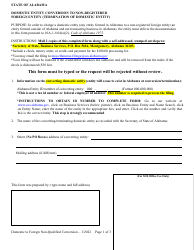

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

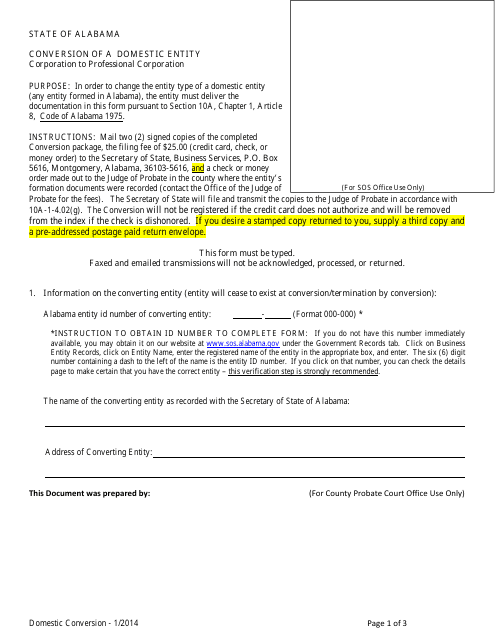

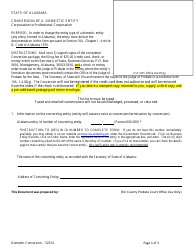

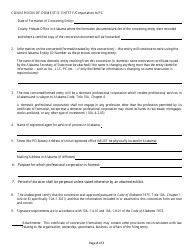

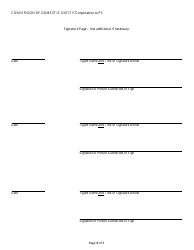

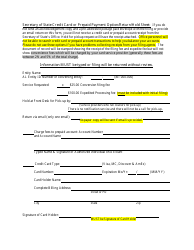

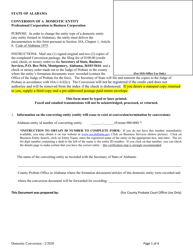

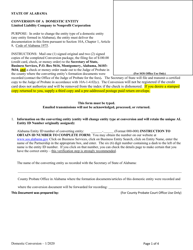

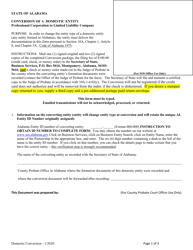

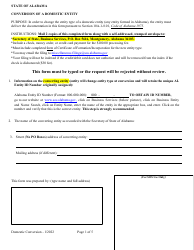

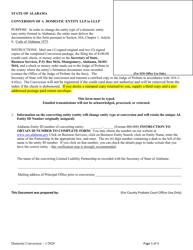

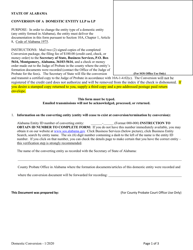

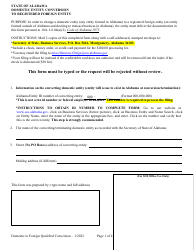

Conversion of a Domestic Entity - Corporation to Professional Corporation - Alabama

Conversion of a Domestic Entity - Corporation to Professional Corporation is a legal document that was released by the Alabama Secretary of State - a government authority operating within Alabama.

FAQ

Q: What is a professional corporation?

A: A professional corporation is a type of corporation that is formed for professional individuals, such as doctors, lawyers, and accountants.

