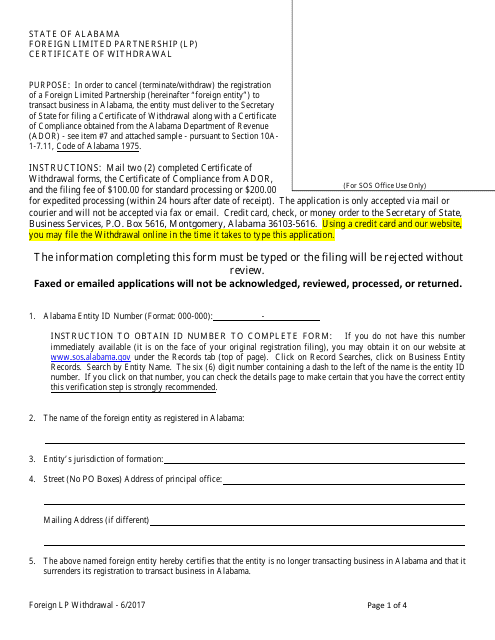

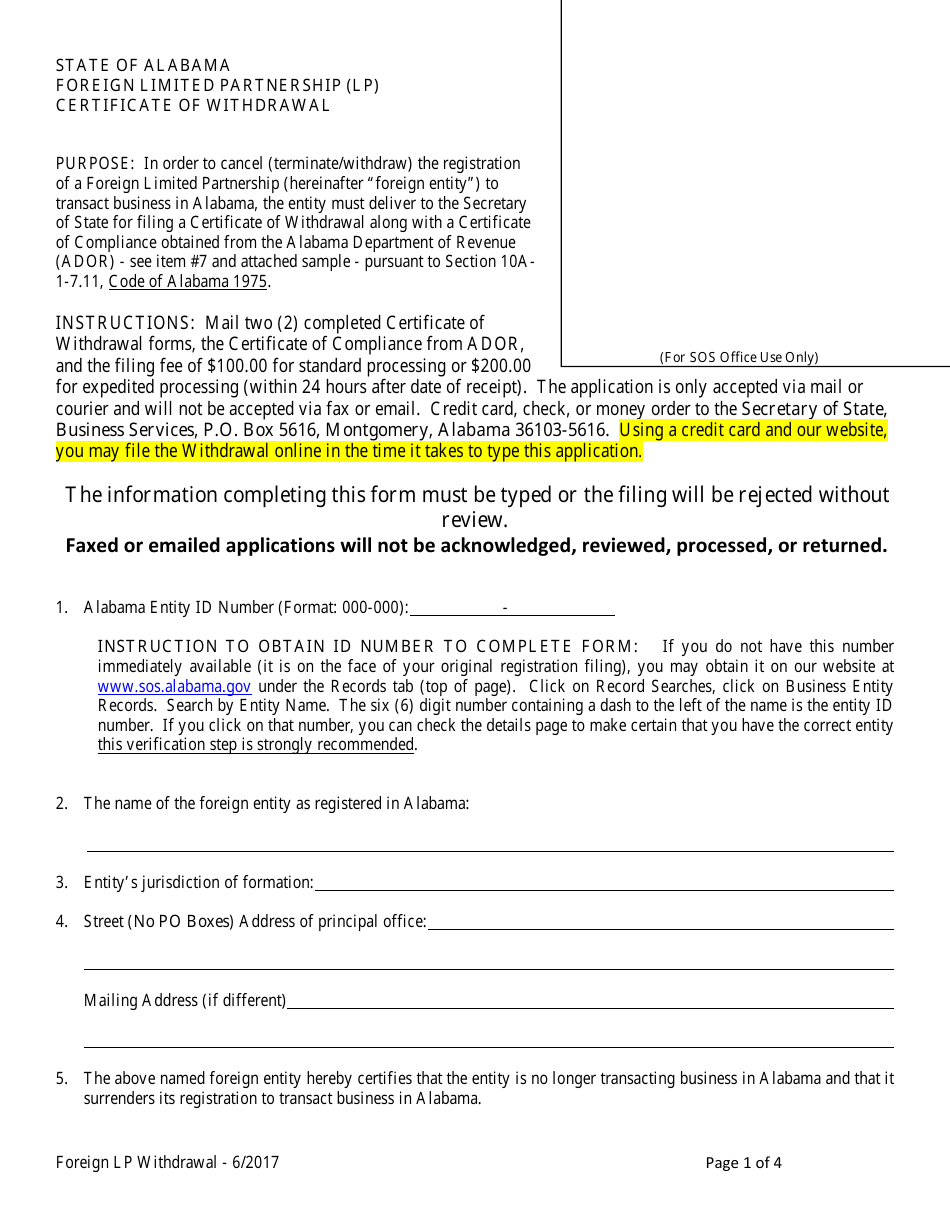

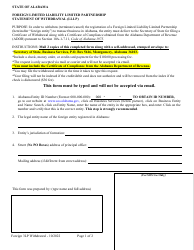

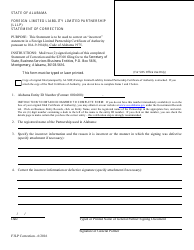

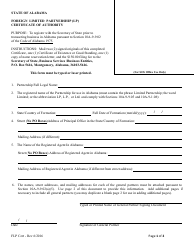

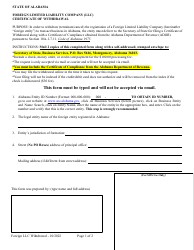

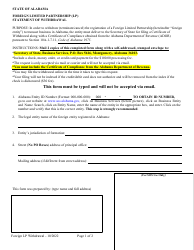

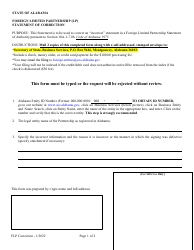

Foreign Limited Partnership (Lp) Certificate of Withdrawal - Alabama

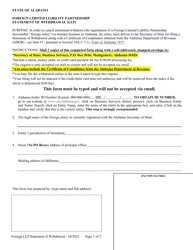

Foreign Limited Partnership (Lp) Certificate of Withdrawal is a legal document that was released by the Alabama Secretary of State - a government authority operating within Alabama.

FAQ

Q: What is a Foreign Limited Partnership?

A: A Foreign Limited Partnership (LP) is a type of business entity that is formed in one state but conducts business in another state.

