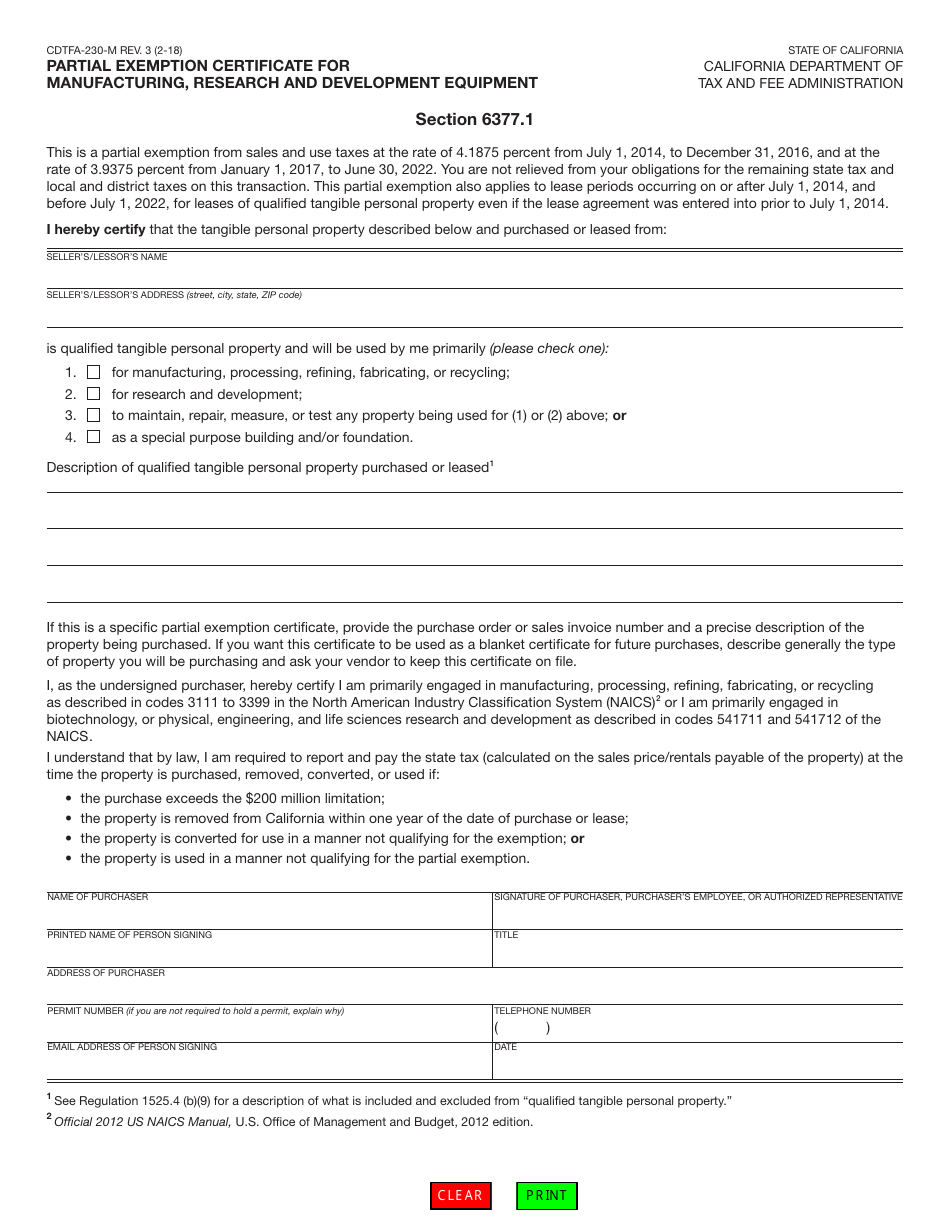

This version of the form is not currently in use and is provided for reference only. Download this version of

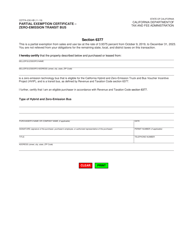

Form CDTFA-230-M

for the current year.

Form CDTFA-230-M Partial Exemption Certificate for Manufacturing, Research and Development Equipment - California

What Is Form CDTFA-230-M?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-230-M?

A: Form CDTFA-230-M is the Partial Exemption Certificate for Manufacturing, Research and Development (R&D) Equipment in California.

Q: What is the purpose of Form CDTFA-230-M?

A: The purpose of Form CDTFA-230-M is to claim a partial exemption from certain sales and use taxes on qualifying equipment used for manufacturing and R&D in California.

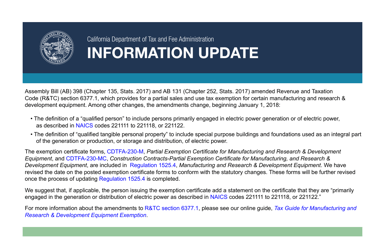

Q: Who can use Form CDTFA-230-M?

A: Manufacturers and R&D organizations in California can use Form CDTFA-230-M to claim the partial exemption on qualifying equipment.

Q: What is the benefit of using Form CDTFA-230-M?

A: Using Form CDTFA-230-M allows eligible businesses to save on sales and use taxes for qualifying manufacturing and R&D equipment purchases.

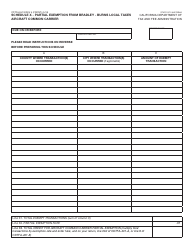

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-230-M by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.