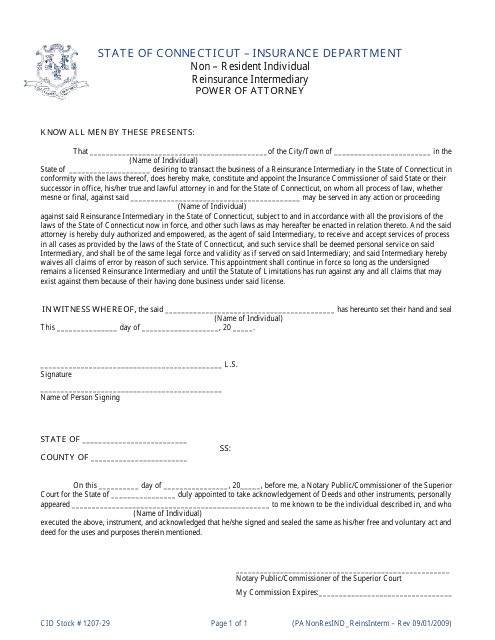

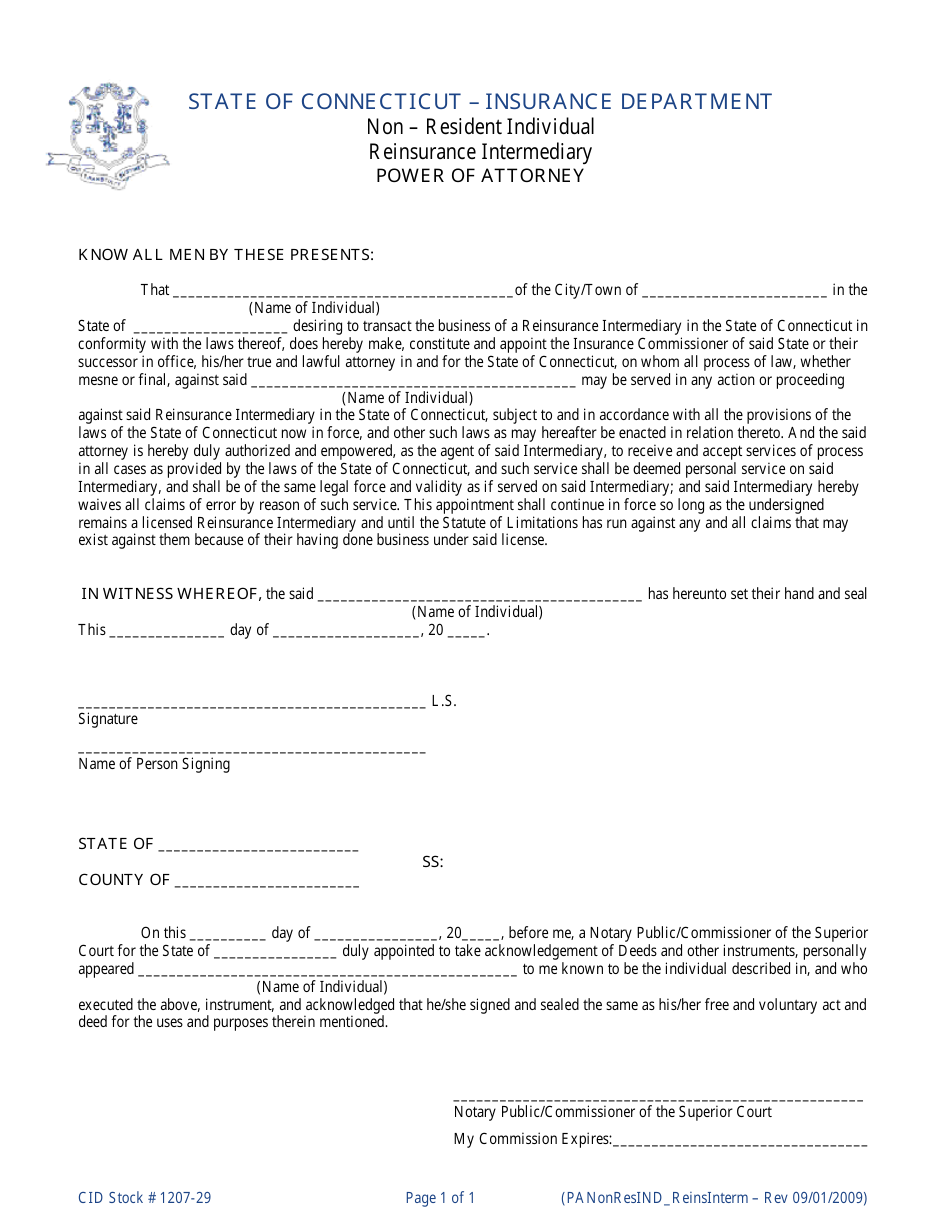

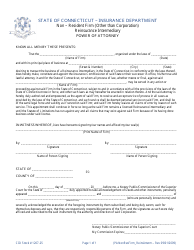

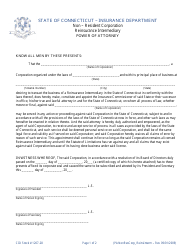

Reinsurance Intermediary Power of Attorney (Nonresident Individual) - Connecticut

Reinsurance Intermediary Power of Attorney (Nonresident Individual) is a legal document that was released by the Connecticut Insurance Department - a government authority operating within Connecticut.

FAQ

Q: What is a Reinsurance Intermediary Power of Attorney?

A: A Reinsurance Intermediary Power of Attorney is a legal document that grants authority to a nonresident individual to act on behalf of an insurance company in Connecticut.

Q: Who can use a Reinsurance Intermediary Power of Attorney?

A: A nonresident individual who is acting as a reinsurance intermediary for an insurance company in Connecticut can use a Reinsurance Intermediary Power of Attorney.

Q: What is the purpose of a Reinsurance Intermediary Power of Attorney?

A: The purpose of a Reinsurance Intermediary Power of Attorney is to enable a nonresident individual to perform certain reinsurance-related activities, such as signing contracts or conducting business transactions, on behalf of an insurance company in Connecticut.

Q: What authority does a Reinsurance Intermediary Power of Attorney grant?

A: A Reinsurance Intermediary Power of Attorney grants specific authority to a nonresident individual, as specified in the document, to act on behalf of an insurance company in Connecticut.

