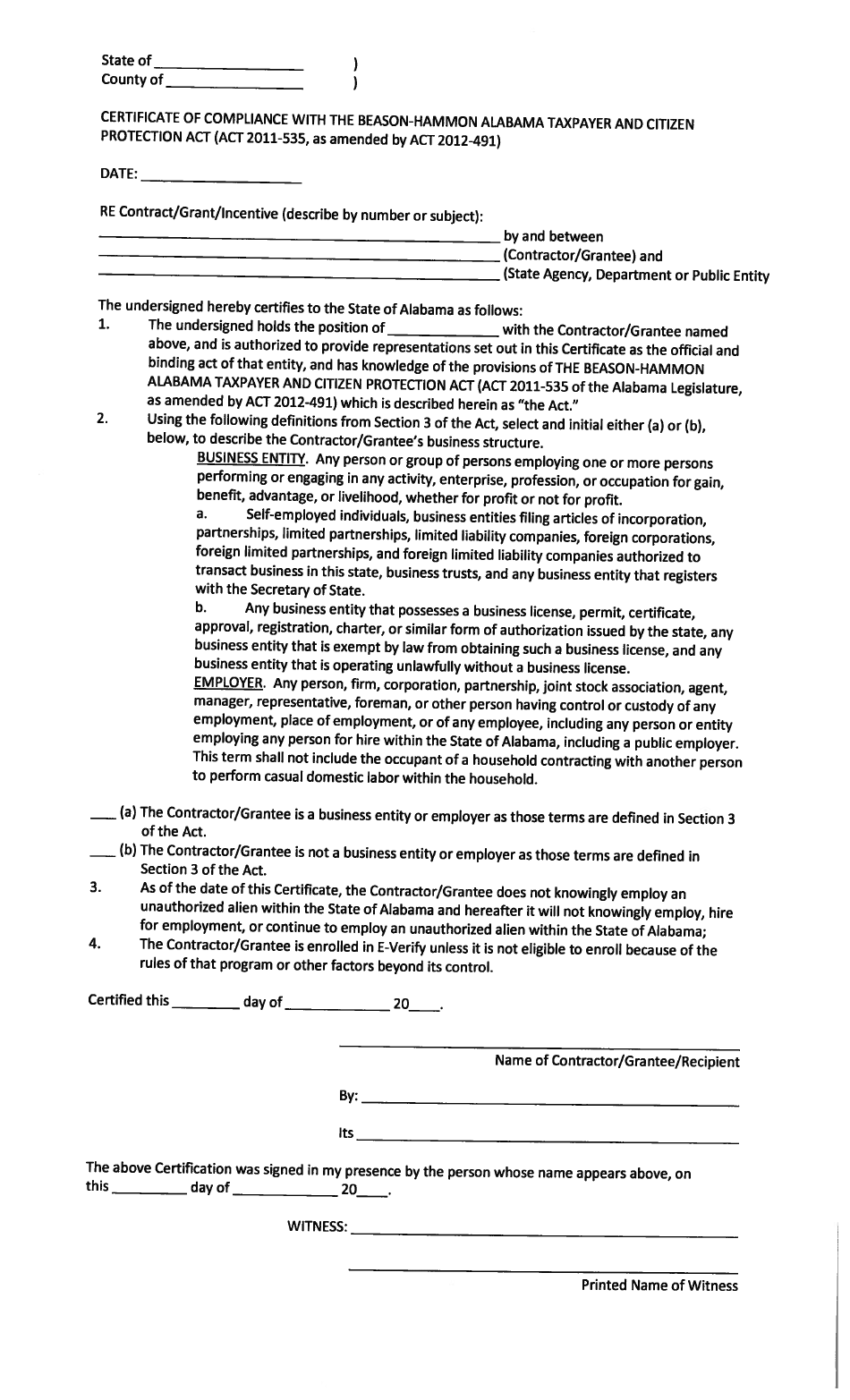

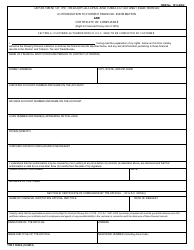

Certificate of Compliance With the Beason-Hammon Alabama Taxpayer and Citizen Protection Act - Alabama

