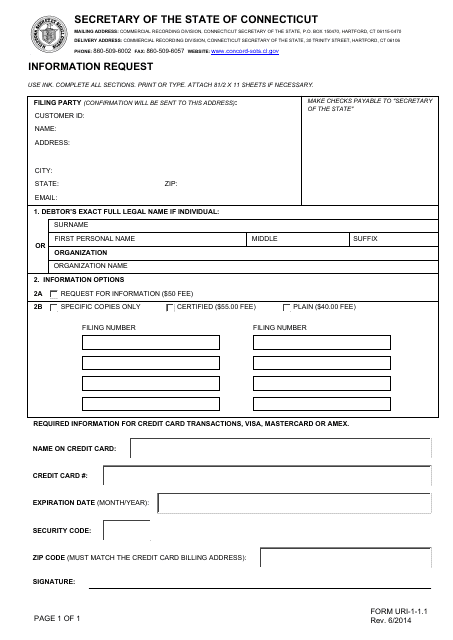

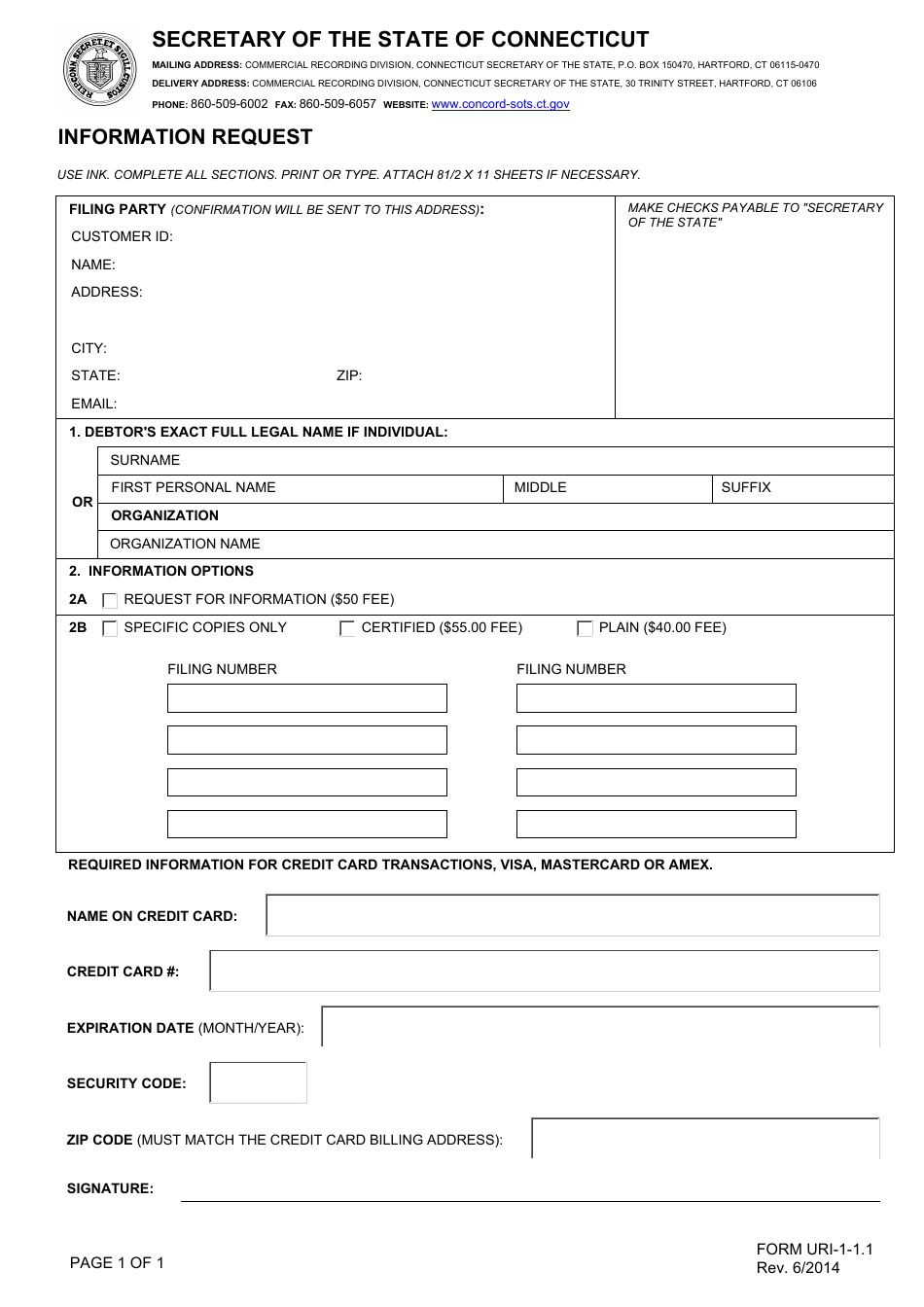

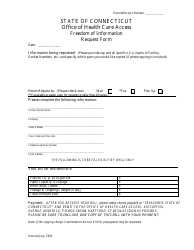

Form URI-1-1.1 Information Request - Connecticut

What Is Form URI-1-1.1?

