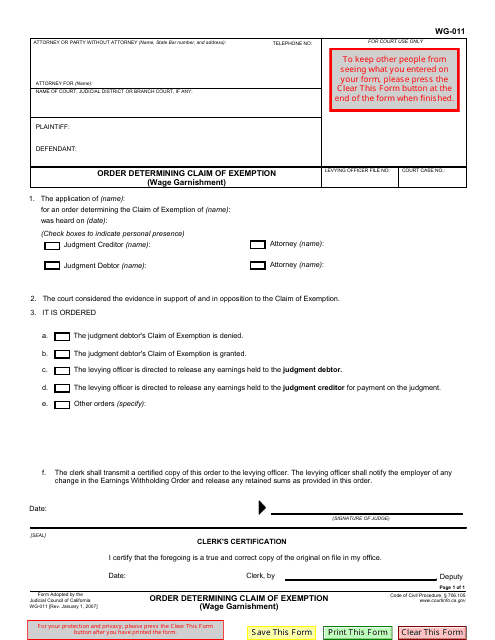

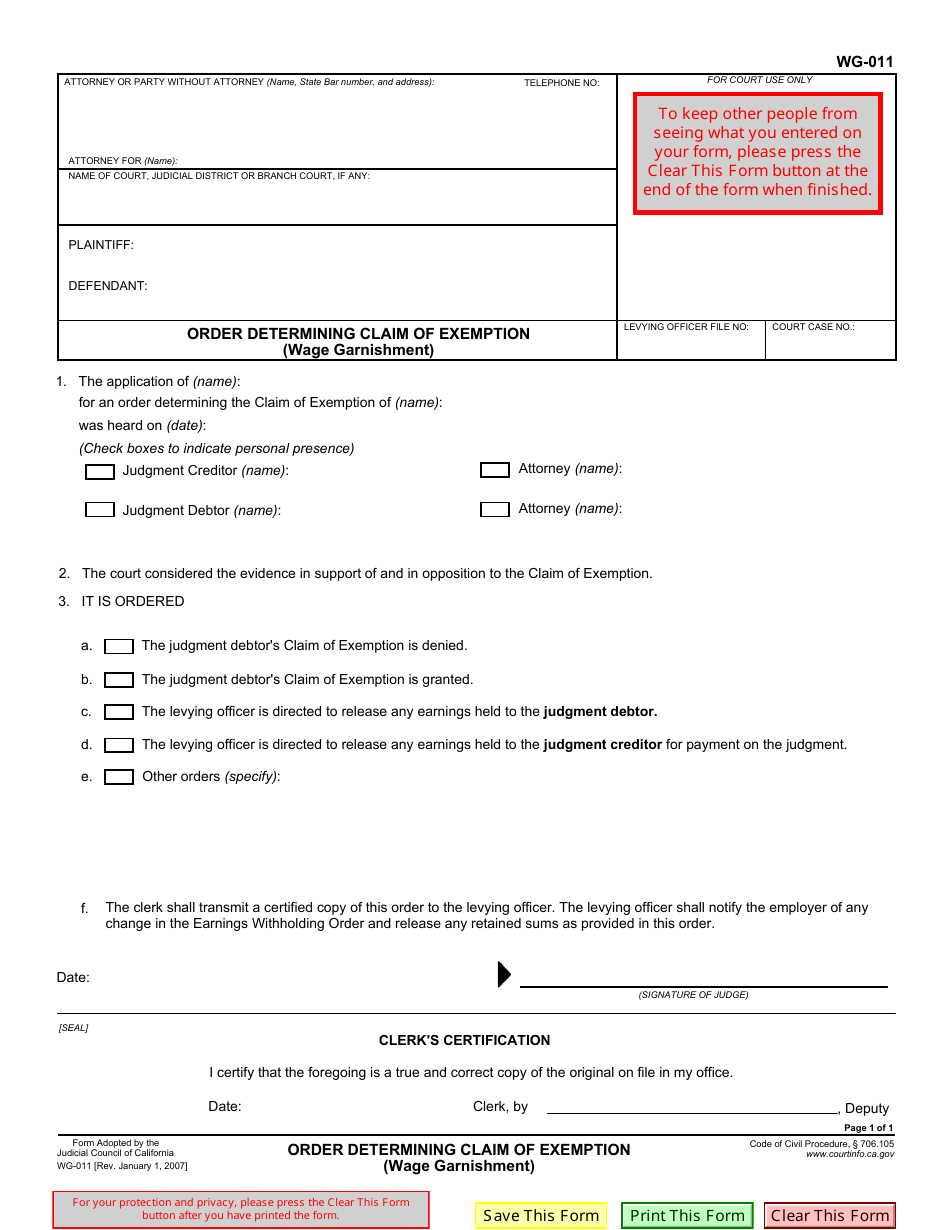

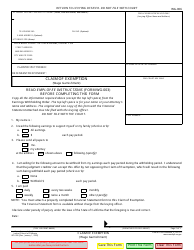

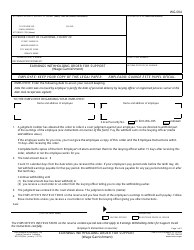

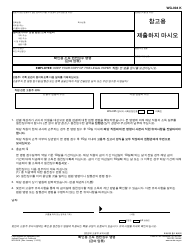

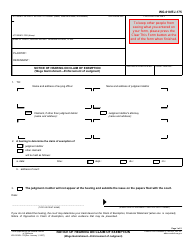

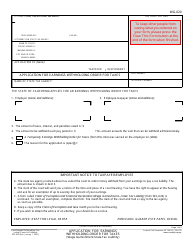

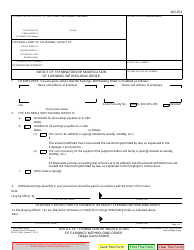

Form WG-011 Order Determining Claim of Exemption (Wage Garnishment) - California

What Is Form WG-011?

This is a legal form that was released by the California Superior Court - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WG-011?

A: Form WG-011 is a legal document used in California to determine the claim of exemption for wage garnishment.

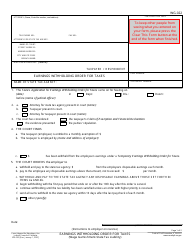

Q: What is a claim of exemption?

A: A claim of exemption is a request made by a debtor to the court to protect certain assets or income from being garnished.

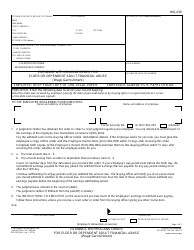

Q: What is wage garnishment?

A: Wage garnishment is a legal process where a portion of an individual's wages are withheld by their employer to pay off a debt.

Q: Who can use Form WG-011?

A: Any individual who has received a wage garnishment notice in California can use Form WG-011 to claim an exemption.

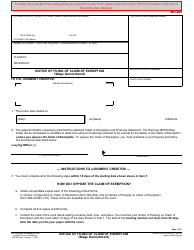

