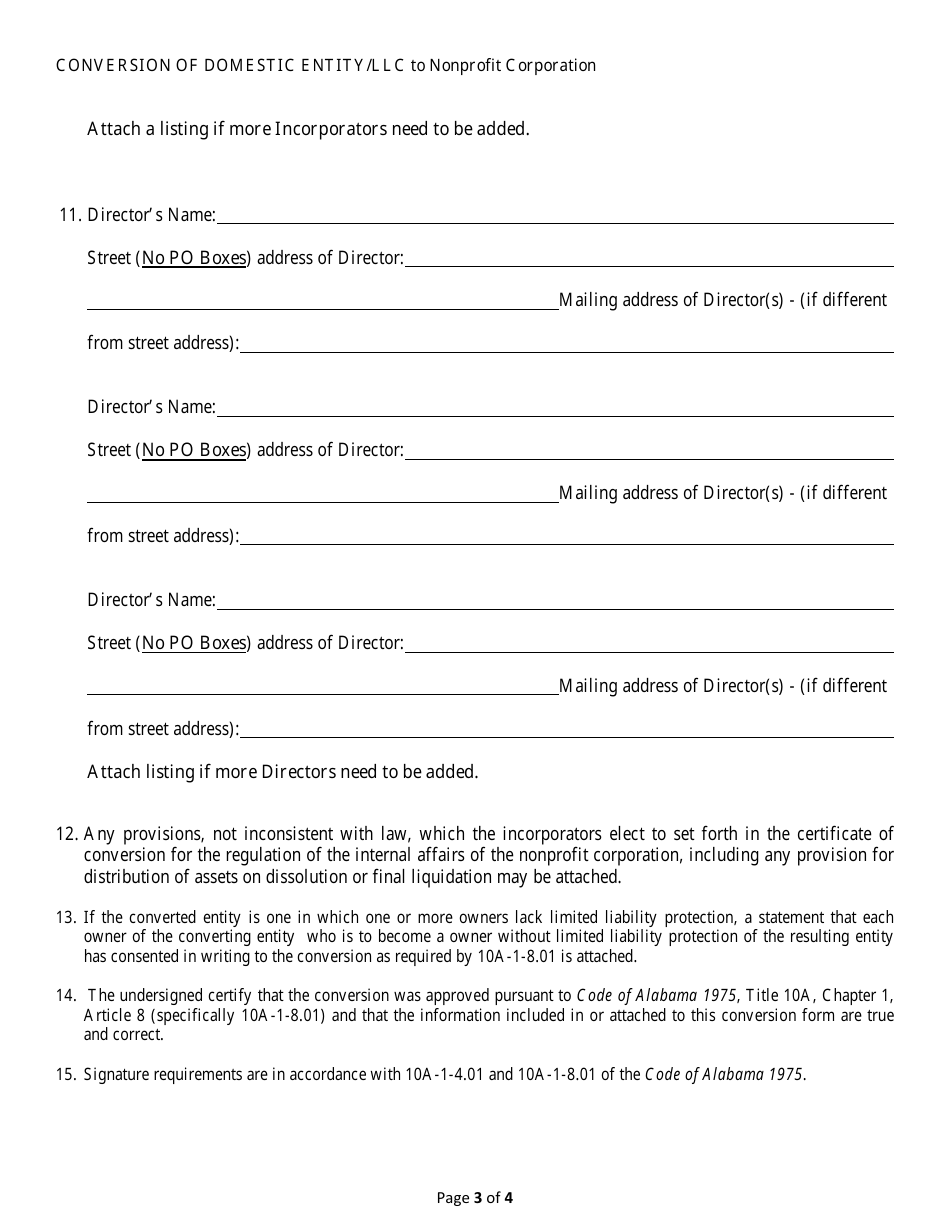

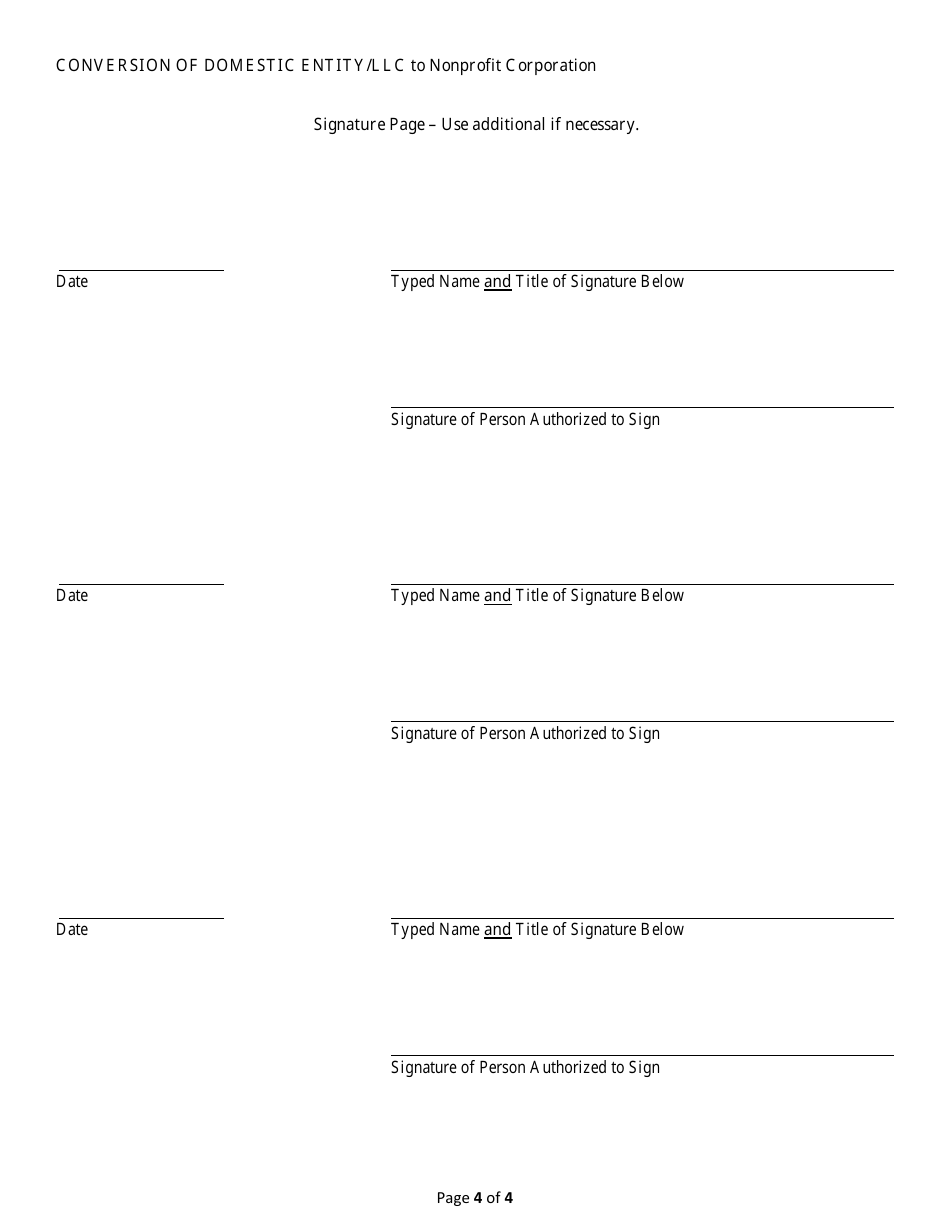

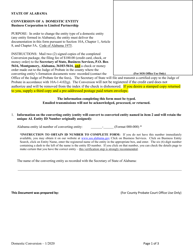

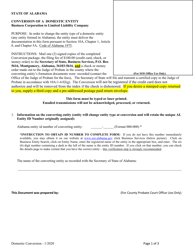

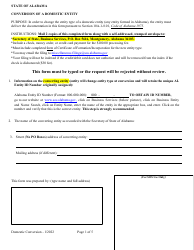

Conversion of a Domestic Entity - Limited Liability Company to Nonprofit Corporation - Alabama

Conversion of a Limited Liability Company to Nonprofit Corporation is a legal document that was released by the Alabama Secretary of State - a government authority operating within Alabama.

FAQ

Q: Can a limited liability company be converted to a nonprofit corporation in Alabama?

A: Yes, it is possible to convert a limited liability company into a nonprofit corporation in Alabama.

Q: What is the process for converting a limited liability company to a nonprofit corporation in Alabama?

