This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

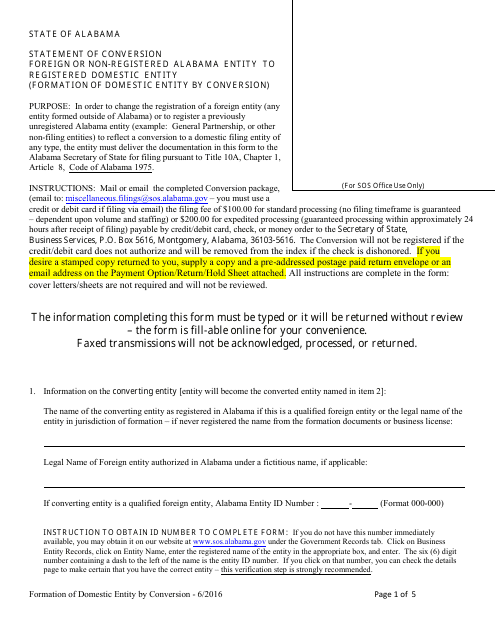

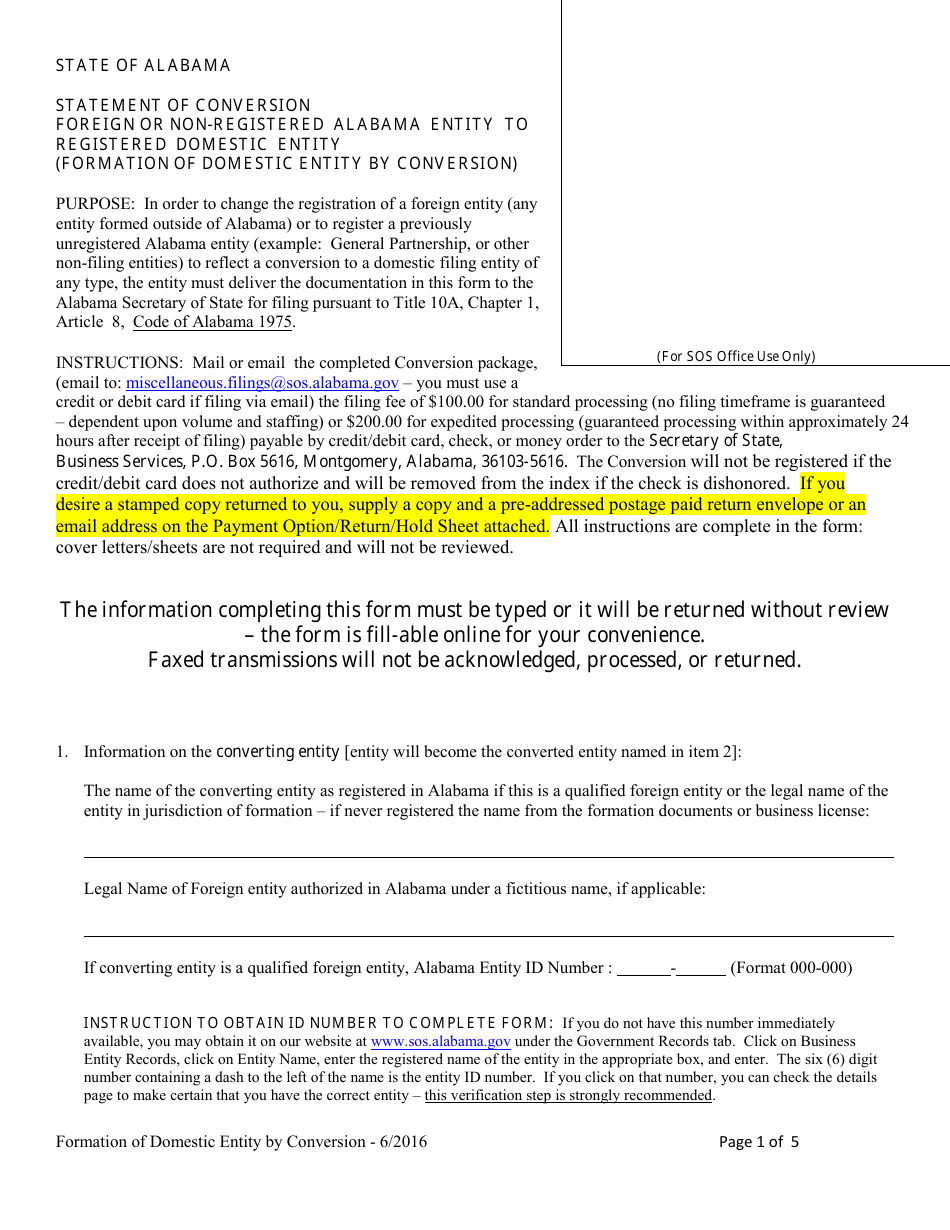

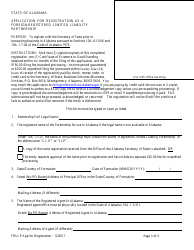

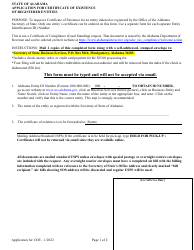

Statement of Conversion Foreign or Non-registered Alabama Entity to Registered Domestic Entity (Formation of Domestic Entity by Conversion) - Alabama

