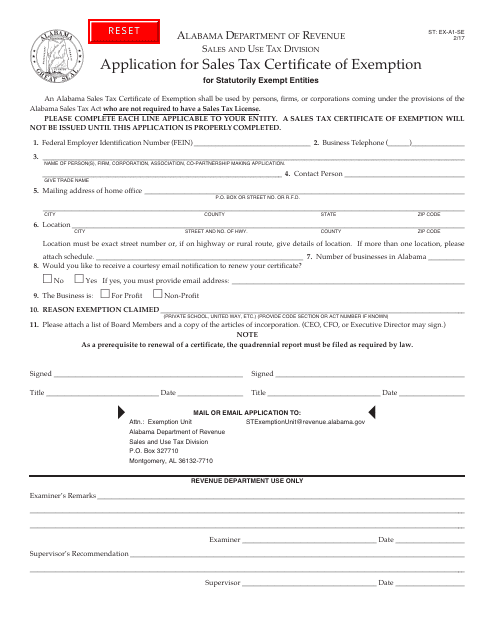

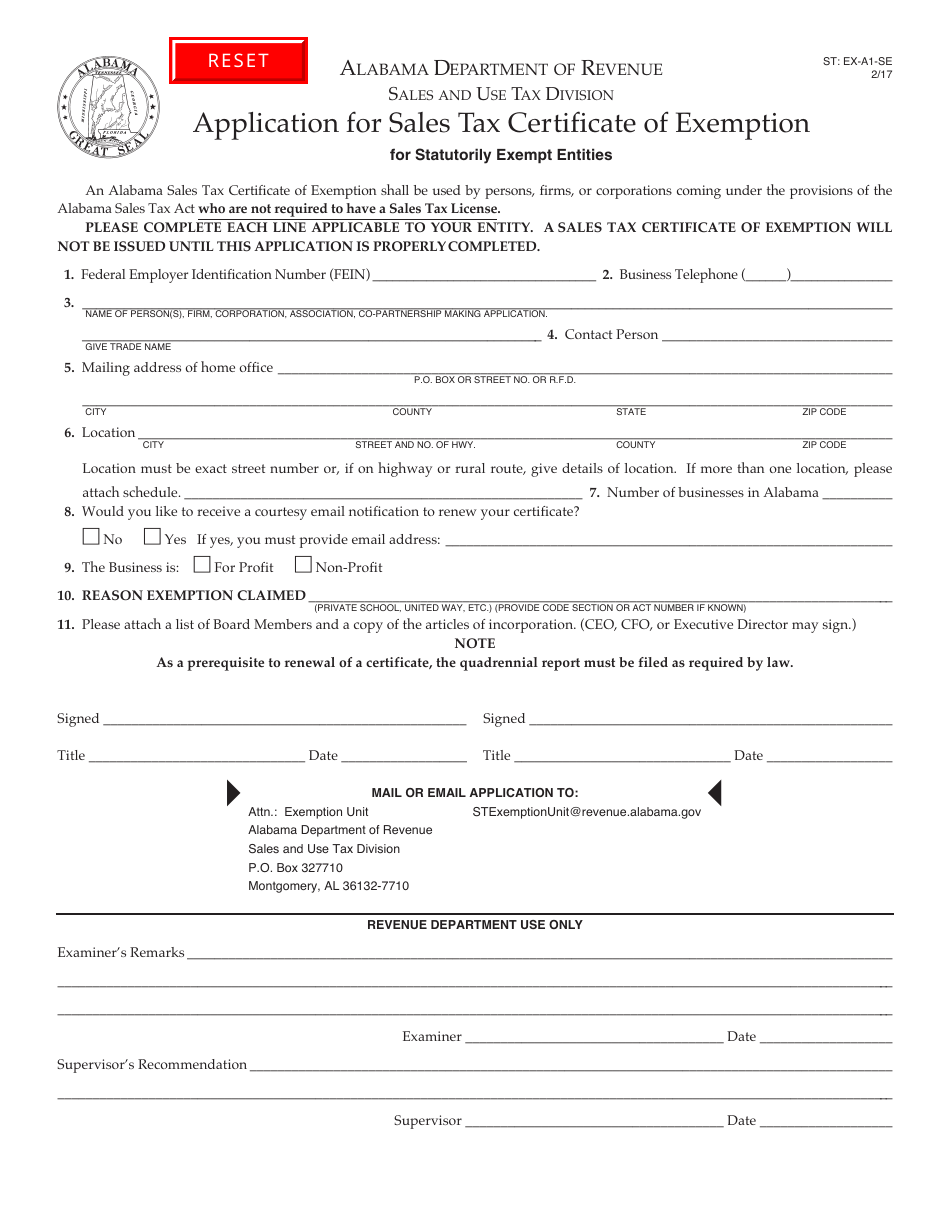

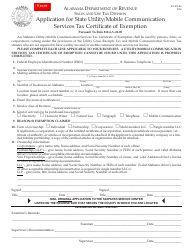

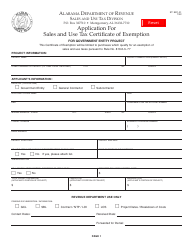

Form ST: EX-A1-SE Application for Sales Tax Certificate of Exemption for Statutorily Exempt Entities - Alabama

What Is Form ST: EX-A1-SE?

This is a legal form that was released by the Alabama Department of Revenue - a government authority operating within Alabama. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form ST: EX-A1-SE?

A: The Form ST: EX-A1-SE is an application for a Sales Tax Certificate of Exemption for Statutorily Exempt Entities in Alabama.

Q: Who can use the Form ST: EX-A1-SE?

A: The Form ST: EX-A1-SE can be used by statutorily exempt entities in Alabama who want to apply for a Sales Tax Certificate of Exemption.

Q: What is a Sales Tax Certificate of Exemption?

A: A Sales Tax Certificate of Exemption is a document that allows certain entities to make purchases without paying sales tax.

Q: Who are statutorily exempt entities?

A: Statutorily exempt entities are organizations or individuals who are exempt from paying sales tax by law.

Q: What information do I need to provide on the Form ST: EX-A1-SE?

A: You will need to provide information about your organization, including its name, address, and tax identification number.

Q: Are there any fees for applying for a Sales Tax Certificate of Exemption?

A: No, there are no fees for applying for a Sales Tax Certificate of Exemption.

Q: Is the Sales Tax Certificate of Exemption permanent?

A: No, the Sales Tax Certificate of Exemption is not permanent. It needs to be renewed periodically.

Form Details:

- Released on February 1, 2017;

- The latest edition provided by the Alabama Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST: EX-A1-SE by clicking the link below or browse more documents and templates provided by the Alabama Department of Revenue.