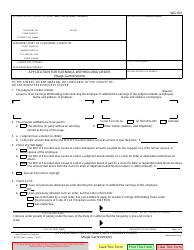

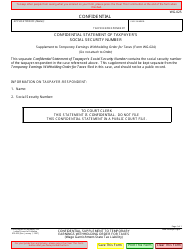

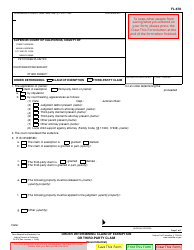

Q: What information is required in Form WG-011?

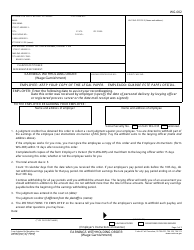

A: Form WG-011 requires the debtor to provide information about their income, expenses, and financial circumstances to support the claim of exemption.

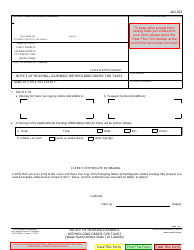

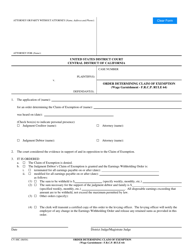

Q: What happens after submitting Form WG-011?

A: After submitting Form WG-011, the court will review the claim of exemption and determine whether to grant or deny it.

Q: Can Form WG-011 stop wage garnishment?

A: If the court grants the claim of exemption submitted using Form WG-011, it can stop or reduce the amount of wage garnishment.

Q: What should I do if my claim of exemption is denied?

A: If your claim of exemption is denied, you may need to seek legal advice or explore other options to address your wage garnishment situation.

Form Details:

- Released on January 1, 2007;

- The latest edition provided by the California Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WG-011 by clicking the link below or browse more documents and templates provided by the California Superior Court.