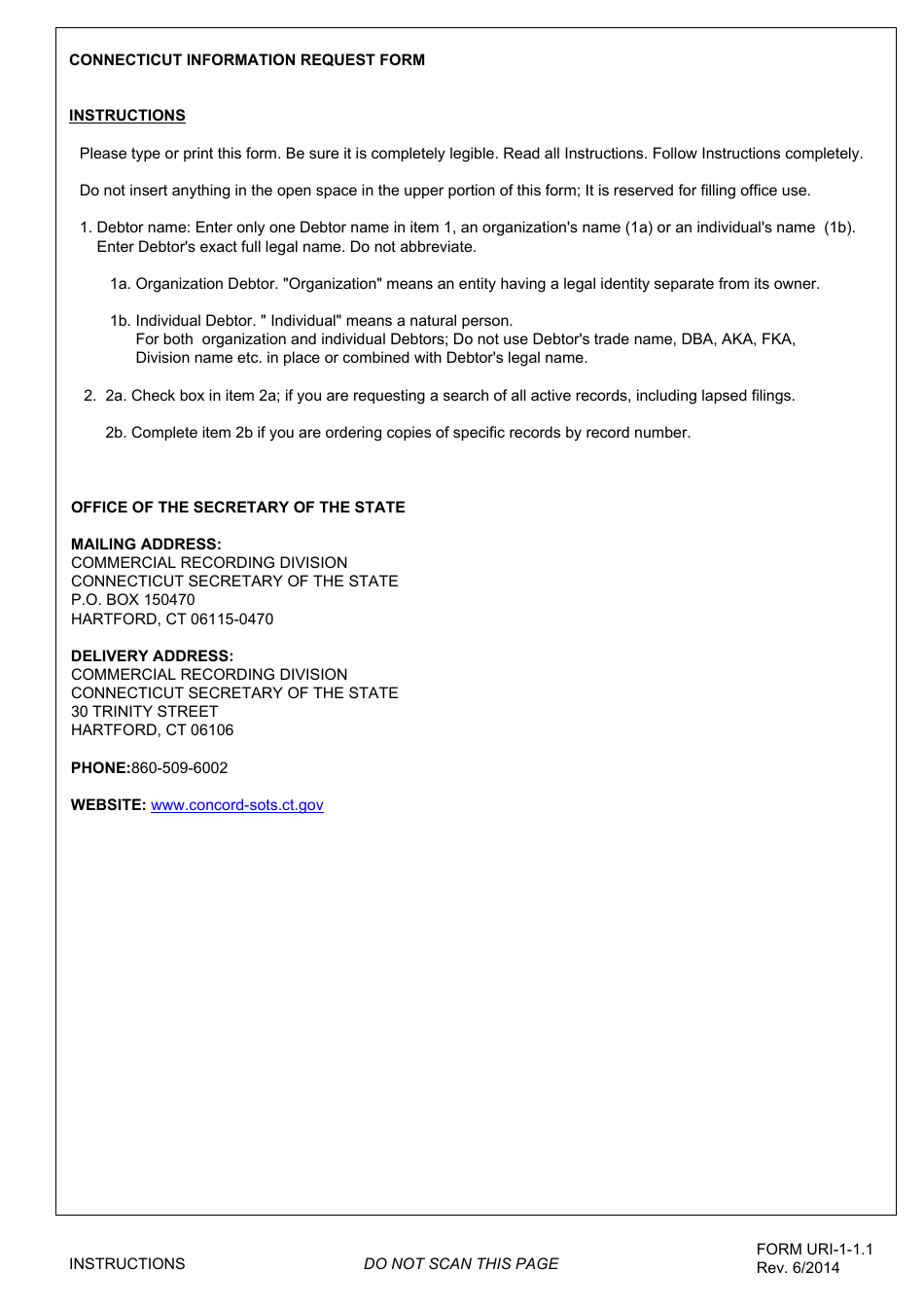

This is a legal form that was released by the Connecticut Secretary of the State - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

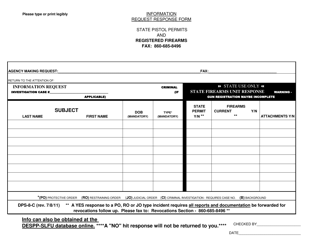

Q: What is a URI-1-1.1 information request?

A: A URI-1-1.1 information request is a form used in Connecticut to gather information about a property for tax assessment purposes.

Q: Who uses a URI-1-1.1 information request?

A: The Connecticut tax authorities use a URI-1-1.1 information request to obtain property details for assessment.

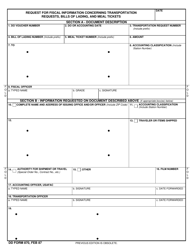

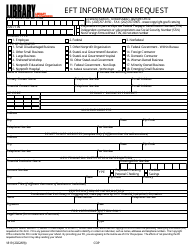

Q: What kind of information is required in a URI-1-1.1 information request?

A: The URI-1-1.1 information request form collects details about the property's location, construction, improvements, and other relevant factors that can impact its value.

Q: Why is a URI-1-1.1 information request important?

A: The information gathered through a URI-1-1.1 information request helps determine the property's assessed value, which is used for tax purposes.

Q: Is completing a URI-1-1.1 information request mandatory?

A: Yes, property owners in Connecticut are required to complete a URI-1-1.1 information request when requested by the tax authorities.

Q: What should I do if I have questions about the URI-1-1.1 information request?

A: If you have any questions about the URI-1-1.1 information request form, you can reach out to the Connecticut tax authorities for clarification and assistance.

Form Details:

- Released on June 1, 2014;

- The latest edition provided by the Connecticut Secretary of the State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form URI-1-1.1 by clicking the link below or browse more documents and templates provided by the Connecticut Secretary of the State.