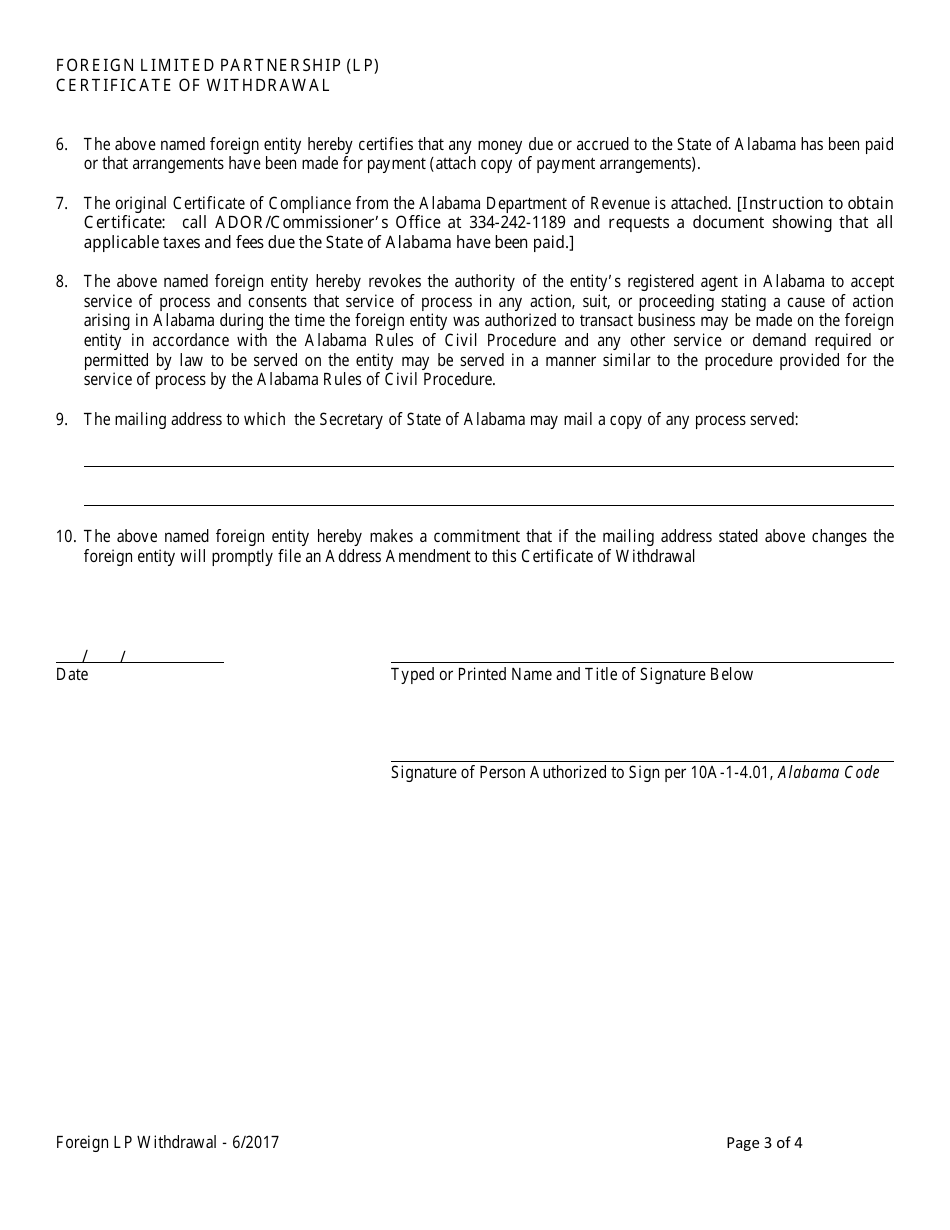

Q: What is a Certificate of Withdrawal?

A: A Certificate of Withdrawal is a legal document filed by a foreign limited partnership to officially terminate its authority to conduct business in a specific state.

Q: What is a Foreign Limited Partnership (LP) Certificate of Withdrawal in Alabama?

A: In Alabama, a Foreign Limited Partnership (LP) Certificate of Withdrawal is the document that foreign limited partnerships use to cease their authority to conduct business in the state of Alabama.

Q: How can I file a Foreign Limited Partnership Certificate of Withdrawal in Alabama?

