This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

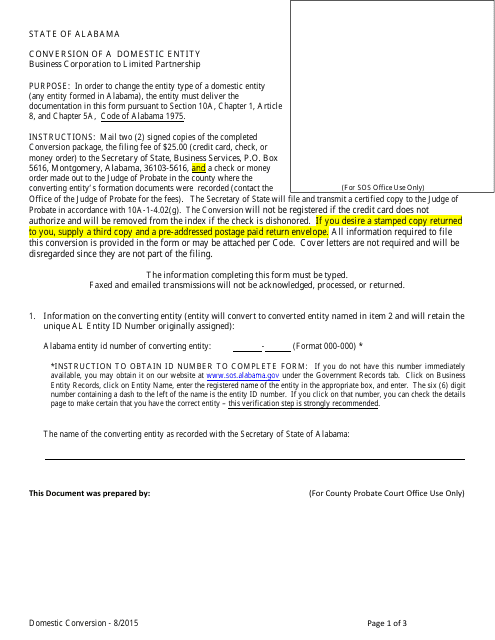

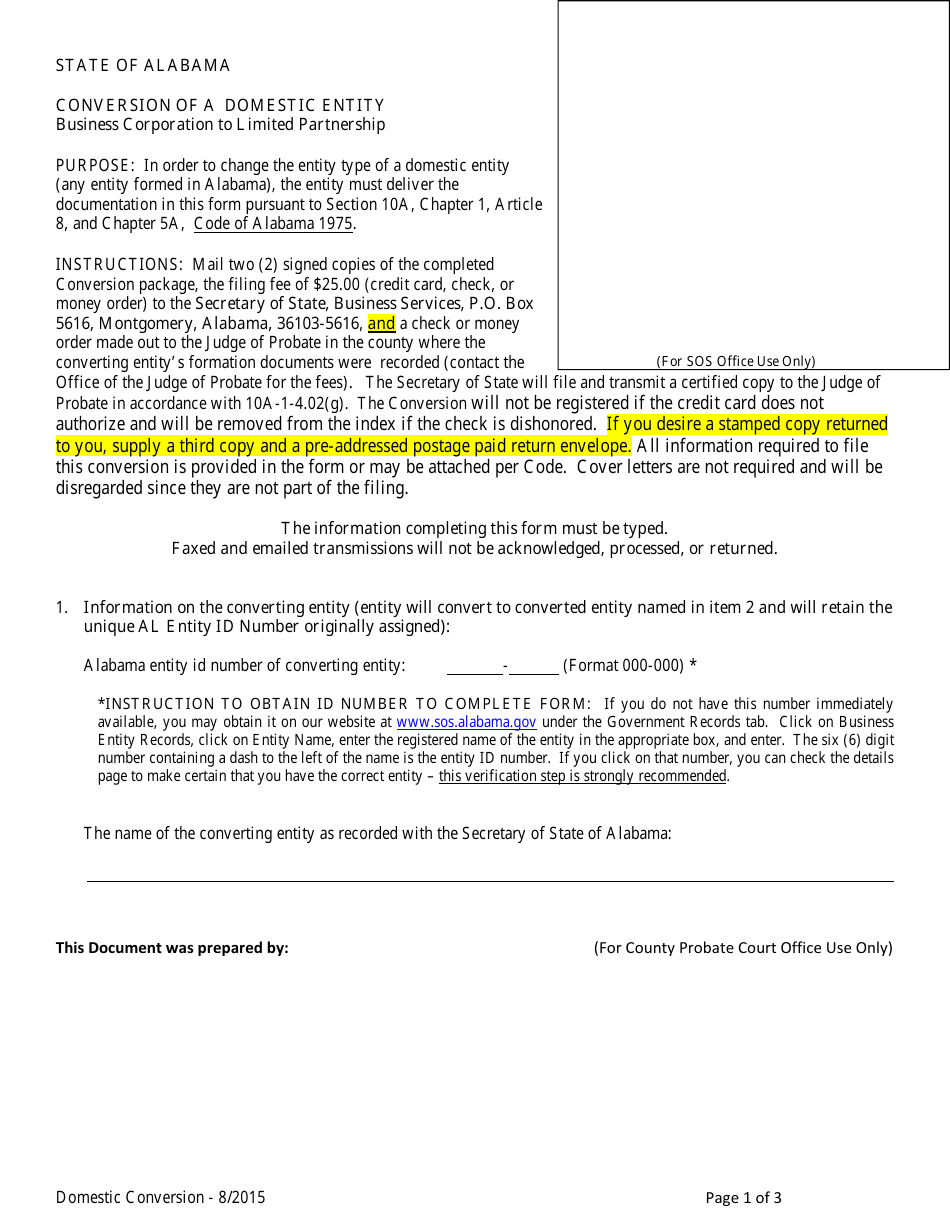

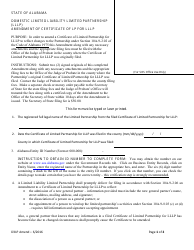

Conversion of a Domestic Entity - Business Corporation to Limited Partnership - Alabama

Conversion of a Business Corporation to Limited Partnership is a legal document that was released by the Alabama Secretary of State - a government authority operating within Alabama.