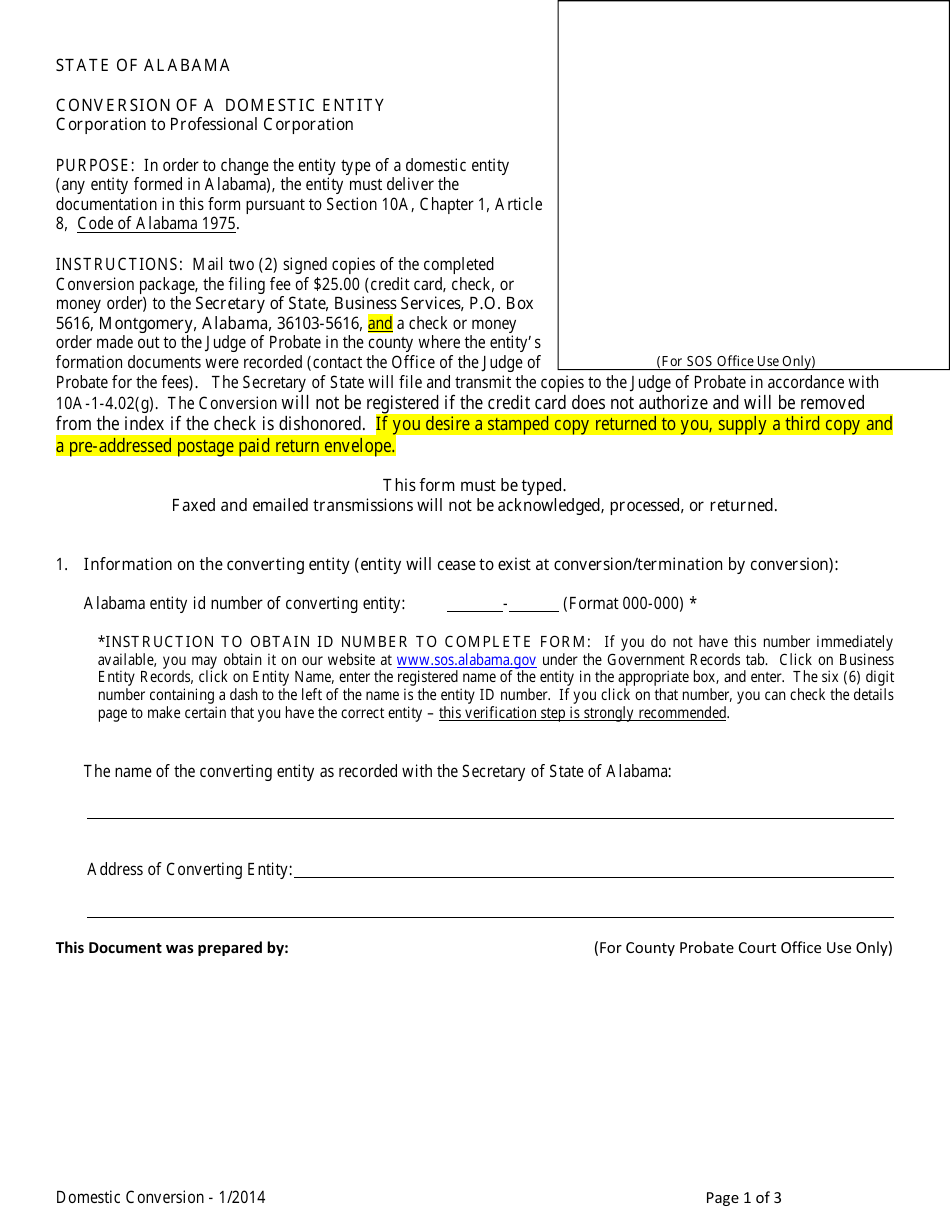

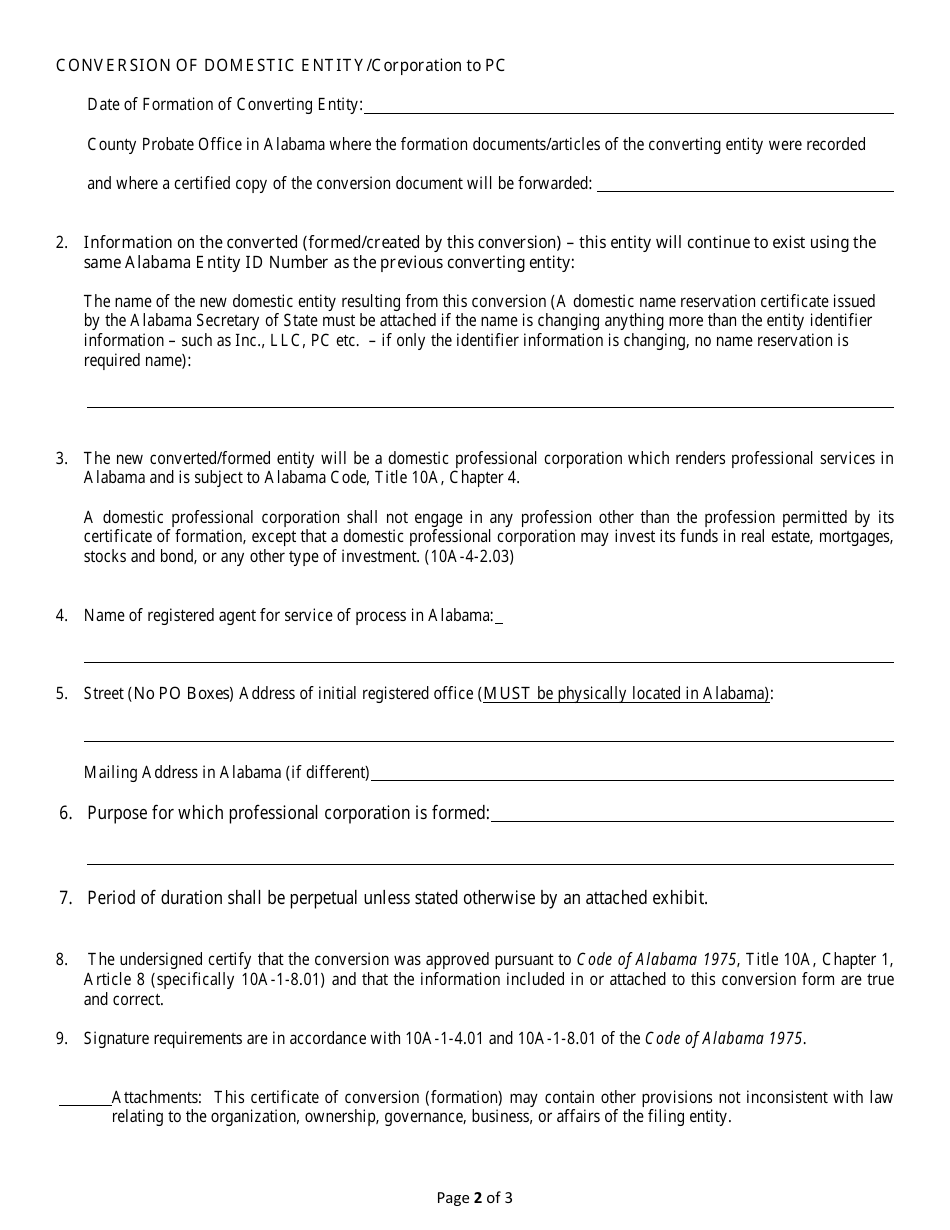

Q: What is the process for converting a domestic corporation to a professional corporation in Alabama?

