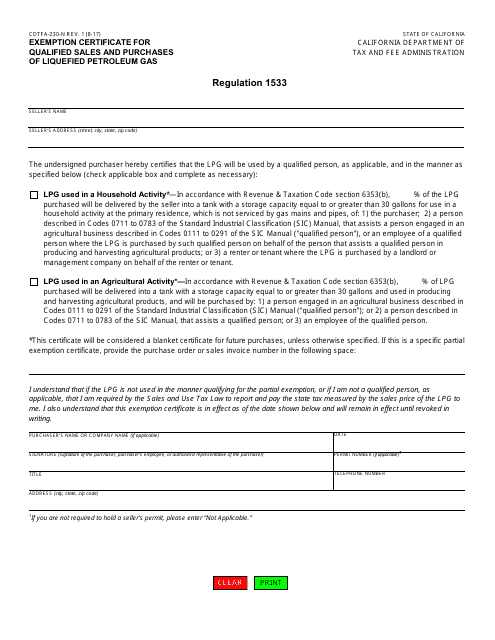

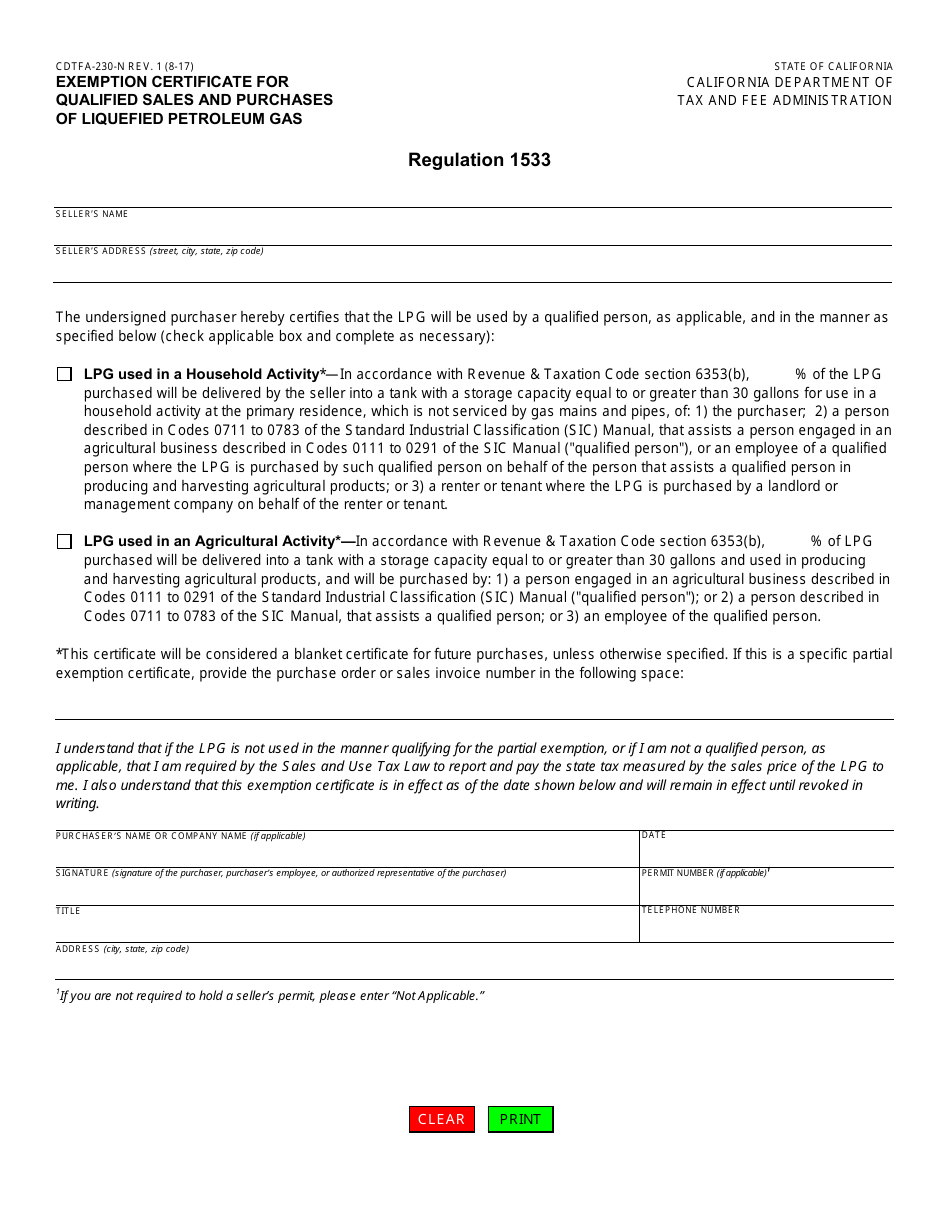

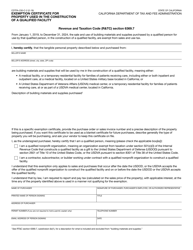

Form CDTFA-230-N Exemption Certificate for Qualified Sales and Purchases of Liquefied Petroleum Gas - California

What Is Form CDTFA-230-N?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CDTFA-230-N?

A: Form CDTFA-230-N is an Exemption Certificate for Qualified Sales and Purchases of Liquefied Petroleum Gas.

Q: What is the purpose of this form?

A: The purpose of this form is to claim an exemption on sales and purchases of liquefied petroleum gas in California.

Q: Who should use this form?

A: This form should be used by individuals or businesses who qualify for the exemption on sales and purchases of liquefied petroleum gas.

Q: How should I fill out this form?

A: You should carefully complete all the required fields on the form, including your personal or business information and details of the exemption claimed.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-230-N by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.