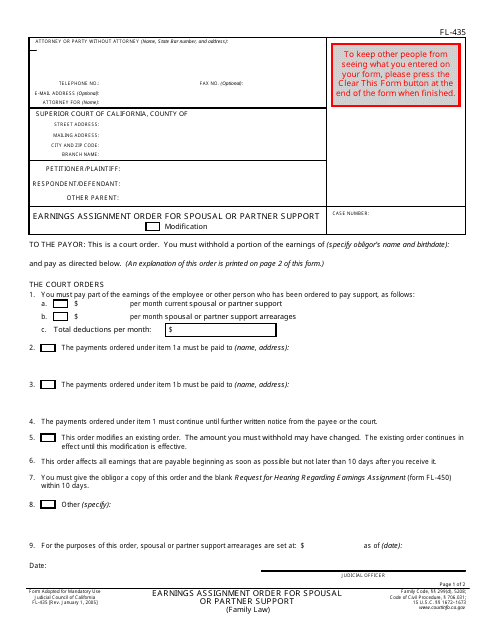

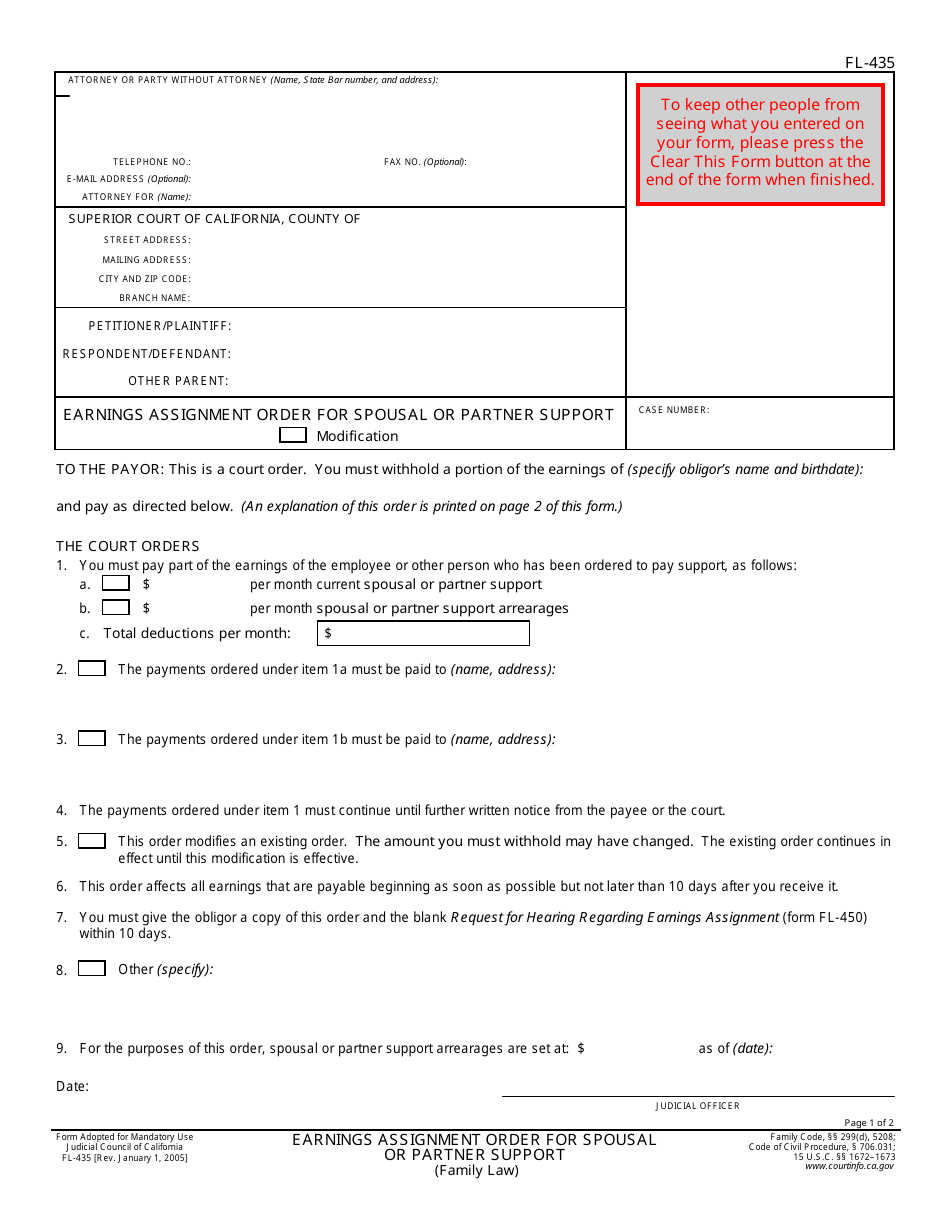

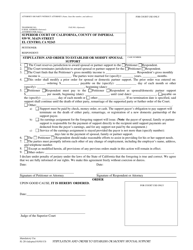

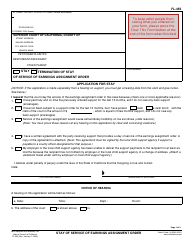

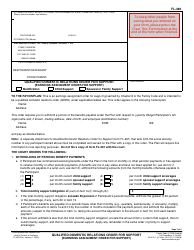

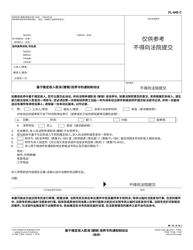

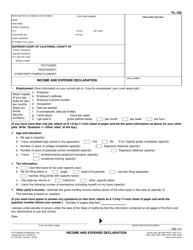

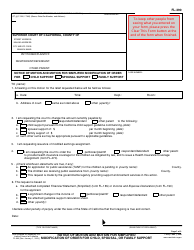

Form FL-435 Earnings Assignment Order for Spousal or Partner Support - California

What Is Form FL-435?

This is a legal form that was released by the California Superior Court - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FL-435?

A: Form FL-435 is the Earnings Assignment Order for Spousal or Partner Support in California.