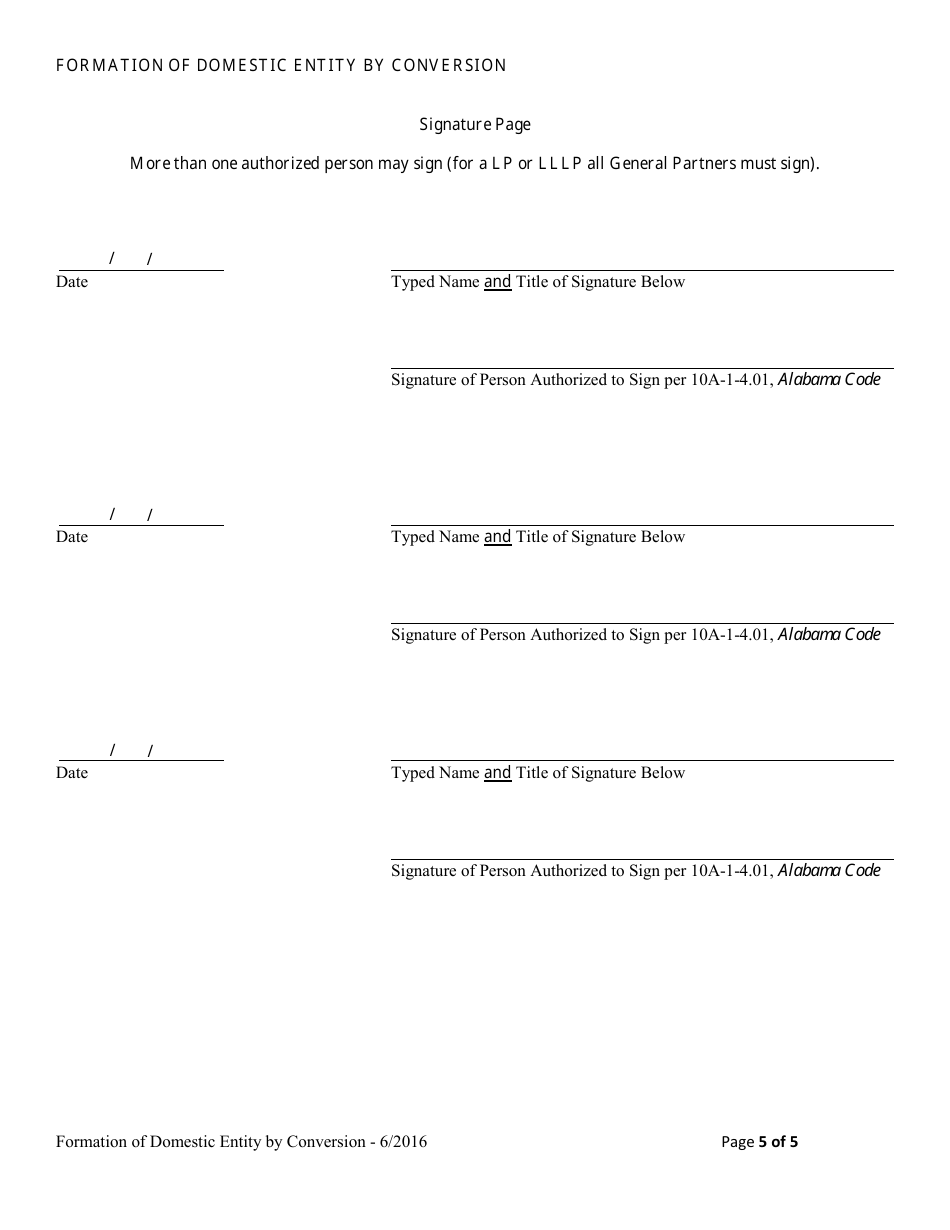

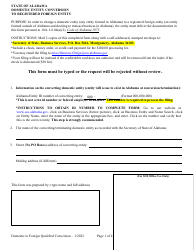

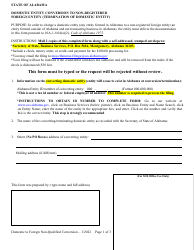

Statement of Conversion Foreign or Non-registered Alabama Entity to Registered Domestic Entity (Formation of Domestic Entity by Conversion) is a legal document that was released by the Alabama Secretary of State - a government authority operating within Alabama.

FAQ

Q: What is a foreign or non-registered Alabama entity?

A: A foreign or non-registered Alabama entity is a business organization that was formed outside of Alabama or a non-registered entity that has not completed the necessary steps to become registered in Alabama.

Q: What is a registered domestic entity?

A: A registered domestic entity is a business organization that has completed the necessary steps to be registered in Alabama.

Q: What is the process of converting a foreign or non-registered Alabama entity to a registered domestic entity?