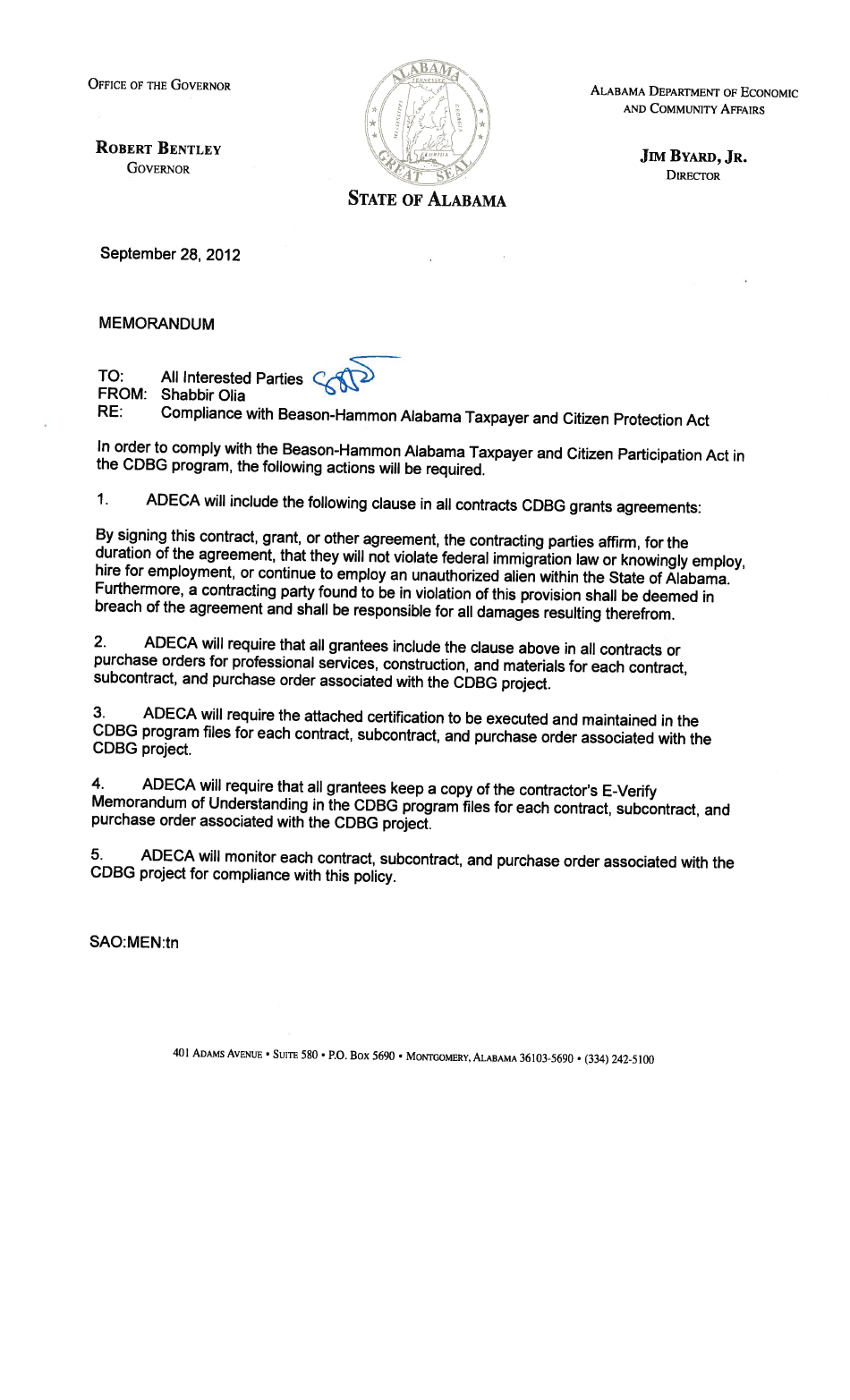

Certificate of Compliance With the Beason-Hammon Alabama Taxpayer and Citizen Protection Act is a legal document that was released by the Alabama Department of Economic and Community Affairs - a government authority operating within Alabama.

FAQ

Q: What is the Beason-Hammon Alabama Taxpayer and Citizen Protection Act?

A: The Beason-Hammon Alabama Taxpayer and Citizen Protection Act is an Alabama law that aims to address issues related to immigration and protect taxpayers and citizens.

Q: What does the Certificate of Compliance refer to?

A: The Certificate of Compliance refers to a document that confirms an individual or entity's compliance with the Beason-Hammon Alabama Taxpayer and Citizen Protection Act.

Q: Who needs to obtain a Certificate of Compliance?

A: Certain individuals and entities in Alabama, such as contractors and subcontractors, need to obtain a Certificate of Compliance.

Q: How can one obtain a Certificate of Compliance?

A: To obtain a Certificate of Compliance, individuals or entities need to complete the application process and meet the requirements outlined by the Alabama Department of Homeland Security.

Q: What are the consequences of not having a Certificate of Compliance?

A: Failure to have a valid Certificate of Compliance may result in penalties, fines, or other legal consequences.

Q: Is the Certificate of Compliance only relevant to businesses?

A: No, the Certificate of Compliance is not only relevant to businesses. It may also apply to individuals in certain situations.

Q: Is the Beason-Hammon Alabama Taxpayer and Citizen Protection Act applicable to non-residents of Alabama?

A: Yes, the Beason-Hammon Alabama Taxpayer and Citizen Protection Act applies to both residents and non-residents of Alabama who meet certain criteria.

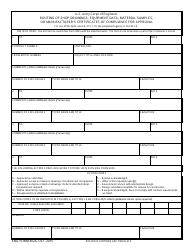

Form Details:

- The latest edition currently provided by the Alabama Department of Economic and Community Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Alabama Department of Economic and Community Affairs.