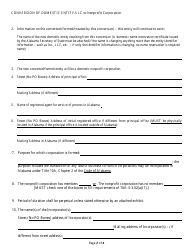

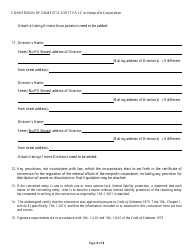

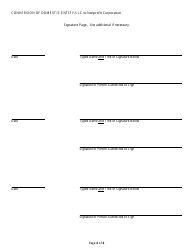

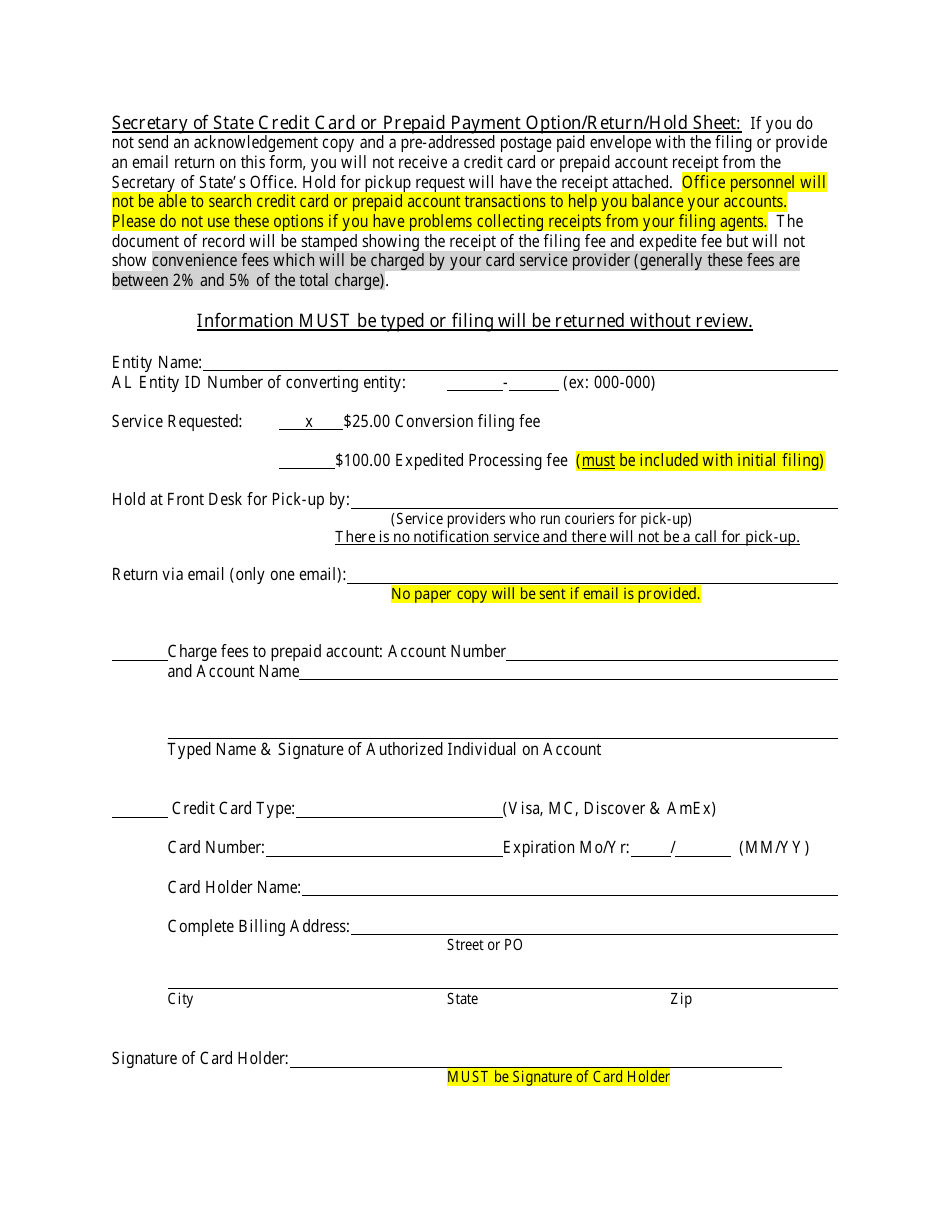

A: The process for converting a limited liability company to a nonprofit corporation in Alabama involves filing Articles of Conversion with the Alabama Secretary of State.

Q: Are there any specific requirements for converting a limited liability company to a nonprofit corporation in Alabama?

A: Yes, there are specific requirements that must be met for converting a limited liability company to a nonprofit corporation in Alabama, such as obtaining a tax-exempt status from the IRS.

Q: Is there a fee for converting a limited liability company to a nonprofit corporation in Alabama?

A: Yes, there is a fee associated with filing the Articles of Conversion with the Alabama Secretary of State.

Q: Can the owners/shareholders of a limited liability company become members of the nonprofit corporation?

A: Yes, the owners/shareholders of a limited liability company can become members of the nonprofit corporation after the conversion.

Form Details:

- Released on February 1, 2012;

- The latest edition currently provided by the Alabama Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Alabama Secretary of State.