FAQ

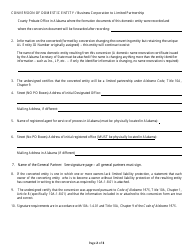

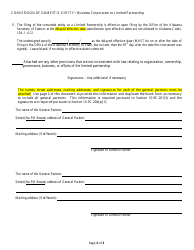

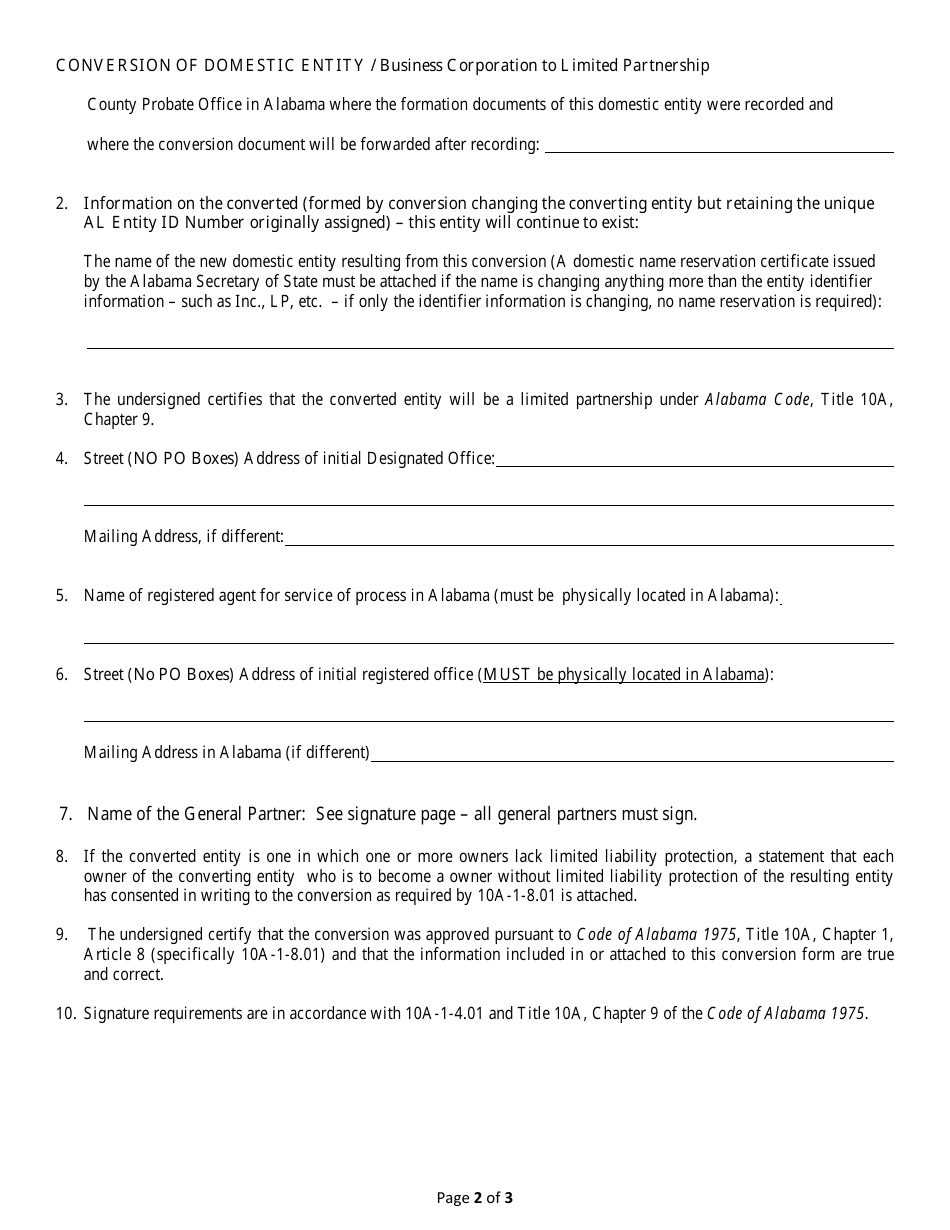

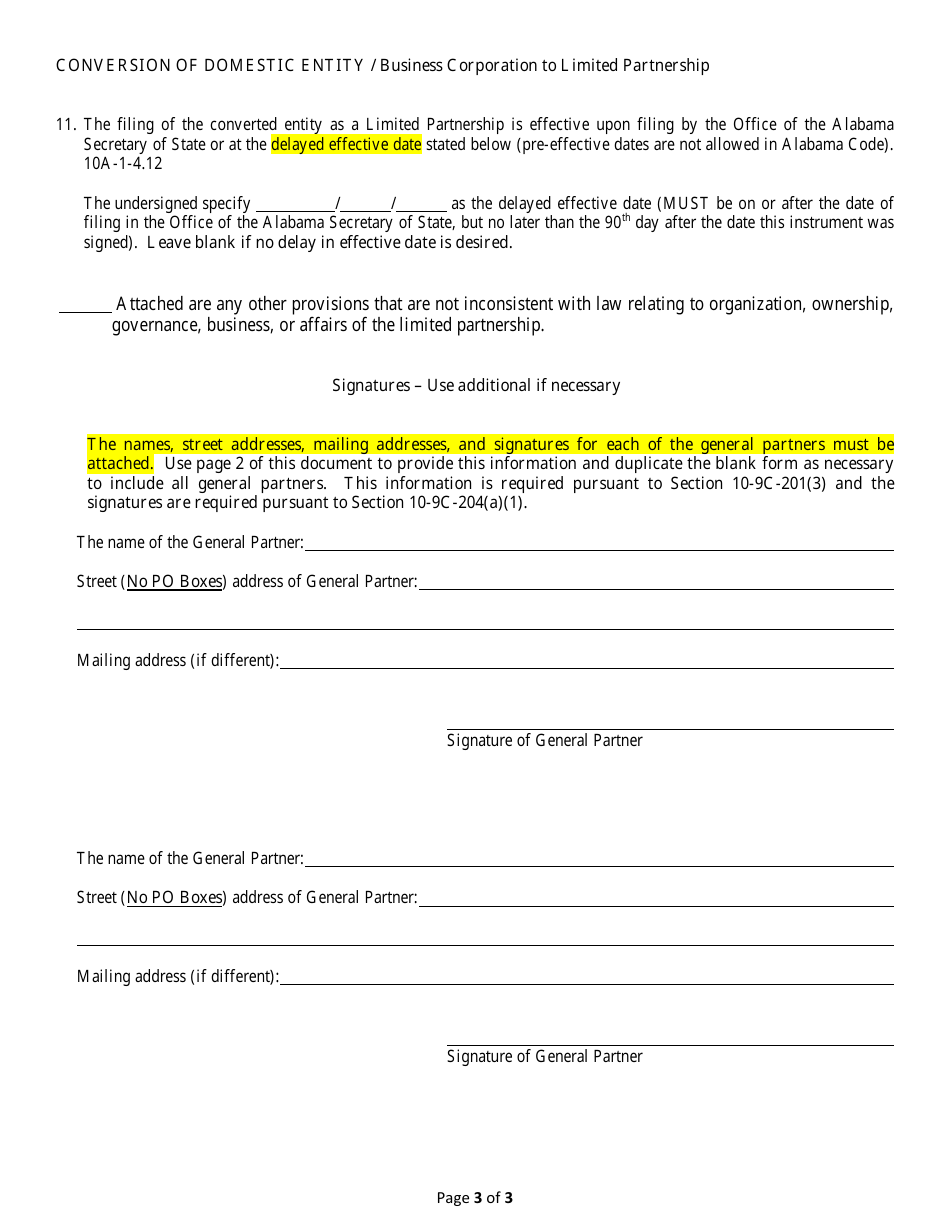

Q: What is the process for converting a Domestic Business Corporation to a Limited Partnership in Alabama?

A: The process involves filing a Certificate of Conversion with the Alabama Secretary of State.

Q: What is a Domestic Business Corporation?

A: A Domestic Business Corporation is a type of business entity that is incorporated and operating within the state of Alabama.

Q: What is a Limited Partnership?

A: A Limited Partnership is a type of business entity that consists of general partners who manage the business and limited partners who invest in the business but have limited liability.

Q: Why would a Domestic Business Corporation choose to convert to a Limited Partnership?

A: There may be various reasons for such a conversion, such as a change in the business structure, tax advantages, or the desire to bring in additional investors.

Q: What documents need to be filed for the conversion?

A: The primary document that needs to be filed is the Certificate of Conversion, along with any other required forms or supporting documents as specified by the Secretary of State.

