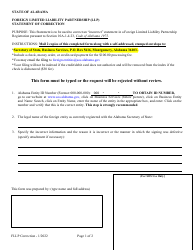

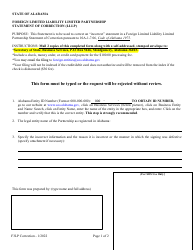

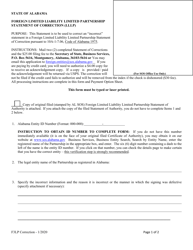

This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

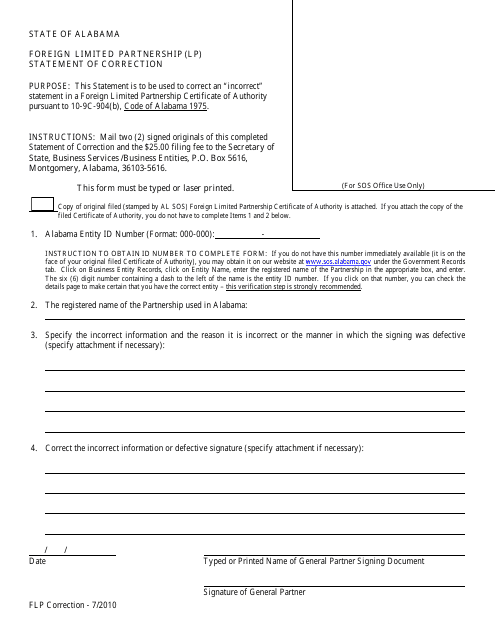

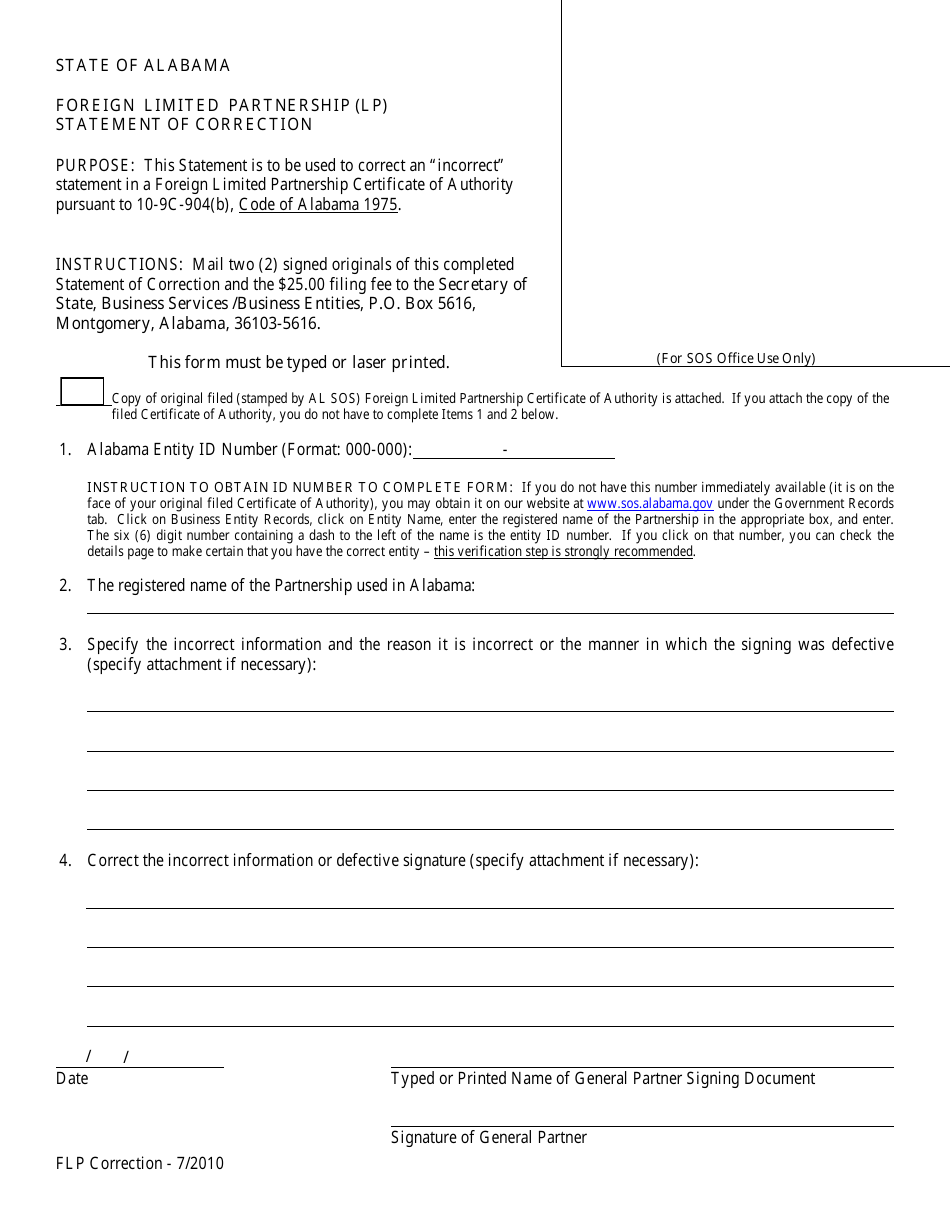

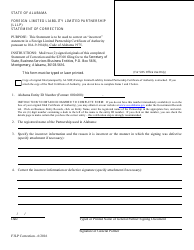

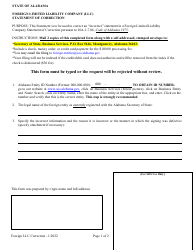

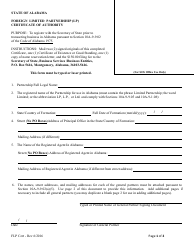

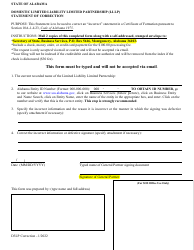

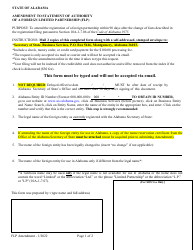

Foreign Limited Partnership (Lp) Statement of Correction - Alabama

Foreign Limited Partnership (Lp) Statement of Correction is a legal document that was released by the Alabama Secretary of State - a government authority operating within Alabama.

FAQ

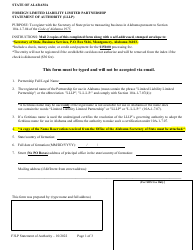

Q: What is a Foreign Limited Partnership?

A: A Foreign Limited Partnership is a type of business entity formed in one state but operating in another state.

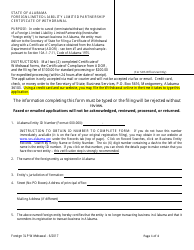

Q: What is a Statement of Correction?

A: A Statement of Correction is a document that is filed to correct or amend information that was previously submitted in a document.

Q: When is a Foreign Limited Partnership required to file a Statement of Correction?

A: A Foreign Limited Partnership may need to file a Statement of Correction if there are errors or discrepancies in previously filed documents.

Q: What information can be corrected using a Statement of Correction?

A: A Statement of Correction can be used to correct various types of information, such as the business name, business address, or the names of partners.

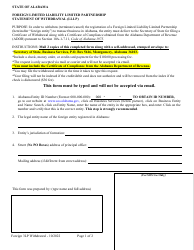

Q: How can a Foreign Limited Partnership file a Statement of Correction in Alabama?

A: A Foreign Limited Partnership can file a Statement of Correction in Alabama by submitting the completed form and the filing fee to the Alabama Secretary of State.

Q: Is there a deadline for filing a Statement of Correction?

A: There is no specific deadline for filing a Statement of Correction, but it is recommended to file as soon as possible after the discovery of the error.

Q: What happens after a Statement of Correction is filed?

A: After a Statement of Correction is filed, the corrected information will be updated in the state's records, and the partnership will be considered in compliance with the corrected information.

Q: Is there a fee for filing a Statement of Correction?

A: Yes, there is a filing fee associated with filing a Statement of Correction. The amount may vary depending on the state and the type of correction being made.

Q: Can a Foreign Limited Partnership be penalized for not filing a Statement of Correction?

A: Failure to file a required Statement of Correction may result in penalties or consequences, such as fines or the loss of good standing status.

Q: Can a Foreign Limited Partnership dissolve if it fails to correct information?

A: If a Foreign Limited Partnership fails to correct inaccurate information, it may face consequences such as the loss of good standing status or potential legal issues.

Form Details:

- Released on July 1, 2010;

- The latest edition currently provided by the Alabama Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Alabama Secretary of State.