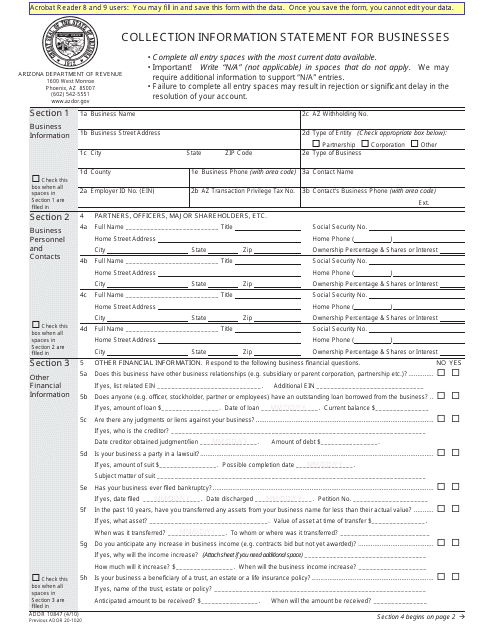

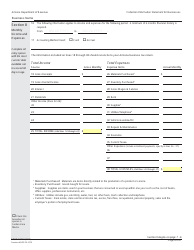

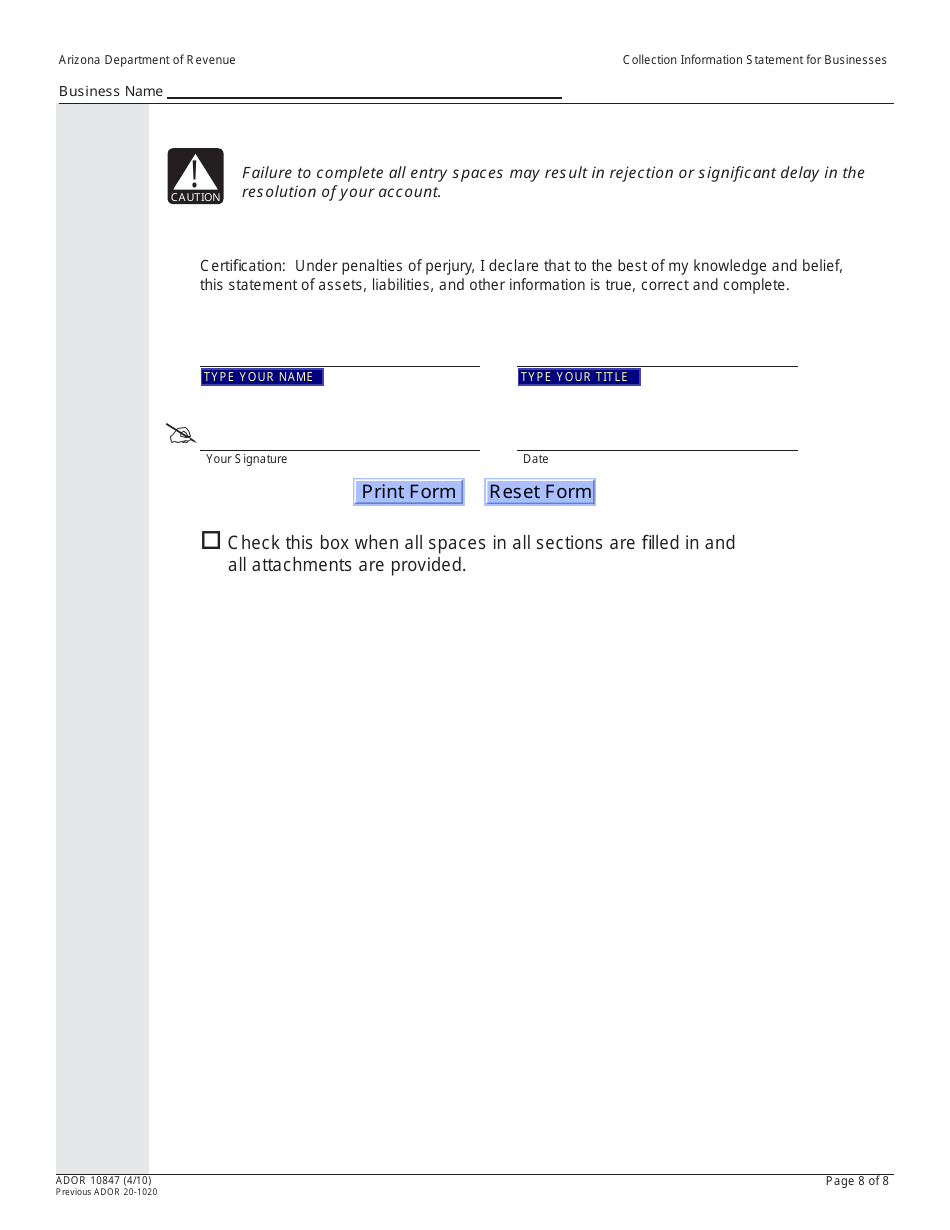

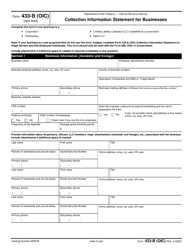

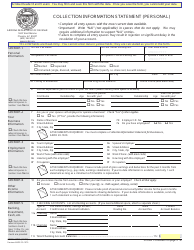

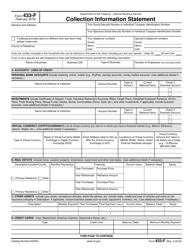

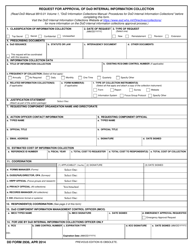

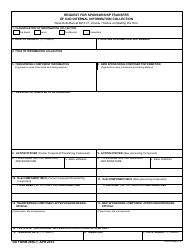

Form ADOR10847 Collection Information Statement for Businesses - Arizona

What Is Form ADOR10847?

This is a legal form that was released by the Arizona Department of Revenue - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is ADOR10847?

A: ADOR10847 is a Collection Information Statement for Businesses in Arizona.

Q: Who needs to file ADOR10847?

A: Businesses in Arizona that owe taxes or have outstanding tax liabilities may need to file ADOR10847.

Q: What is the purpose of ADOR10847?

A: The purpose of ADOR10847 is to provide the Arizona Department of Revenue (ADOR) with information about a business's financial situation and ability to pay outstanding taxes.