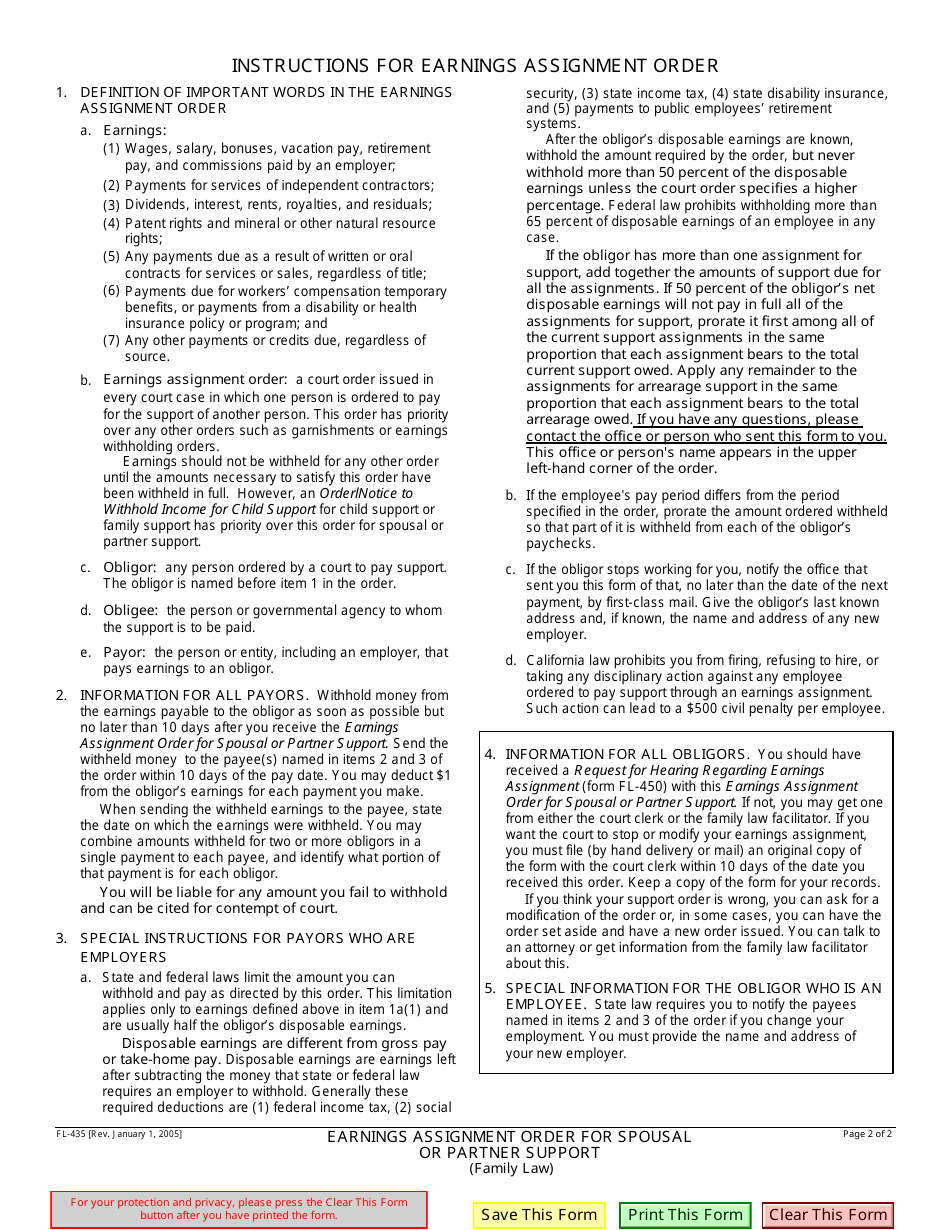

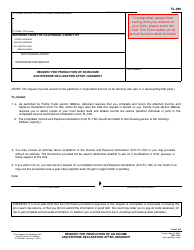

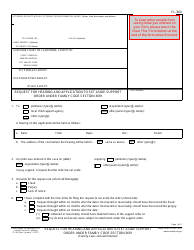

Q: What is the purpose of Form FL-435?

A: The purpose of Form FL-435 is to establish an order to deduct spousal or partner support directly from an individual's wages or earnings.

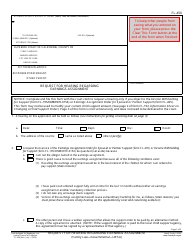

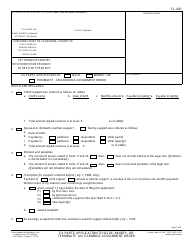

Q: Who can use Form FL-435?

A: Form FL-435 can be used by individuals in California who need to enforce a spousal or partner support order.

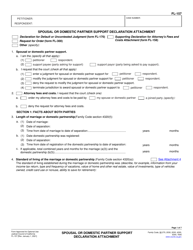

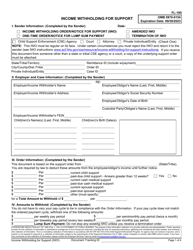

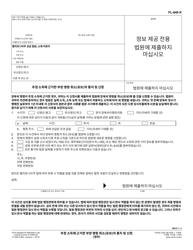

Q: What information is required on Form FL-435?

A: Form FL-435 requires information about the employer, employee, and the support order, including the amount to be deducted.

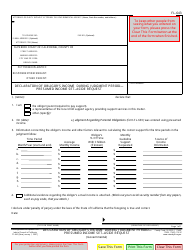

Q: What do I need to do after completing Form FL-435?

A: After completing Form FL-435, you must file it with the court and serve a copy on the employer.

Q: What happens once Form FL-435 is filed?

A: Once Form FL-435 is filed and served, the employer will be directed to deduct the specified amount for spousal or partner support from the employee's wages or earnings.

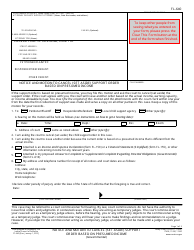

Q: Can Form FL-435 be modified or terminated?

A: Yes, Form FL-435 can be modified or terminated if there is a change in circumstances or if the spousal or partner support order is modified or terminated by the court.

Form Details:

- Released on January 1, 2005;

- The latest edition provided by the California Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FL-435 by clicking the link below or browse more documents and templates provided by the California Superior Court.