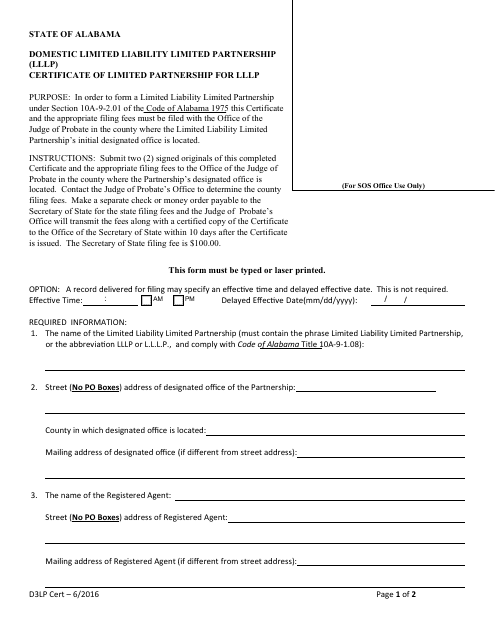

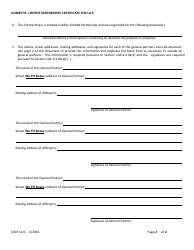

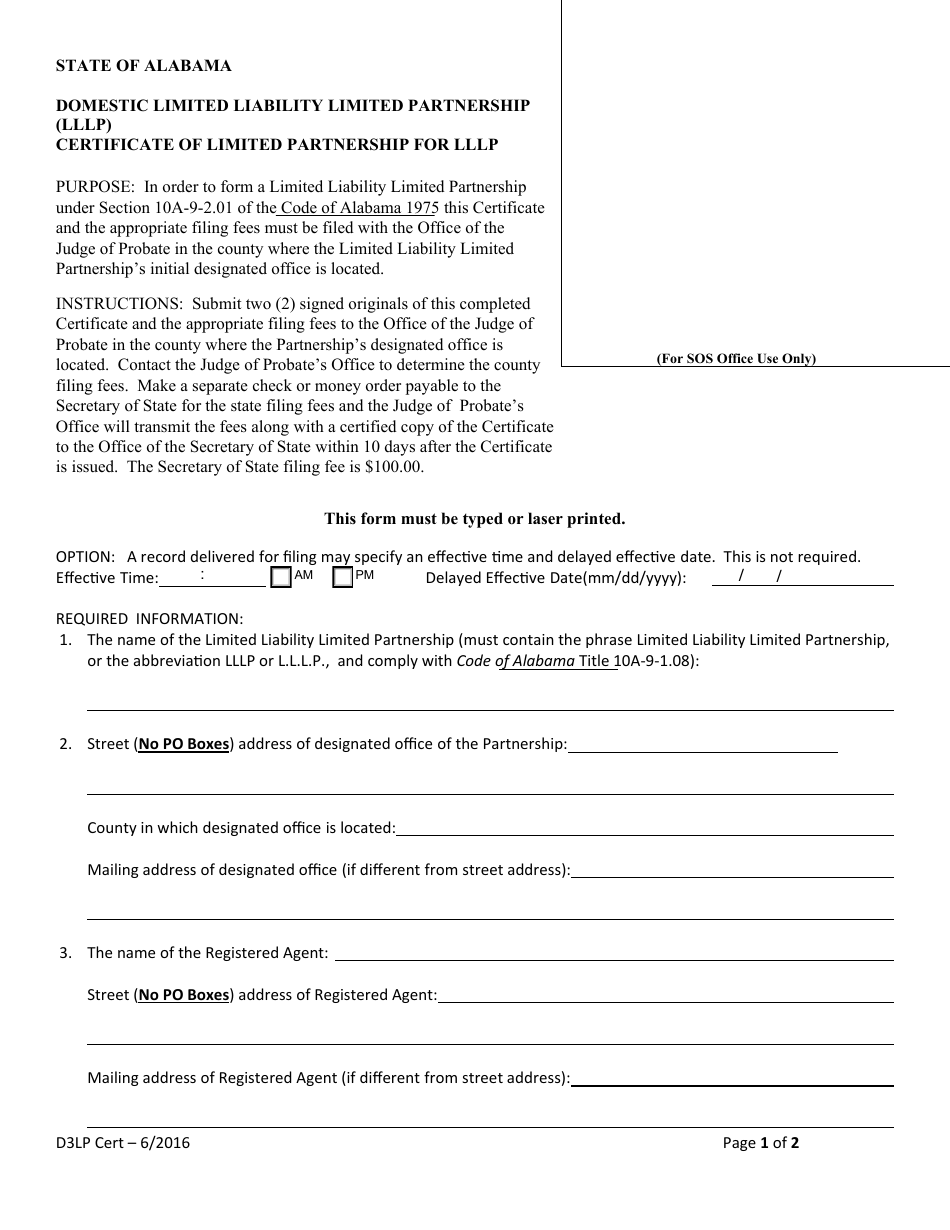

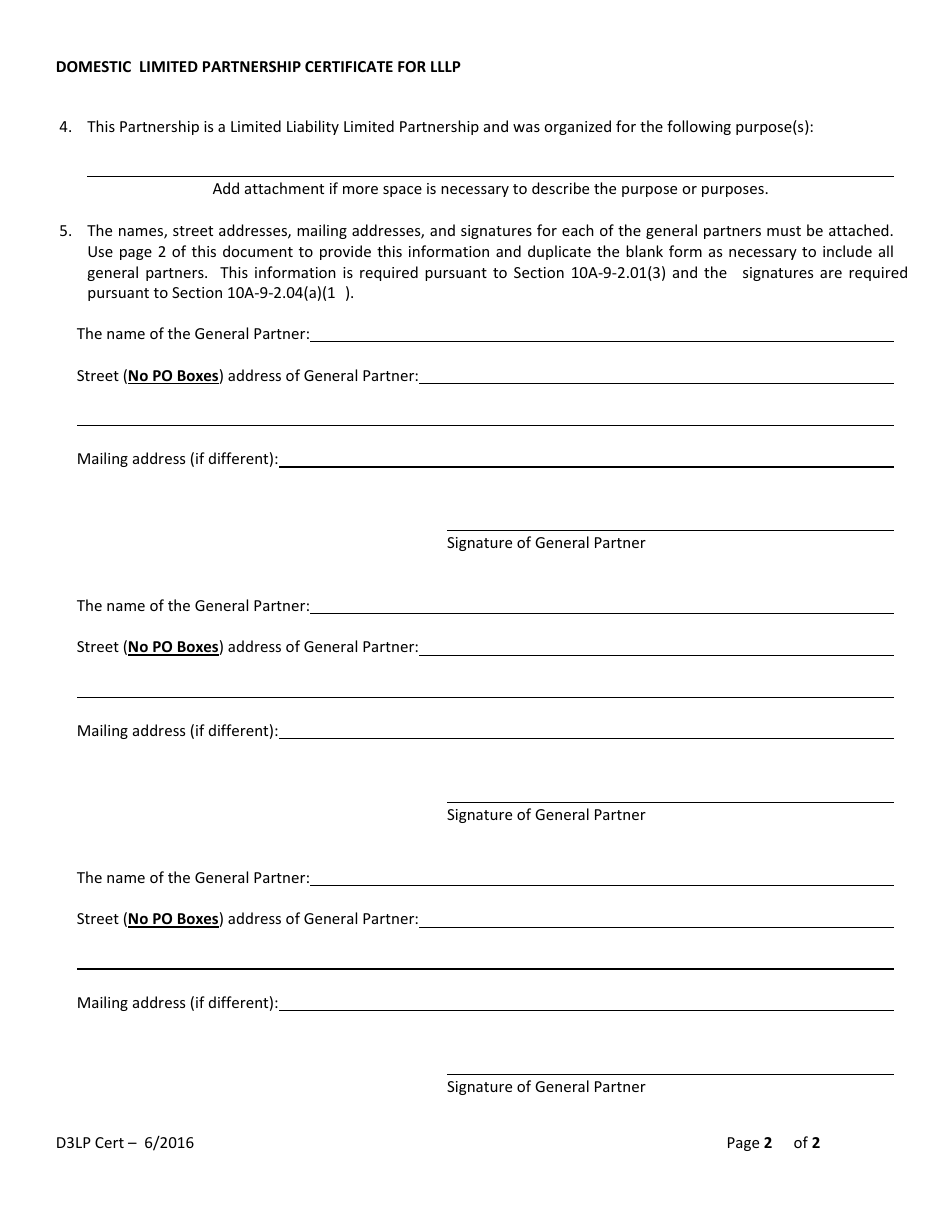

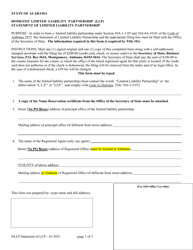

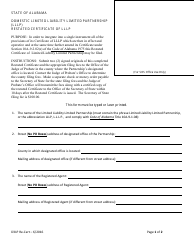

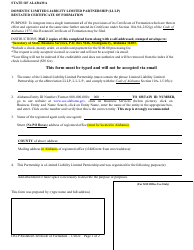

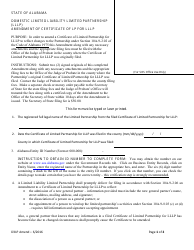

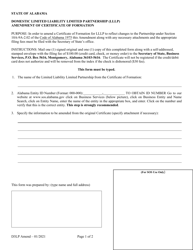

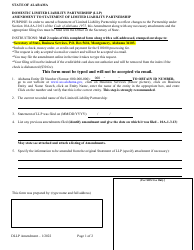

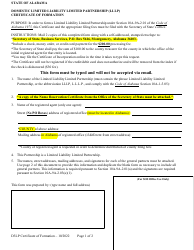

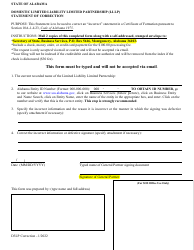

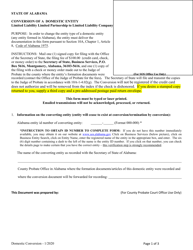

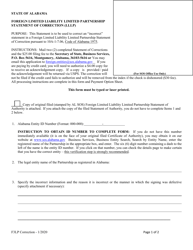

Domestic Limited Liability Limited Partnership (Lllp) Certificate of Limited Partnership for Lllp - Alabama

Domestic Limited Partnership for Lllp is a legal document that was released by the Alabama Secretary of State - a government authority operating within Alabama.

FAQ

Q: What is a Domestic Limited Liability Limited Partnership (LLLP)?

A: A Domestic Limited Liability Limited Partnership (LLLP) is a type of partnership that offers the limited liability protection of a corporation and the tax advantages of a partnership.

Q: What is a Certificate of Limited Partnership for LLLP?

