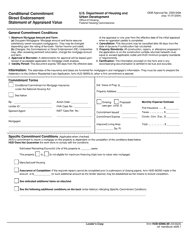

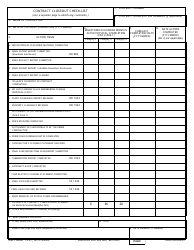

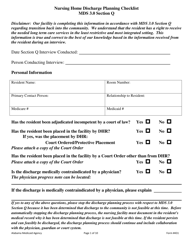

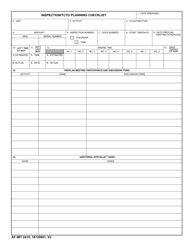

Letter of Conditional Commitment Planning Checklist - Alabama

Letter of Conditional Commitment Planning Checklist is a legal document that was released by the Alabama Department of Economic and Community Affairs - a government authority operating within Alabama.

FAQ

Q: What is a Letter of Conditional Commitment?

A: A Letter of Conditional Commitment is a document issued by a lender to a borrower, indicating that the lender is willing to provide a loan under certain conditions.

Q: Who issues a Letter of Conditional Commitment?

A: A lender issues a Letter of Conditional Commitment to a borrower.

Q: What does a Letter of Conditional Commitment indicate?

A: A Letter of Conditional Commitment indicates that a lender is willing to provide a loan to the borrower, subject to certain conditions being met.

Q: What are the conditions mentioned in a Letter of Conditional Commitment?

A: The specific conditions mentioned in a Letter of Conditional Commitment can vary, but they typically include requirements related to creditworthiness, property appraisal, and documentation.

Q: What is the purpose of a Letter of Conditional Commitment?

A: The purpose of a Letter of Conditional Commitment is to assure the borrower that the lender is willing to provide a loan, provided that certain conditions are met.