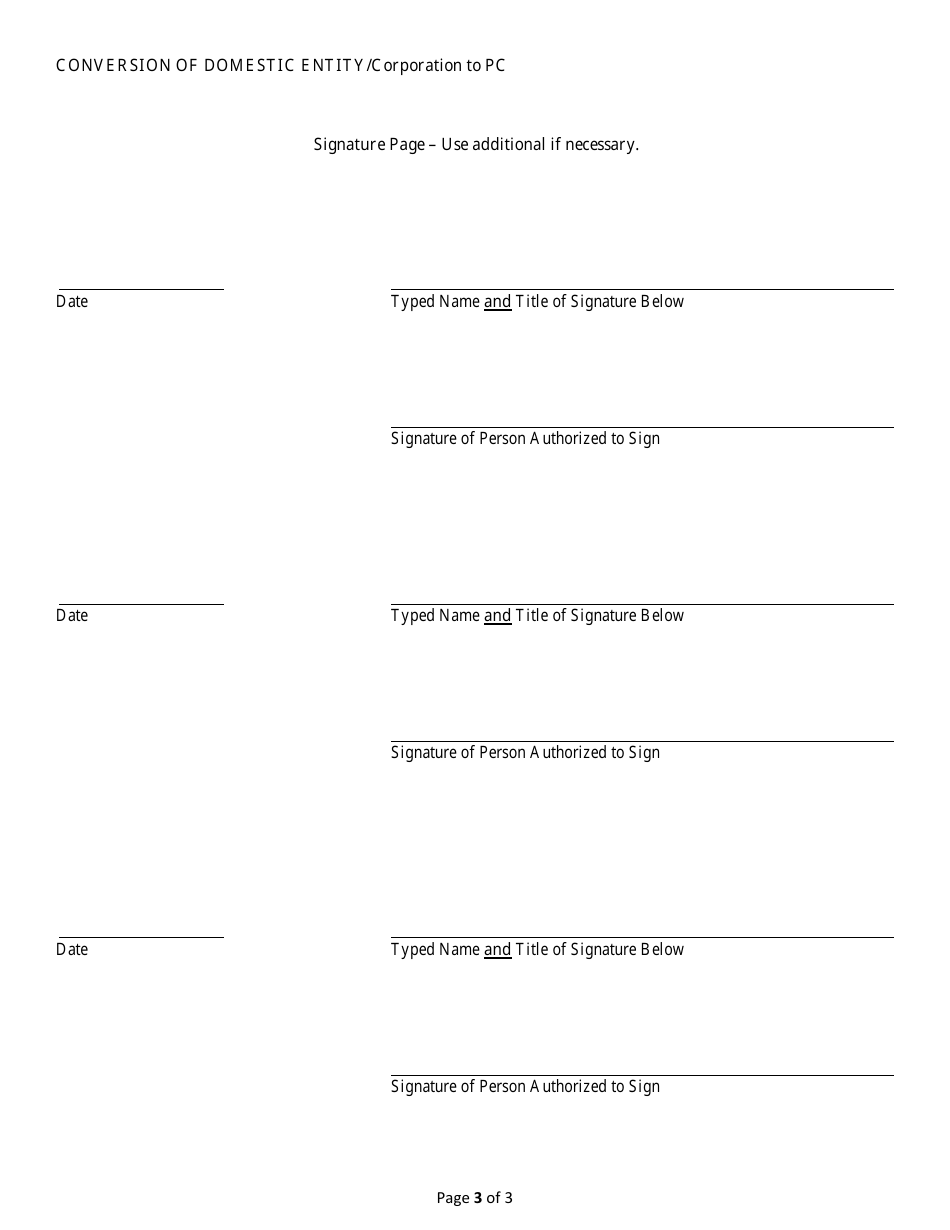

A: To convert a domestic corporation to a professional corporation in Alabama, you need to file a Certificate of Conversion and a Certificate of Formation for the professional corporation with the Alabama Secretary of State.

Q: What information is required to convert a domestic corporation to a professional corporation in Alabama?

A: When converting a domestic corporation to a professional corporation in Alabama, you need to provide the names of the shareholders, the new name of the professional corporation, and a statement that the corporation will engage in a professional service.

Q: Are there any specific requirements for shareholders of a professional corporation in Alabama?

A: Yes, shareholders of a professional corporation in Alabama must be licensed or otherwise legally authorized to render the professional service for which the corporation is formed.

Q: What are the benefits of converting a domestic corporation to a professional corporation in Alabama?

A: Some benefits of converting a domestic corporation to a professional corporation in Alabama include liability protection for individual shareholders, tax advantages, and the ability to market the corporation as a professional entity.

Q: Are there any limitations on who can form a professional corporation in Alabama?

A: Yes, only individuals who are licensed or legally authorized to render the professional service for which the corporation is formed can form a professional corporation in Alabama.

Q: Can a professional corporation in Alabama offer services outside of the licensed profession?

A: No, a professional corporation in Alabama can only engage in the specific licensed profession for which it is formed.

Q: Is it necessary to have a professional corporation in Alabama?

A: Having a professional corporation in Alabama can offer certain benefits, such as liability protection and tax advantages, but it is not a requirement for all professional individuals.

Q: What are the filing fees for converting a domestic corporation to a professional corporation in Alabama?

A: The filing fees for converting a domestic corporation to a professional corporation in Alabama vary depending on the specific circumstances of the conversion. It is recommended to check with the Alabama Secretary of State for the most up-to-date fee information.

Form Details:

- Released on January 1, 2014;

- The latest edition currently provided by the Alabama Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Alabama Secretary of State.