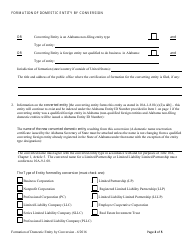

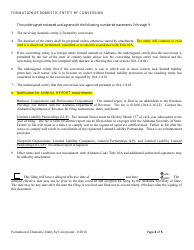

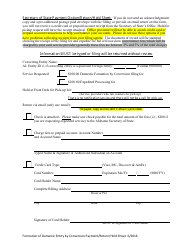

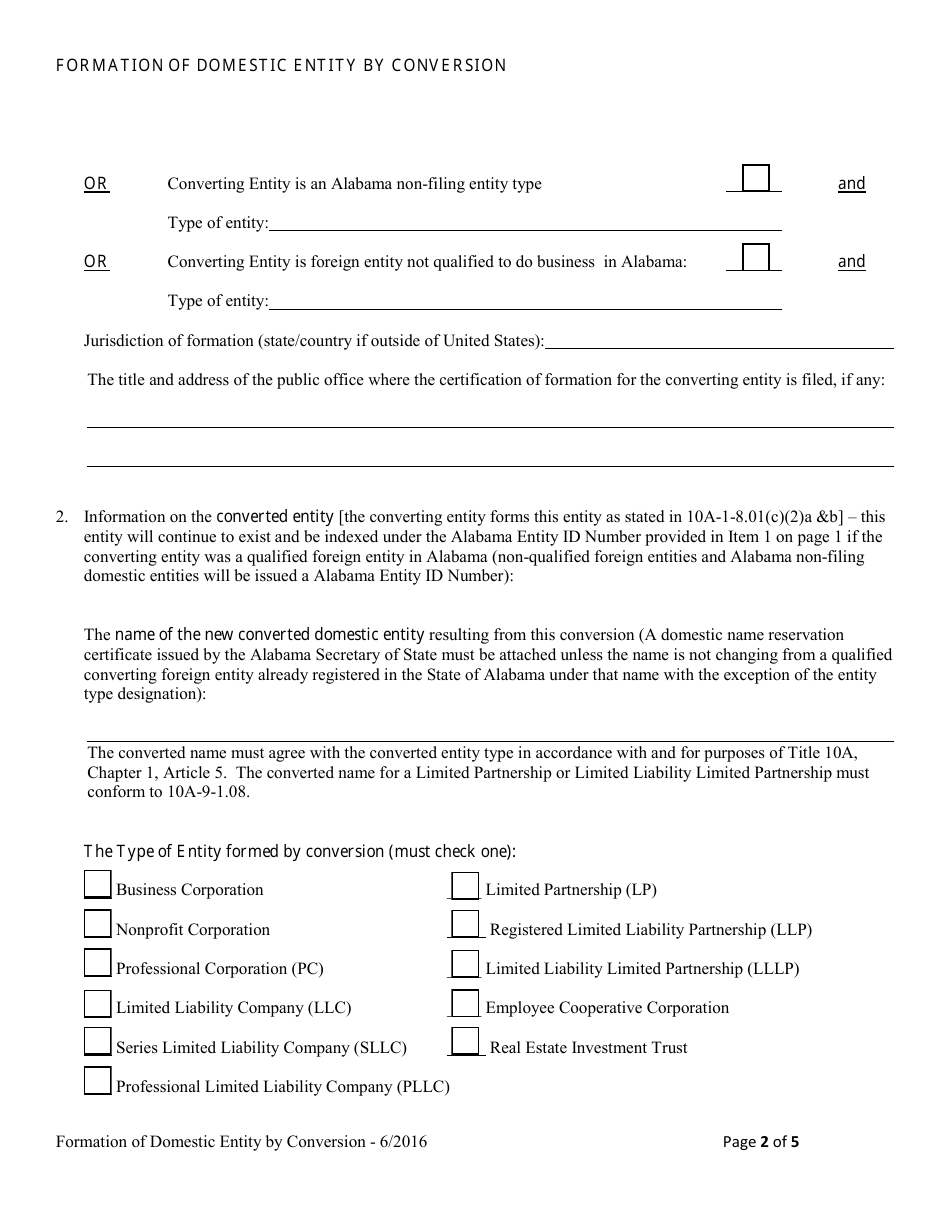

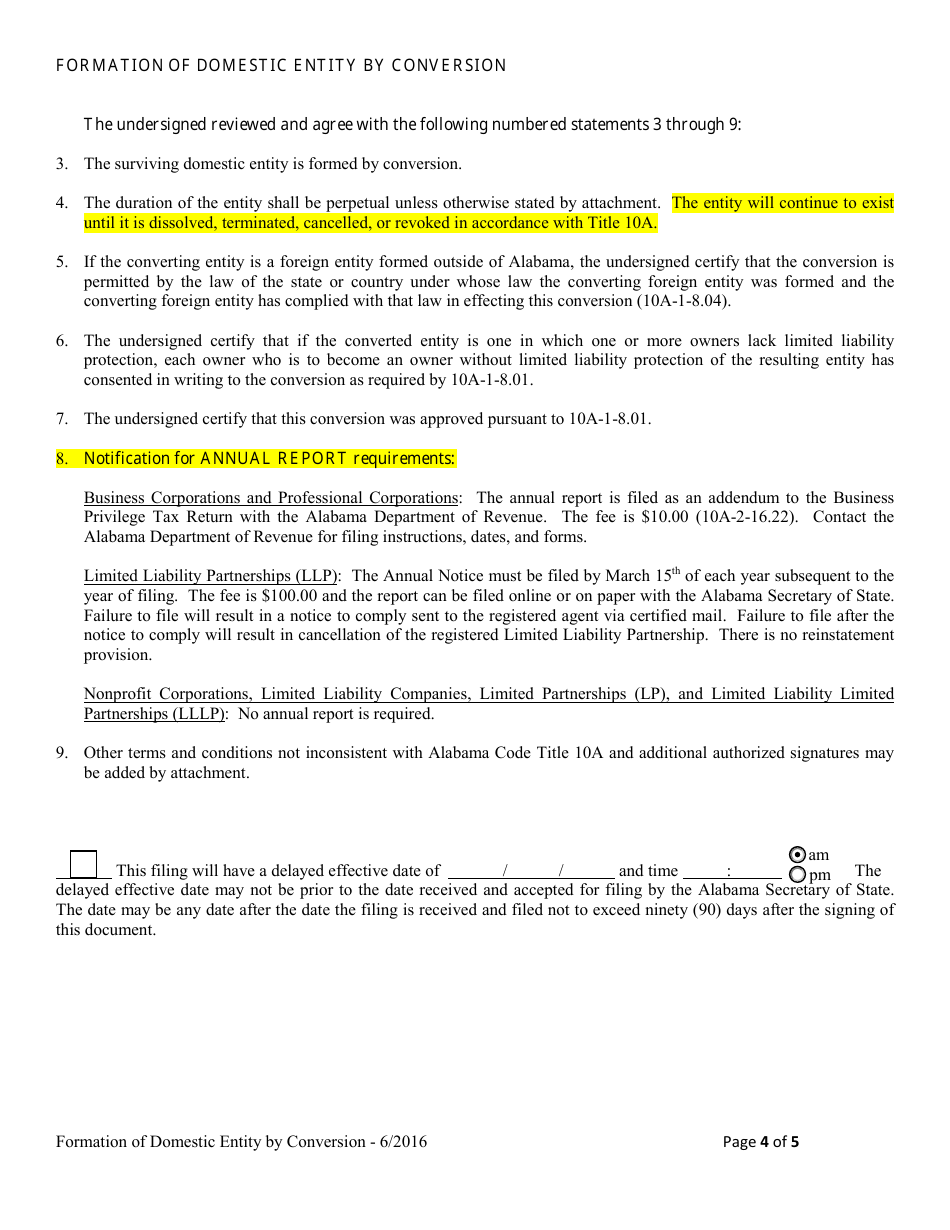

A: The process involves filing a Statement of Conversion with the Alabama Secretary of State, which officially converts the entity from foreign or non-registered to a registered domestic entity.

Q: What is the purpose of converting a foreign or non-registered Alabama entity to a registered domestic entity?

A: Converting to a registered domestic entity allows the business organization to operate in Alabama with all the benefits and legal protections provided to registered entities.