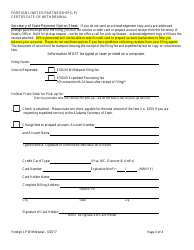

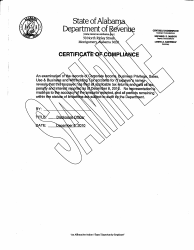

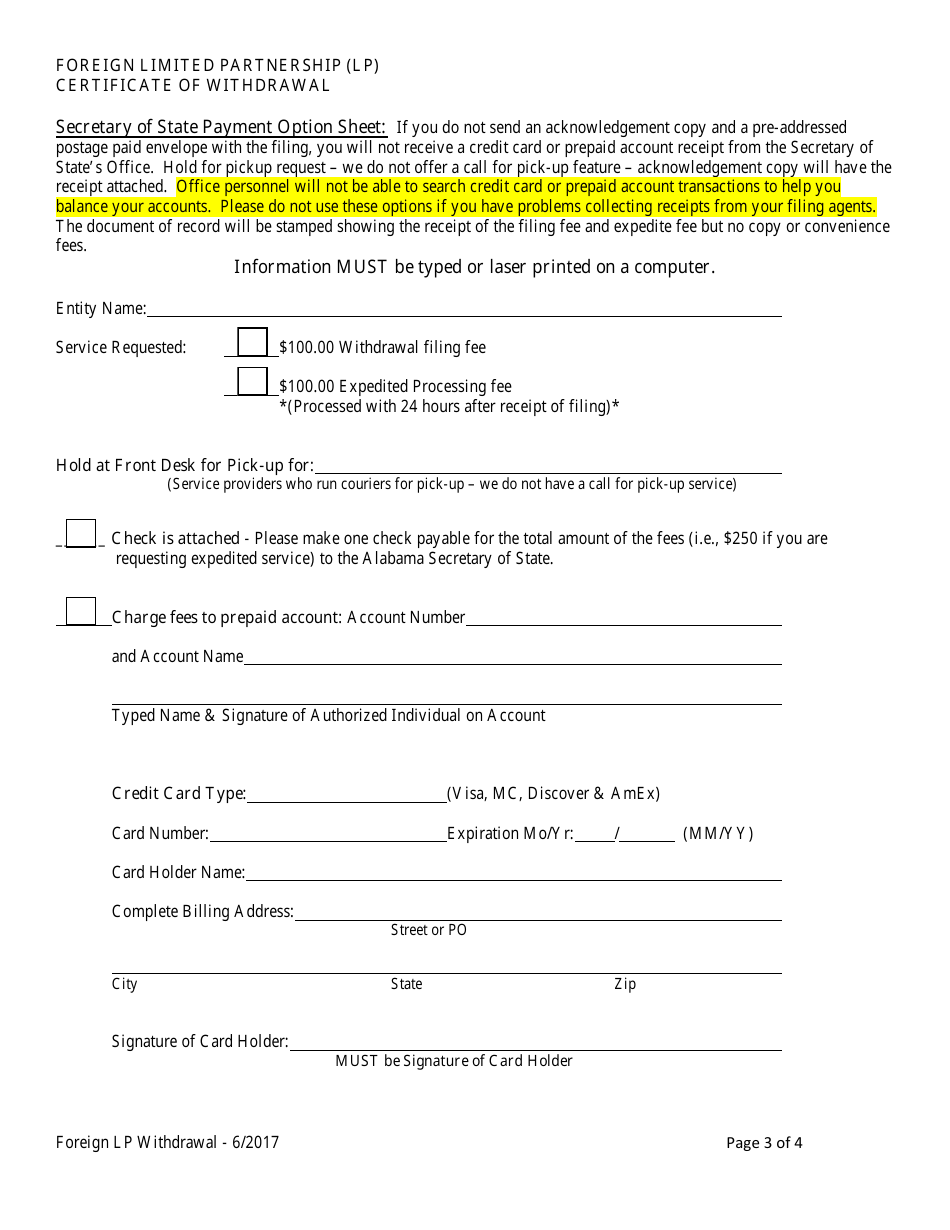

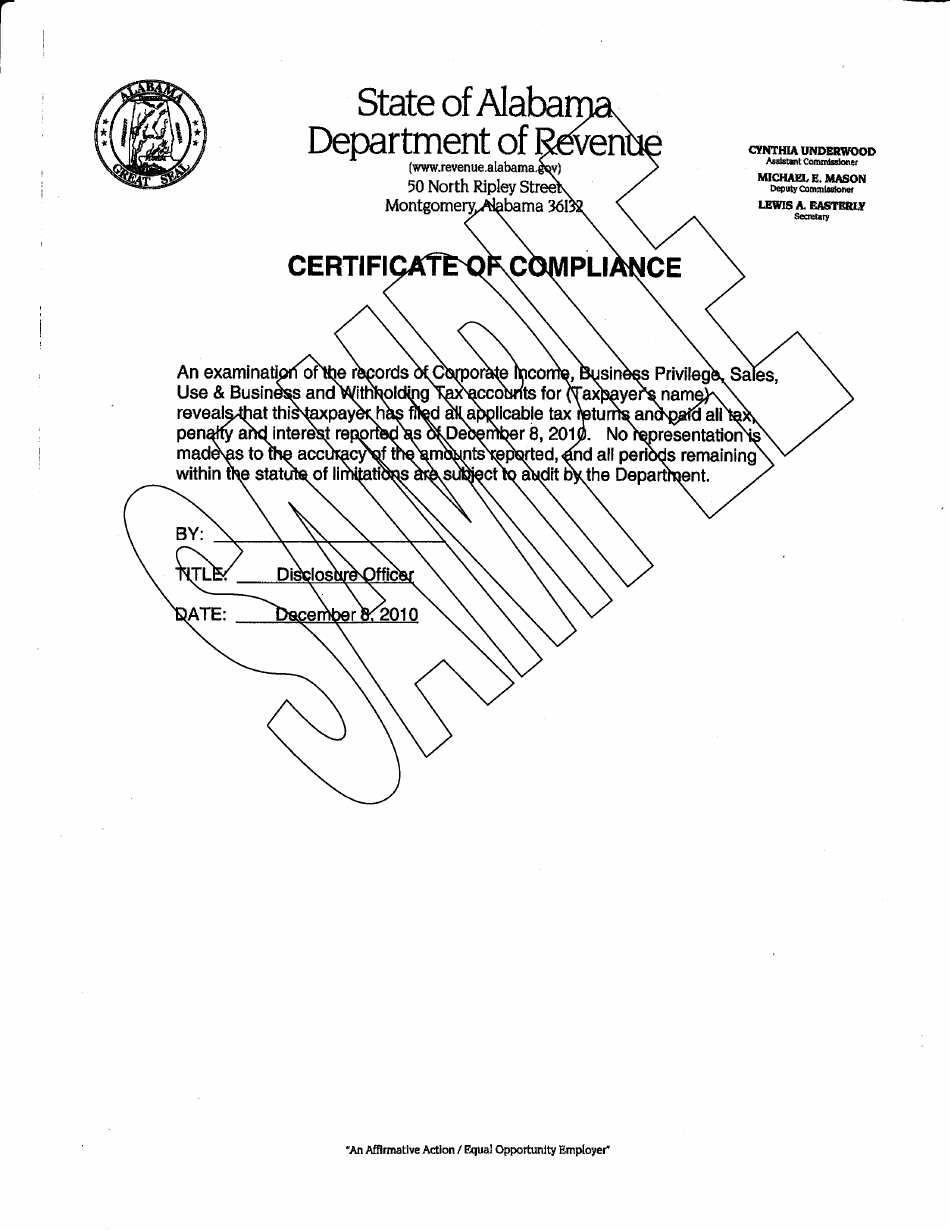

A: To file a Foreign Limited Partnership Certificate of Withdrawal in Alabama, you need to complete the necessary form provided by the Alabama Secretary of State and submit it along with the required filing fee.

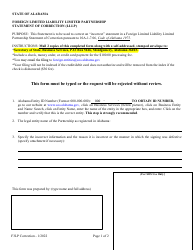

Q: What happens after filing a Foreign Limited Partnership Certificate of Withdrawal in Alabama?

A: After filing a Foreign Limited Partnership Certificate of Withdrawal in Alabama, the foreign limited partnership's authority to conduct business in the state will be terminated. The partnership will no longer be required to file annual reports or pay state taxes in Alabama.

Q: Can a foreign limited partnership reinstate its authority to do business in Alabama after filing a Certificate of Withdrawal?

A: Yes, if a foreign limited partnership wishes to reinstate its authority to do business in Alabama after filing a Certificate of Withdrawal, it will need to file a Certificate of Reinstatement with the Alabama Secretary of State and fulfill any other requirements set forth by the state.

Q: What are the consequences of not filing a Foreign Limited Partnership Certificate of Withdrawal in Alabama?

A: If a foreign limited partnership does not file a Certificate of Withdrawal in Alabama, it may still be responsible for filing annual reports and paying state taxes in Alabama, even if it is no longer conducting business in the state.

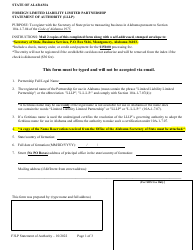

Form Details:

- Released on June 1, 2017;

- The latest edition currently provided by the Alabama Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Alabama Secretary of State.