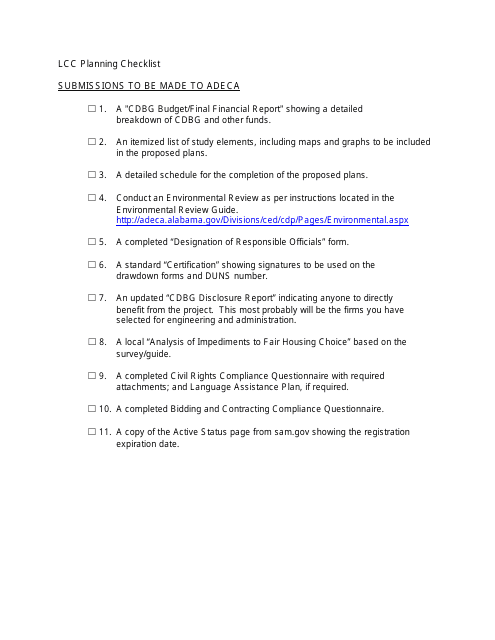

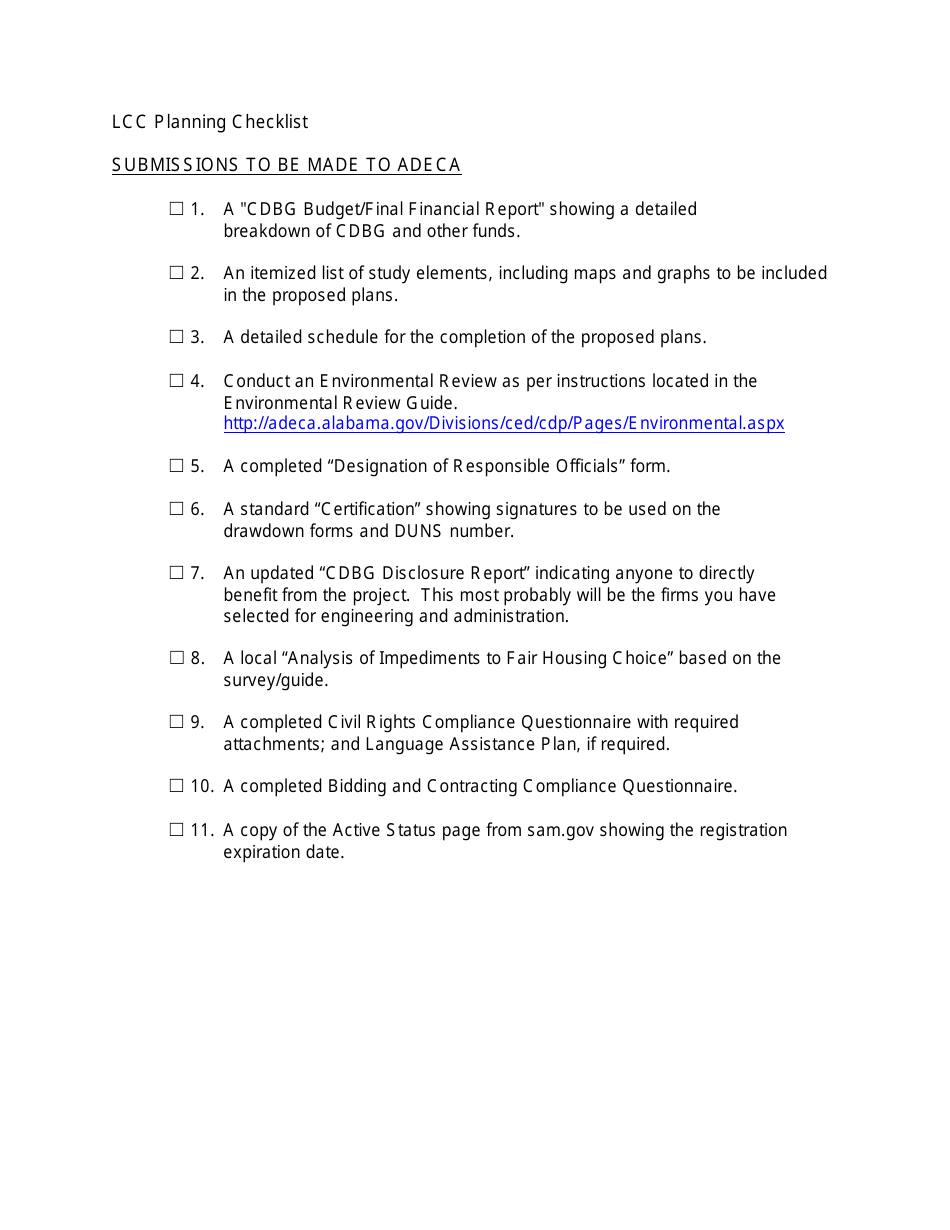

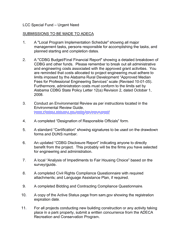

Q: What should be included in a planning checklist for a Letter of Conditional Commitment?

A: A planning checklist for a Letter of Conditional Commitment should include steps such as gathering necessary documents, completing a loan application, obtaining a property appraisal, and reviewing the terms of the commitment.

Q: Why is a planning checklist important?

A: A planning checklist is important because it helps borrowers stay organized and ensure that they complete all the necessary steps to obtain a Letter of Conditional Commitment.

Q: What happens after receiving a Letter of Conditional Commitment?

A: After receiving a Letter of Conditional Commitment, the borrower should review the terms and conditions, satisfy any remaining conditions, and proceed with the loan closing process.

Q: Can a Letter of Conditional Commitment be revoked?

A: Yes, a Letter of Conditional Commitment can be revoked if the borrower fails to satisfy the conditions mentioned in the letter or if there are significant changes in the borrower's financial situation.

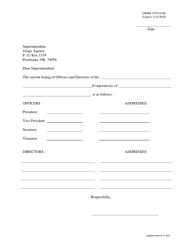

Form Details:

- The latest edition currently provided by the Alabama Department of Economic and Community Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Alabama Department of Economic and Community Affairs.