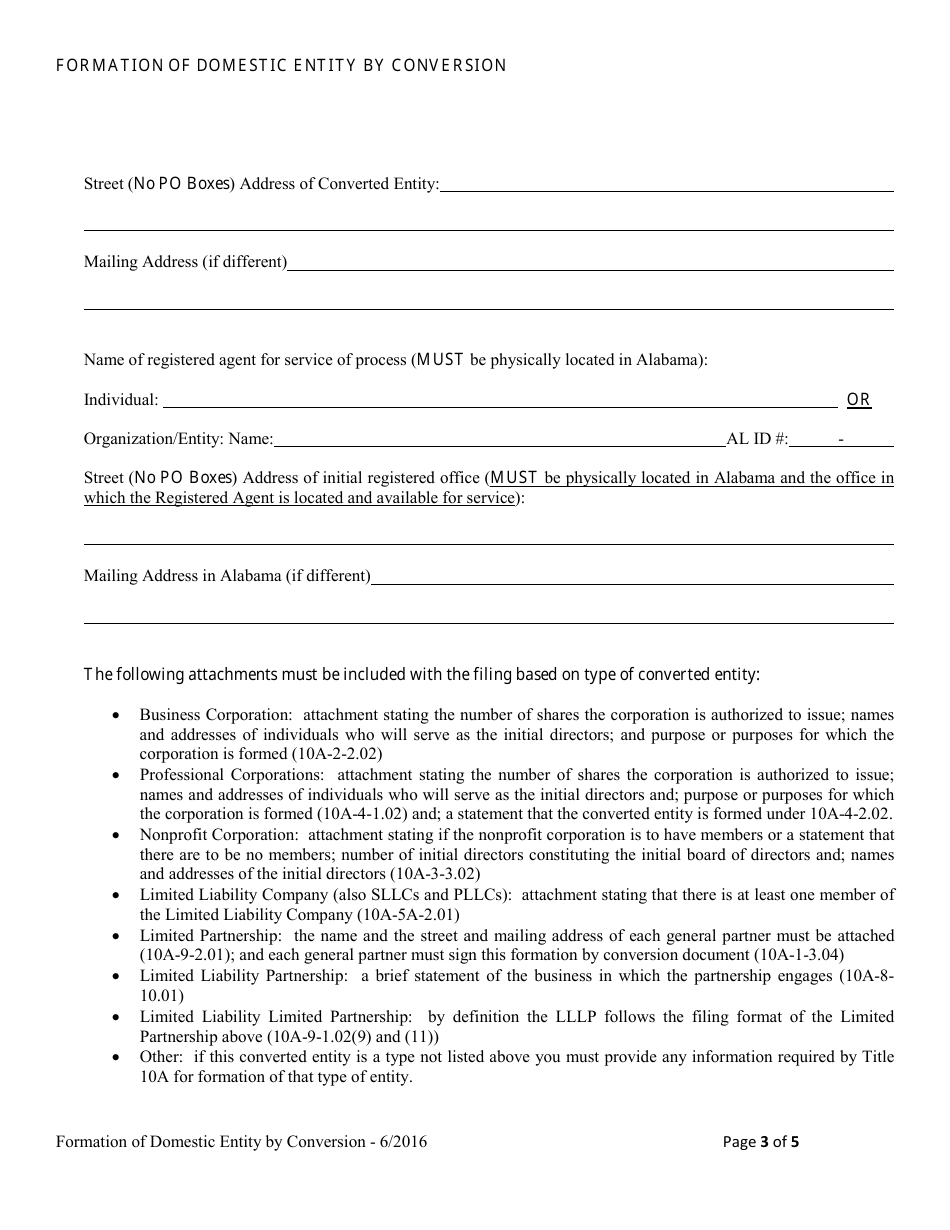

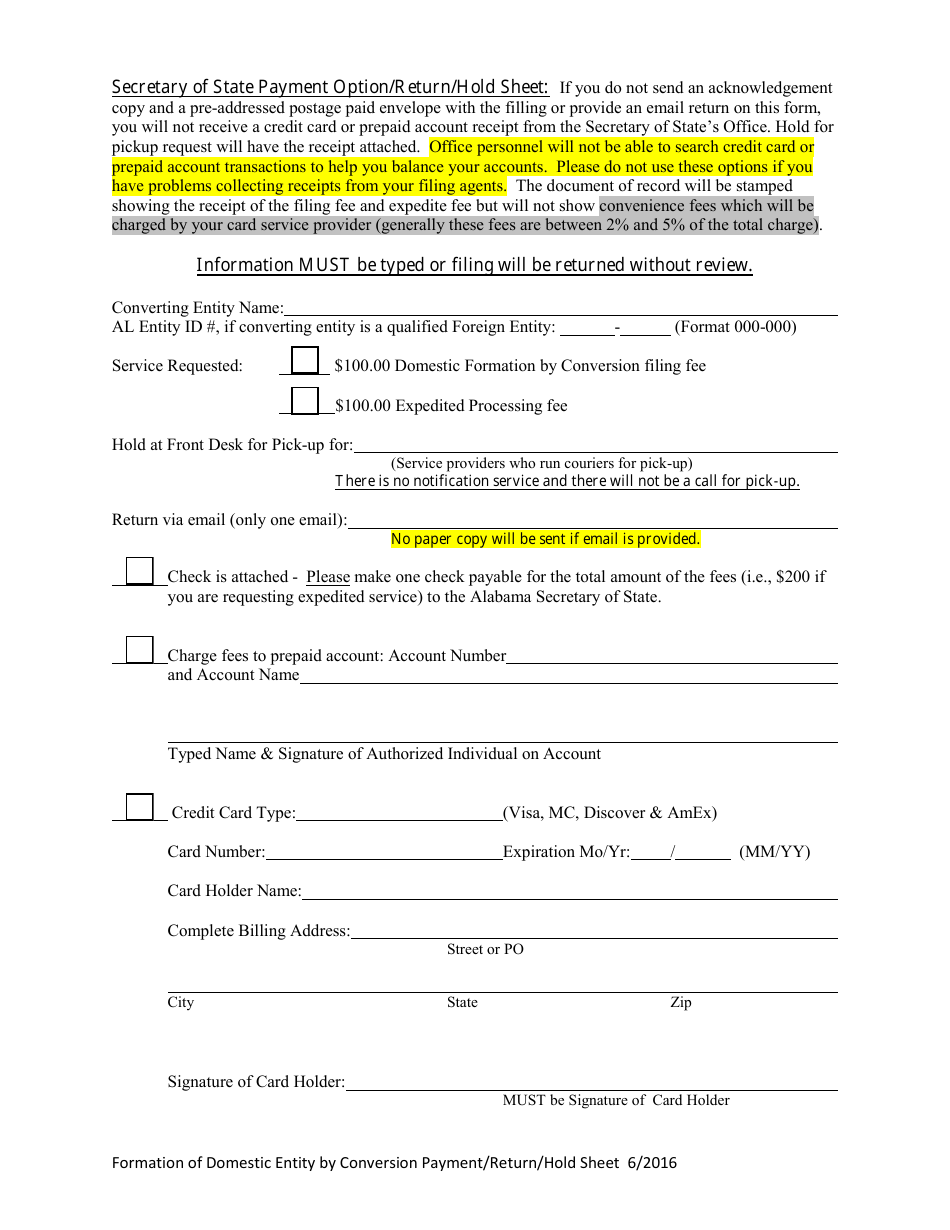

Q: What are the requirements for filing a Statement of Conversion?

A: The requirements may vary, but generally include providing information about the converting entity, the domestic entity to be formed, and paying the necessary fees.

Q: Is there a deadline for filing a Statement of Conversion?

A: There may not be a specific deadline, but it is recommended to file the conversion as soon as possible to ensure the business organization can begin operating as a registered domestic entity.

Q: What are the benefits of operating as a registered domestic entity in Alabama?

A: Some benefits include access to certain business opportunities, legal protections, and the ability to sue or be sued in Alabama courts.

Q: Are there any tax implications of converting to a registered domestic entity?

A: There may be tax implications, and it is recommended to consult with a tax professional or accountant to understand the specific implications for your business organization.

Q: Can I convert back to a foreign or non-registered Alabama entity after converting to a registered domestic entity?

A: Yes, it is possible to convert back, but the process and requirements may vary. It is advisable to consult with an attorney or business advisor for guidance in this situation.

Form Details:

- Released on June 1, 2016;

- The latest edition currently provided by the Alabama Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Alabama Secretary of State.