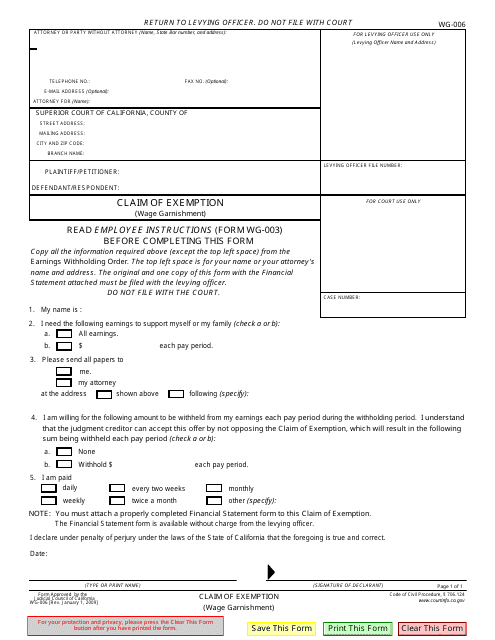

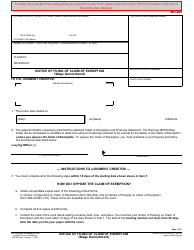

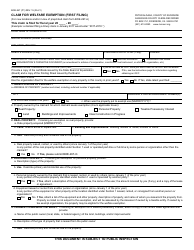

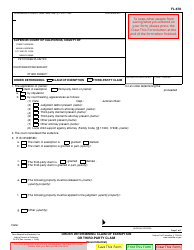

Form WG-006 Claim of Exemption (Wage Garnishment) - California

What Is Form WG-006?

This is a legal form that was released by the California Superior Court - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form WG-006 Claim of Exemption (Wage Garnishment)?

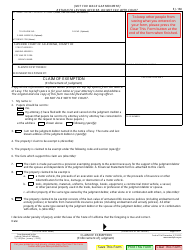

A: The Form WG-006 Claim of Exemption (Wage Garnishment) is a document that allows an individual in California to claim exemptions from having their wages garnished.

Q: When should I use Form WG-006 Claim of Exemption (Wage Garnishment)?

A: You should use Form WG-006 Claim of Exemption (Wage Garnishment) if your wages are being garnished and you believe that you qualify for exemption under California law.

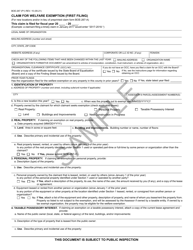

Q: What is a wage garnishment?

A: A wage garnishment is a legal process in which a portion of a person's wages are withheld by an employer to pay off a debt or judgment.

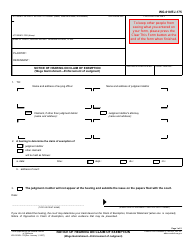

Q: How can I claim exemptions from wage garnishment in California?

A: To claim exemptions from wage garnishment in California, you need to complete and file the Form WG-006 Claim of Exemption (Wage Garnishment) with the appropriate court.

Q: What are some common exemptions from wage garnishment in California?

A: Some common exemptions from wage garnishment in California include head of household exemption, low-income exemption, and the exemption for public benefits.

Q: Are there any fees associated with filing Form WG-006 Claim of Exemption (Wage Garnishment)?

A: There may be filing fees associated with filing Form WG-006 Claim of Exemption (Wage Garnishment). It is best to check with the court or consult with an attorney to determine if any fees apply.

Q: What happens after I file Form WG-006 Claim of Exemption (Wage Garnishment)?

A: After you file Form WG-006 Claim of Exemption (Wage Garnishment), the court will review your claim and determine if you qualify for exemption. If approved, the wage garnishment may be stopped or reduced.

Q: What should I do if my wages are being garnished and I believe I qualify for exemption?

A: If your wages are being garnished and you believe you qualify for exemption, you should complete and file Form WG-006 Claim of Exemption (Wage Garnishment) as soon as possible to protect your rights.

Q: Can I claim exemptions from wage garnishment if I owe child support or spousal support?

A: No, child support and spousal support are not eligible for exemption from wage garnishment. These types of debts are typically prioritized and can be subject to garnishment without exemption.

Form Details:

- Released on January 1, 2009;

- The latest edition provided by the California Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WG-006 by clicking the link below or browse more documents and templates provided by the California Superior Court.