A: A Certificate of Limited Partnership for LLLP is a legal document filed with the state of Alabama that establishes the formation of a Limited Liability Limited Partnership.

Q: What are the benefits of forming an LLLP?

A: One of the benefits of forming an LLLP is that it provides limited liability protection to its partners, shielding them from personal liability for the partnership's debts and liabilities.

Q: What are the tax advantages of an LLLP?

A: The tax advantages of an LLLP include the ability to pass profits and losses through to the partners' personal income tax returns, avoiding double taxation.

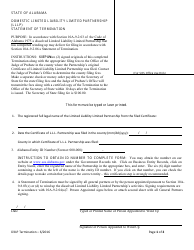

Q: How do I form an LLLP in Alabama?

A: To form an LLLP in Alabama, you need to file a Certificate of Limited Partnership with the Alabama Secretary of State and comply with any additional requirements set forth by the state.

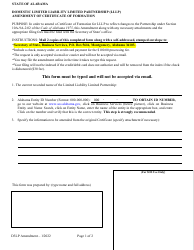

Q: Are there any ongoing obligations for an LLLP?

A: Yes, an LLLP is required to file annual reports with the Alabama Secretary of State and fulfill any other obligations outlined by the state's laws.

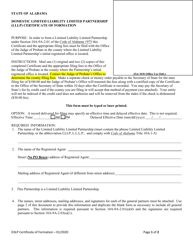

Q: Can an LLLP be converted into a different legal entity?

A: Yes, it is possible to convert an LLLP into a different legal entity, such as a corporation or a limited liability company (LLC), by following the appropriate legal procedures.

Q: Can an LLLP operate in multiple states?

A: Yes, an LLLP can operate in multiple states by filing the necessary foreign qualification documents in each state where it wishes to conduct business.

Q: Is professional assistance necessary to form an LLLP?

A: While it is not required, seeking professional assistance from an attorney or business formation service can help ensure that the formation process is completed accurately and in compliance with the applicable laws.

Q: What is the difference between an LLLP and an LLC?

A: The main difference between an LLLP and an LLC is that an LLLP is specifically designed for professional entities, such as law firms and accounting firms, whereas an LLC can be formed for any type of business or investment activity.

Form Details:

- Released on June 1, 2016;

- The latest edition currently provided by the Alabama Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Alabama Secretary of State.