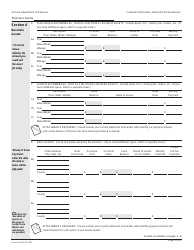

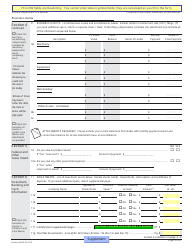

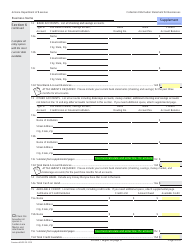

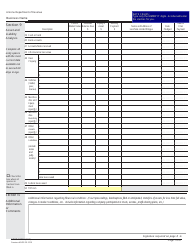

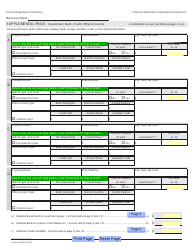

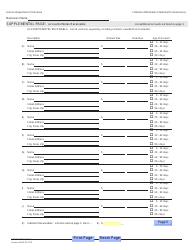

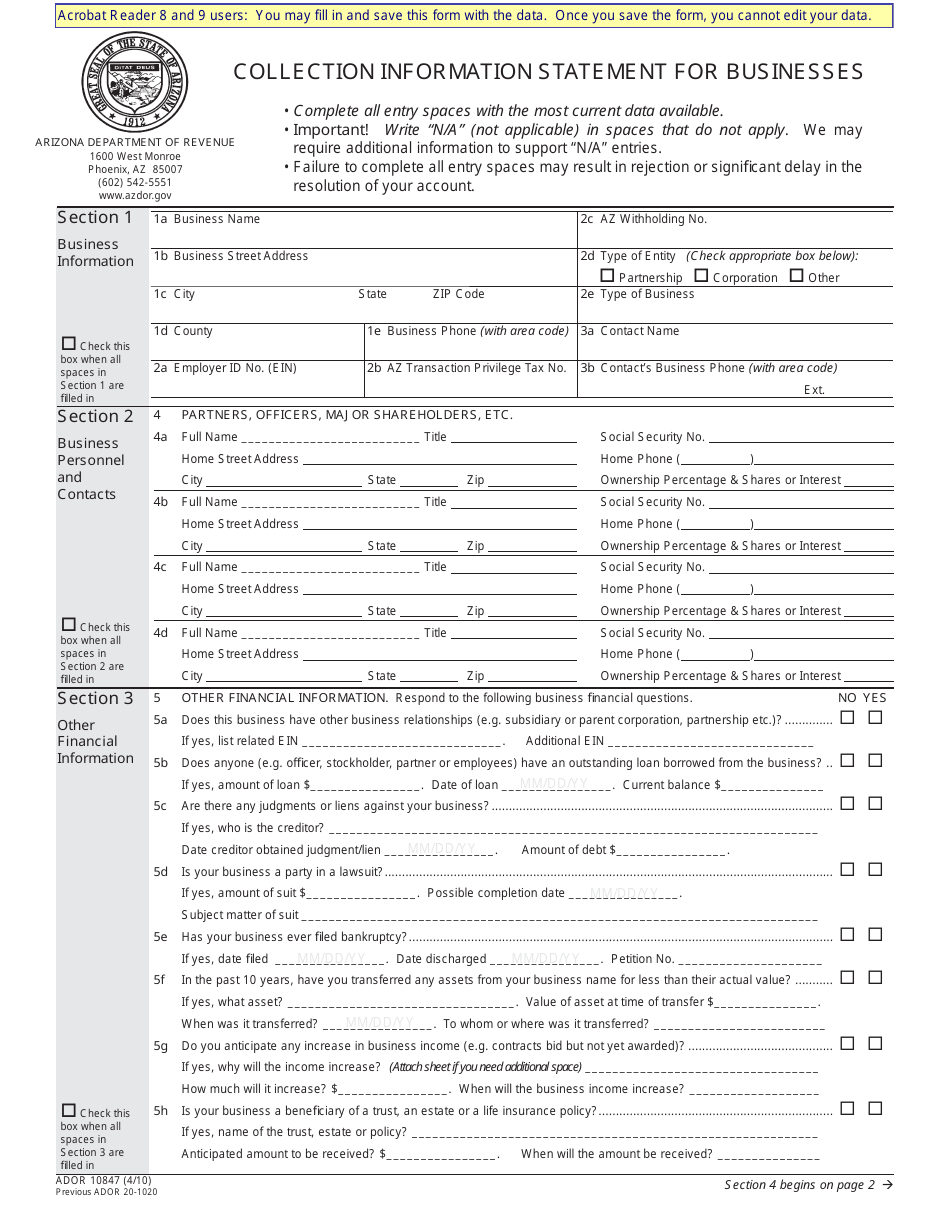

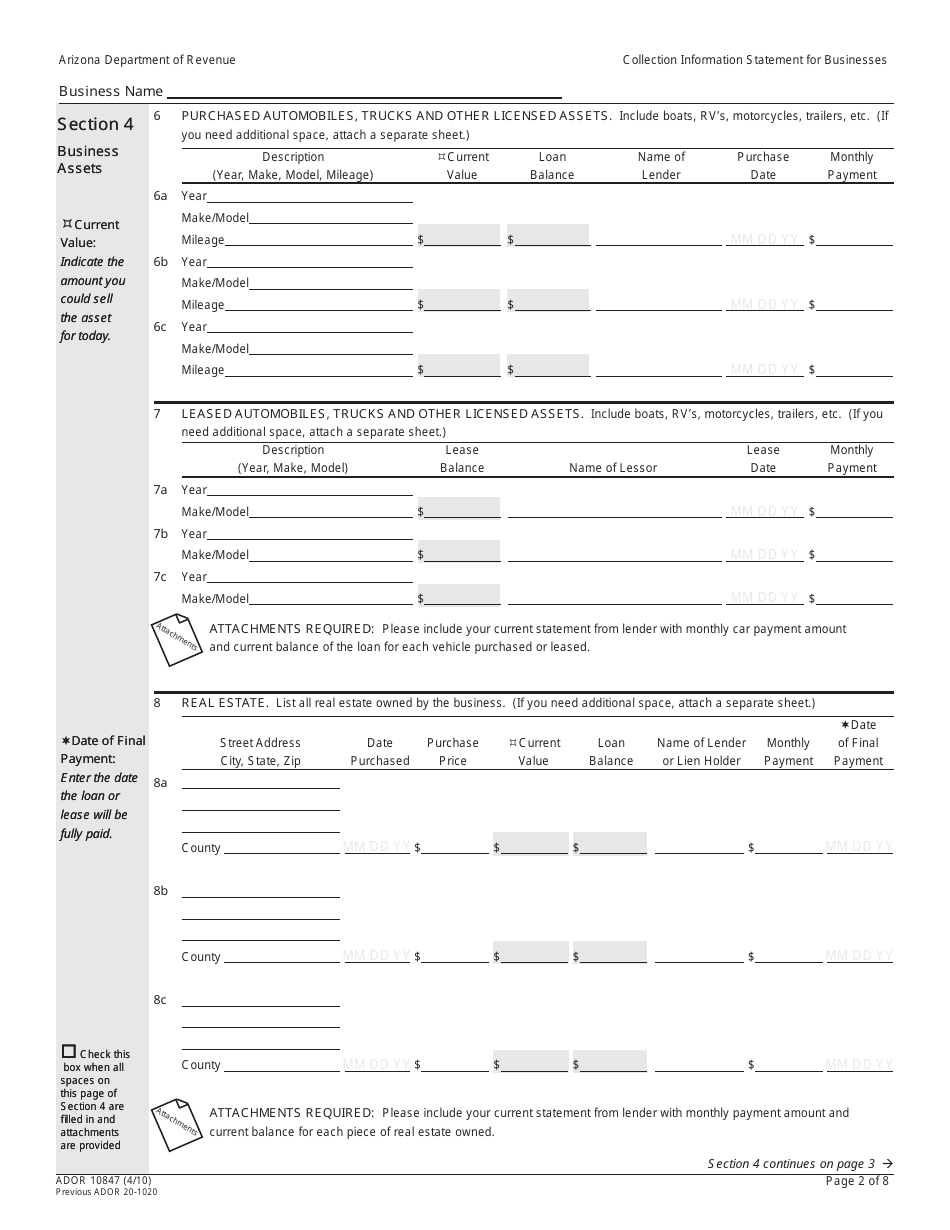

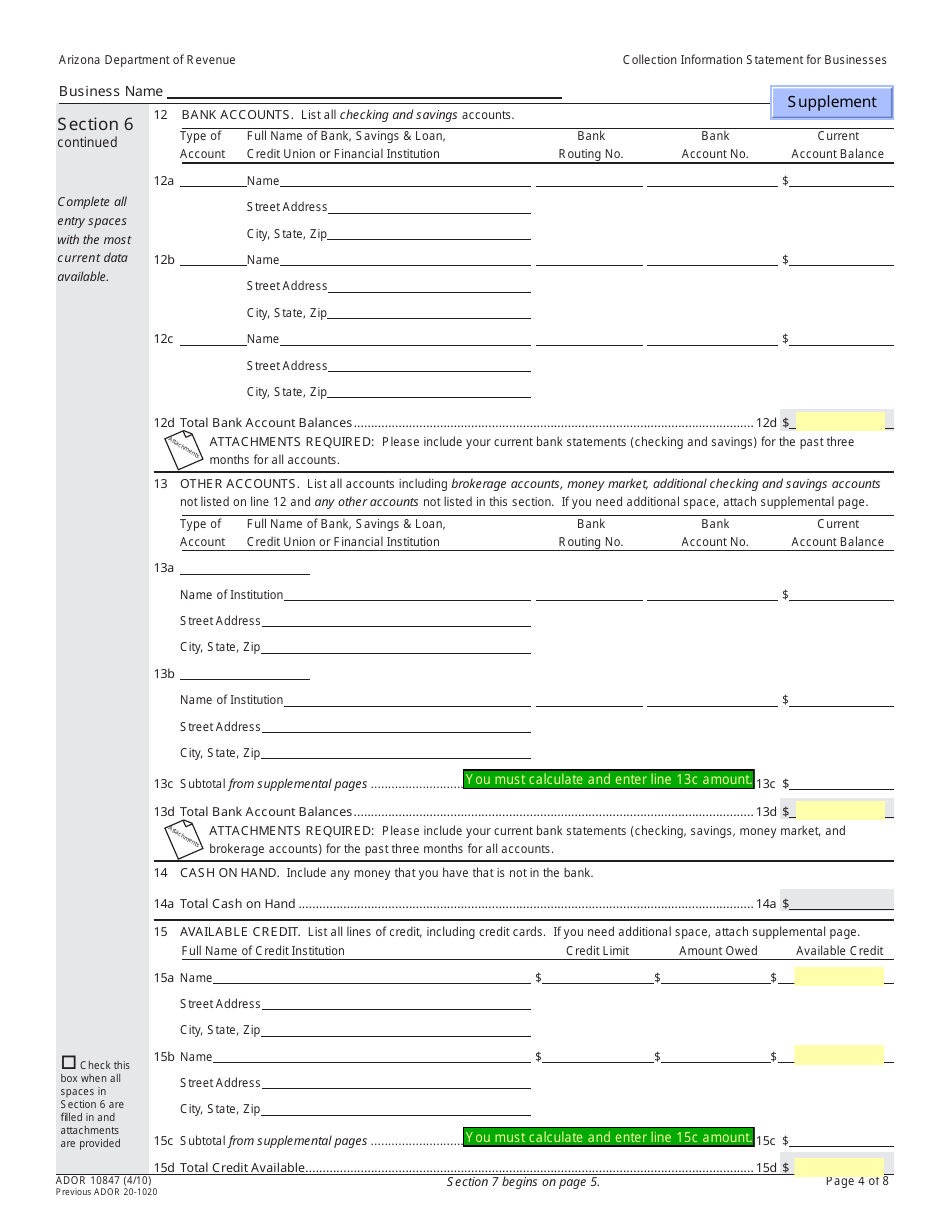

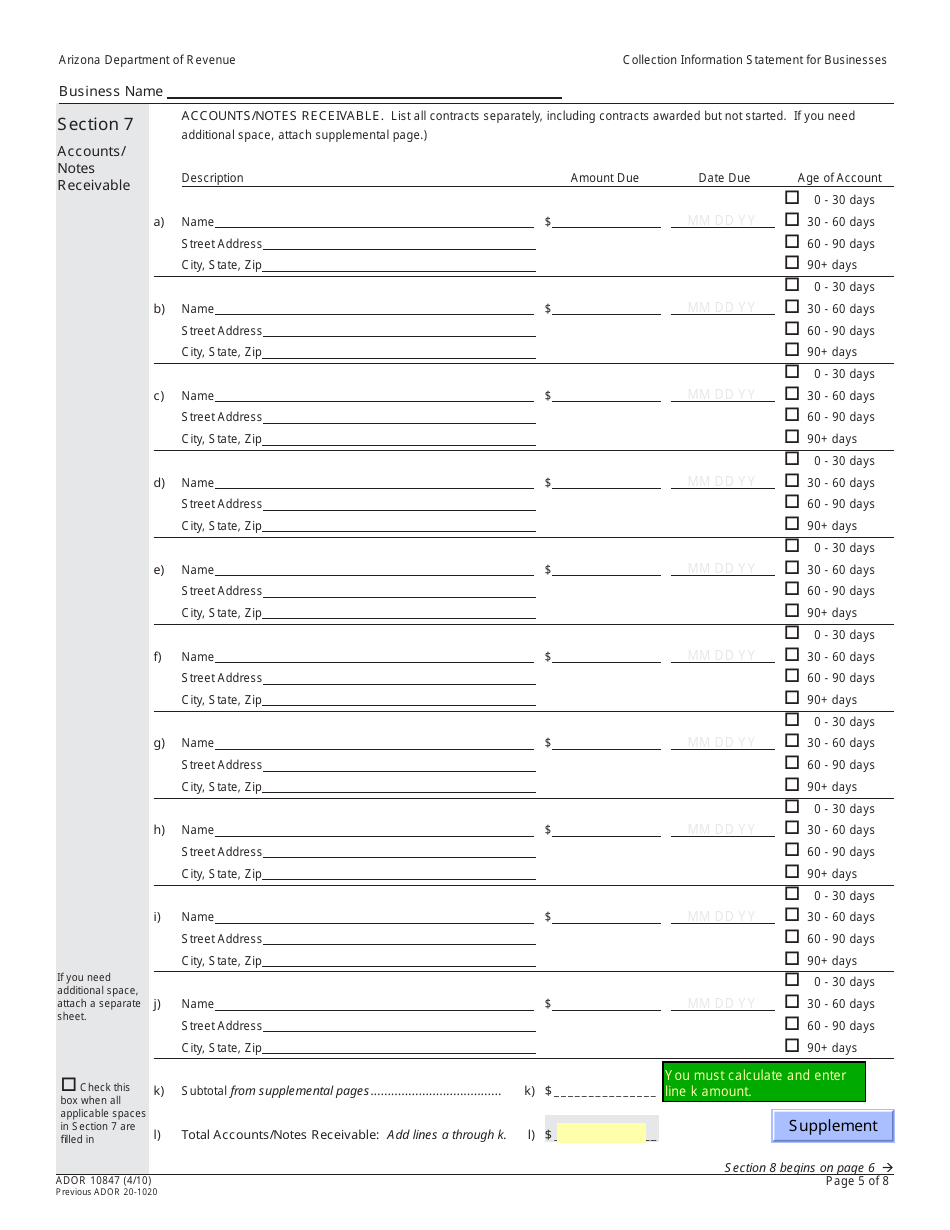

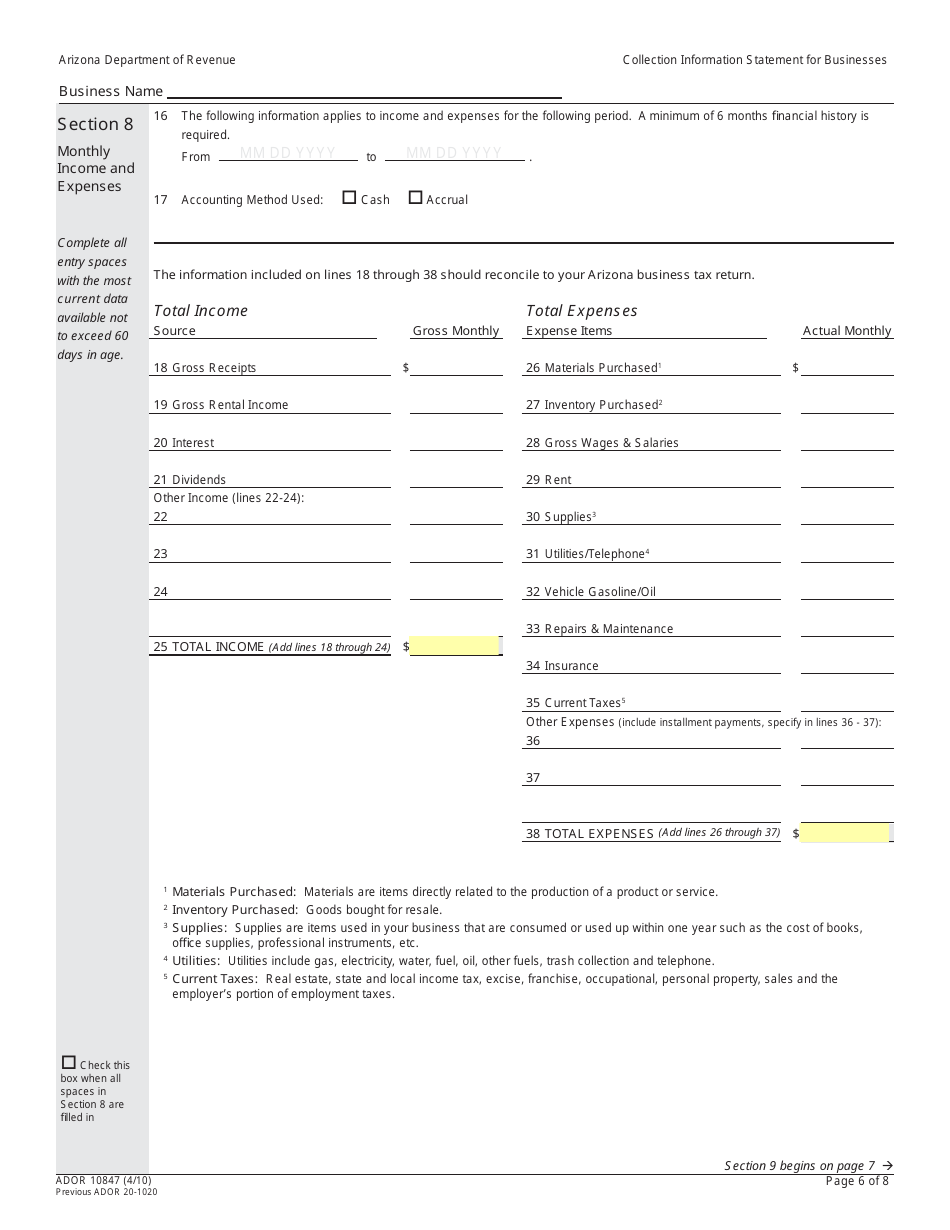

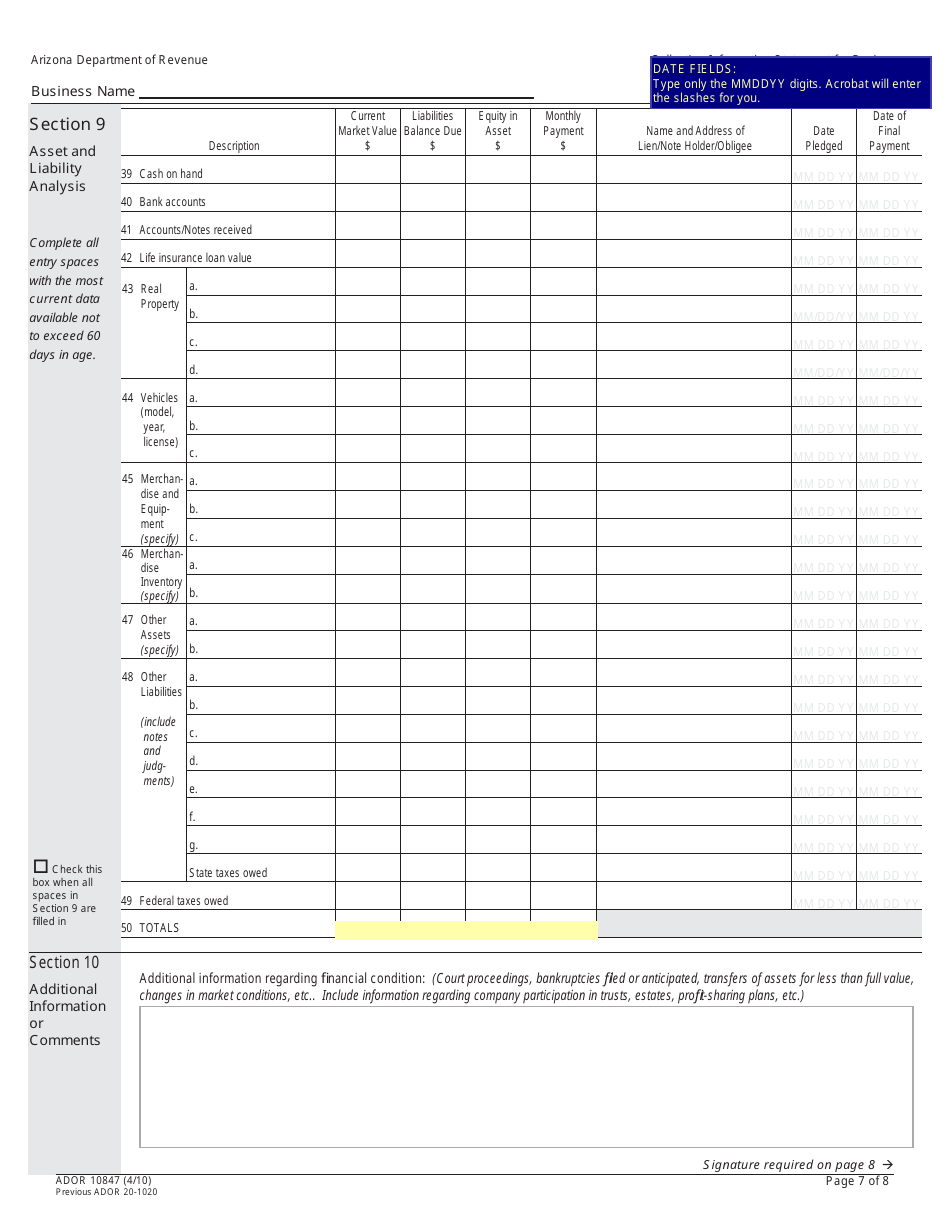