Q: Is a Reinsurance Intermediary Power of Attorney valid for all types of insurance companies in Connecticut?

A: Yes, a Reinsurance Intermediary Power of Attorney can be used by a nonresident individual acting on behalf of any type of insurance company in Connecticut, as long as they meet the necessary requirements and qualifications.

Q: Are there any specific requirements for a Reinsurance Intermediary Power of Attorney?

A: Yes, a nonresident individual must meet certain qualifications, such as being licensed as a reinsurance intermediary in their home state, in order to use a Reinsurance Intermediary Power of Attorney.

Q: Is a Reinsurance Intermediary Power of Attorney specific to Connecticut?

A: Yes, a Reinsurance Intermediary Power of Attorney is specific to Connecticut and grants authority only for reinsurance-related activities in the state.

Q: How can a Reinsurance Intermediary Power of Attorney be revoked?

A: A Reinsurance Intermediary Power of Attorney can be revoked by either party, the nonresident individual or the insurance company, by providing written notice to the other party.

Q: Is a Reinsurance Intermediary Power of Attorney required by law in Connecticut?

A: No, a Reinsurance Intermediary Power of Attorney is not required by law in Connecticut, but it is commonly used to establish the authority of a nonresident individual acting on behalf of an insurance company.

Form Details:

- Released on September 1, 2009;

- The latest edition currently provided by the Connecticut Insurance Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Connecticut Insurance Department.