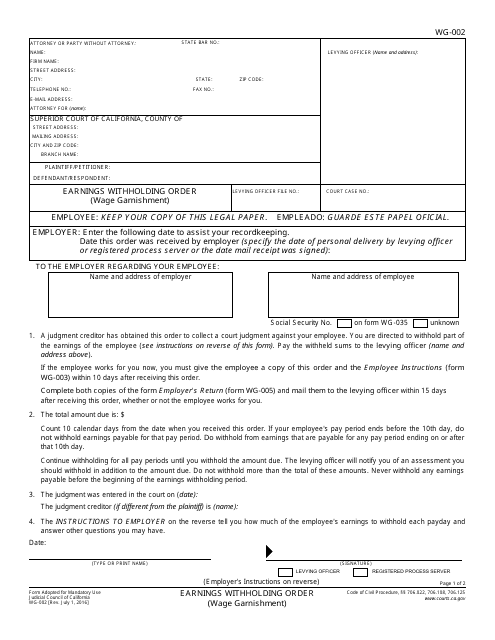

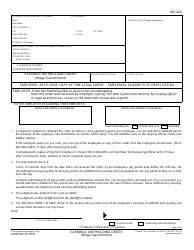

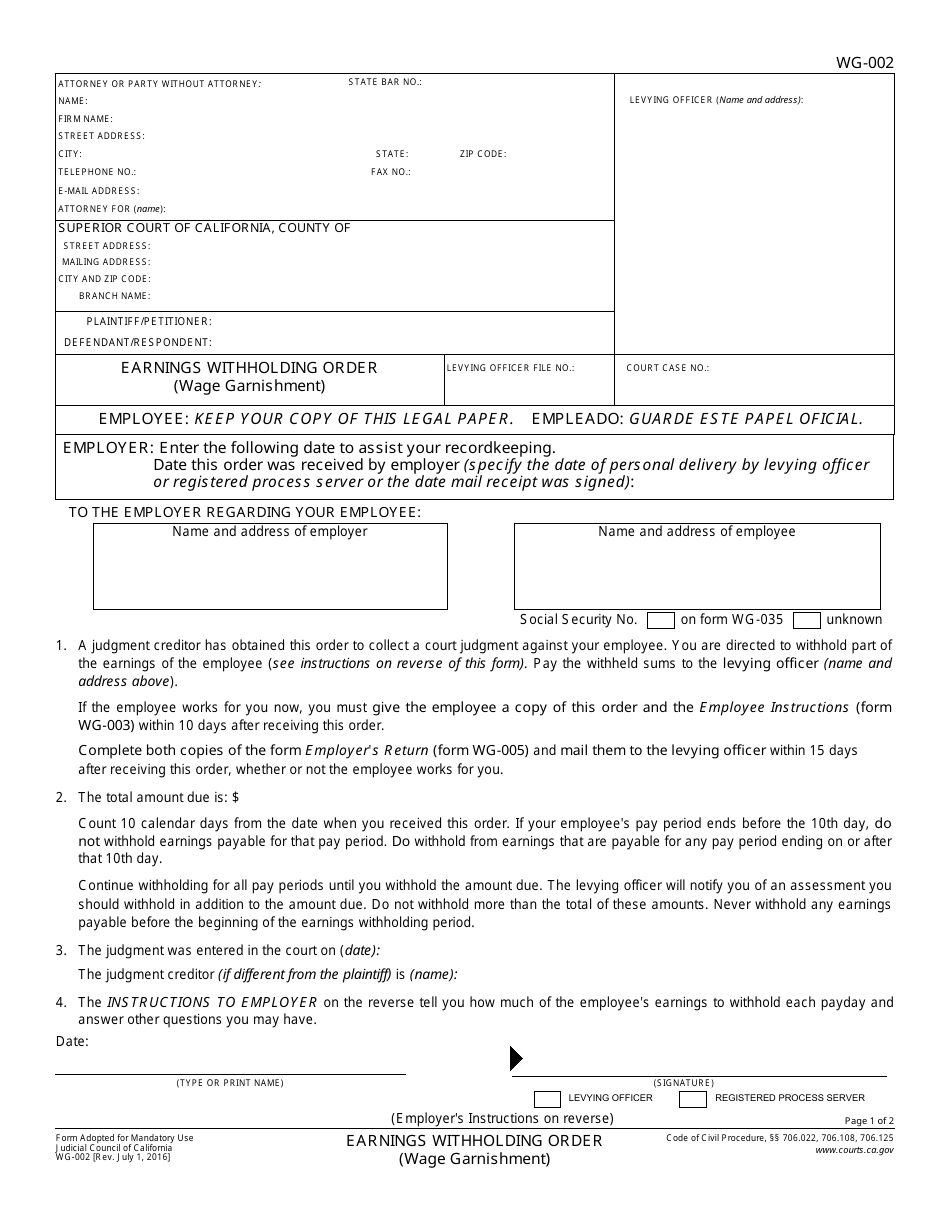

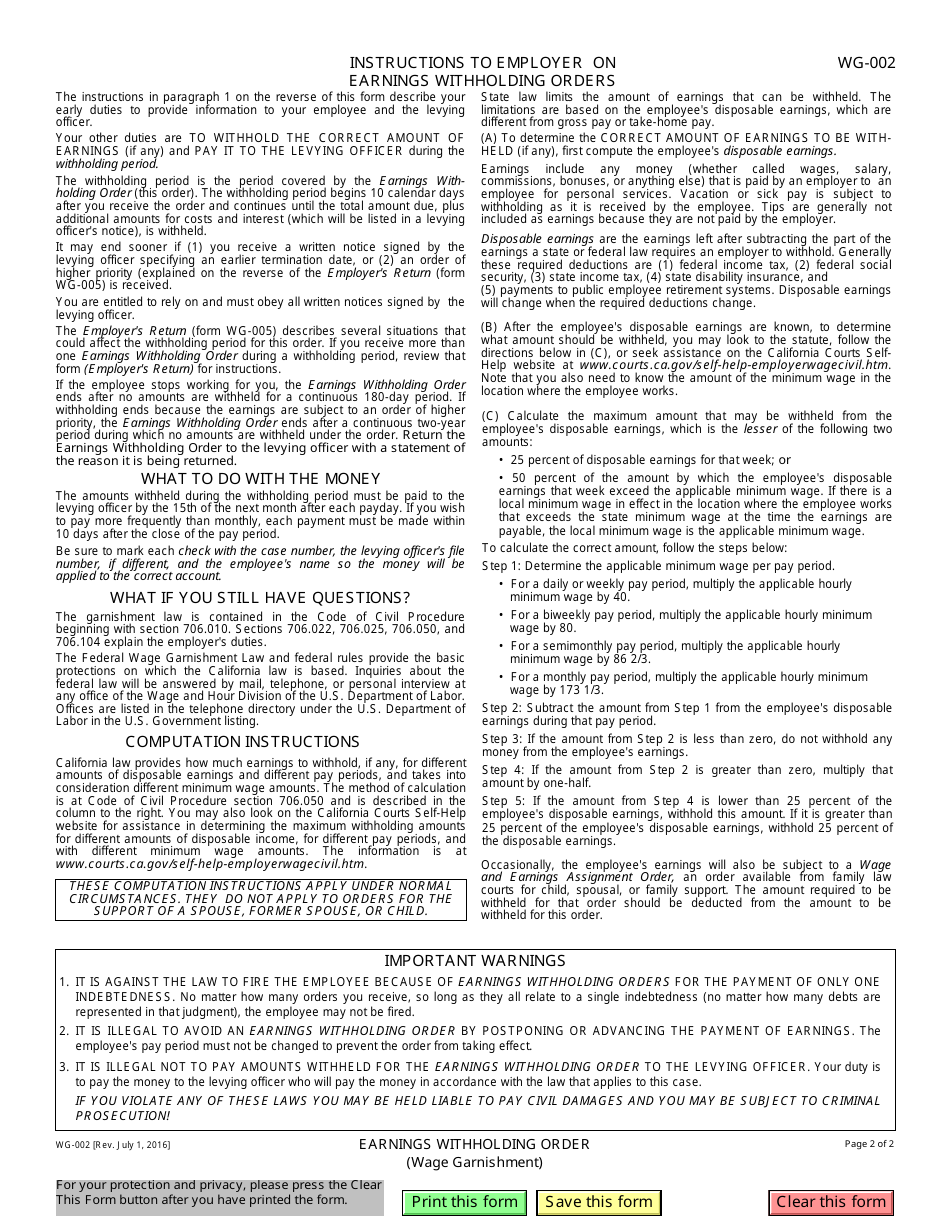

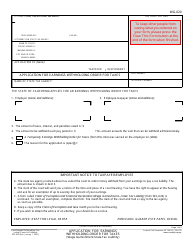

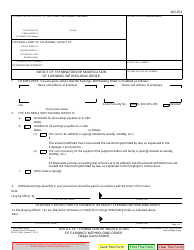

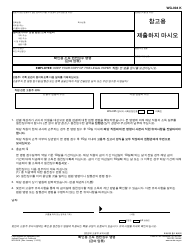

Form WG-002 Earnings Withholding Order (Wage Garnishment) - California

What Is Form WG-002?

This is a legal form that was released by the California Superior Court - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WG-002?

A: Form WG-002 is the Earnings Withholding Order (Wage Garnishment) used in California.

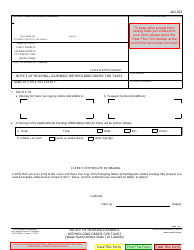

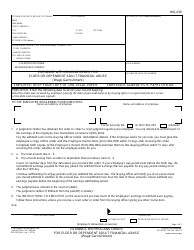

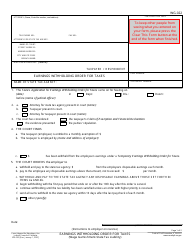

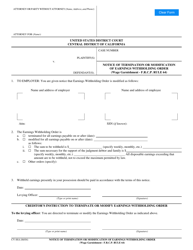

Q: What is an Earnings Withholding Order?

A: An Earnings Withholding Order is a legal document that requires an employer to withhold a certain amount of an employee's wages to pay off a debt.

Q: What is Wage Garnishment?

A: Wage Garnishment is the process of deducting money from an employee's wages to satisfy a debt or court-ordered payment.

Q: Who can use Form WG-002?

A: Form WG-002 is used by creditors to obtain an Earnings Withholding Order against a debtor's wages in California.

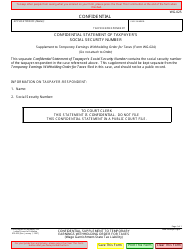

Q: What information is required on Form WG-002?

A: Form WG-002 requires information such as the debtor's name, employer information, amount owed, and details of the debt.

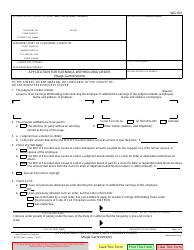

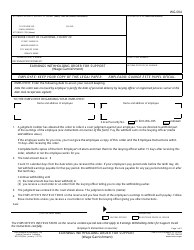

Q: How does Form WG-002 work?

A: Once Form WG-002 is served to the employer, they are legally obligated to withhold the specified amount from the debtor's wages and remit it to the creditor.

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the California Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WG-002 by clicking the link below or browse more documents and templates provided by the California Superior Court.