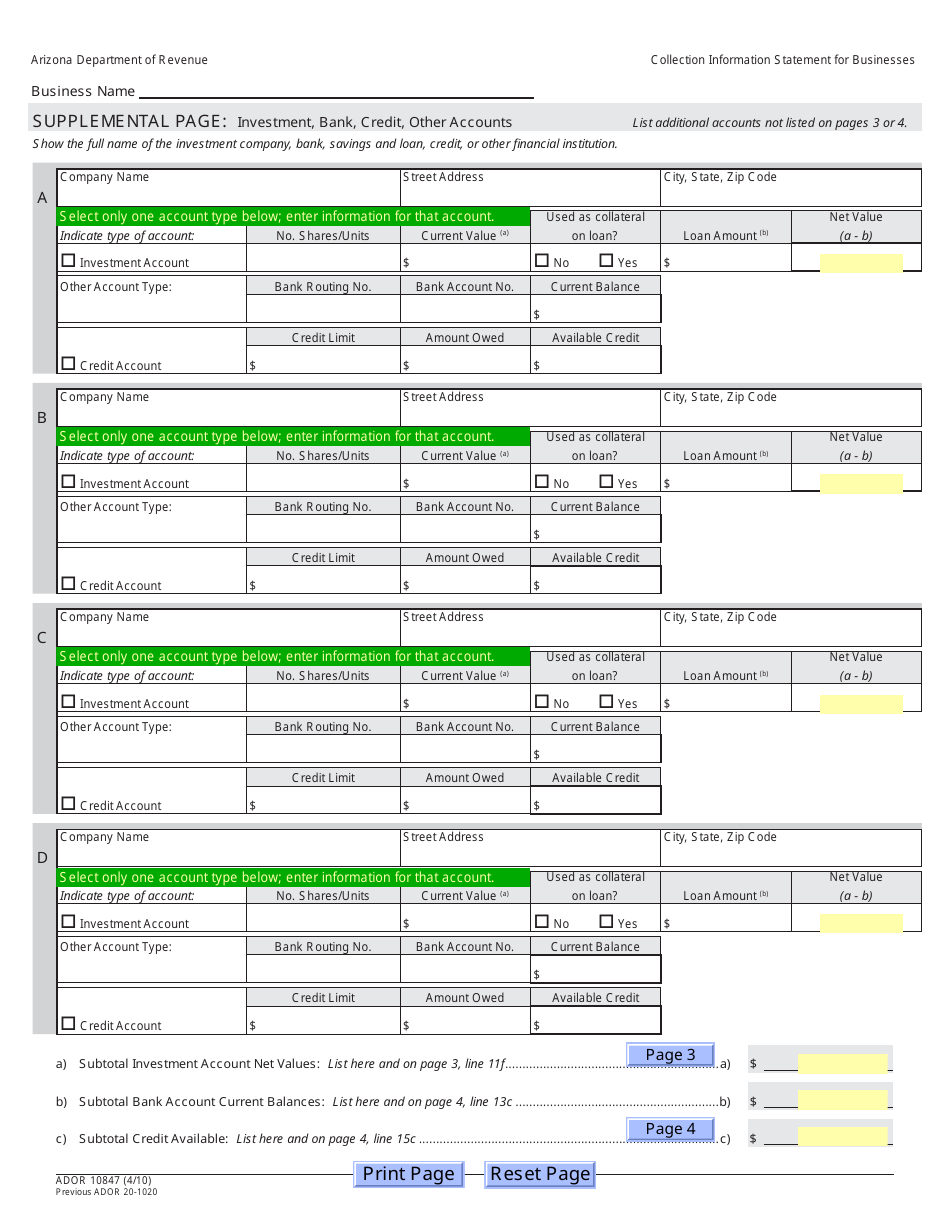

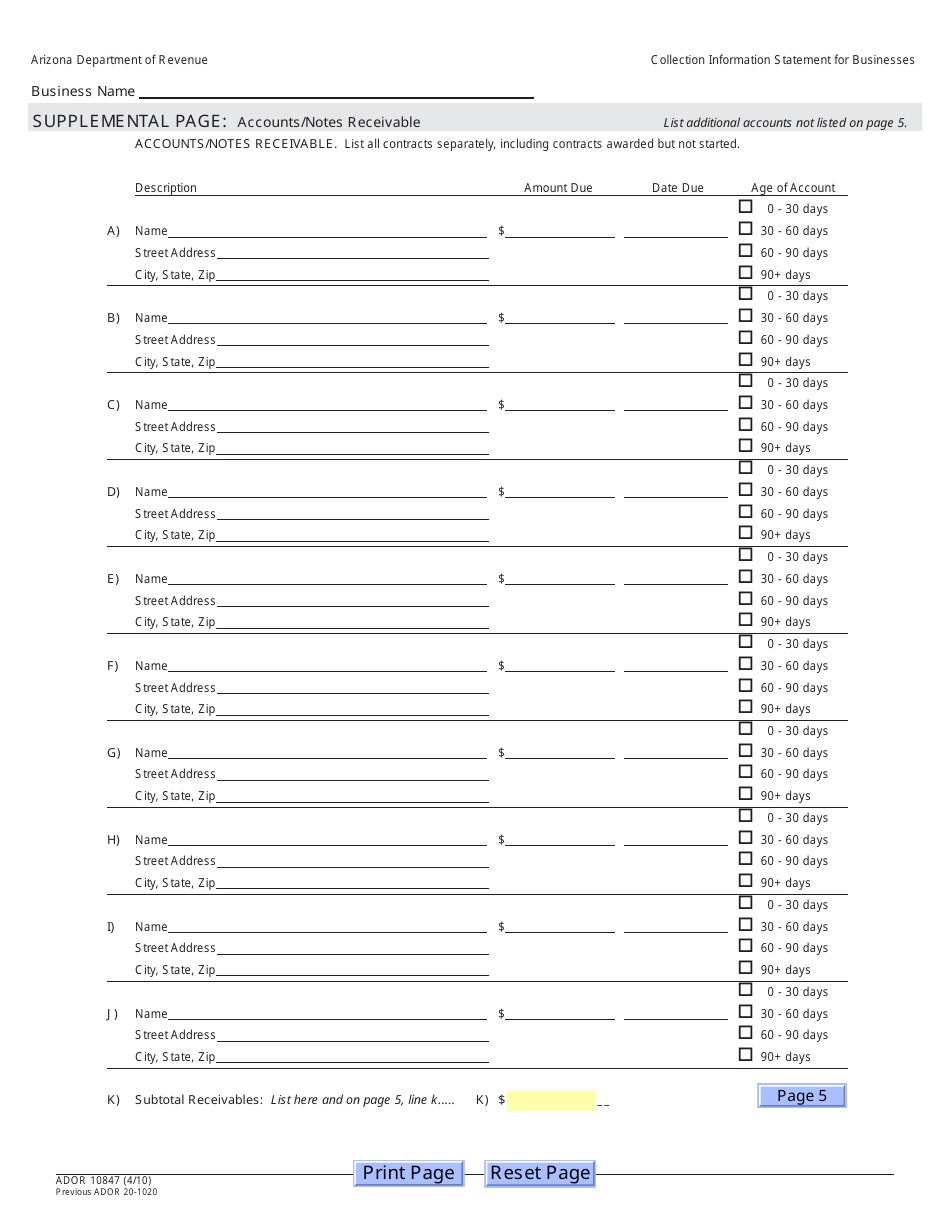

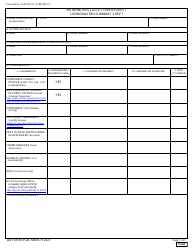

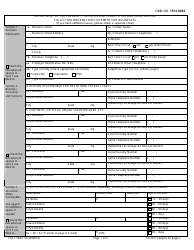

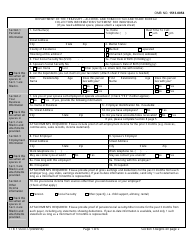

Q: What information is required in ADOR10847?

A: ADOR10847 requires information such as the business's assets, liabilities, income, and expenses.

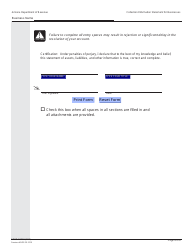

Q: Is ADOR10847 confidential?

A: Yes, the information provided in ADOR10847 is confidential and protected under Arizona law.

Q: What happens after filing ADOR10847?

A: After filing ADOR10847, the Arizona Department of Revenue (ADOR) will review the information and determine an appropriate collection action, if necessary.

Q: Are there any penalties for not filing ADOR10847?

A: Yes, businesses that fail to file ADOR10847 may face penalties and interest on their outstanding tax liabilities.

Q: Can I get assistance with filling out ADOR10847?

A: Yes, the Arizona Department of Revenue (ADOR) can provide assistance and guidance in filling out ADOR10847.

Form Details:

- Released on April 1, 2010;

- The latest edition provided by the Arizona Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ADOR10847 by clicking the link below or browse more documents and templates provided by the Arizona Department of Revenue.