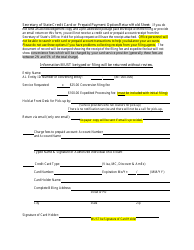

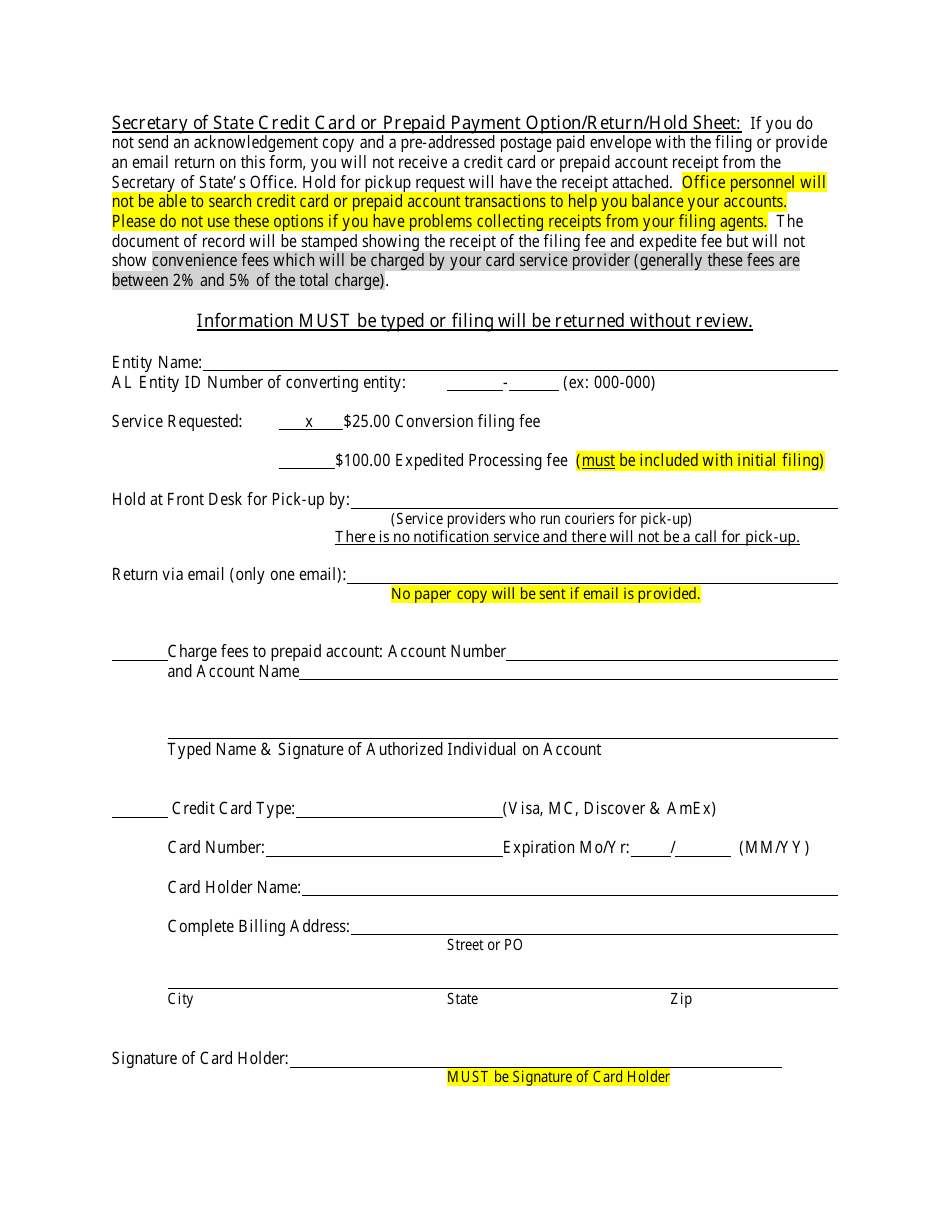

Q: Is there a fee for filing the conversion?

A: Yes, there is typically a filing fee for submitting the Certificate of Conversion and any other related documents.

Q: Can an attorney or legal service assist with the conversion process?

A: Yes, it is recommended to consult with an attorney or legal service familiar with business entity conversions to ensure compliance and accuracy throughout the process.

Q: Is there a specific timeframe for completing the conversion?

A: The timeframe may vary depending on various factors, including the efficiency of document preparation and processing by the Secretary of State.

Q: Are there any specific requirements or qualifications for converting a Domestic Business Corporation to a Limited Partnership?

A: Yes, it is important to review the relevant laws, regulations, and guidelines specific to Alabama and consult with an attorney or legal service to ensure compliance with all requirements and qualifications.

Q: Are there any tax implications associated with the conversion?

A: There may be tax implications associated with converting a Domestic Business Corporation to a Limited Partnership. It is advisable to consult with a tax professional to understand and address any potential tax consequences.

Form Details:

- Released on August 1, 0215;

- The latest edition currently provided by the Alabama Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Alabama Secretary of State.